Enlarge image

Instructions for 2024 Wisconsin Form PW-U:

Underpayment of Estimated Withholding Tax by Pass-Through Entities

Purpose of Form PW-U

Pass-through entities use Form PW-U to determine if they are subject to interest for underpayment of estimated

withholding tax and, if so, the amount of interest. A pass-through entity must have made estimated withholding

tax payments if the total of its withholding tax for its taxable year beginning in 2024 is $500 or more. Form PW-

U is also used to compute both extension and delinquent interest whenever the withholding tax due is paid after

the unextended due date of the Form PW-1.

Exception Codes

If you qualify for an exception listed below, enter the appropriate exception code in the brackets to the left of

Form PW-1, line 9. If you qualify for more than one exception code, enter the lowest applicable code number.

Exception Code "02" – According to sec. 71.775(4)(fm)1., Wis. Stats., you are not subject to underpayment

interest if your withholding tax due for 2024 is less than $500. Your withholding tax due is the amount from line

1 of the 2024 Form PW-1 minus the total of lines 3 and 4 of the 2024 Form PW-1. If your withholding tax due is

less than $500, enter exception code "02" in the brackets to the left of Form PW-1, line 9.

Exception Code "03" – According to sec. 71.775(4)(fm)2., Wis. Stats., you are not subject to underpayment

interest if you meet all of the following conditions:

• Your withholding tax due for 2024 is less than $5,000. Your withholding tax due for 2024 is the amount

from line 1 of the 2024 Form PW-1 minus the total of lines 3 and 4 of the 2024 Form PW-1.

• Your preceding taxable year was a full 12 months.

• Your withholding tax liability for the preceding taxable year was zero. Your withholding tax liability for the

preceding taxable year is the amount reported or required to be reported on line 1 of the 2023 Form PW-

1. If you did not file Form PW-1 for the preceding taxable year because you were not required to file, your

withholding tax liability for the preceding taxable year is zero.

If you meet the above conditions, enter exception code "03" in the brackets to the left of Form PW-1, line 9.

Exception Code "04" – According to sec. 71.775(4)(g), Wis. Stats., you are not subject to underpayment interest

if you meet all of the following conditions:

• Your preceding taxable year was a full 12 months.

• You filed Form 2, Form 3, Form 5S, or Form PW-1 for the preceding taxable year.

• Your withholding tax due for the preceding taxable year was zero. Your withholding tax due for the

preceding taxable year is the amount from line 1 of the 2023 Form PW-1 minus the total of lines 3 and 4

of the 2023 Form PW-1. If you did not file Form PW-1 for the preceding taxable year because you were

not required to file, your withholding tax due for the preceding taxable year is zero.

If you meet the above conditions, enter exception code "04" in the brackets to the left of Form PW-1, line 9.

Estates and grantor trusts with a taxable year ending less than two years after the decedent's death may also

use exception code "04" since they are not required to make estimated tax payments for those years.

Exception Code “05” – According to sec. 71.775(4)(h), Wis. Stats., you may qualify to calculate a lower amount

of underpayment interest if you use the annualized income installment method on Form PW-U, Part III. If you

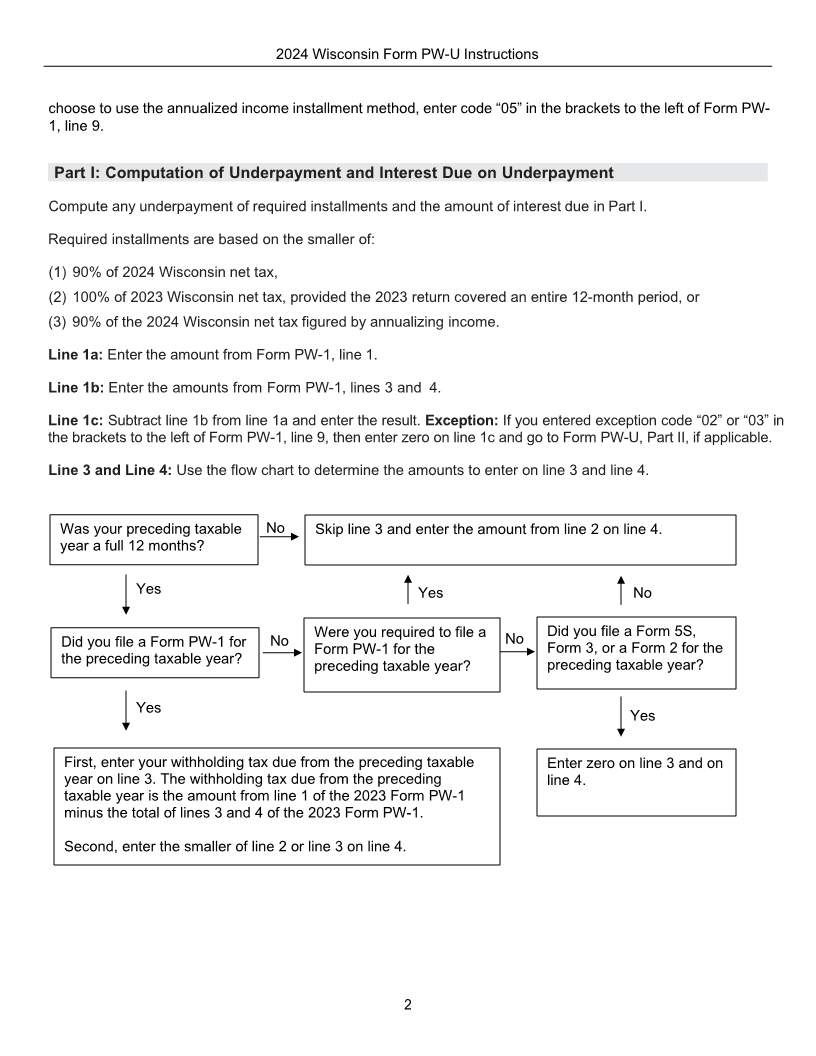

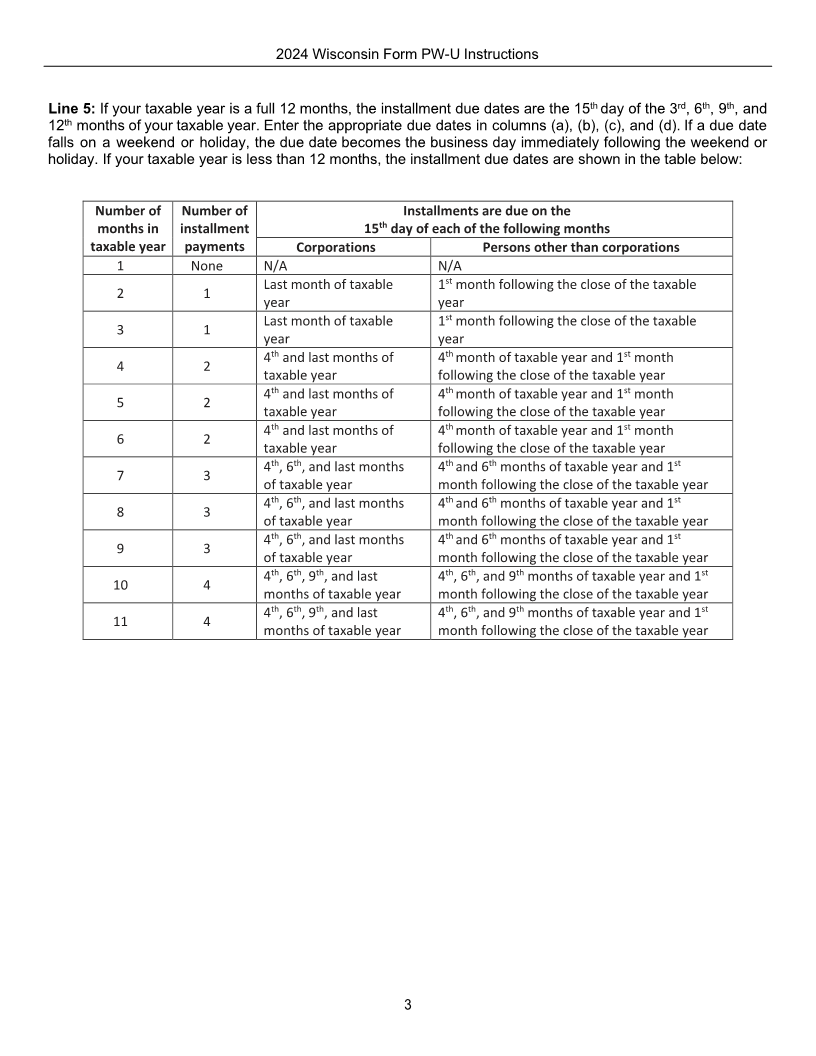

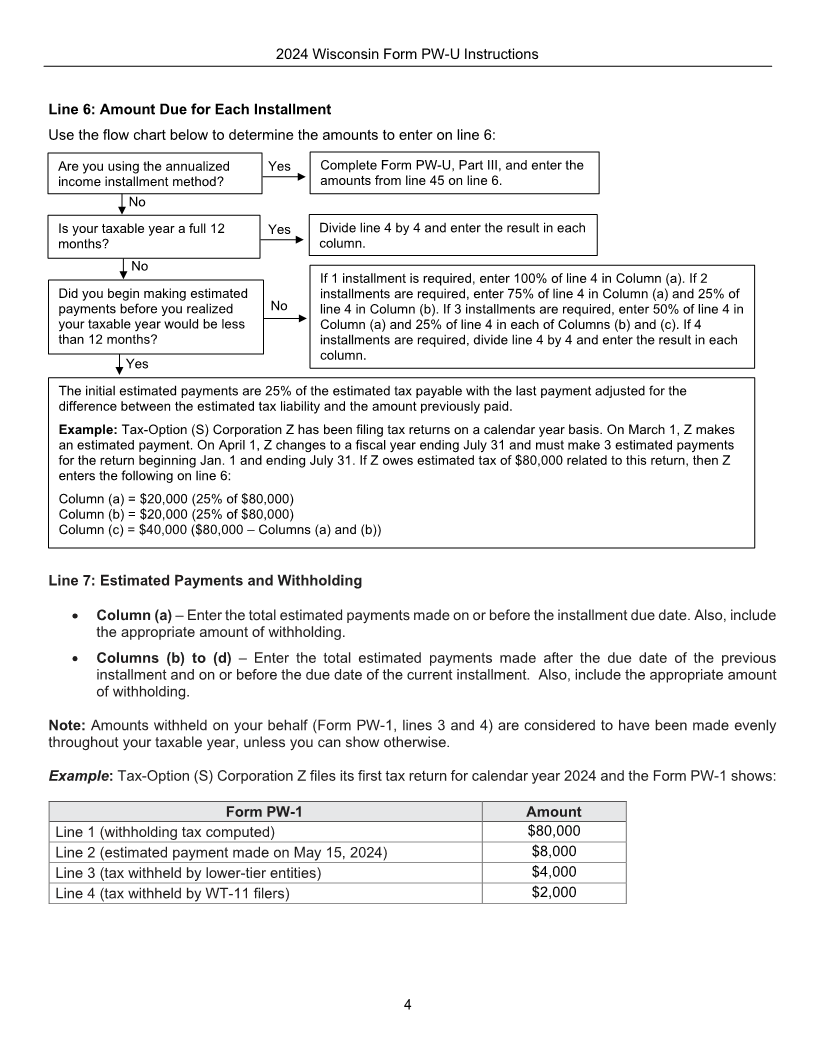

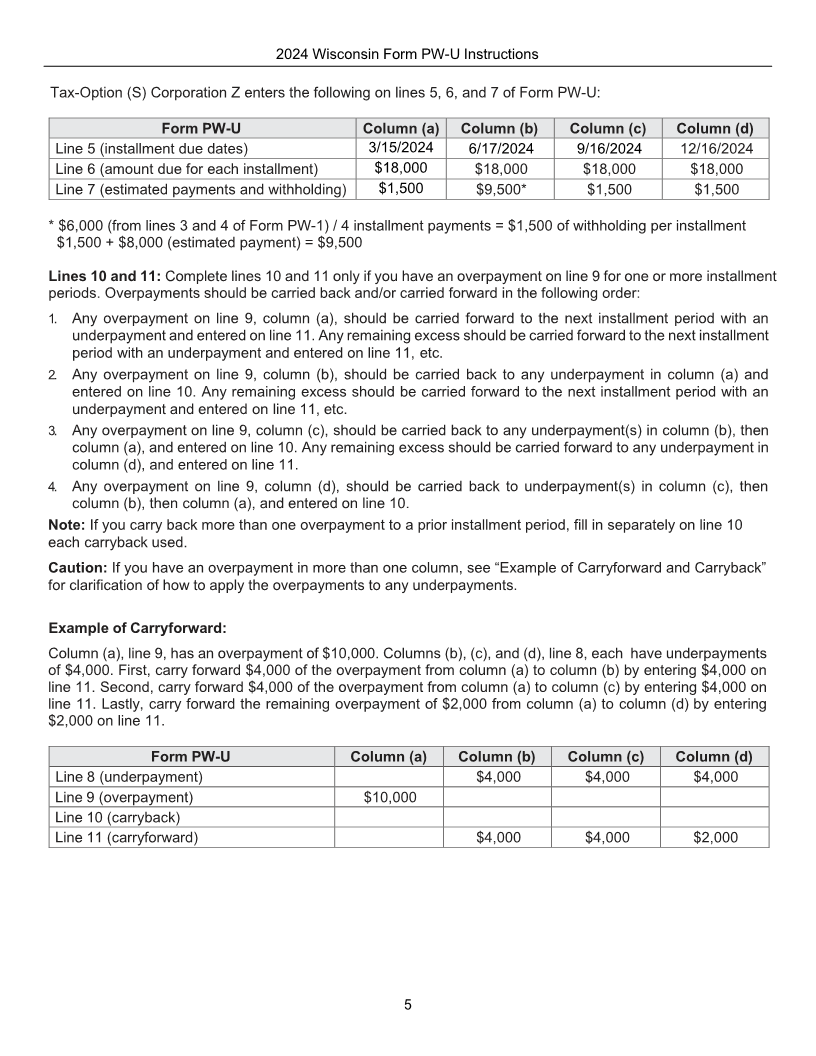

IC-106 (R. 12-24)