Enlarge image

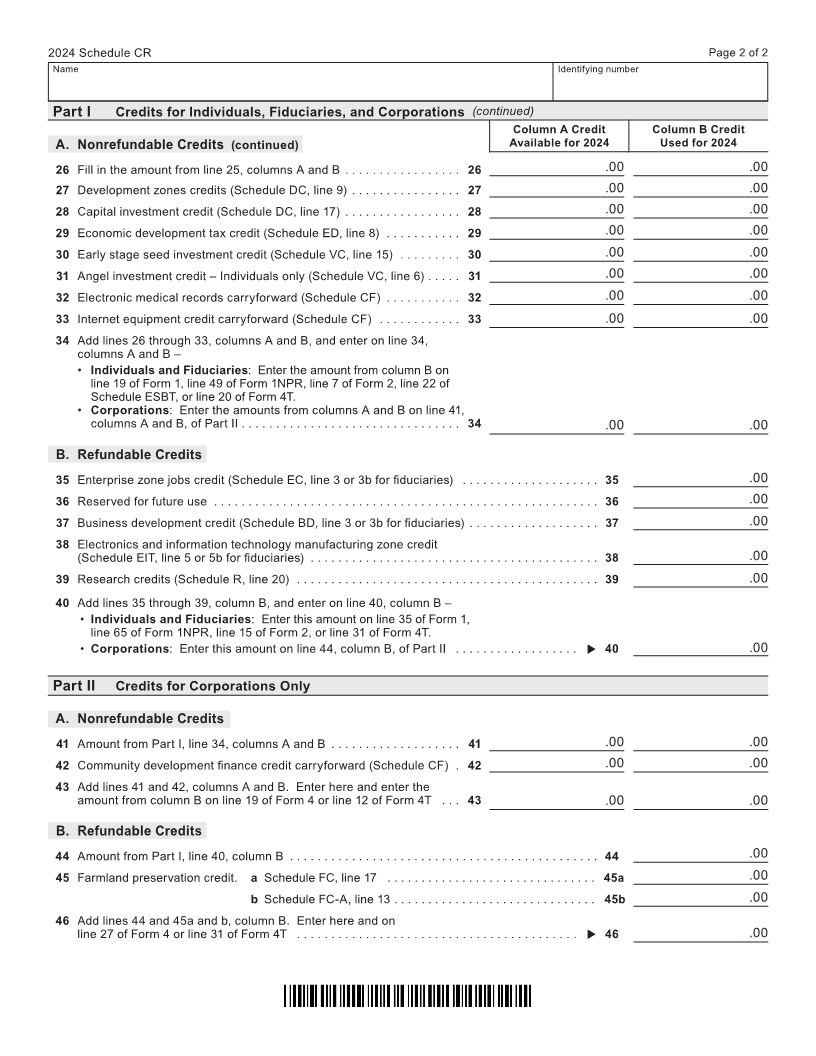

Tab to navigate within form. Use mouse to check Save Print Clear

applicable boxes, press spacebar or press Enter.

Schedule

Other Credits

CR

Wisconsin

Department of Revenue Include with Wisconsin Form 1, 1NPR, 2, 4, or 4T 2024

Name Identifying Number

Part I Credits for Individuals, Fiduciaries, and Corporations

Column A Credit Column B Credit

A. Nonrefundable Credits Available for 2024 Used for 2024

1 Postsecondary education credit carryforward (Schedule CF) . . . . . . . 1 .00 .00

2 Water consumption credit carryforward (Schedule CF) . . . . . . . . . . . . 2 .00 .00

3 Biodiesel fuel production credit carryforward (Schedule CF) . . . . . . . . 3 .00 .00

4 Health insurance risk-sharing plan assessments credit carryforward

(Schedule CF) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 .00 .00

5 Veteran employment credit carryforward (Schedule CF) . . . . . . . . . . . 5 .00 .00

6 Employee college savings account contribution credit (Schedule ES, line 6) 6 .00 .00

7 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 .00 .00

8 Community rehabilitation program credit (Schedule CM, line 7) . . . . . . 8 .00 .00

9 Research facilities credit carryforward (Schedule CF) . . . . . . . . . . . . . 9 .00 .00

10 Research facilities credit related to internal combustion engines

carryforward (Schedule CF) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 .00 .00

11 Research facilities credit related to energy efficient products

carryforward (Schedule CF) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 .00 .00

12 Low-income housing tax credit (Schedule LI, line 5) . . . . . . . . . . . . . . . 12 .00 .00

13 Supplement to federal historic rehabilitation credit (Schedule HR, line 11) 13 .00 .00

14 Manufacturing credit (Schedule MA-M, see instructions) . . . . . . . . . . . 14 .00 .00

15 Agriculture credit (Schedule MA-A, see instructions) . . . . . . . . . . . . . . 15 .00 .00

16 State historic rehabilitation credit – individuals only (Schedule HR, line 16) 16 .00 .00

17 Research credits (Schedule R, line 23) . . . . . . . . . . . . . . . . . . . . . . . . . 17 .00 .00

18 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 .00 .00

19 Manufacturer’s sales tax credit carryforward (Schedule MS, line 3) . . . 19 .00 .00

20 Manufacturing investment credit (Schedule CF) . . . . . . . . . . . . . . . . . . 20 .00 .00

21 Dairy and livestock farm investment credit carryforward (Schedule CF) 21 .00 .00

22 Ethanol and biodiesel fuel pump credit carryforward (Schedule CF) . . 22 .00 .00

23 Opportunity zone investment credit carryforward (Schedule CF) . . . . . 23 .00 .00

24 Technology zone credit carryforward (Schedule CF) . . . . . . . . . . . . . . 24 .00 .00

25 Add lines 1-24, columns A and B . Fill in here and on line 26, columns

A and B, at the top of page 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 .00 .00

Now go to page 2

I-048 (R. 06-24)