Enlarge image

Tab to navigate within form. Use mouse to check Save Print Clear

applicable boxes, press spacebar, or press Enter.

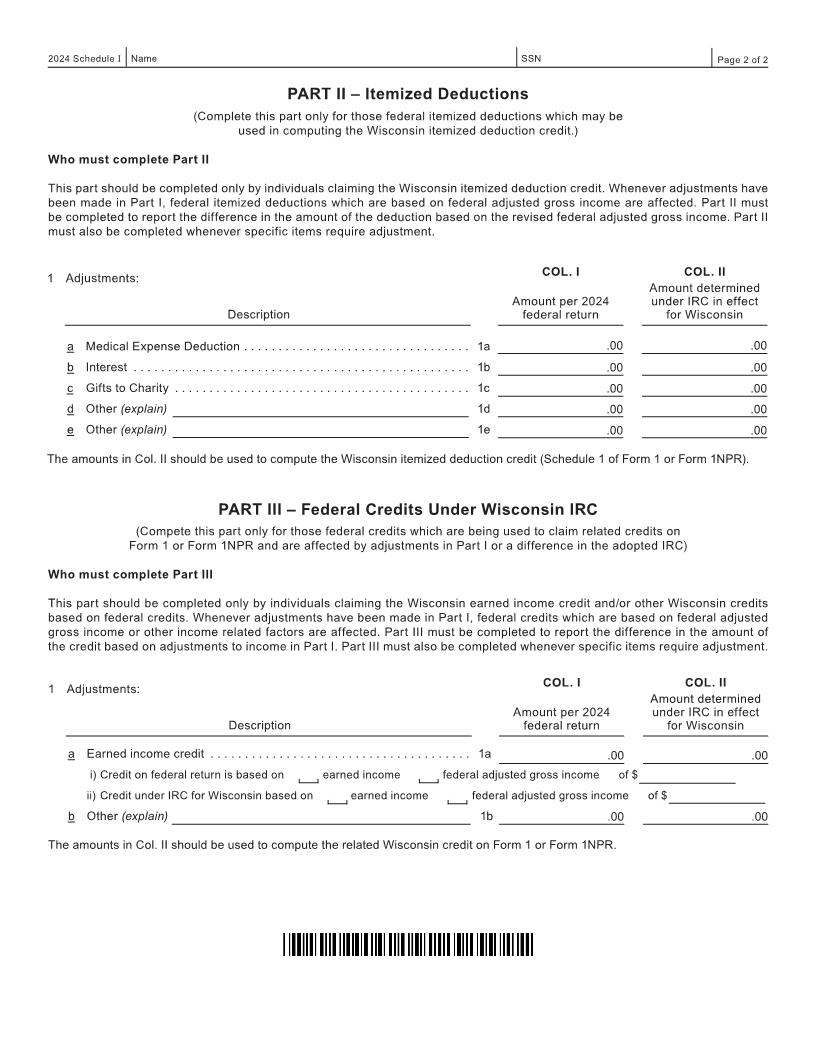

Schedule Adjustments to Convert Federal Adjusted

Gross Income, Itemized Deductions, and Credits

I to the Amounts Allowable for Wisconsin

Wisconsin 2024

Department of Revenue Include with Wisconsin Form 1 or Form 1NPR

Name(s) shown on Form 1 or Form 1NPR Your social security number

PART I – Adjustments to Federal Adjusted Gross Income

(Read instructions before completing Schedule ) I

1 Additions to federal adjusted gross income (enter as positive numbers):

a Discharge of indebtedness on principal residence . . . . . . . . . . . . . . . . . 1a .00

b Federal depreciation and sec . 179 expense . . . . . . . . . . . . . . . . . . . . . . 1b .00

c Federal capital losses from line 7 of federal Form 1040 or 1040-SR . . 1c .00

d Federal ordinary losses from line 4 of federal Schedule 1 (Form 1040) . 1d .00

e Wisconsin capital gains from line 7 of revised federal Form 1040 or

1040-SR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1e .00

f Wisconsin ordinary gains from line 4 of revised federal Schedule 1

(Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1f .00

g Certain student loan forgiveness (see instructions) . . . . . . . . . . . . . . . . 1g .00

h Other . . . . . . . . . . . . . . . . 1h .00

i Other . . . . . . . . . . . . . . . . 1i .00

j Total additions - Add lines 1a through 1i . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1j .00

2 Subtractions from federal adjusted gross income (enter as positive numbers):

a Health savings account adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a .00

b Wisconsin depreciation and sec . 179 expense . . . . . . . . . . . . . . . . . . . . 2b .00

c Wisconsin capital losses from line 7 of revised federal Form 1040 or

1040-SR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c .00

d Wisconsin ordinary losses from line 4 of revised federal Schedule 1

(Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d .00

e Federal capital gains from line 7 of federal Form 1040 or 1040-SR . . . . 2e .00

f Federal ordinary gains from line 4 of federal Schedule 1 (Form 1040) . 2f .00

g Other . . . . . . . . . . . . . . . . 2g .00

h Other . . . . . . . . . . . . . . . . 2h .00

i Other . . . . . . . . . . . . . . . . 2i .00

j Total subtractions - Add lines 2a through 2i . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2j .00

3 Subtract line 2j from line 1j . If line 3 is a negative number, place a minus sign (-) in front of the number .

Fill in here and on line 2 of Wisconsin Form 1 . (Note: The above figures must also be used to complete

Columns A and B for each of the lines 1 through 29 of Form 1NPR) . . . . . . . . . . . . . . . . . . . . . . . . . . 3 .00

I-028 (R. 06-24)