- 3 -

Enlarge image

|

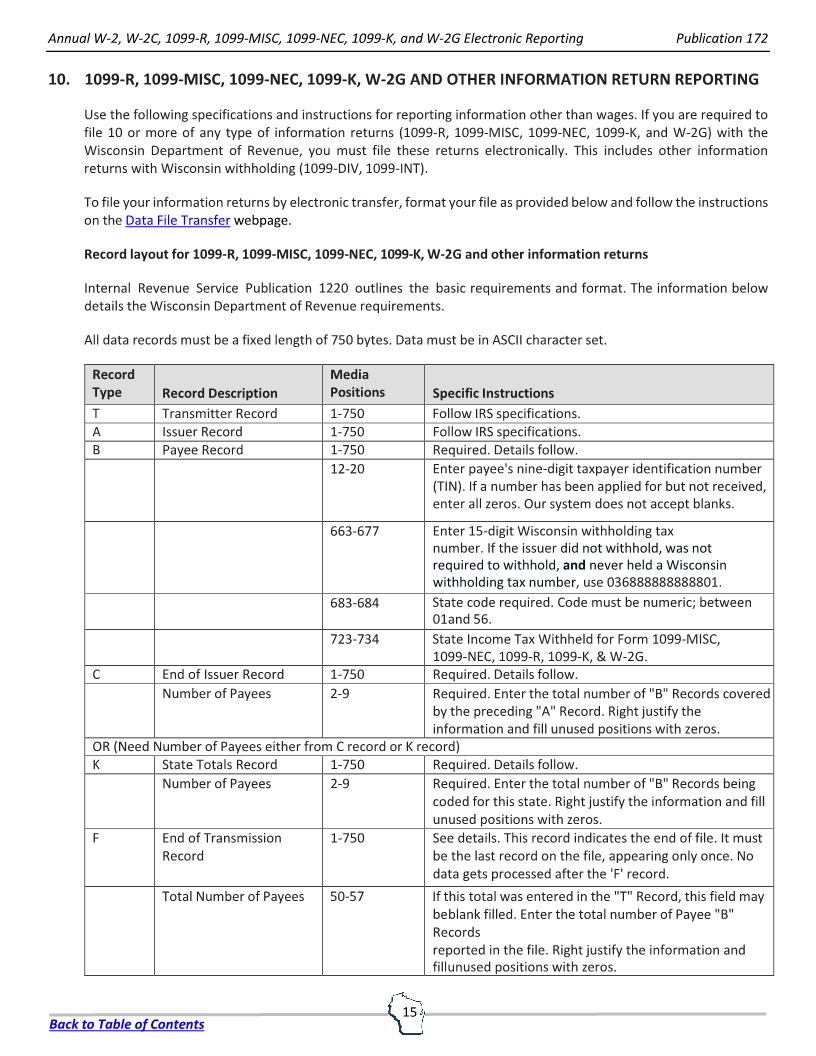

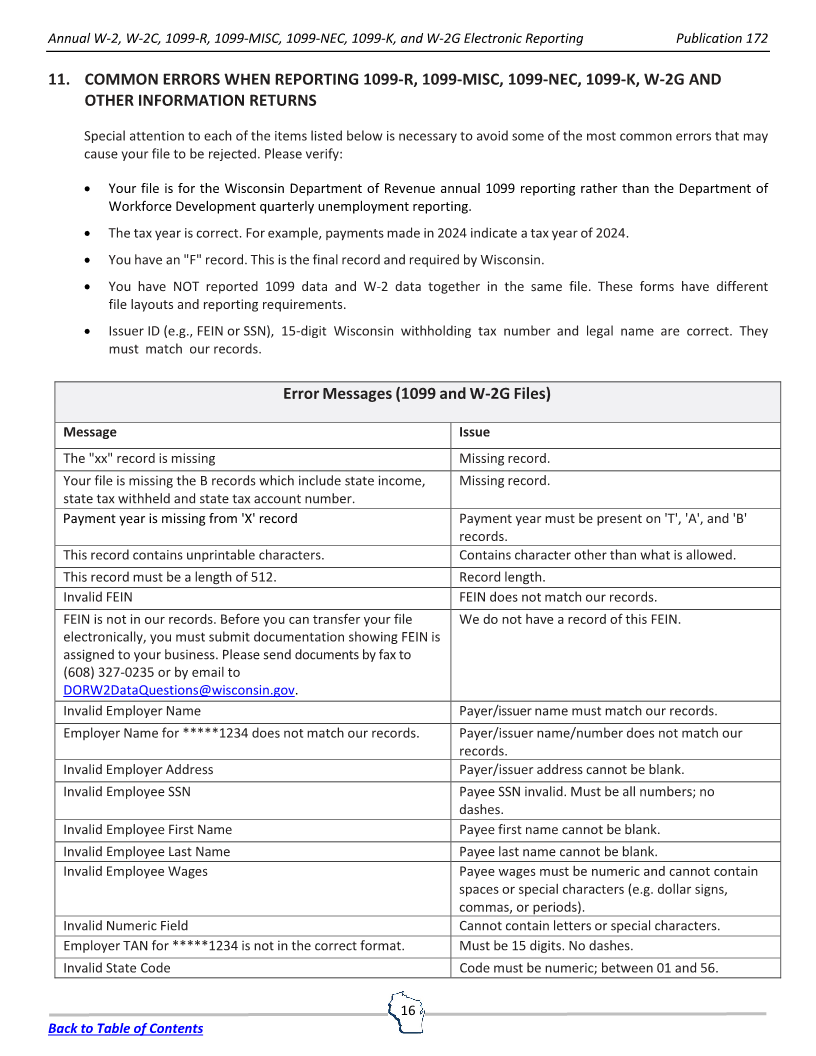

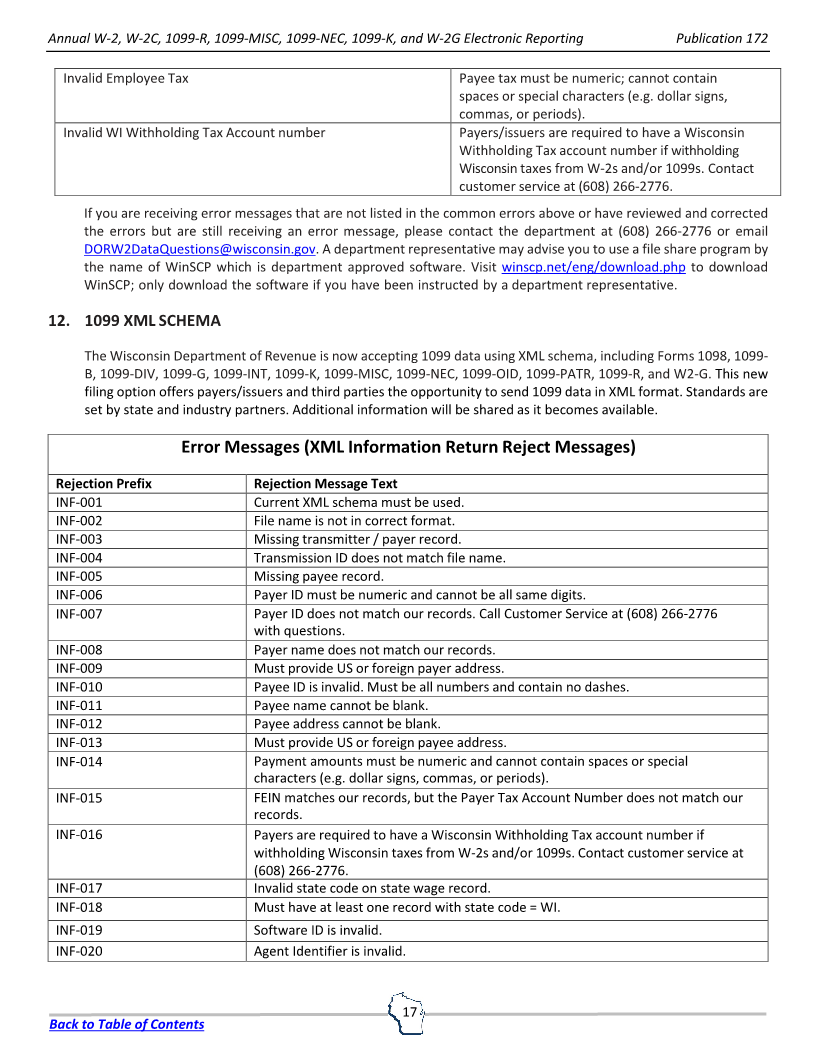

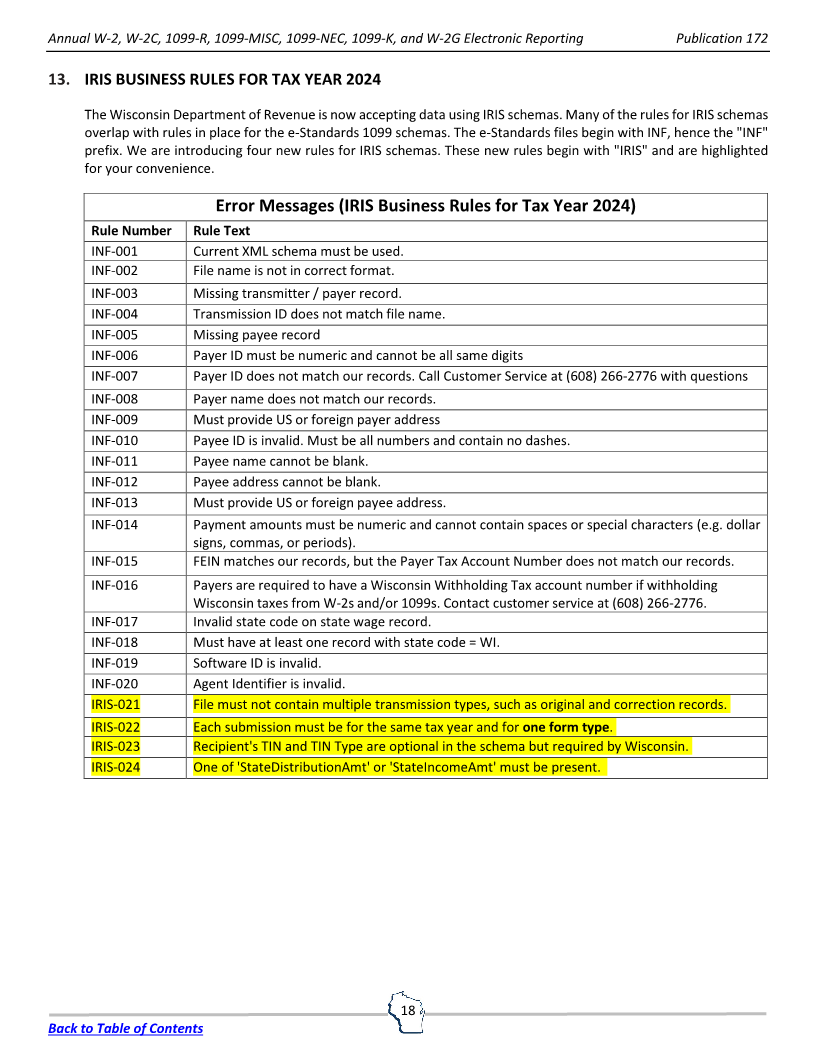

Annual W-2, W-2C, 1099-R, 1099-MISC, 1099-NEC, 1099-K, and W-2G Electronic Reporting Publication 172

1. SPECIAL NOTICE

Employers and other payers doing business in Wisconsin must file wage statements and information returns with

the Wisconsin Department of Revenue for certain payments made in 2024 (see Publication 117, Guide to Wisconsin

Wage Statements and Information Returns). This includes (1) payments made to Wisconsin residents, regardless of

where services were performed, and (2) payments made to nonresidents for services performed in Wisconsin.

If you file 10 or more wage statements or information returns with the department, you must file electronically. If

you file fewer than 10 wage or information returns, we encourage you to file electronically. Electronic filing options

include: My Tax Account,Data File Transfer, and secure file transfer protocol (sFTP).

This publication contains the specifications and instructions for reporting state wages, withholding and information

other than wages to the Wisconsin Department of Revenue electronically.

For the Data File Transfer, we accept the following files.

A. W-2 files in EFW2 Social Security Administration format

B. W-2C files in EFW2C Social Security Administration format

C. 1099-R, 1099-MISC, 1099-NEC, 1099-K, and W-2G files in Internal Revenue Service format as shown in IRS

Publication 1220.

For the Data File Transfer, we do not accept other types of files (for example, PDFs scanned or created with any

other software product). We also do not accept CD-ROMs, cartridges, flash drives, floppy disks, magnetic media,

and PDF files created at SSA website. The specifications and record formats in this publication should be used for

Tax Year 2024 reporting and for filing prior year, current year and corrected (EFW2, EFW2C, and 1099/W-2G) files.

These specifications and record formats are designed to be compatible with the formats in:

• Social Security Administration Publication No. 42-007, EFW2 Tax Year 2024 – Use for W-2 files in EFW2 format.

Any reference within this publication to the SSA specification is in italics. Records/files are designed so that

copies of the SSA file may be sent to Wisconsin as long as the state information, known as the 'RS' records are

included.

• Social Security Administration Publication No. 42-014, EFW2C Tax Year 2024 – Use for W-2C files in EFW2C

format.

• IRS Publication 1220, Tax Year 2024 – Use for 1099-R, 1099-MISC, 1099-NEC, 1099-K, and W-2G files. All

references made to the IRS specifications refer to Publication 1220.

For sFTP, we accept the following files:

A. 1099-R, 1099-MISC, 1099-NEC, 1099-K, and W-2G files in the eStandards format

B. W-2G and 1099s in the IRIS format

• IRS Publication 5718 – Use for all information returns. See the publication for a list of all form types

accepted in IRIS format.

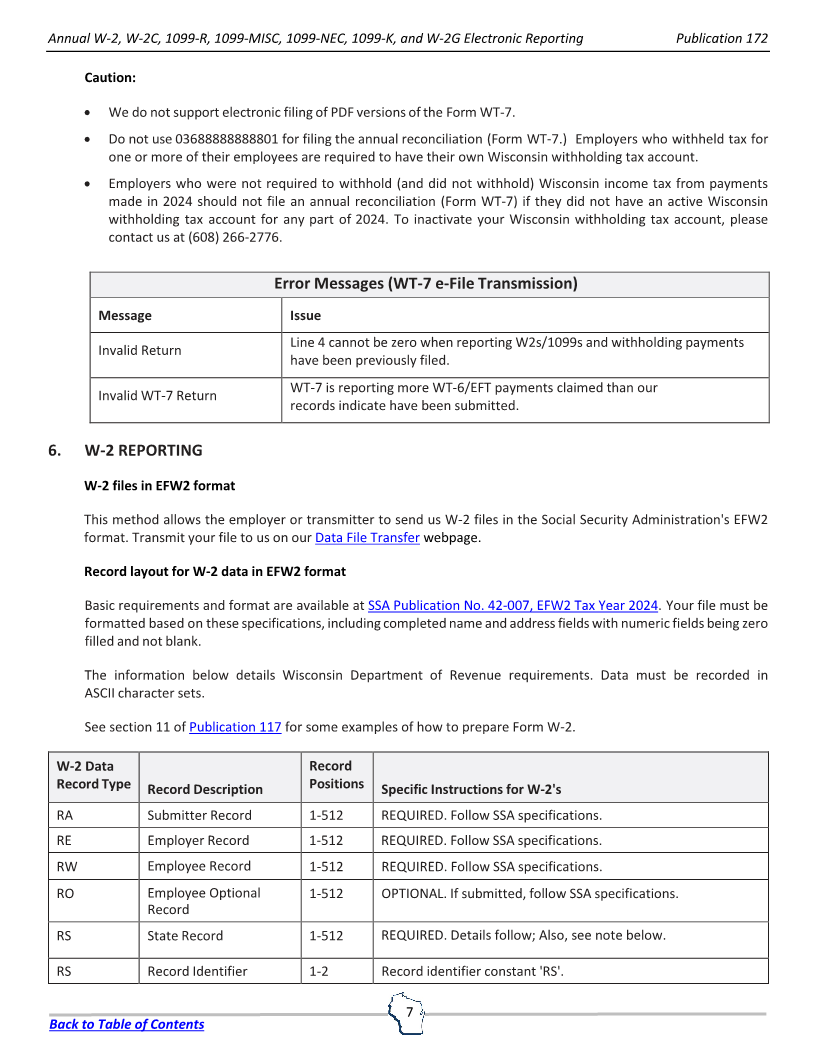

Caution:

• Sections 6, 7, and 8 of this publication refer to the annual reporting of W-2 information to the Wisconsin

Department of Revenue and should not be confused with quarterly wage reporting for unemployment

(Department of Workforce Development) purposes.

3

Back to Table of Contents

|