Enlarge image

Tab to navigate within form. Use mouse to check Instructions Save Print Clear

applicable boxes, press spacebar or press Enter.

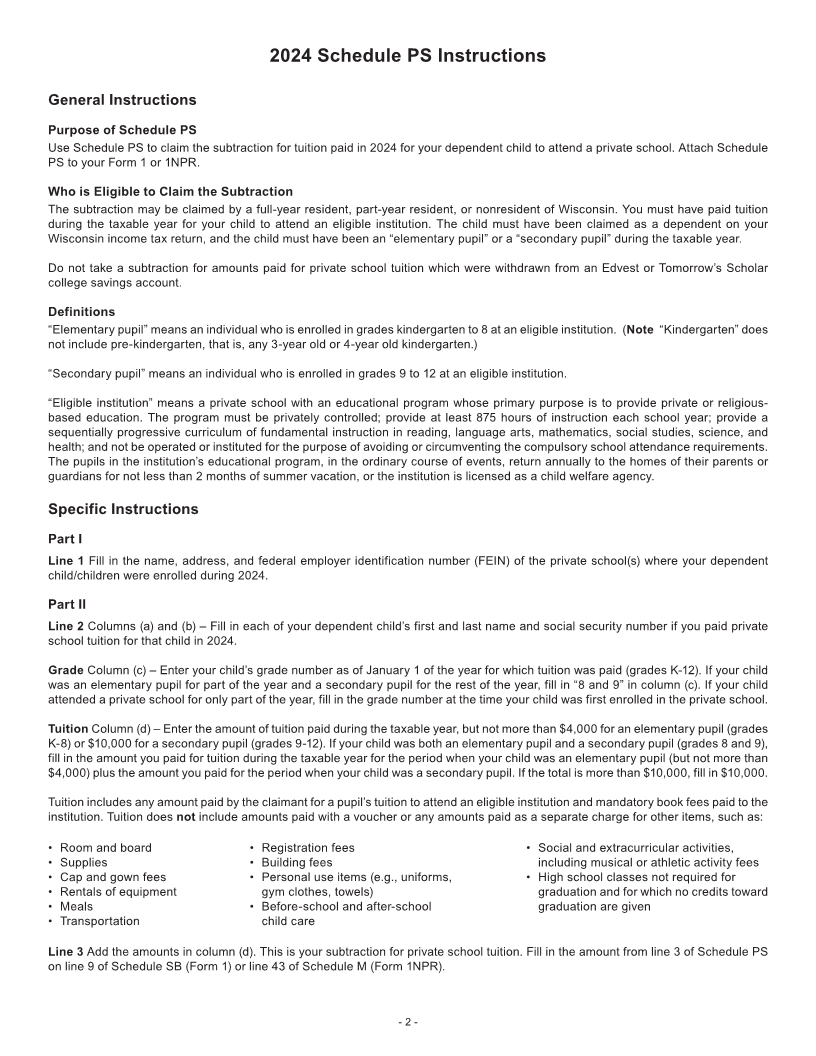

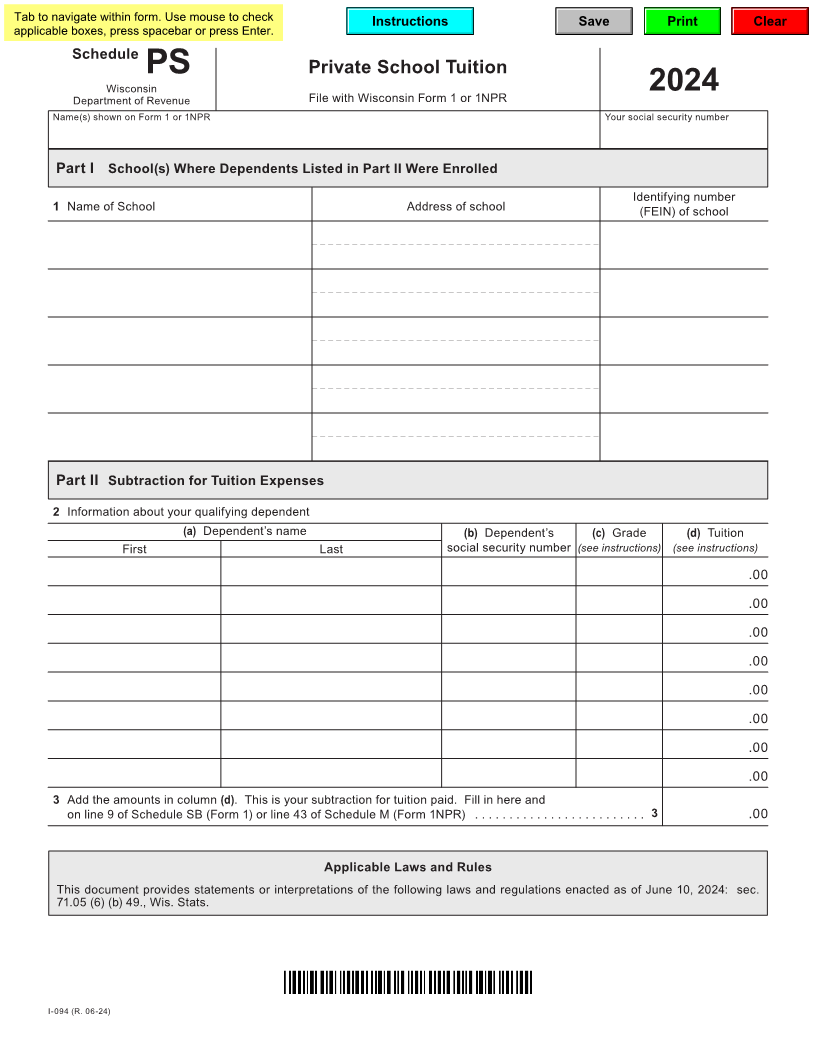

Schedule

PS Private School Tuition

Wisconsin

Department of Revenue File with Wisconsin Form 1 or 1NPR 2024

Name(s) shown on Form 1 or 1NPR Your social security number

Part I School(s) Where Dependents Listed in Part II Were Enrolled

Identifying number

1 Name of School Address of school (FEIN) of school

Part II Subtraction for Tuition Expenses

2 Information about your qualifying dependent

(a) Dependent’s name (b) Dependent’s (c) Grade (d) Tuition

First Last social security number (see instructions) (see instructions)

.00

.00

.00

.00

.00

.00

.00

.00

3 Add the amounts in column (d). This is your subtraction for tuition paid. Fill in here and

on line 9 of Schedule SB (Form 1) or line 43 of Schedule M (Form 1NPR) ......................... 3 .00

Applicable Laws and Rules

This document provides statements or interpretations of the following laws and regulations enacted as of June 10, 2024: sec.

71.05 (6) (b) 49., Wis. Stats.

I-094 (R. 06-24)