Enlarge image

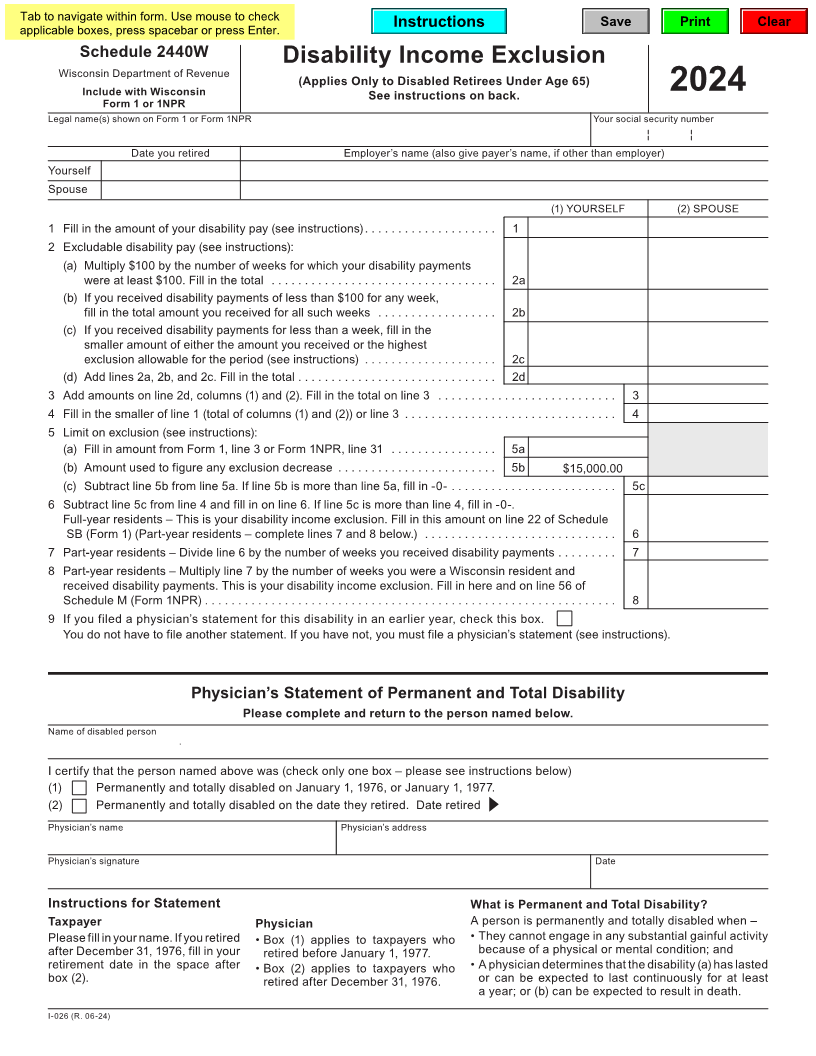

Tab to navigate within form. Use mouse to check Save Print Clear

applicable boxes, press spacebar or press Enter. Instructions

Schedule 2440W

Disability Income Exclusion

Wisconsin Department of Revenue

(Applies Only to Disabled Retirees Under Age 65)

Include with Wisconsin See instructions on back. 2024

Form 1 or 1NPR

Legal name(s) shown on Form 1 or Form 1NPR Your social security number

Date you retired Employer’s name (also give payer’s name, if other than employer)

Yourself

Spouse

(1) YOURSELF (2) SPOUSE

1 Fill in the amount of your disability pay (see instructions) . . . . . . . . . . . . . . . . . . . . 1

2 Excludable disability pay (see instructions):

(a) Multiply $100 by the number of weeks for which your disability payments

were at least $100 . Fill in the total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

(b) If you received disability payments of less than $100 for any week,

fill in the total amount you received for all such weeks . . . . . . . . . . . . . . . . . . 2b

(c) If you received disability payments for less than a week, fill in the

smaller amount of either the amount you received or the highest

exclusion allowable for the period (see instructions) . . . . . . . . . . . . . . . . . . . . 2c

(d) Add lines 2a, 2b, and 2c . Fill in the total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

3 Add amounts on line 2d, columns (1) and (2) . Fill in the total on line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Fill in the smaller of line 1 (total of columns (1) and (2)) or line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Limit on exclusion (see instructions):

(a) Fill in amount from Form 1, line 3 or Form 1NPR, line 31 . . . . . . . . . . . . . . . . 5a

(b) Amount used to figure any exclusion decrease . . . . . . . . . . . . . . . . . . . . . . . . 5b $15,000 .00

(c) Subtract line 5b from line 5a . If line 5b is more than line 5a, fill in -0- . . . . . . . . . . . . . . . . . . . . . . . . . 5c

6 Subtract line 5c from line 4 and fill in on line 6 . If line 5c is more than line 4, fill in -0- .

Full-year residents – This is your disability income exclusion . Fill in this amount on line 22 of Schedule

SB (Form 1) (Part-year residents – complete lines 7 and 8 below .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Part-year residents – Divide line 6 by the number of weeks you received disability payments . . . . . . . . . 7

8 Part-year residents – Multiply line 7 by the number of weeks you were a Wisconsin resident and

received disability payments . This is your disability income exclusion . Fill in here and on line 56 of

Schedule M (Form 1NPR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 If you filed a physician’s statement for this disability in an earlier year, check this box .

You do not have to file another statement . If you have not, you must file a physician’s statement (see instructions) .

Physician’s Statement of Permanent and Total Disability

Please complete and return to the person named below.

Name of disabled person

I certify that the person named above was (check only one box – please see instructions below)

(1) Permanently and totally disabled on January 1, 1976, or January 1, 1977 .

(2) Permanently and totally disabled on the date they retired . Date retired

Physician’s name Physician’s address

Physician’s signature Date

Instructions for Statement What is Permanent and Total Disability?

Taxpayer Physician A person is permanently and totally disabled when –

Please fill in your name . If you retired • Box (1) applies to taxpayers who • They cannot engage in any substantial gainful activity

after December 31, 1976, fill in your retired before January 1, 1977 . because of a physical or mental condition; and

retirement date in the space after • Box (2) applies to taxpayers who • A physician determines that the disability (a) has lasted

box (2) . retired after December 31, 1976 . or can be expected to last continuously for at least

a year; or (b) can be expected to result in death .

I-026 (R. 06-24)