Enlarge image

2024 Wisconsin Form 1CNS Instructions

A tax-option (S) corporation having two or more qualifying nonresident shareholders may use

Form 1CNS to report and pay the Wisconsin income tax owed by those shareholders. In order to

file Form 1CNS, the corporation and its shareholders must agree to the rules prescribed by the

Wisconsin Department of Revenue set forth in these instructions.

The composite return replaces the separate Wisconsin individual income tax return, Form 1NPR,

that otherwise would be filed by each of the qualifying and participating nonresident shareholders.

Note: Filing the Form 1CNS does not relieve the entity from filing other required forms; the entity

is still required to file Form 5S, Form PW-1, and withhold on Form PW-1 for all shareholders with

Wisconsin income of $2,000 or more.

Table of Contents

General Instructions for Form 1CNS....................................................................................... 1

Who May Participate in Composite Return .......................................................................................... 1

Who May Not Participate in Composite Return ................................................................................... 2

What Income Is Reportable on Form 1CNS .......................................................................................... 2

When to File .......................................................................................................................................... 2

Filing Methods ...................................................................................................................................... 3

Internal Revenue Service Adjustments and Amended Returns.............................................................. 3

Refunds, Assessments, and Correspondence ........................................................................................ 4

Additional Information and Forms ........................................................................................................ 4

Wisconsin Taxation of Tax-Option (S) Corporation Income for Nonresidents ..... 5

Nonresident Individual Filing Requirements ........................................................................................ 5

Shareholder’s Share of Income Taxable to Wisconsin .......................................................................... 5

Withholding Requirement for Tax-Option (S) Corporations Having Nonresident Shareholders ........... 5

Specific Instructions for Form 1CNS ....................................................................................... 6

Line-by-Line Instructions ..................................................................................................................... 6

Schedule 2 Instructions ......................................................................................................................... 6

Schedule 1 Instructions ......................................................................................................................... 9

Instructions for Third Party Designee, Signatures, Payment, and Supplemental Schedules ......... 9

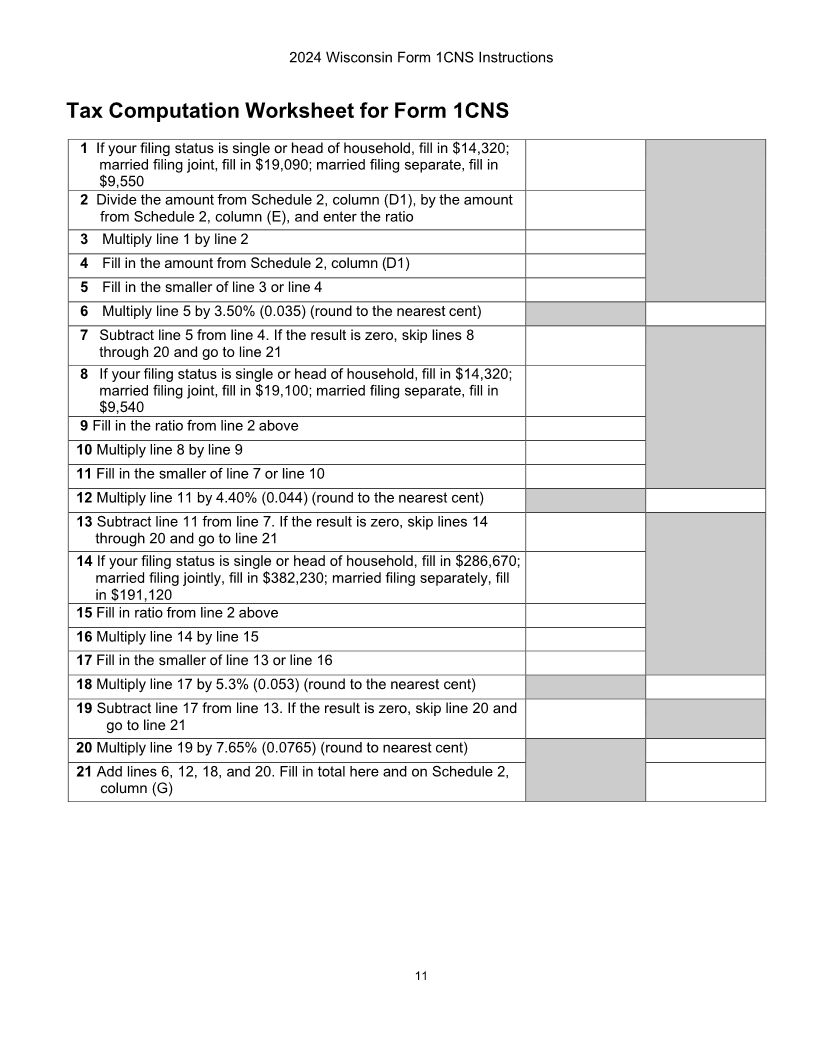

Tax Computation Worksheet for Form 1CNS ...................................................................... 11

General Instructions for Form 1CNS

Who May Participate in Composite Return

A tax-option (S) corporation that derives income from business transacted, services performed,

or property located in Wisconsin may file Form 1CNS on behalf of its nonresident shareholders

who derive no taxable income or deductible loss from Wisconsin other than their pro rata shares

of the Wisconsin tax-option (S) corporation income or loss.

IC-157 (R. 7-24)