Enlarge image

Tab to navigate within form. Use mouse to check Save Print Clear

applicable boxes, press spacebar or press Enter.

Schedule College Savings Accounts

CS (Edvest and Tomorrow’s Scholar)

Wisconsin 2024

Department of Revenue File with Wisconsin Form 1 or 1NPR

Name Social Security Number

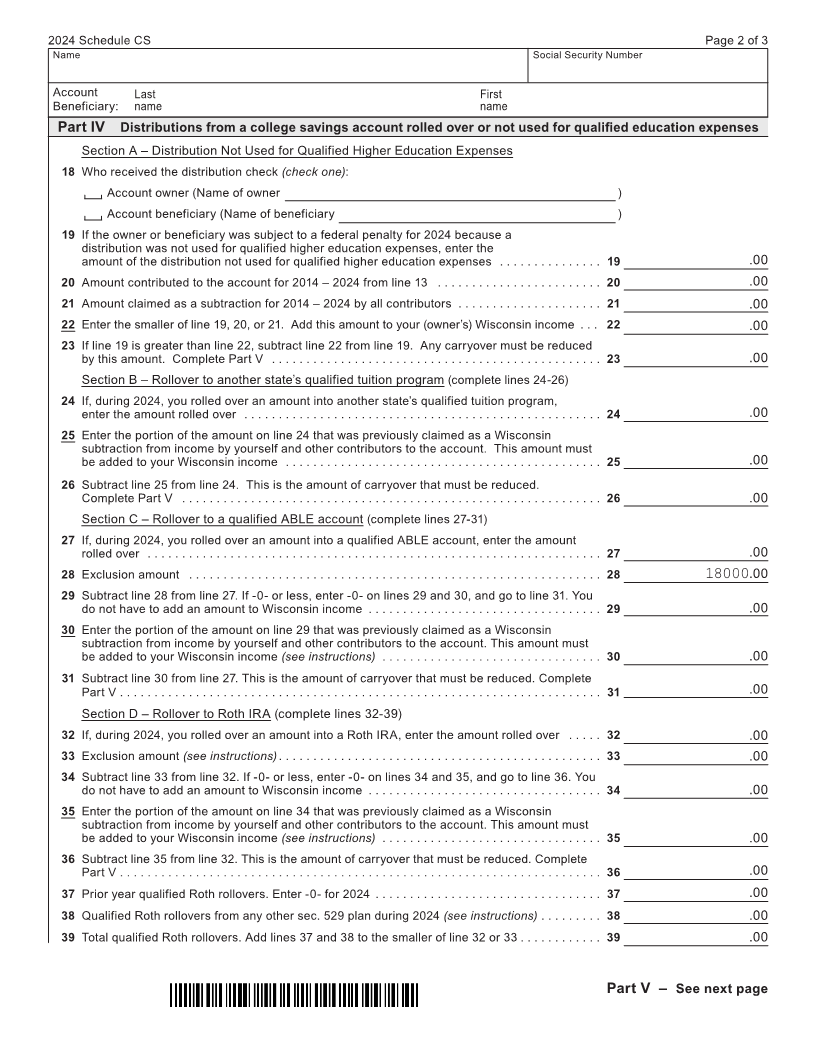

Part I Contributions to an Edvest or Tomorrow’s Scholar college savings account

Section A – Owners of the Edvest or Tomorrow’s Scholar College Savings Account

1 Name of account beneficiary: Last First

2 Amount you contributed to the account for 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 .00

Section B – Persons Other Than the Account Owner

3 Name and address of account owner: Last First

Address

4 Name of account beneficiary: Last First

5 Amount you contributed to the account for 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 .00

Section C – Allowable Subtraction

6 Add lines 2 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 .00

7 Enter $5,000 ($2,500 if you are married and filing a separate return) . . . . . . . . . . . . . . . . . . . . . 7 .00

8 Enter the smaller of line 6 or 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 .00

9 Carryover from 2023 Schedule CS (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 .00

10 Allowable subtraction. Add lines 8 and 9 (see instructions for further limitations) . Do not enter

more than $5,000 ($2,500 if married and filing a separate return .) Also complete Part II . . . . . . 10 .00

Section D – Total Amount Contributed to Account for 2014-2024

11 Amount contributed to the account by others for 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 .00

12 Amount contributed to the account for 2014-2023 (from line 13 of 2023 Schedule CS) . . . . . . . 12 .00

13 Add lines 2, 11, and 12 . This is the total amount contributed to the account for 2014-2024 . . . . 13 .00

Part II Eligible carryover

See instructions for completing form.

14 Amount you contributed to the accounts for 2024 . Enter amount from line 6 . . . . . . . . . . . . . . . 14 .00

15 Amount from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 .00

16 Carryover to future years . Subtract line 15 from line 14 . If line 15 is more than line 14, enter - 0- .

Also complete Part V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 .00

Part III Withdrawals within 365 days of deposit

17 Using a first-in, first-out method, did you withdraw an amount in 2024 from an Edvest or

Tomorrow’s Scholar account within 365 days of a contribution to the account (see instructions)?

a If yes, enter the amount deposited and withdrawn within 365 days . . . . . . . . . . . . . . . . . . . . 17a .00

b Enter the portion of the amount withdrawn that was previously claimed as a subtraction

from income . This amount must be included in income (see the instructions) . . . . . . . . . . . . 17b .00

c Subtract line 17b from line 17a . This is the amount of carryover that must be reduced .

Complete Part V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17c .00

Part IV – See next page

I-092 (R. 8-24)