Enlarge image

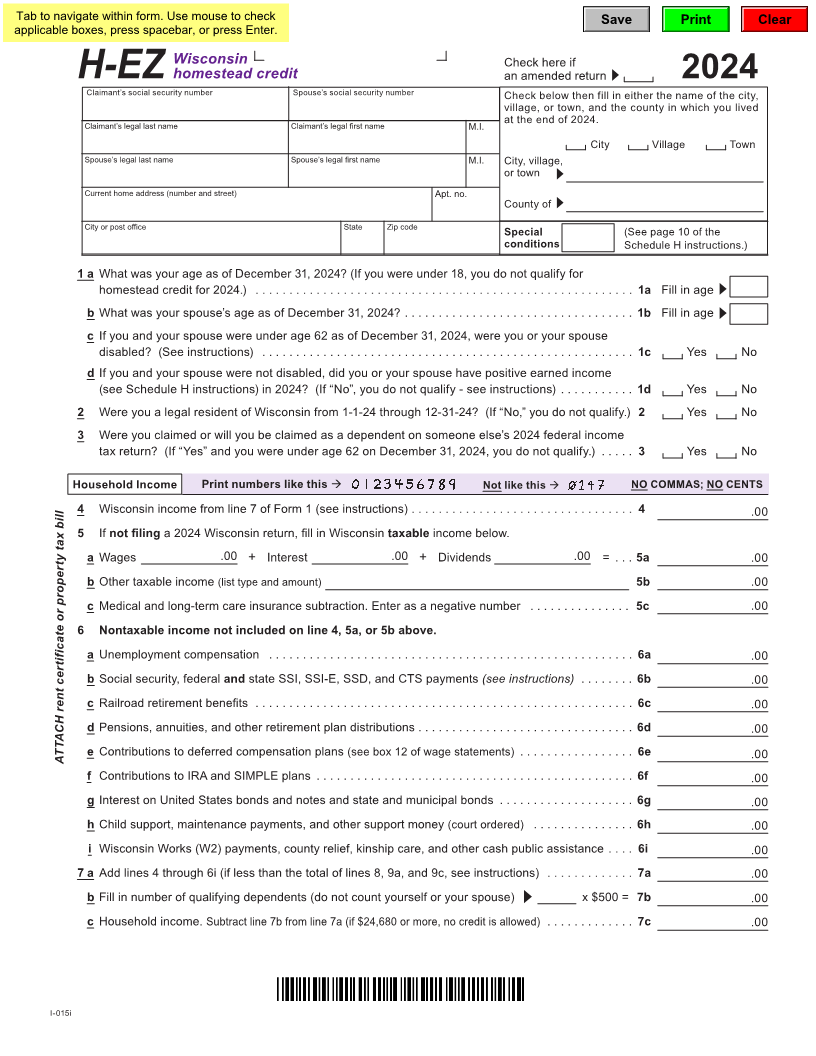

Tab to navigate within form. Use mouse to check Save Print Clear

applicable boxes, press spacebar, or press Enter.

Wisconsin Check here if

homestead credit an amended return

H‑EZ 2024

Claimant’s social security number Spouse’s social security number Check below then fill in either the name of the city,

village, or town, and the county in which you lived

Claimant’s legal last name Claimant’s legal first name M.I. at the end of 2024.

City Village Town

Spouse’s legal last name Spouse’s legal first name M.I. City, village,

or town

Current home address (number and street) Apt. no.

County of

City or post office State Zip code (See page 10 of the

Special

conditions Schedule H instructions.)

1 a What was your age as of December 31, 2024? (If you were under 18, you do not qualify for

homestead credit for 2024.) ........................................................ Fill in age 1a

bWhat was your spouse’s age as of December 31, 2024? .................................. Fill in age 1b

c If you and your spouse were under age 62 as of December 31, 2024, were you or your spouse

disabled? (See instructions) ....................................................... 1c Yes No

dIf you and your spouse were not disabled, did you or your spouse have positive earned income

(see Schedule H instructions) in 2024? (If “No”, you do not qualify - see instructions) ........... 1d Yes No

2Were you a legal resident of Wisconsin from 1-1-24 through 12-31-24? (If “No,” you do not qualify.) 2 Yes No

3Were you claimed or will you be claimed as a dependent on someone else’s 2024 federal income

tax return? (If “Yes” and you were under age 62 on December 31, 2024, you do not qualify.) ..... 3 Yes No

Household Income Print numbers like this Not like this NO COMMAS; NO CENTS

4Wisconsin income from line 7 of Form 1 (see instructions) ................................. 4 .00

If5 not a 2024 Wisconsin return, fill in Wisconsin taxable income below. filing

Wagesa .00 + Interest .00 + Dividends .00 = ... 5a .00

bOther taxable income (list type and amount) 5b .00

c Medical and long-term care insurance subtraction. Enter as a negative number ............... 5c .00

6 Nontaxable income not included on line 4, 5a, or 5b above.

aUnemployment compensation ...................................................... 6a .00

bSocial security, federal and state SSI, SSI-E, SSD, and CTS payments (see instructions) ........ 6b .00

c Railroad retirement benefits ........................................................ 6c .00

dPensions, annuities, and other retirement plan distributions ................................ 6d .00

ATTACH eContributionsrent certificateto deferredor propertycompensationtax billplans (see box 12 of wage statements) ................. 6e .00

f Contributions to IRA and SIMPLE plans ............................................... 6f .00

gInterest on United States bonds and notes and state and municipal bonds .................... 6g.00

hChild support, maintenance payments, and other support money (court ordered) ............... 6h .00

i Wisconsin Works (W2) payments, county relief, kinship care, and other cash public assistance .... 6i .00

7 a Add lines 4 through 6i (if less than the total of lines 8, 9a, and 9c, see instructions) ............. 7a .00

Fillb in number of qualifying dependents (do not count yourself or your spouse) x $500 = 7b .00

cHousehold income. Subtract line 7b from line 7a (if $24,680 or more, no credit is allowed) ............. 7c .00

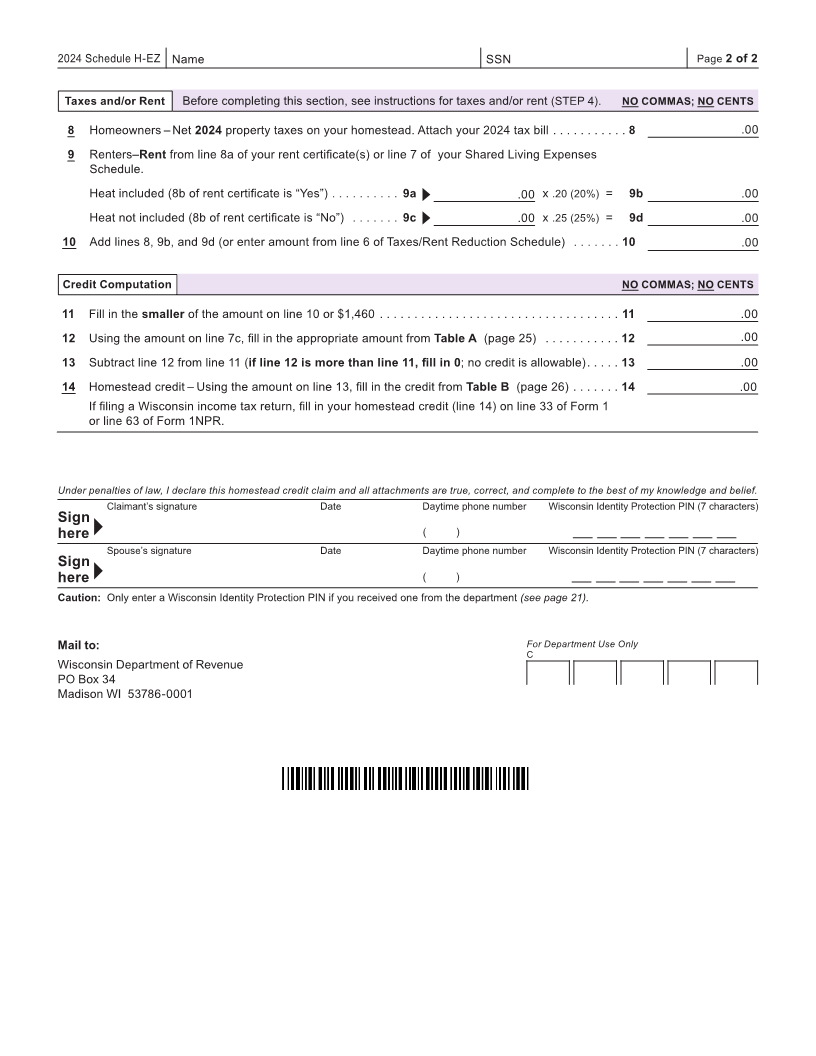

I-015i