Enlarge image

2024 Wisconsin Schedule 5K-1 Instructions

Table of Contents

General Instructions ................................................................................................................... 1

Federal Schedules K-1 ............................................................................................................... 2

Limitations on Losses, Deductions and Credits .......................................................................... 3

Specific Instructions ................................................................................................................... 5

Parts I and II – Information about the Tax-Option (S) Corporation and Shareholder ............... 5

Part III - Schedule 5K-1, Columns (a) Through (e) .................................................................. 7

Shareholders That Are Full-Year Residents of Wisconsin ................................................... 8

Shareholders That Are Nonresidents .................................................................................. 8

Shareholders That Are Part-Year Residents ....................................................................... 9

Line-by-Line Instructions: Part III ...........................................................................................10

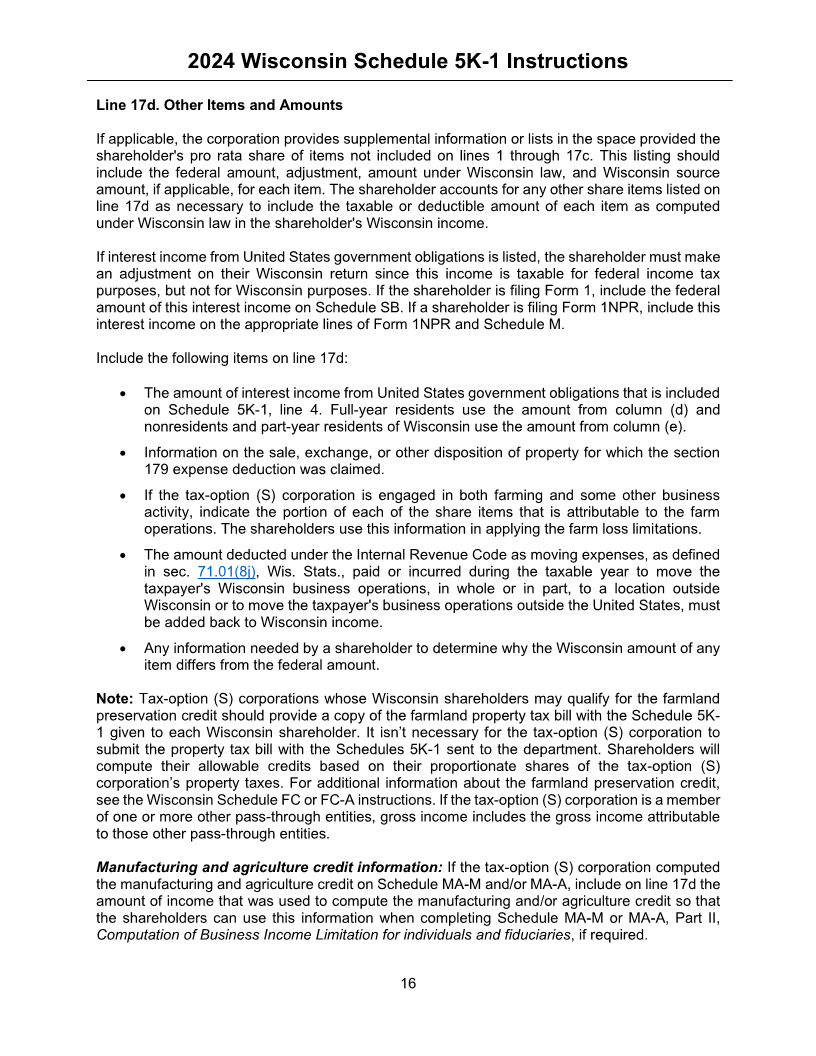

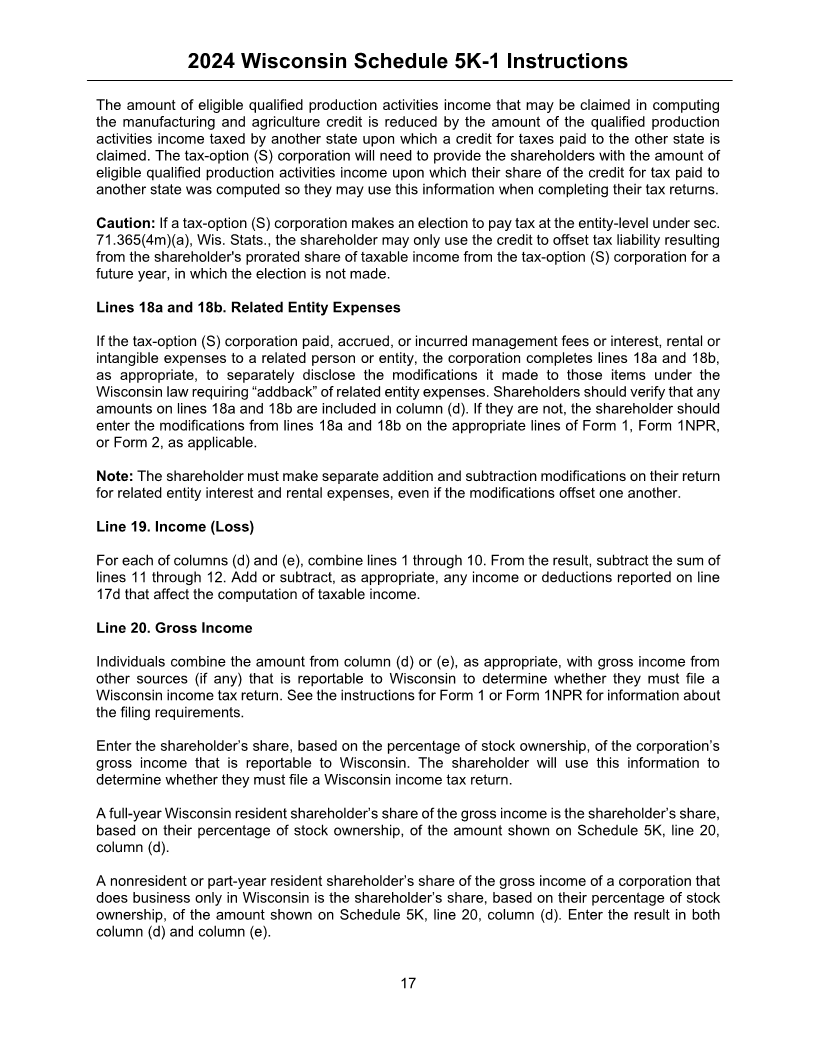

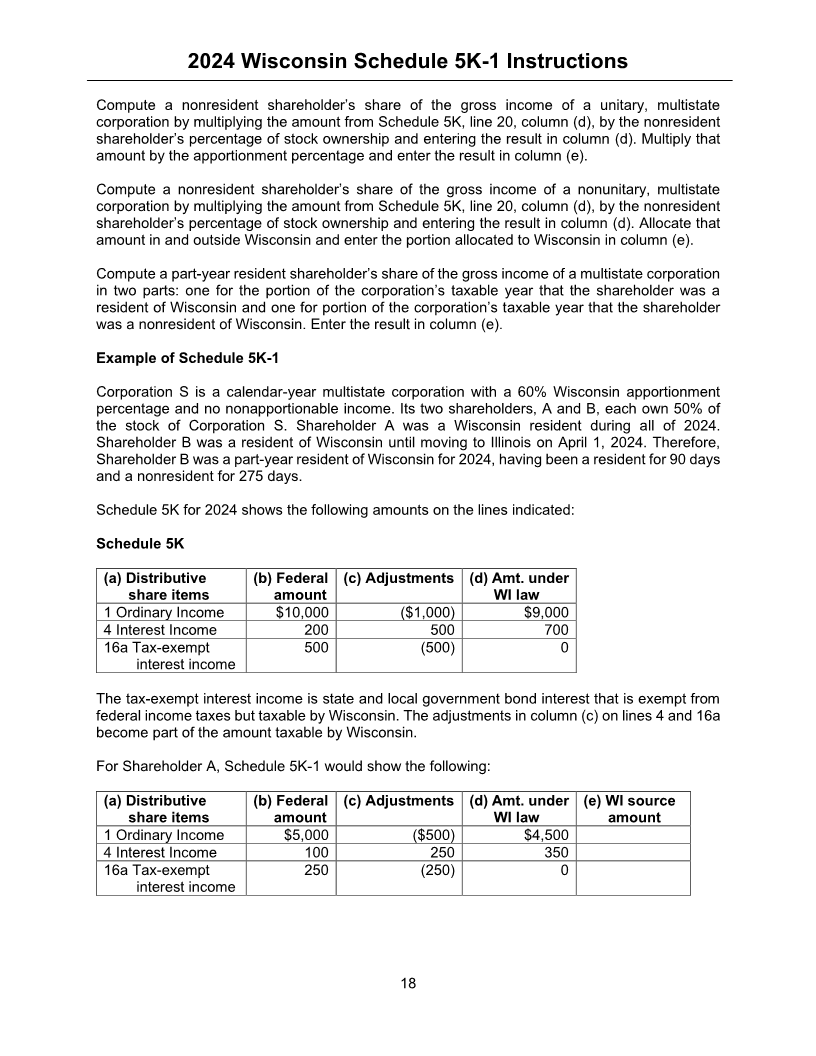

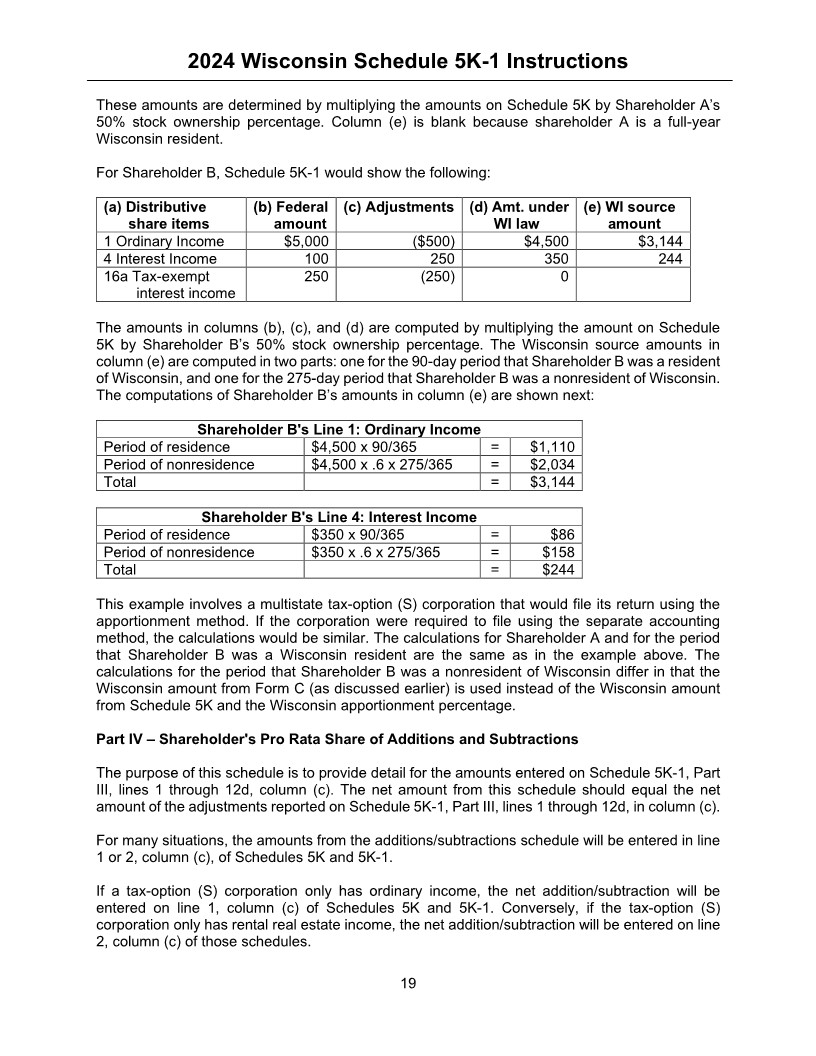

Example of Schedule 5K-1 ....................................................................................................18

Part IV – Shareholder's Pro Rata Share of Additions and Subtractions .................................19

Schedule I Adjustments .....................................................................................................20

Line-by-Line Instructions: Additions....................................................................................20

Line-by-Line Instructions: Subtractions ..............................................................................24

Determining Wisconsin Income of Multistate Tax-Option (S) Corporations ................................27

Who Must Use Apportionment? .............................................................................................27

What Is the Apportionment Percentage? ...............................................................................28

What Is Nonapportionable Income? .......................................................................................28

Corporate Partners or LLC Members .....................................................................................28

Separate Accounting .............................................................................................................29

Shareholder Reporting of Schedule 5K-1 Items from a Tax-Option (S) Corporation Electing to Pay

Tax at the Entity Level ...............................................................................................................29

Shareholder Reporting Requirements....................................................................................29

Shareholder Basis .................................................................................................................30

Schedule 5K-1 Items Allowed to Be Claimed by the Shareholder ..........................................30

Schedule 5K-1 Items Not Allowed to Be Claimed By the Shareholder ...................................30

Proportionate Share of an Electing Tax-Option (S) Corporation's Income..............................30

Additional Information, Assistance, and Forms..........................................................................31

Web Resources .....................................................................................................................31

Contact Information ...............................................................................................................31

Obtaining Forms ....................................................................................................................31

General Instructions

Caution: If a tax-option (S) corporation elects to pay tax at the entity level according to sec.

71.365(4m)(a), Wis. Stats., the shareholders may not include any items of income, gain, loss, or

deduction from the Schedule 5K-1 on their income tax return. Instead, the entity must compute

and pay the tax due on Schedule 5S-ET. See the section titled: Shareholder Reporting of

Schedule 5K-1 Items from a Tax-Option (S) Corporation Electing to Pay Tax at the Entity Level

later in these instructions.

IC-156 (R. 07-24)