Enlarge image

2024 Wisconsin Schedule 3-ET Instructions

Purpose of Schedule

A partnership or limited liability company treated as a partnership that makes the election to pay tax at

the entity level must use Schedule 3-ET to compute the entity-level tax on items that would otherwise

be reportable to Wisconsin if the election was not made. For the taxable year in which the election is

made, partners do not include in their Wisconsin adjusted gross income their proportionate share of

items of income, gain, loss, or deduction of the electing partnership.

The election to pay tax at the entity level must be made each year on or before the extended due date

of the Form 3, Wisconsin Partnership Return. The election is made at the time the Form 3 is filed by

checking box "I" under the information section at the beginning of Form 3. The electing partnership

must have consent from partners who hold an aggregate of more than 50 percent of the capital and

profits of the partnership on the day of the election, according to sec. 71.21(6)(a), Wis. Stats. The

election may be revoked by filing an amended Form 3 on or before the extended due date of the Form

3. Partners who hold an aggregate of more than 50 percent of the capital and profits of the partnership

must consent to the revocation.

Result of Making the Election

Income/Gains/Tax Rate

• Reporting income and gains

o Net income reportable to Wisconsin is taxed to the partnership and is not taxable to the

partners.

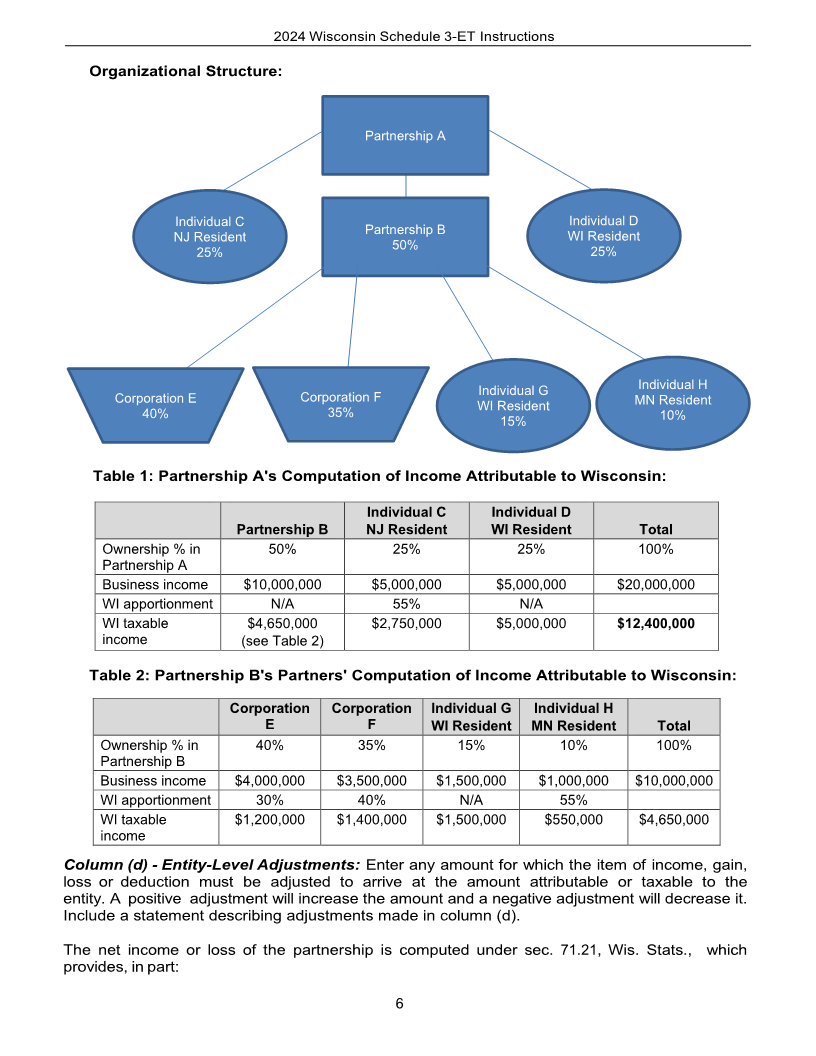

o All income of Wisconsin resident partners that are an individual, estate, or trust must be

reported by the electing partnership.

o Income of Wisconsin resident partners that are not an individual, estate, or trust must be

reported by the electing partnership if the income is attributable to Wisconsin. See

instructions for Column (c) – Nonresidents later in these instructions.

o Income of nonresident partners must be reported by the electing partnership if the income

is attributable to Wisconsin. See instructions for Column (c) – Nonresidents later in these

instructions.

o To the extent a partner would include guaranteed payments in Wisconsin taxable income

had the election not been made, the electing partnership must include the guaranteed

payments in Wisconsin taxable income.

o Partners subtract from their federal adjusted gross income the income reported by the

electing partnership that is included on the electing partnership's Schedule 3-ET for

determining the entity-level tax.

• Tax Rate The net income reportable to Wisconsin is taxed at 7.9 percent. There is no special

capital gains tax rate.

Losses/Deductions

• Reporting losses and deductions An electing partnership may not pass through any

partnership items of loss or deduction to the partners.

• Net operating or business loss An electing partnership may not carryforward a net

operating or business loss to be used to offset income reportable by the electing partnership.

IP-140 (R. 12-24)