Enlarge image

Wisconsin Income Tax

1

Form 1 Instructions 2024

Use WisTax to electronically file your Wisconsin individual income tax New: Wisconsin has joined the IRS Direct File program.

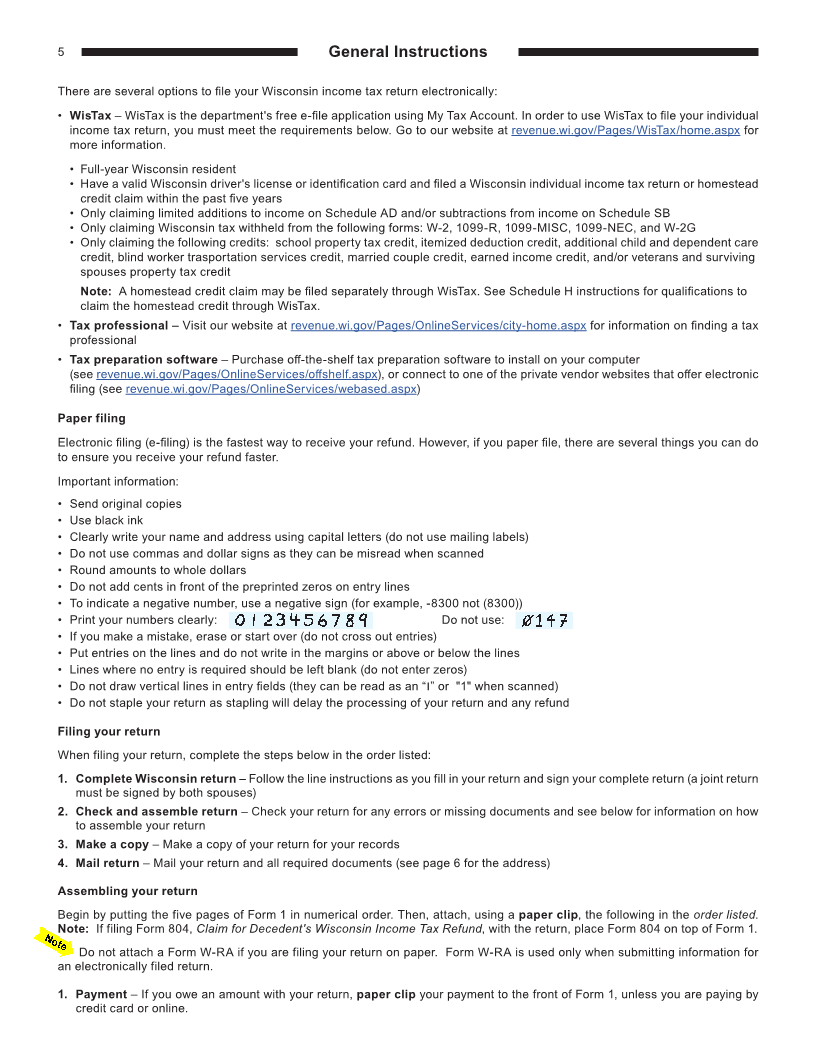

return (Form 1) and standalone homestead credit claim (Schedule H) This enables eligible Wisconsin taxpayers who use IRS

for free (see page 5). Direct File to pass their federal information into WisTax,

creating an easier filing experience.

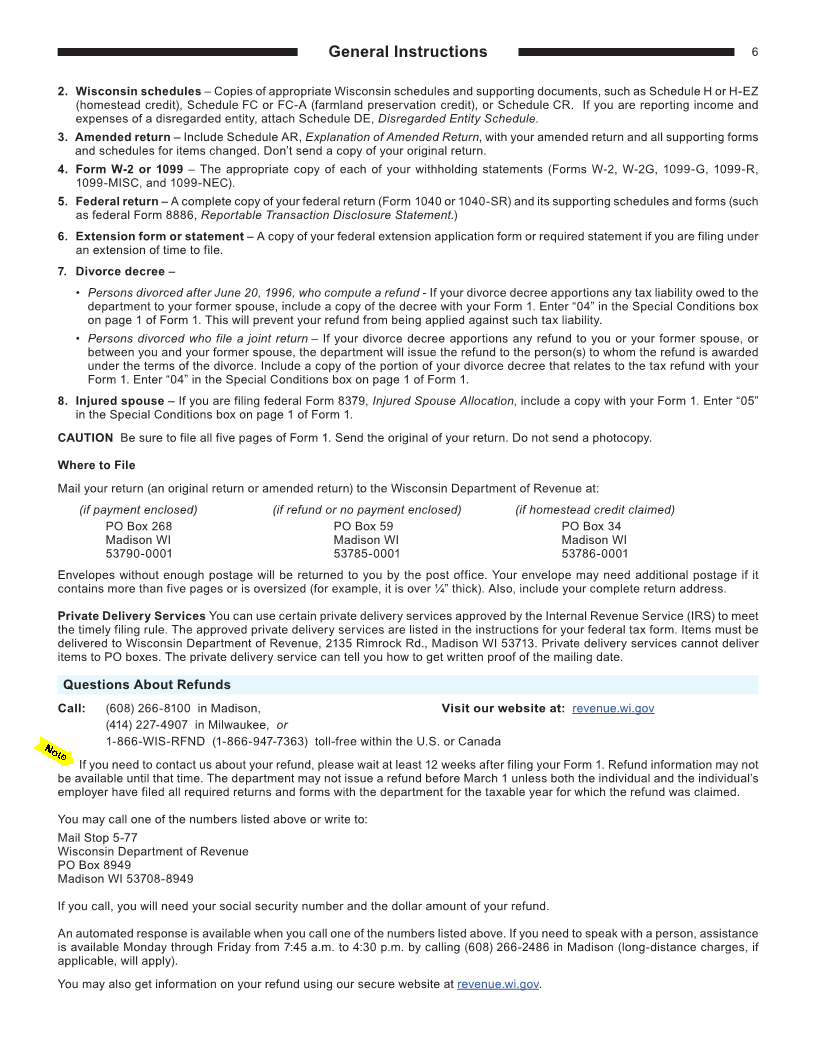

Use My Tax Account (MTA) to manage and protect your Wisconsin tax

account. MTA allows taxpayers to:

• File with Wis Tax WIS MY TAX

• Sign up for Wisconsin Identity Protection PIN (see page 34)

• View and schedule estimated payments and cancel previously

scheduled payments

TAX ACCOUNT

• Opt in to receive electronic notices – no need to wait for the mail

• Check refund status and more

New in 2024

Additional Child and Dependent Care Credit – The amount of

qualifying expenses and maximum credit allowable have been

increased. Complete the new Schedule WI-2441 to compute the Tax returns are due:

allowable credit.

Tuesday

College Savings Account – The subtraction for contributions to a

Wisconsin state-sponsored college savings account is increased to April 15, 2025

$5,000 per beneficiary ($2,500 per beneficiary if you are married and

file a separate return). See the Schedule CS instructions.

Tuition and Fee Expenses – The subtraction for tuition and fees

increased to $7,333 per student and the phase-out range increased.

See the Schedule SB instructions.

Blind Worker Transportation Services Credit – A new credit

is available for blind persons who pay for transportation services Free help with your taxes

between their home and place of work. The maximum credit is

$1,500 per qualifying person. See the instructions for line 15. You may be eligible for free

tax help. See page 2 for:

Become an Organ Donor Through Tax Return – Check the

box on Schedule 3, Part II to include your name as a potential • Who can get help

donor of an anatomical gift in the Wisconsin Donor Registry. Visit • How to find a location

donatelifewisconsin.org to learn about organ and tissue donation in • What to bring with you

Wisconsin, or visit the National Donor Registry Program at donatelife.

net to learn about organ and tissue donation in the United States. Para Assistencia Gratuita

Angel Investment Tax Credit Transferable – Credits first approved en Español

by the Wisconsin Economic Development Corporation to claim on or Ver página 2

after March 23, 2024, are eligible to sell or otherwise transfer.

Reminder

IRS Adjustments – If the IRS adjusted any of your federal income

tax returns, you must notify us within 180 days of any adjustment

affecting your Wisconsin income tax returns. See page 9.

revenue.wi.gov

FEDERAL PRIVACY ACT In compliance with federal law, you are hereby notified that the request for your Social Security number on the Wisconsin income tax return is made under the

authority of sec. 71.03(6)(a) of the Wisconsin Statutes. The disclosure of this number on your return is mandatory. It will be used for identification purposes throughout the processing,

filing and auditing of your return, and issuing refund checks.

I-111