Enlarge image

2024 Form 4 Instructions for Non-Combined Franchise Income Tax Return

Table of Contents

Who Must File Form 4 ............................................................................................................................................. 2

Corporations Required to File ................................................................................................................................................ 2

“Doing Business in Wisconsin” .............................................................................................................................................. 3

Franchise or Income Tax ....................................................................................................................................................... 4

Economic Development Surcharge ....................................................................................................................................... 5

Separate Return or Combined Return? ................................................................................................................ 5

Combined Returns and Groups in General ............................................................................................................................ 5

Test 1: Commonly Controlled Group...................................................................................................................................... 5

Test 2: Unitary Business ........................................................................................................................................................ 6

Test 3: Water’s Edge ............................................................................................................................................................. 8

General Franchise or Income Tax Return Instructions ....................................................................................... 9

When and Where to File ........................................................................................................................................................ 9

Period Covered by Return ................................................................................................................................................... 10

Accounting Methods and Elections ...................................................................................................................................... 10

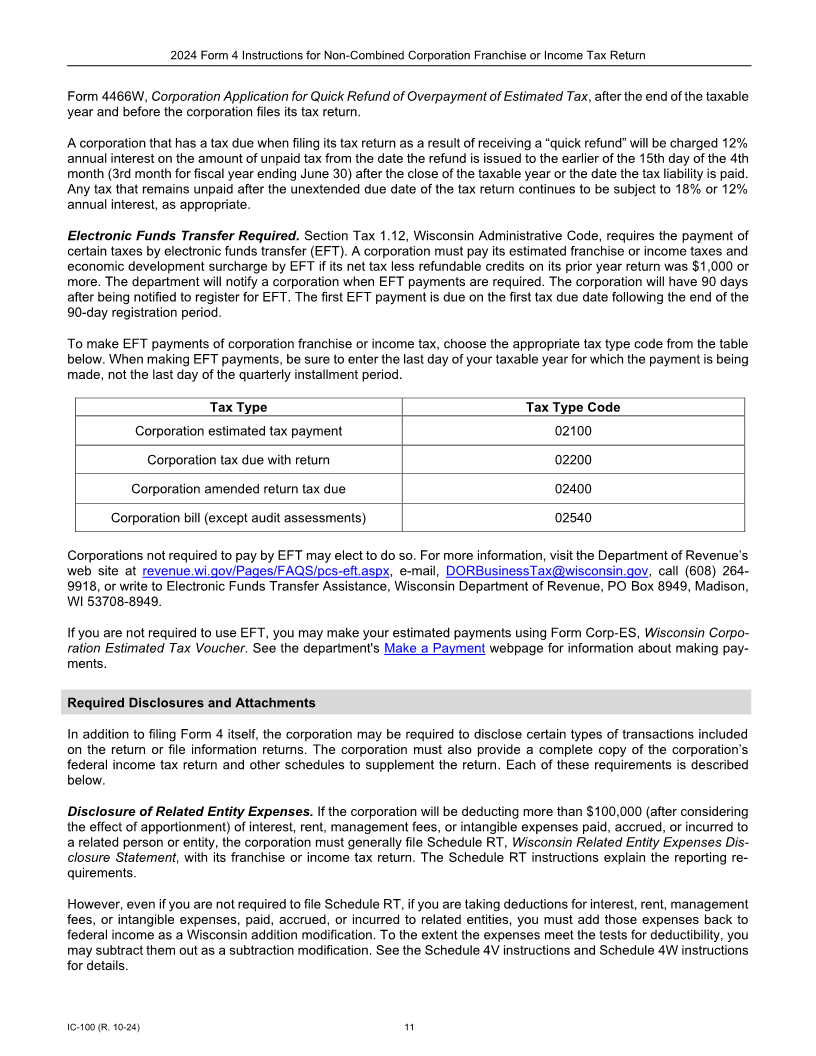

Payment of Estimated Tax ................................................................................................................................................... 10

Required Disclosures and Attachments ............................................................................................................................... 11

Internal Revenue Service Adjustments, Amended Returns, and Claims for Refund ............................................................ 12

Final Return ......................................................................................................................................................................... 13

Penalties for Not Filing or Filing Incorrect Returns ............................................................................................................... 13

Conformity with Internal Revenue Code and

Exceptions ............................................................................................................................................................. 13

Provisions of the Internal Revenue Code Not Adopted by Wisconsin: ................................................................................. 14

Capital Losses ..................................................................................................................................................................... 19

Limitations on Certain Federal Deductions .......................................................................................................................... 19

Differences Between Federal and Wisconsin Basis of Assets ............................................................................................. 19

General Instructions for Apportionment ............................................................................................................ 19

Who Must Use Apportionment ............................................................................................................................................. 20

Apportionment Method......................................................................................................................................................... 20

Nonapportionable Income .................................................................................................................................................... 21

Separately Apportioned Income ........................................................................................................................................... 21

Corporate Partners or LLC Members ................................................................................................................................... 21

Separate Accounting............................................................................................................................................................ 21

Treatment of Specialized Industries and Entities .............................................................................................. 22

Foreign Sales Corporations (FSCs) ..................................................................................................................................... 22

Interest Charge Domestic International Sales Corporations (IC-DISCs) .............................................................................. 22

Insurance Companies .......................................................................................................................................................... 22

Personal Holding Companies .............................................................................................................................................. 22

RICs, REMICs, REITs, and FASITs ..................................................................................................................................... 23

Tax Exempt Organizations ................................................................................................................................................... 23

Urban Transit Companies .................................................................................................................................................... 23

Line-by-Line Instructions for Form 4 .................................................................................................................. 23

Additional Information, Assistance, and Forms ................................................................................................ 32

Web Resources .................................................................................................................................................................. 32

Obtaining Forms ................................................................................................................................................................ 32

IC-100 (R. 10-24) 1