Enlarge image

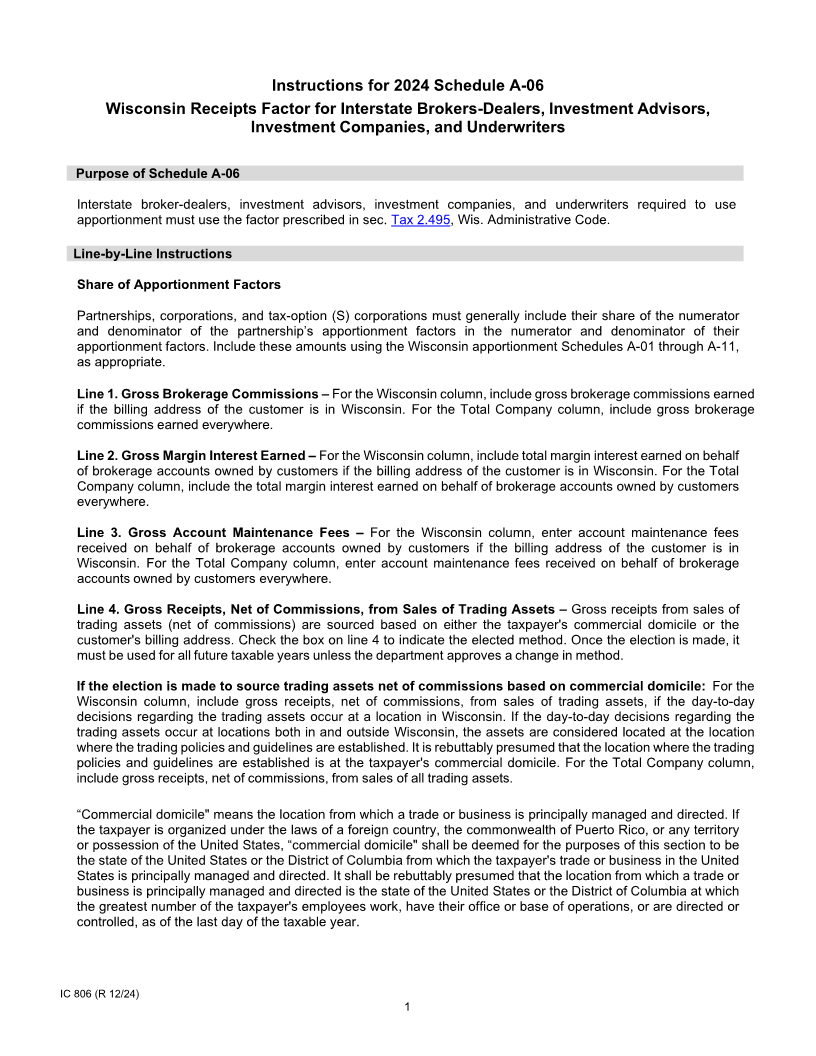

Instructions for 2024 Schedule A-06

Wisconsin Receipts Factor for Interstate Brokers-Dealers, Investment Advisors,

Investment Companies, and Underwriters

Purpose of Schedule A-06

Interstate broker-dealers, investment advisors, investment companies, and underwriters required to use

apportionment must use the factor prescribed in sec. Tax 2.495, Wis. Administrative Code.

Line-by-Line Instructions

Share of Apportionment Factors

Partnerships, corporations, and tax-option (S) corporations must generally include their share of the numerator

and denominator of the partnership’s apportionment factors in the numerator and denominator of their

apportionment factors. Include these amounts using the Wisconsin apportionment Schedules A-01 through A-11,

as appropriate.

Line 1. Gross Brokerage Commissions – For the Wisconsin column, include gross brokerage commissions earned

if the billing address of the customer is in Wisconsin. For the Total Company column, include gross brokerage

commissions earned everywhere.

Line 2. Gross Margin Interest Earned – For the Wisconsin column, include total margin interest earned on behalf

of brokerage accounts owned by customers if the billing address of the customer is in Wisconsin. For the Total

Company column, include the total margin interest earned on behalf of brokerage accounts owned by customers

everywhere.

Line 3. Gross Account Maintenance Fees – For the Wisconsin column, enter account maintenance fees

received on behalf of brokerage accounts owned by customers if the billing address of the customer is in

Wisconsin. For the Total Company column, enter account maintenance fees received on behalf of brokerage

accounts owned by customers everywhere.

Line 4. Gross Receipts, Net of Commissions, from Sales of Trading Assets – Gross receipts from sales of

trading assets (net of commissions) are sourced based on either the taxpayer's commercial domicile or the

customer's billing address. Check the box on line 4 to indicate the elected method. Once the election is made, it

must be used for all future taxable years unless the department approves a change in method.

If the election is made to source trading assets net of commissions based on commercial domicile: For the

Wisconsin column, include gross receipts, net of commissions, from sales of trading assets, if the day-to-day

decisions regarding the trading assets occur at a location in Wisconsin. If the day-to-day decisions regarding the

trading assets occur at locations both in and outside Wisconsin, the assets are considered located at the location

where the trading policies and guidelines are established. It is rebuttably presumed that the location where the trading

policies and guidelines are established is at the taxpayer's commercial domicile. For the Total Company column,

include gross receipts, net of commissions, from sales of all trading assets.

“Commercial domicile" means the location from which a trade or business is principally managed and directed. If

the taxpayer is organized under the laws of a foreign country, the commonwealth of Puerto Rico, or any territory

or possession of the United States, “commercial domicile" shall be deemed for the purposes of this section to be

the state of the United States or the District of Columbia from which the taxpayer's trade or business in the United

States is principally managed and directed. It shall be rebuttably presumed that the location from which a trade or

business is principally managed and directed is the state of the United States or the District of Columbia at which

the greatest number of the taxpayer's employees work, have their office or base of operations, or are directed or

controlled, as of the last day of the taxable year.

IC 806 (R 12/24)

1