Enlarge image

2024 Schedule NOL2 Instructions

Purpose of Schedule NOL2

The 2024 Schedule NOL2 is used by an individual, estate, or trust to compute your allowable net operating loss (NOL) carryforward

deduction and Wisconsin modified taxable income. Part I of Schedule NOL2 is used to figure the amount of NOL that may be

deducted on your 2024 Wisconsin tax return. The deduction for a Wisconsin NOL carryforward may not be more than your

Wisconsin taxable income as computed before any deduction for the NOL. If you are filing Form X-NOL, Carryback of Wisconsin

Net Operating Loss (NOL), to carry back an NOL, see the instructions for Form X-NOL to determine the allowable deduction for

the NOL carryback.

Part II of Schedule NOL2 is used to compute your Wisconsin modified taxable income. Your Wisconsin modified taxable income

is your Wisconsin income (for example, line 7 of 2024 Form 1) with the following adjustments:

(1) You cannot claim an NOL deduction

(2) You cannot claim a capital gain exclusion for the exclusion for capital gain on the sale of investments held at least 5 years in

a qualified Wisconsin business or the exclusion for capital gain on the sale of investments held at least 5 years in a Wisconsin

qualified opportunity fund

(3) You cannot claim a deduction for a net capital loss

(4) Wisconsin modified taxable income cannot be less than zero

Who Must File Schedule NOL2

Schedule NOL2 must be filed by individuals, estates, and trusts who incur an NOL in a taxable year and will claim an NOL

deduction in 2024. Include Schedule NOL2 with your Form 1, 1NPR, 2, or X-NOL in the year you wish to claim an NOL deduction.

Specific Instructions

Part I – Allowable Deduction for a Wisconsin NOL Carryforward

Line 1 If you are filing Form 1NPR, do not fill in any amount on this line. Instead, see the instructions for line 3. Estates and

trusts fill in the amount from line 3 of Wisconsin Form 2.

Line 2 If you are filing Form 1NPR, do not fill in any amount on this line (see line 3 instructions). Estates and trusts fill in the

amount from line 4 of Form 2. Do not include any amount of NOL in this figure.

Line 3 If you are filing Form 1NPR, fill in on line 3 the amount from line 16, column B, of Form 1NPR, less the amount on line

29, column B, of Form 1NPR (not including any amount of the NOL deduction).

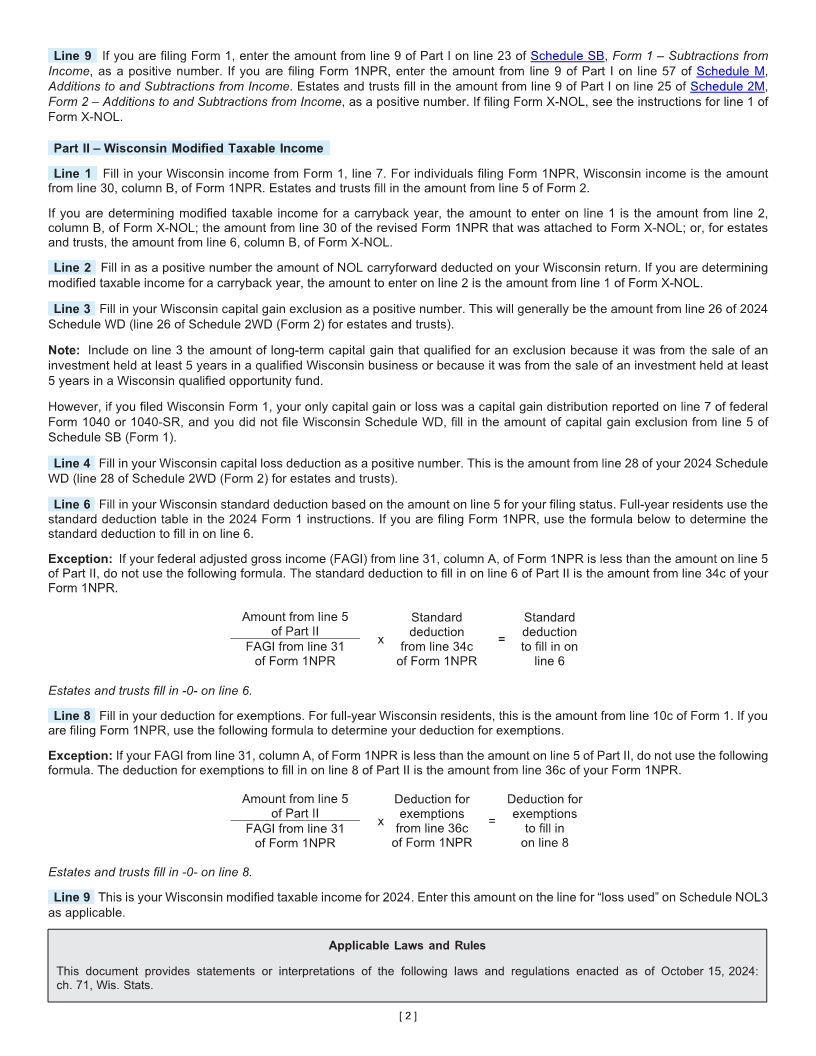

Line 4 If you are filing Form 1NPR, use the following formula to compute the standard deduction to fill in on line 4.

Exception: If your federal adjusted gross income (FAGI) from line 31, column A, of Form 1NPR is less than the amount on line 3

of Part I, do not use the following formula. The standard deduction to fill in on line 4 of Part I is the standard deduction from the

table in the 2024 Form 1NPR instructions based on your filing status and FAGI.

Amount from line 3 Standard deduction Amount to

of Part I from table in Form 1NPR fill in on

x =

FAGI from line 31 instructions based on your line 4 of

of Form 1NPR filing status and FAGI Part I

Estates and trusts do not fill in any amount on line 4.

Line 6 If you are filing Form 1, you will first have to complete line 10c of Form 1 before you can complete Part I. Fill in the amount

from line 10c of Form 1 on line 6 of Part I.

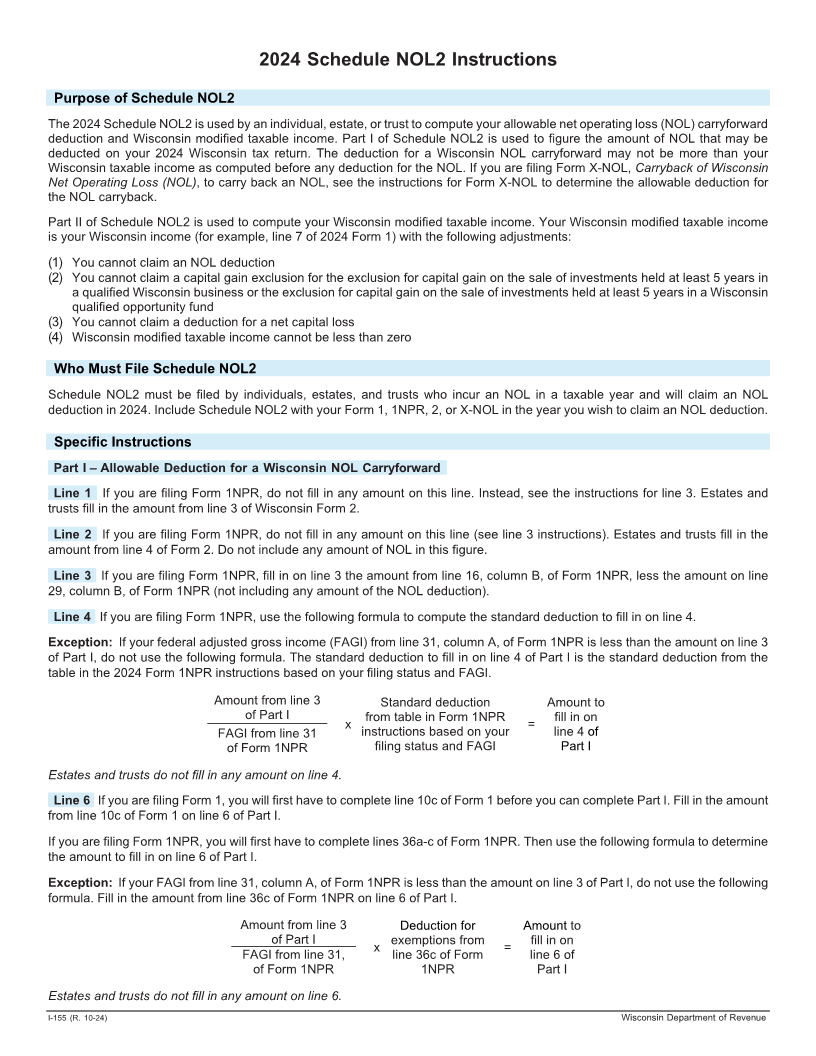

If you are filing Form 1NPR, you will first have to complete lines 36a-c of Form 1NPR. Then use the following formula to determine

the amount to fill in on line 6 of Part I.

Exception: If your FAGI from line 31, column A, of Form 1NPR is less than the amount on line 3 of Part I, do not use the following

formula. Fill in the amount from line 36c of Form 1NPR on line 6 of Part I.

Amount from line 3 Deduction for Amount to

of Part I exemptions from fill in on

x =

FAGI from line 31, line 36c of Form line 6 of

of Form 1NPR 1NPR Part I

Estates and trusts do not fill in any amount on line 6.

I-155 (R. 10-24) Wisconsin Department of Revenue