Enlarge image

Instructions for 2024 Schedule ES

Purpose of Schedule ES

Use Schedule ES to claim the non-refundable employee college savings account contribution tax credit.

Who is Eligible to Claim the Credit

A sole proprietor, partner of a partnership, a member of a limited liability company (LLC), a corporation, or a

shareholder of a tax-option (S) corporation that is an employer and contributes to an employee's college savings

account is eligible for the credit. Estate and trusts are not eligible to compute the credit.

Partnerships, limited liability companies, and tax−option corporations may not claim the credit, but the eligibility

and amount of the credit are based on the amount they paid into a college savings account owned by the employee

in the taxable year the contribution is made. A partnership, limited liability company, or tax−option corporation

computes the amount of credit that each of its partners, members, or shareholders may claim and provides that

information to them. Partners, members of limited liability companies, and shareholders of tax−option corporations

may claim the credit in proportion to their ownership interests.

Definitions

• “Claimant” means an individual who files a claim under this subsection and who is a sole proprietor, partner

of a partnership, member of a limited liability company, or shareholder of a tax−option corporation that is an

employer and that contributes to an employee’s college savings account under par. (b).

• “College savings account” means a college savings account, as described in sec. 224.50, Wis. Stats.

• “Employee” has the meaning given in sec. 71.63 (2), Wis. Stats.

• “Employer” means a person for whom an individual performs or performed any service as an employee of that

person and who is required to furnish a W-2 form to the employee for federal income tax purposes.

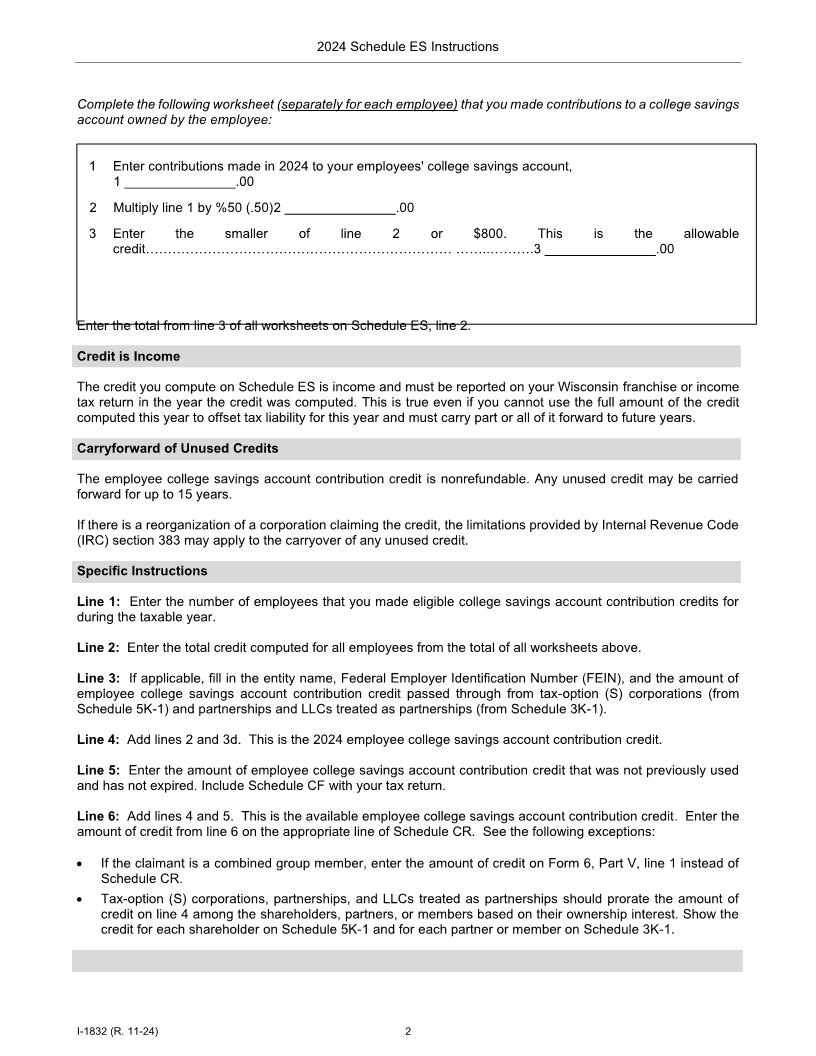

Credit Computation

The credit may be computed for each employee of the employer equal to the amount the employer paid into a

college savings account owned by the employee in the taxable year in which the contribution is made.

The maximum credit per employee is equal to 50 percent of the amount the employer contributed to the

employee’s college savings account, not to exceed a maximum credit of $800..

A credit may be claimed only if, for federal income tax purposes, the compensation of the employee is reported,

or required to be reported, on a W-2 form issued by the claimant.

The credit must be claimed within four years of the unextended due date of your return.

I-1832 (R. 11-24) 1