Enlarge image

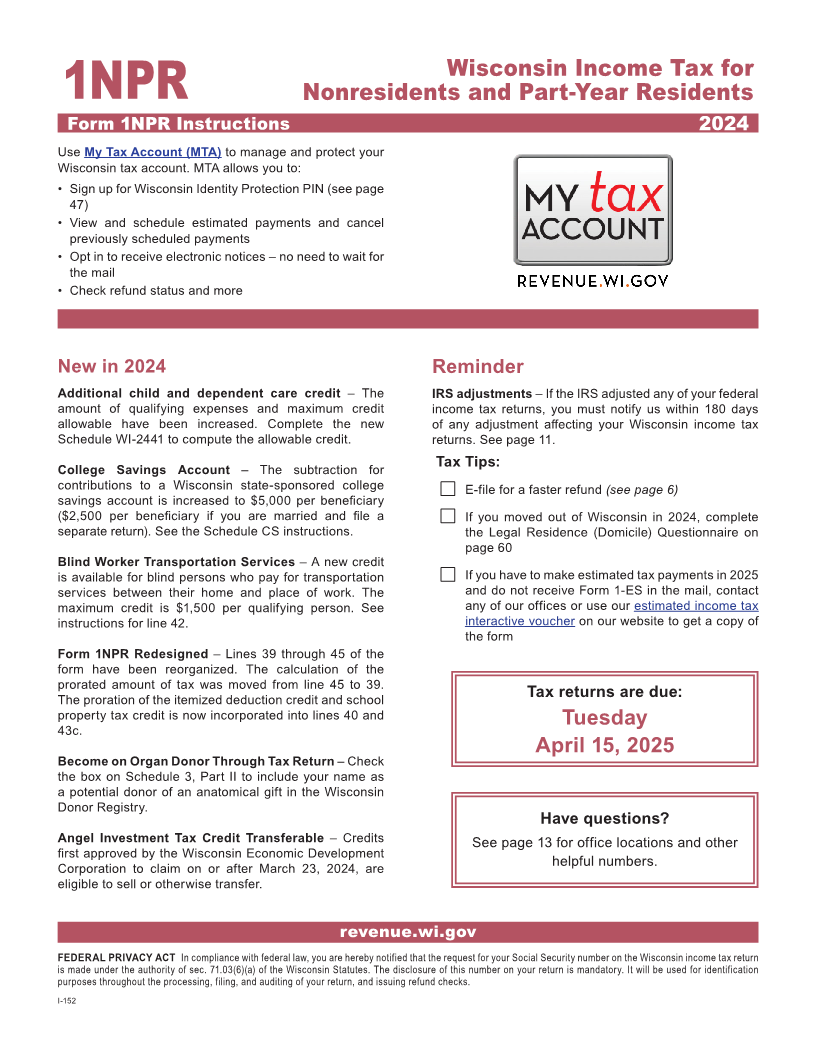

Wisconsin Income Tax for

Nonresidents and Part-Year Residents

1NPR

Form 1NPR Instructions 2024

Use My Tax Account (MTA) to manage and protect your

Wisconsin tax account. MTA allows you to:

• Sign up for Wisconsin Identity Protection PIN (see page MY TAX

47)

• View and schedule estimated payments and cancel

previously scheduled payments

ACCOUNT

• Opt in to receive electronic notices – no need to wait for

the mail

revenue.wi.gov

• Check refund status and more

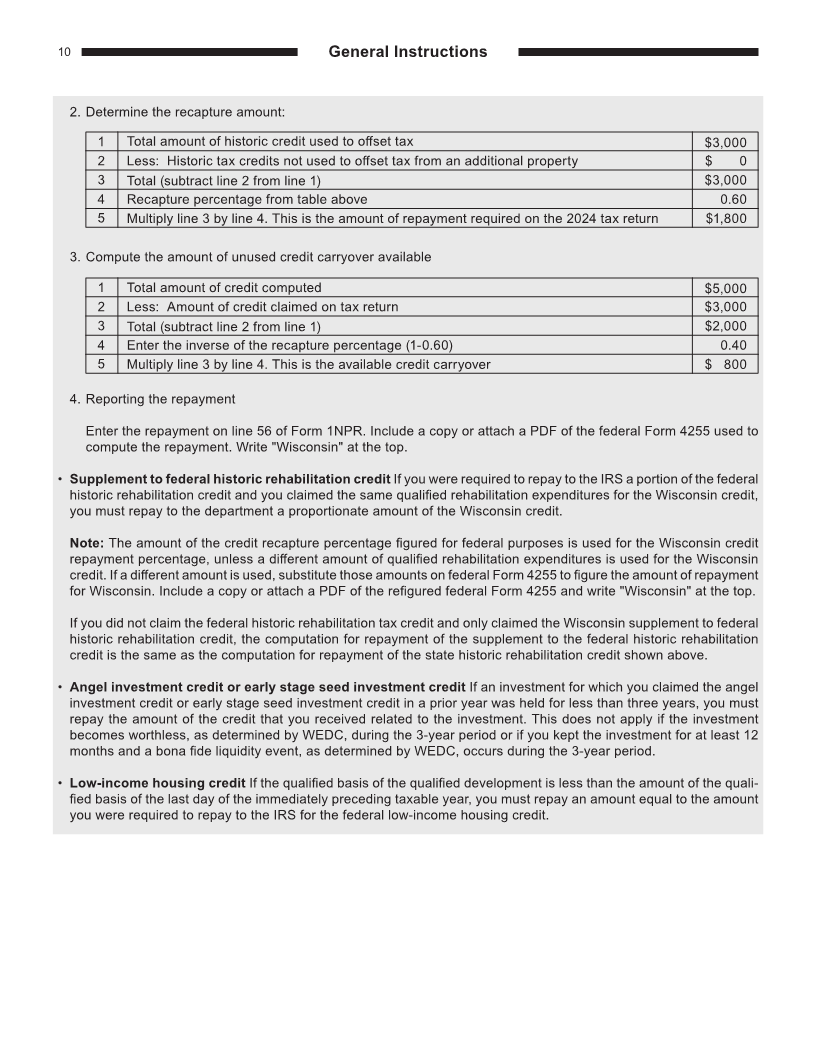

New in 2024 Reminder

Additional child and dependent care credit – The IRS adjustments – If the IRS adjusted any of your federal

amount of qualifying expenses and maximum credit income tax returns, you must notify us within 180 days

allowable have been increased. Complete the new of any adjustment affecting your Wisconsin income tax

Schedule WI-2441 to compute the allowable credit. returns. See page 11.

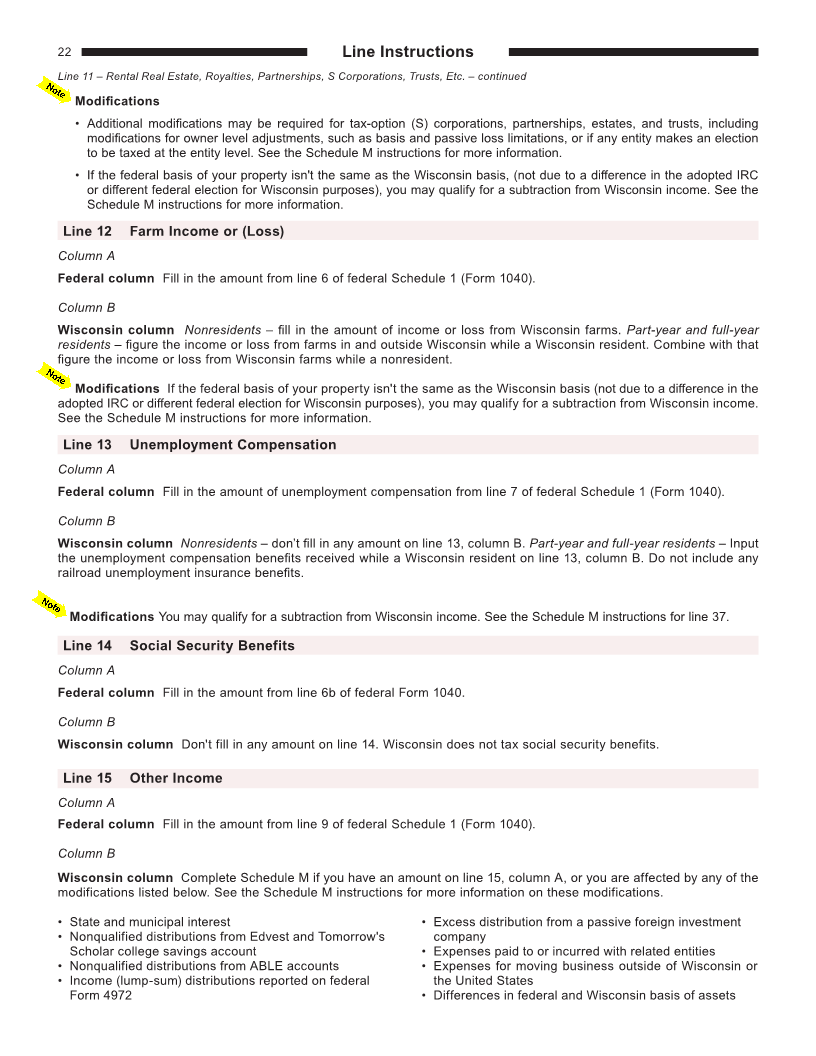

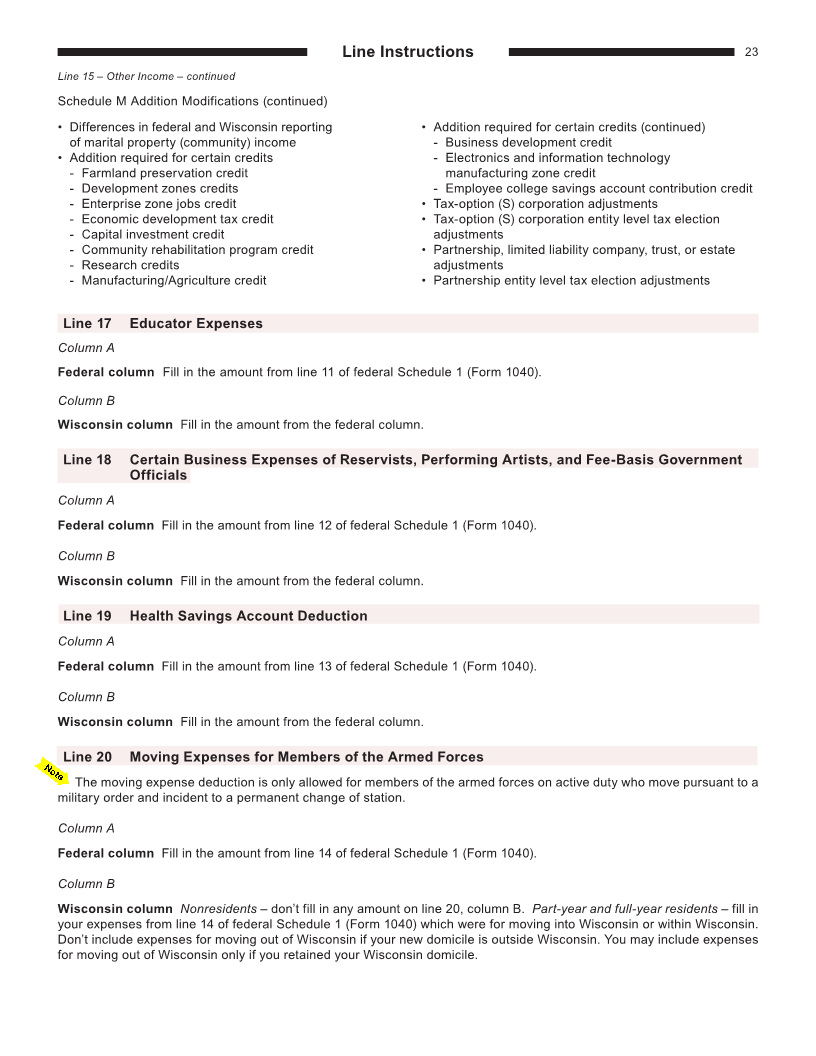

– The subtraction for Tax Tips:

College Savings Account

contributions to a Wisconsin state-sponsored college E-file for a faster refund (see page 6)

savings account is increased to $5,000 per beneficiary

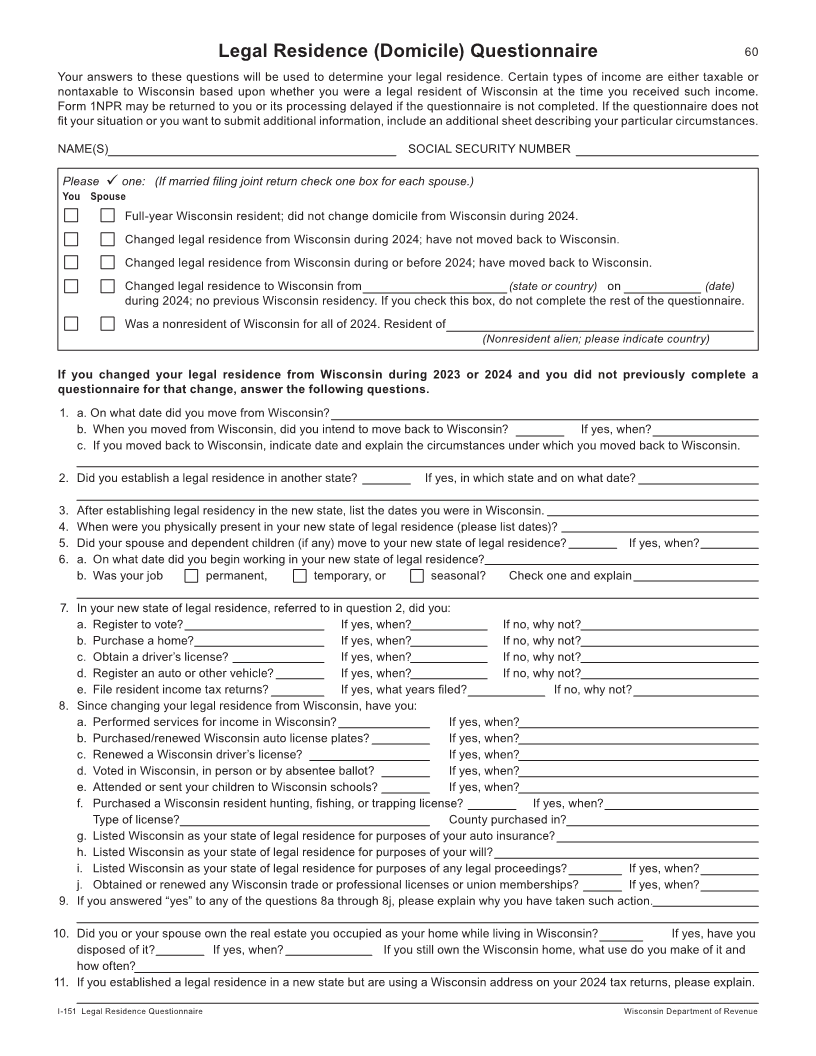

($2,500 per beneficiary if you are married and file a If you moved out of Wisconsin in 2024, complete

separate return). See the Schedule CS instructions. the Legal Residence (Domicile) Questionnaire on

page 60

Blind Worker Transportation Services – A new credit

is available for blind persons who pay for transportation If you have to make estimated tax payments in 2025

services between their home and place of work. The and do not receive Form 1-ES in the mail, contact

maximum credit is $1,500 per qualifying person. See any of our offices or use our estimated income tax

instructions for line 42. interactive voucher on our website to get a copy of

the form

Form 1NPR Redesigned – Lines 39 through 45 of the

form have been reorganized. The calculation of the

prorated amount of tax was moved from line 45 to 39.

The proration of the itemized deduction credit and school Tax returns are due:

property tax credit is now incorporated into lines 40 and

43c. Tuesday

April 15, 2025

Become on Organ Donor Through Tax Return – Check

the box on Schedule 3, Part II to include your name as

a potential donor of an anatomical gift in the Wisconsin

Donor Registry.

Have questions?

Angel Investment Tax Credit Transferable – Credits See page 13 for office locations and other

first approved by the Wisconsin Economic Development

Corporation to claim on or after March 23, 2024, are helpful numbers.

eligible to sell or otherwise transfer.

revenue.wi.gov

FEDERAL PRIVACY ACT In compliance with federal law, you are hereby notified that the request for your Social Security number on the Wisconsin income tax return

is made under the authority of sec. 71.03(6)(a) of the Wisconsin Statutes. The disclosure of this number on your return is mandatory. It will be used for identification

purposes throughout the processing, filing, and auditing of your return, and issuing refund checks.

I-152