Enlarge image

Tab to navigate within form. Use mouse to check Save Print Clear

applicable boxes, press spacebar or press Enter.

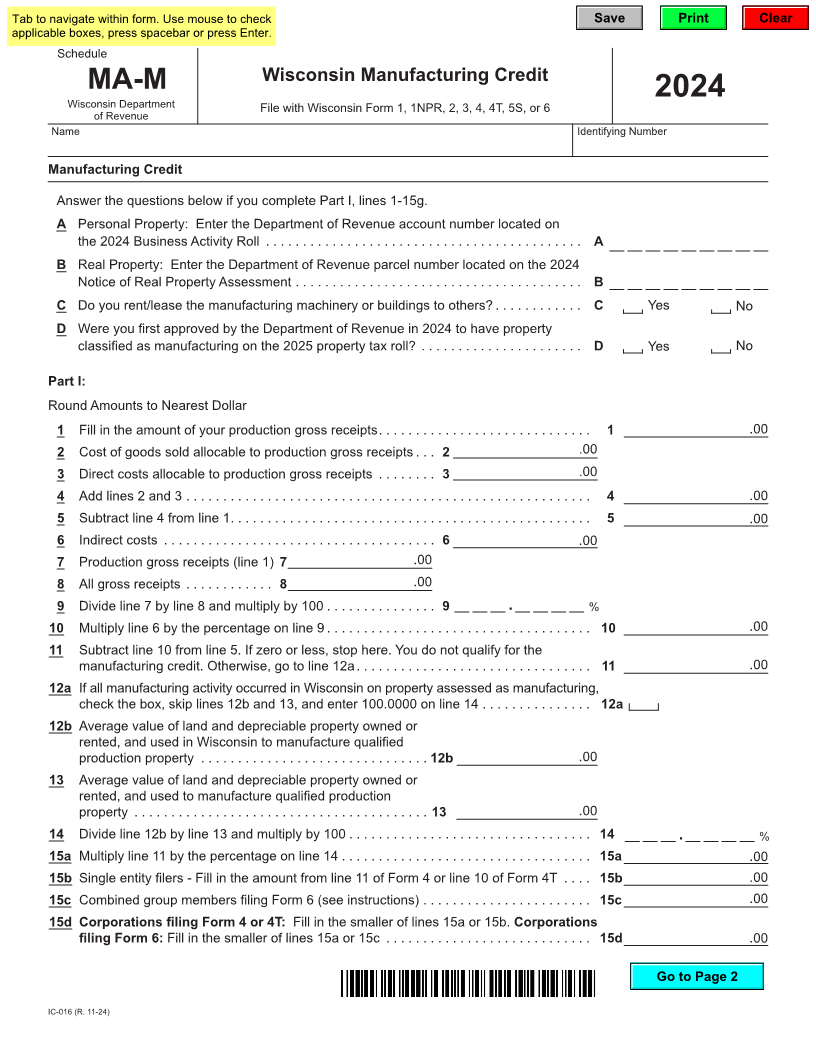

Schedule

Wisconsin Manufacturing Credit

MA-M

Wisconsin Department 2024

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5S, or 6

of Revenue

Name Identifying Number

Manufacturing Credit

Answer the questions below if you complete Part I, lines 1-15g.

A Personal Property: Enter the Department of Revenue account number located on

the 2024 Business Activity Roll ........................................... A

B Real Property: Enter the Department of Revenue parcel number located on the 2024

Notice of Real Property Assessment ....................................... B

C Do you rent/lease the manufacturing machinery or buildings to others? ............ C Yes No

D Were you first approved by the Department of Revenue in 2024 to have property

classified as manufacturing on the 2025 property tax roll? ...................... D Yes No

Part I:

Round Amounts to Nearest Dollar

1 Fill in the amount of your production gross receipts............................. 1 .00

2Cost of goods sold allocable to production gross receipts ... 2 .00

3 Direct costs allocable to production gross receipts ........ 3 .00

4 Add lines 2 and 3 ....................................................... 4 .00

5 Subtract line 4 from line 1................................................. 5 .00

6 Indirect costs ..................................... 6 .00

7 Production gross receipts (line 1) 7 .00

8 All gross receipts ............ 8 .00

9 Divide line 7 by line 8 and multiply by 100 ............... 9 . %

10 Multiply line 6 by the percentage on line 9 .................................... 10 .00

11 Subtract line 10 from line 5. If zero or less, stop here. You do not qualify for the

manufacturing credit. Otherwise, go to line 12a................................ 11 .00

12a If all manufacturing activity occurred in Wisconsin on property assessed as manufacturing,

check the box, skip lines 12b and 13, and enter 100.0000 on line 14 ............... 12a

12b Average value of land and depreciable property owned or

rented, and used in Wisconsin to manufacture qualified

production property ............................... 12b .00

13 Average value of land and depreciable property owned or

rented, and used to manufacture qualified production

property ........................................ 13 .00

14 Divide line 12b by line 13 and multiply by 100 ................................. 14 . %

15a Multiply line 11 by the percentage on line 14 .................................. 15a .00

15b Single entity filers - Fill in the amount from line 11 of Form 4 or line 10 of Form 4T .... 15b .00

15c Combined group members filing Form 6 (see instructions) ....................... 15c .00

15d Corporations filing Form 4 or 4T: Fill in the smaller of lines 15a or 15b. Corporations

filing Form 6: Fill in the smaller of lines 15a or 15c ............................ 15d .00

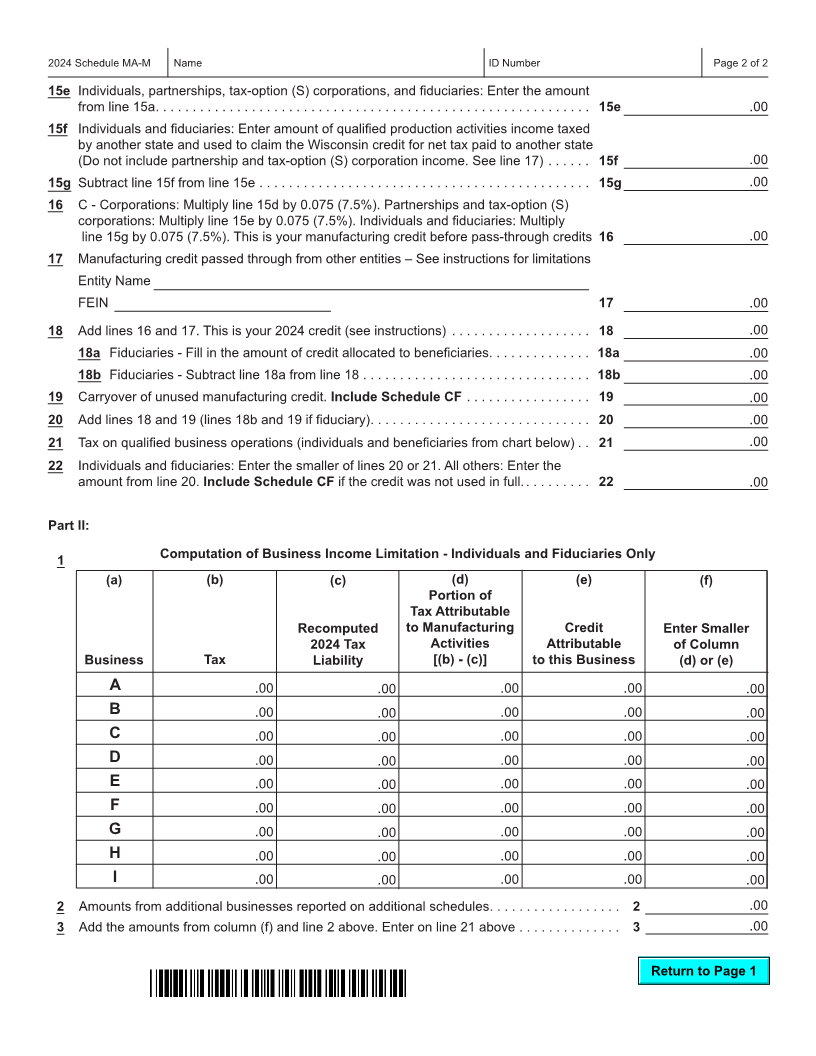

Go to Page 2

IC-016 (R. 11-24)