Enlarge image

2024 Wisconsin Schedule U Instructions

Purpose of Schedule U

Use Schedule U to see if you owe interest for underpaying your estimated tax and, if you do, to figure the amount of interest you

owe. It may be used by individuals, partnerships, estates, and trusts (except trusts subject to the Wisconsin tax on unrelated

business income must use Form U, Underpayment of Estimated Tax by Corporations).

Who Must Pay Underpayment Interest

If you did not pay enough estimated tax by any due date, or if you did not have enough Wisconsin income tax withheld, you may

be charged interest on the underpayment. This is true even if you have a refund when you file your tax return. Underpayment

interest is figured separately for each due date. Therefore, you may owe underpayment interest for an earlier payment due date,

even if you pay enough tax later to make up the underpayment.

In general, you may owe underpayment interest for 2024 if you did not pay at least the smaller of

• 90% of your current year (2024) tax liability, or

• 100% of your prior year (2023) tax liability if you filed a 2023 return that covered a full 12 months.

Note: The alternative to pay 100% of prior year tax liability does not apply to an estate or trust with taxable income of $20,000 or

more.

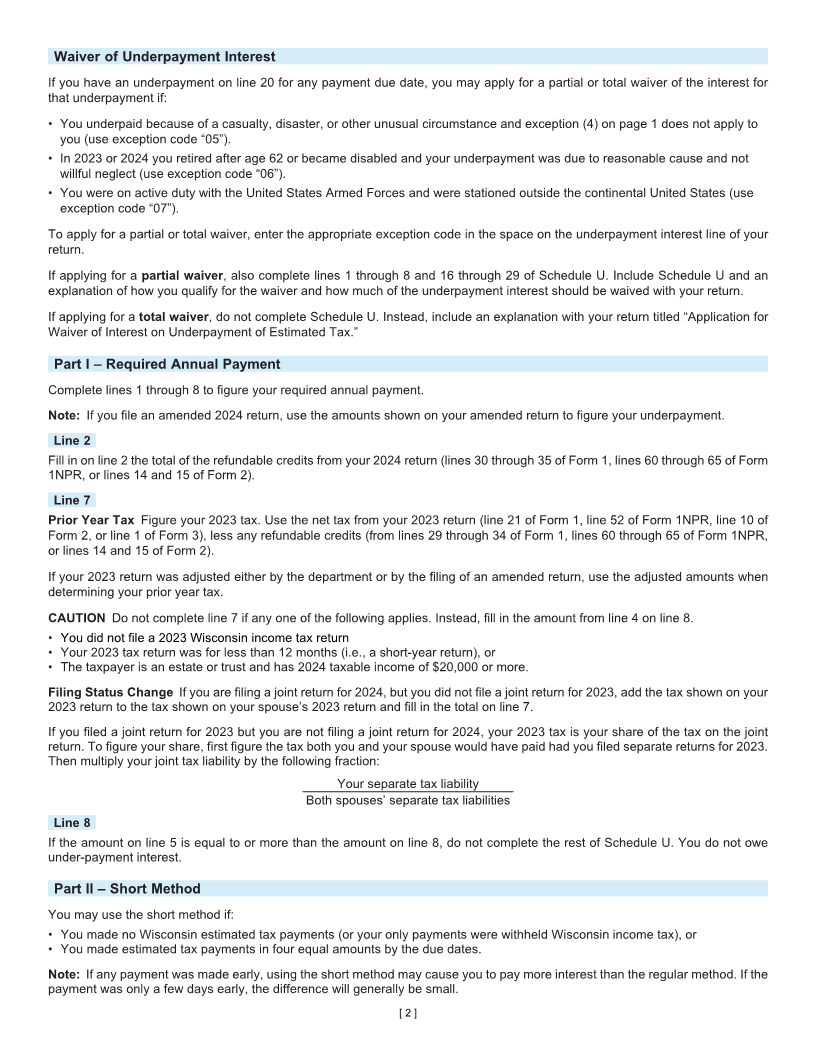

Exception Codes

You will not owe underpayment interest if the total tax shown on your 2024 return minus the amount of tax you paid through

withholding is less than $500. To determine whether you qualify for this exception, complete lines 1 through 6.

If this exception does not apply to you, see below for other exceptions which may apply.

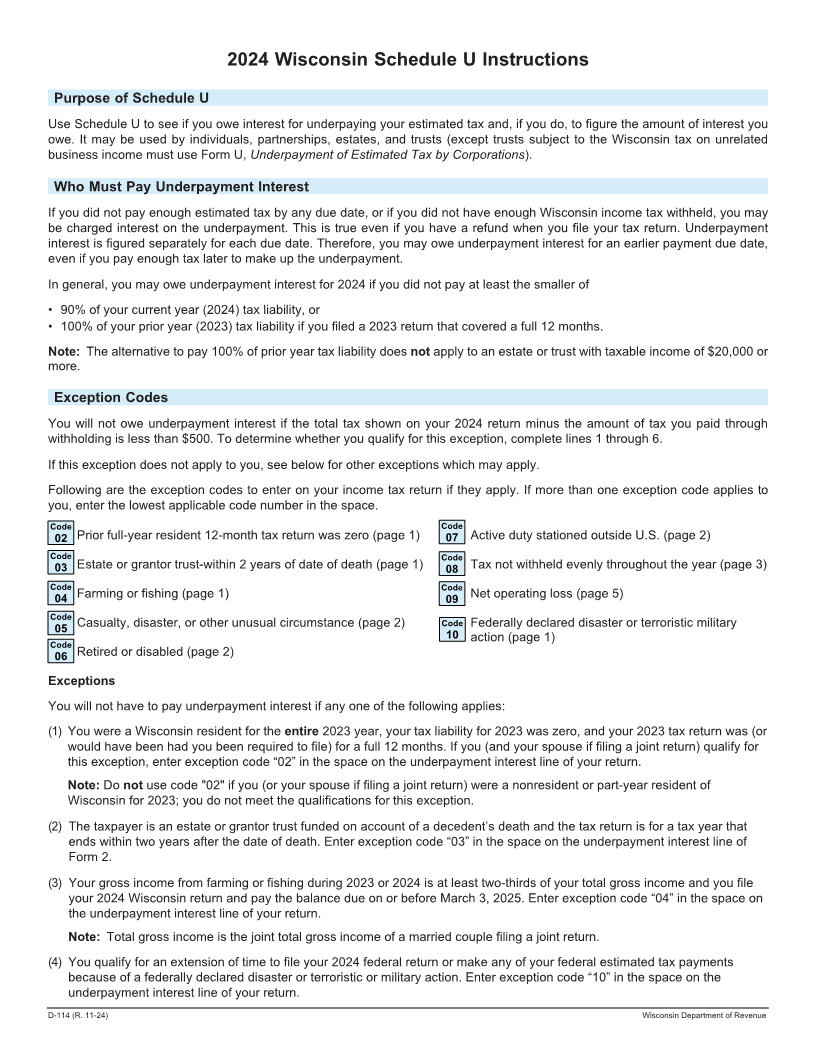

Following are the exception codes to enter on your income tax return if they apply. If more than one exception code applies to

you, enter the lowest applicable code number in the space.

Code Code

02 Prior full-year resident 12-month tax return was zero (page 1) 07 Active duty stationed outside U.S. (page 2)

Code Code

03 Estate or grantor trust-within 2 years of date of death (page 1) 08 Tax not withheld evenly throughout the year (page 3)

Code Code

04 Farming or fishing (page 1) 09 Net operating loss (page 5)

Code Casualty, disaster, or other unusual circumstance (page 2) Code Federally declared disaster or terroristic military

05 10 action (page 1)

Code

06 Retired or disabled (page 2)

Exceptions

You will not have to pay underpayment interest if any one of the following applies:

(1) You were a Wisconsin resident for the entire 2023 year, your tax liability for 2023 was zero, and your 2023 tax return was (or

would have been had you been required to file) for a full 12 months. If you (and your spouse if filing a joint return) qualify for

this exception, enter exception code “02” in the space on the underpayment interest line of your return.

Note: Do not use code "02" if you (or your spouse if filing a joint return) were a nonresident or part-year resident of

Wisconsin for 2023; you do not meet the qualifications for this exception.

(2) The taxpayer is an estate or grantor trust funded on account of a decedent’s death and the tax return is for a tax year that

ends within two years after the date of death. Enter exception code “03” in the space on the underpayment interest line of

Form 2.

(3) Your gross income from farming or fishing during 2023 or 2024 is at least two-thirds of your total gross income and you file

your 2024 Wisconsin return and pay the balance due on or before March 3, 2025. Enter exception code “04” in the space on

the underpayment interest line of your return.

Note: Total gross income is the joint total gross income of a married couple filing a joint return.

(4) You qualify for an extension of time to file your 2024 federal return or make any of your federal estimated tax payments

because of a federally declared disaster or terroristic or military action. Enter exception code “10” in the space on the

underpayment interest line of your return.

D-114 (R. 11-24) Wisconsin Department of Revenue