Enlarge image

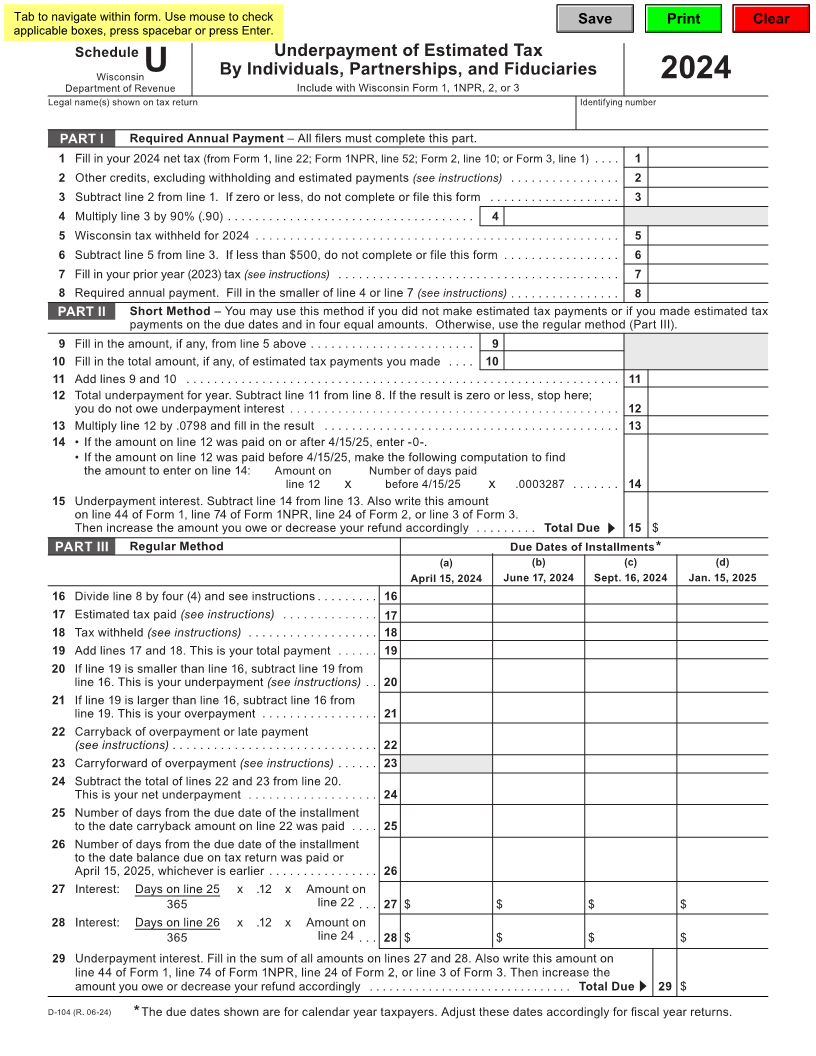

Tab to navigate within form. Use mouse to check Save Print Clear

applicable boxes, press spacebar or press Enter.

Schedule Underpayment of Estimated Tax

WisconsinU By Individuals, Partnerships, and Fiduciaries

Department of Revenue Include with Wisconsin Form 1, 1NPR, 2, or 3 2024

Legal name(s) shown on tax return Identifying number

PART I Required Annual Payment – All filers must complete this part.

1 Fill in your 2024 net tax (from Form 1, line 22; Form 1NPR, line 52; Form 2, line 10; or Form 3, line 1) . . . . 1

2 Other credits, excluding withholding and estimated payments (see instructions) . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1 . If zero or less, do not complete or file this form . . . . . . . . . . . . . . . . . . . 3

4 Multiply line 3 by 90% ( .90) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Wisconsin tax withheld for 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Subtract line 5 from line 3 . If less than $500, do not complete or file this form . . . . . . . . . . . . . . . . . 6

7 Fill in your prior year (2023) tax (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Required annual payment . Fill in the smaller of line 4 or line 7 (see instructions) . . . . . . . . . . . . . . . . 8

PART II Short Method – You may use this method if you did not make estimated tax payments or if you made estimated tax

payments on the due dates and in four equal amounts . Otherwise, use the regular method (Part III) .

9 Fill in the amount, if any, from line 5 above . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Fill in the total amount, if any, of estimated tax payments you made . . . . 10

11 Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Total underpayment for year . Subtract line 11 from line 8 . If the result is zero or less, stop here;

you do not owe underpayment interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Multiply line 12 by .0798 and fill in the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 • If the amount on line 12 was paid on or after 4/15/25, enter -0- .

• If the amount on line 12 was paid before 4/15/25, make the following computation to find

the amount to enter on line 14: Amount on Number of days paid

line 12 x before 4/15/25 x .0003287 . . . . . . . 14

15 Underpayment interest . Subtract line 14 from line 13 . Also write this amount

on line 44 of Form 1, line 74 of Form 1NPR, line 24 of Form 2, or line 3 of Form 3 .

Then increase the amount you owe or decrease your refund accordingly . . . . . . . . . Total Due 15 $

PART III Regular Method Due Dates of Installments *

(a) (b) (c) (d)

April 15, 2024 June 17, 2024 Sept. 16, 2024 Jan. 15, 2025

16 Divide line 8 by four (4) and see instructions . . . . . . . . . 16

17 Estimated tax paid (see instructions) . . . . . . . . . . . . . . 17

18 Tax withheld (see instructions) . . . . . . . . . . . . . . . . . . . 18

19 Add lines 17 and 18 . This is your total payment . . . . . . 19

20 If line 19 is smaller than line 16, subtract line 19 from

line 16 . This is your underpayment (see instructions) . . 20

21 If line 19 is larger than line 16, subtract line 16 from

line 19 . This is your overpayment . . . . . . . . . . . . . . . . . 21

22 Carryback of overpayment or late payment

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Carryforward of overpayment (see instructions) . . . . . . 23

24 Subtract the total of lines 22 and 23 from line 20 .

This is your net underpayment . . . . . . . . . . . . . . . . . . . 24

25 Number of days from the due date of the installment

to the date carryback amount on line 22 was paid . . . . 25

26 Number of days from the due date of the installment

to the date balance due on tax return was paid or

April 15, 2025, whichever is earlier . . . . . . . . . . . . . . . . 26

27 Interest: Days on line 25 x .12 x Amount on

365 line 22 . . . 27 $ $ $ $

28 Interest: Days on line 26 x .12 x Amount on

365 line 24 . . . 28 $ $ $ $

29 Underpayment interest . Fill in the sum of all amounts on lines 27 and 28 . Also write this amount on

line 44 of Form 1, line 74 of Form 1NPR, line 24 of Form 2, or line 3 of Form 3 . Then increase the

amount you owe or decrease your refund accordingly . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total Due 29 $

D-104 (R. 06-24) * The due dates shown are for calendar year taxpayers. Adjust these dates accordingly for fiscal year returns.