Enlarge image

Tab to navigate within form. Use mouse to check Save Print Clear

applicable boxes, press spacebar or press Enter.

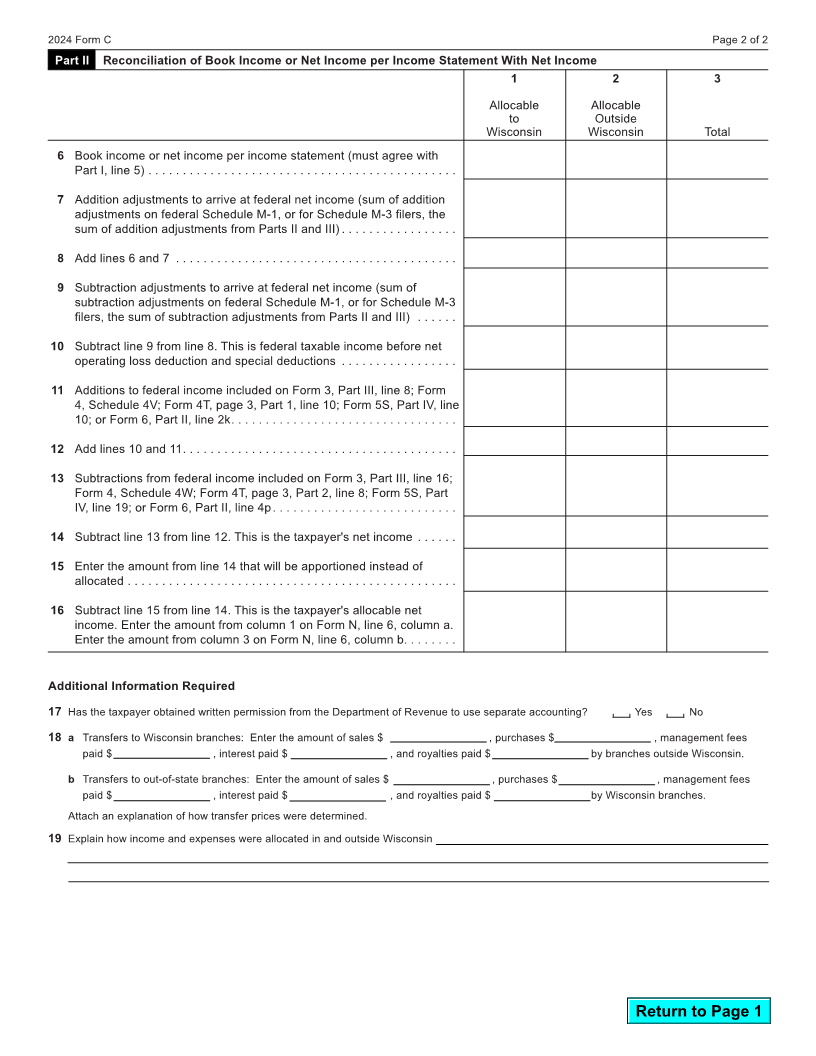

Form

Wisconsin Allocation and Separate Accounting Data

C File with Wisconsin Form 3, 4, 4T, 5S, or 6

Wisconsin Name Federal Employer ID Number

Department of Revenue 2024

Part I Allocation of Book Income or Net Income per Income Statement

1 2 3

Allocable Allocable

Basis of to Outside

Allocation Wisconsin Wisconsin Total

1 Enter items of income:

2 Enter total income

3 Enter expenses:

4 Enter total expenses

5 Enter book income or net income per income statement

The book income on line 5, column 3, must agree with either federal Schedule M‑1, line 1, or for Schedule M‑3 filers, the net income

per income statement, figured on a separate company basis.

IC-044 (R. 6-24) (over)

Go to Page 2