Enlarge image

2024 Form 6 Instructions for Combined Returns

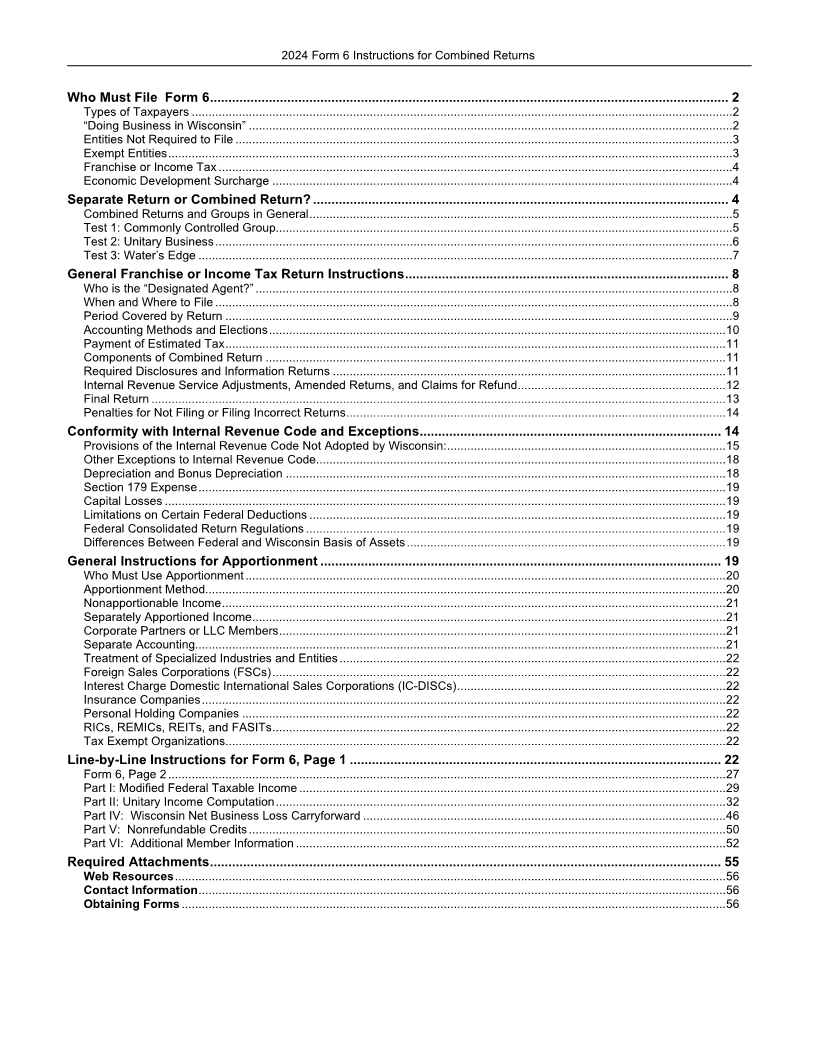

Who Must File Form 6 ............................................................................................................................................. 2

Types of Taxpayers .................................................................................................................................................................2

“Doing Business in Wisconsin” ................................................................................................................................................2

Entities Not Required to File ....................................................................................................................................................3

Exempt Entities ........................................................................................................................................................................3

Franchise or Income Tax .........................................................................................................................................................4

Economic Development Surcharge .........................................................................................................................................4

Separate Return or Combined Return? ................................................................................................................. 4

Combined Returns and Groups in General ..............................................................................................................................5

Test 1: Commonly Controlled Group........................................................................................................................................5

Test 2: Unitary Business ..........................................................................................................................................................6

Test 3: Water’s Edge ...............................................................................................................................................................7

General Franchise or Income Tax Return Instructions ........................................................................................ 8

Who is the “Designated Agent?” ..............................................................................................................................................8

When and Where to File ..........................................................................................................................................................8

Period Covered by Return .......................................................................................................................................................9

Accounting Methods and Elections ........................................................................................................................................ 10

Payment of Estimated Tax ..................................................................................................................................................... 11

Components of Combined Return ......................................................................................................................................... 11

Required Disclosures and Information Returns ..................................................................................................................... 11

Internal Revenue Service Adjustments, Amended Returns, and Claims for Refund .............................................................. 12

Final Return ........................................................................................................................................................................... 13

Penalties for Not Filing or Filing Incorrect Returns ................................................................................................................. 14

Conformity with Internal Revenue Code and Exceptions .................................................................................. 14

Provisions of the Internal Revenue Code Not Adopted by Wisconsin: ................................................................................... 15

Other Exceptions to Internal Revenue Code .......................................................................................................................... 18

Depreciation and Bonus Depreciation ................................................................................................................................... 18

Section 179 Expense ............................................................................................................................................................. 19

Capital Losses ....................................................................................................................................................................... 19

Limitations on Certain Federal Deductions ............................................................................................................................ 19

Federal Consolidated Return Regulations ............................................................................................................................. 19

Differences Between Federal and Wisconsin Basis of Assets ............................................................................................... 19

General Instructions for Apportionment ............................................................................................................. 19

Who Must Use Apportionment ............................................................................................................................................... 20

Apportionment Method........................................................................................................................................................... 20

Nonapportionable Income ...................................................................................................................................................... 21

Separately Apportioned Income ............................................................................................................................................. 21

Corporate Partners or LLC Members ..................................................................................................................................... 21

Separate Accounting.............................................................................................................................................................. 21

Treatment of Specialized Industries and Entities ................................................................................................................... 22

Foreign Sales Corporations (FSCs) ....................................................................................................................................... 22

Interest Charge Domestic International Sales Corporations (IC-DISCs) ................................................................................ 22

Insurance Companies ............................................................................................................................................................ 22

Personal Holding Companies ................................................................................................................................................ 22

RICs, REMICs, REITs, and FASITs ....................................................................................................................................... 22

Tax Exempt Organizations ..................................................................................................................................................... 22

Line-by-Line Instructions for Form 6, Page 1 ..................................................................................................... 22

Form 6, Page 2 ...................................................................................................................................................................... 27

Part I: Modified Federal Taxable Income ............................................................................................................................... 29

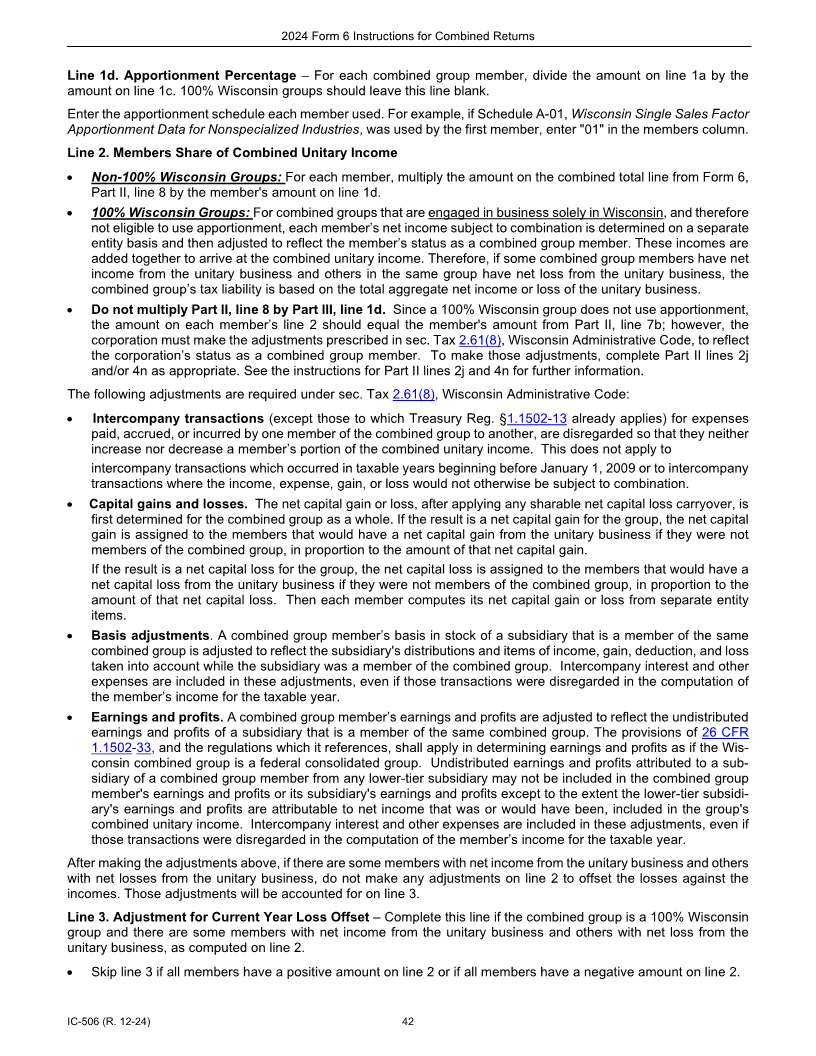

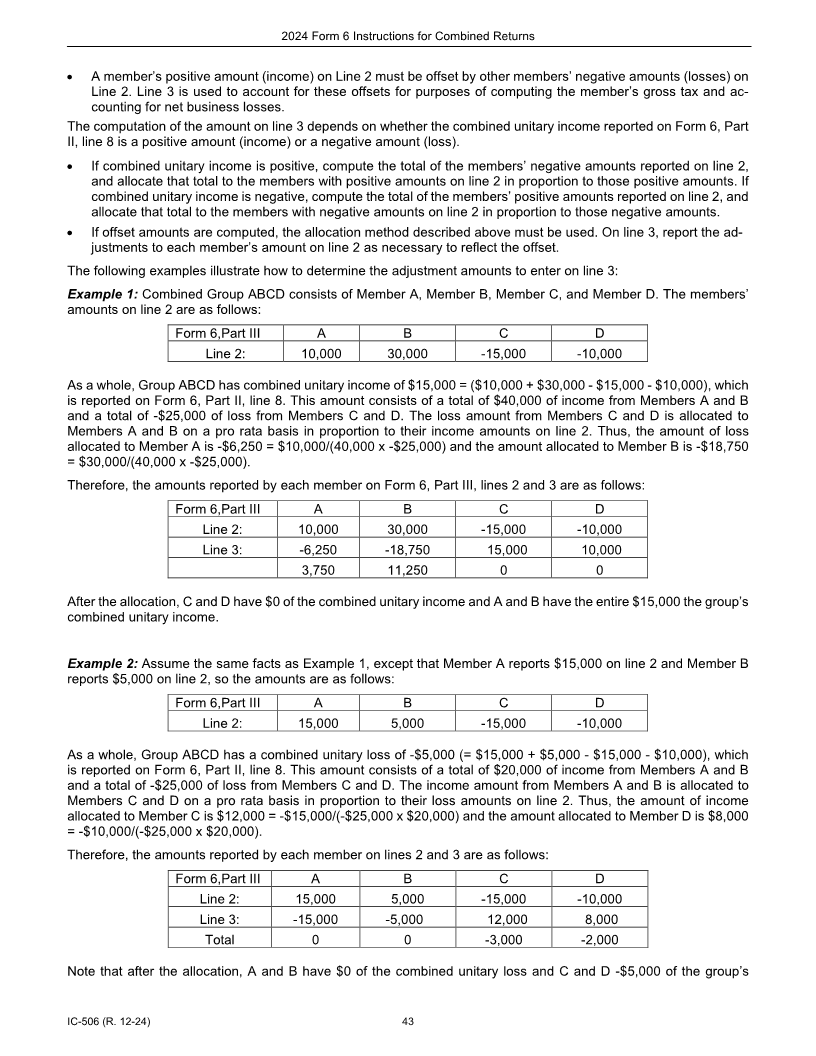

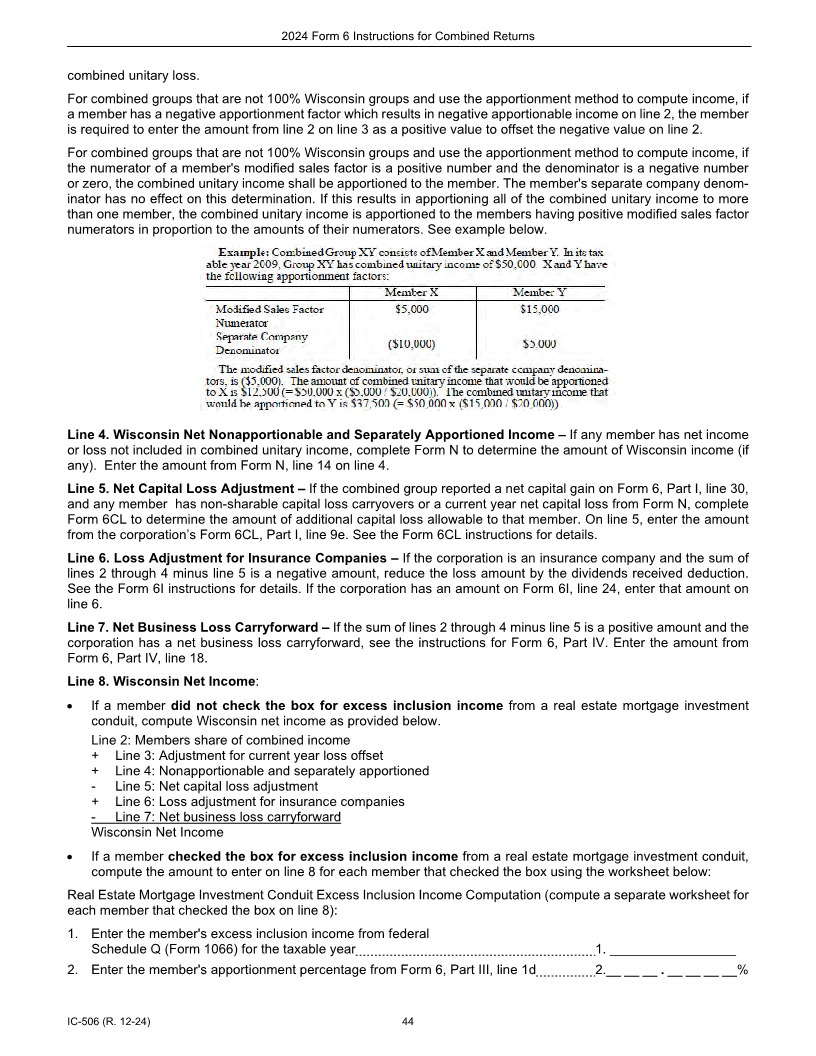

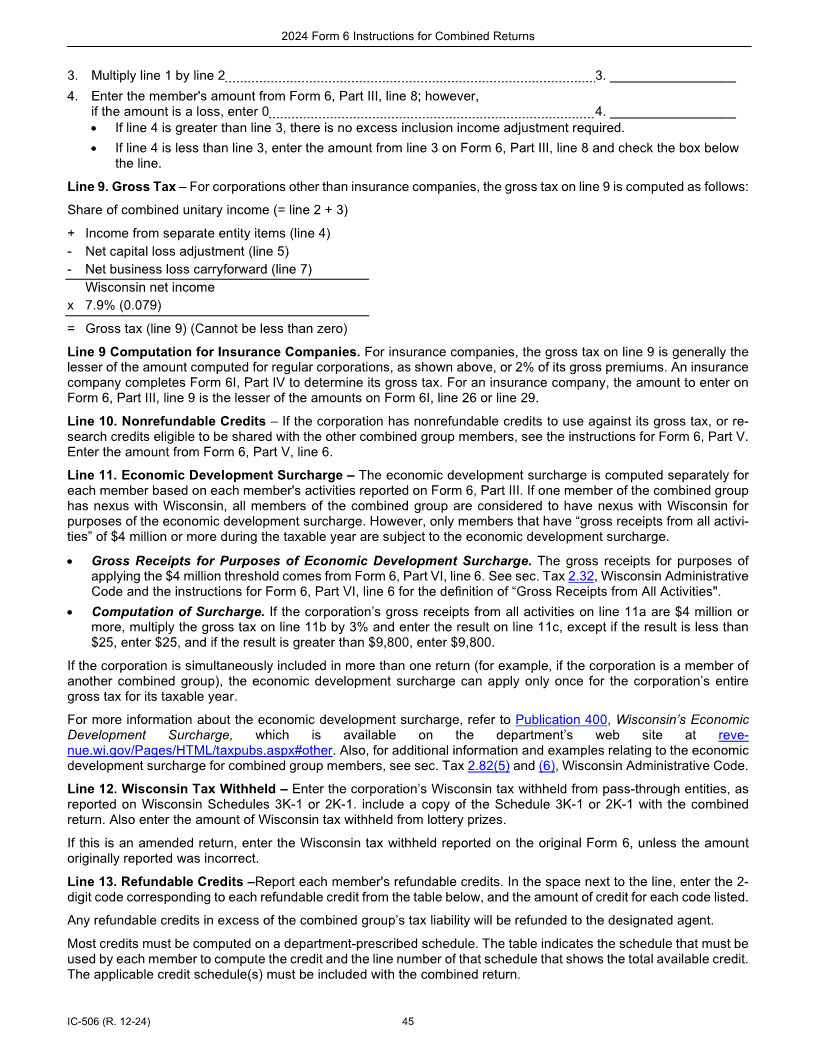

Part II: Unitary Income Computation ...................................................................................................................................... 32

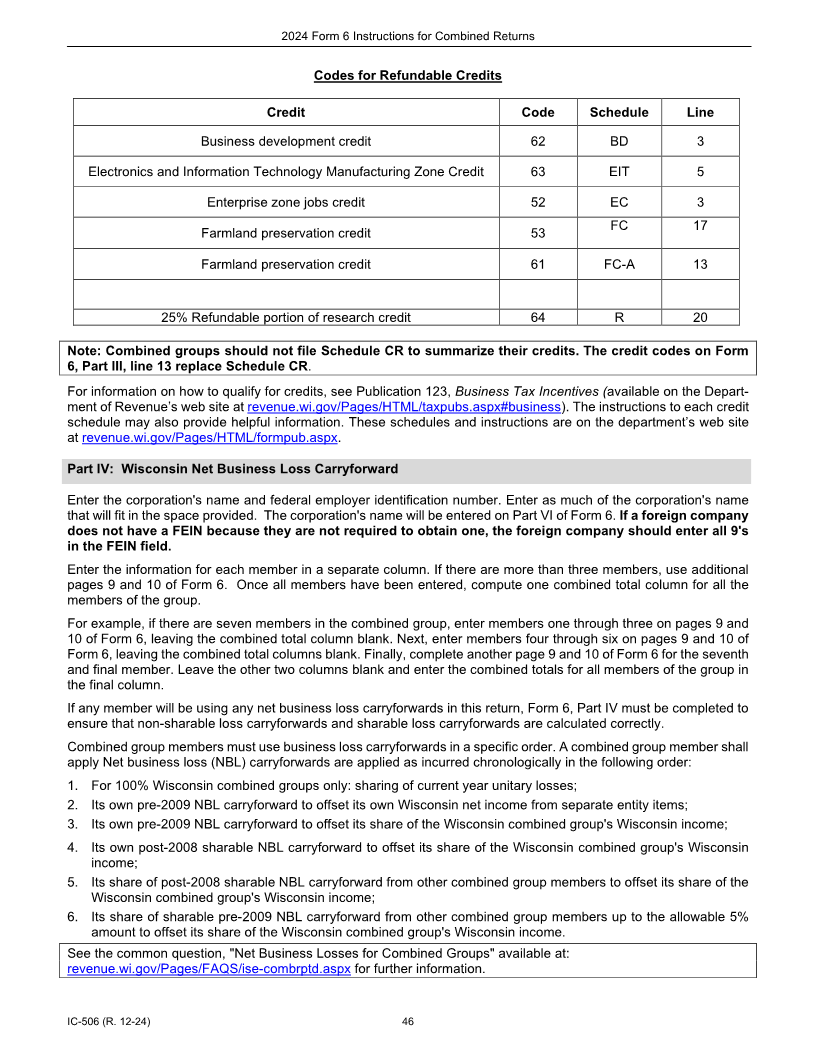

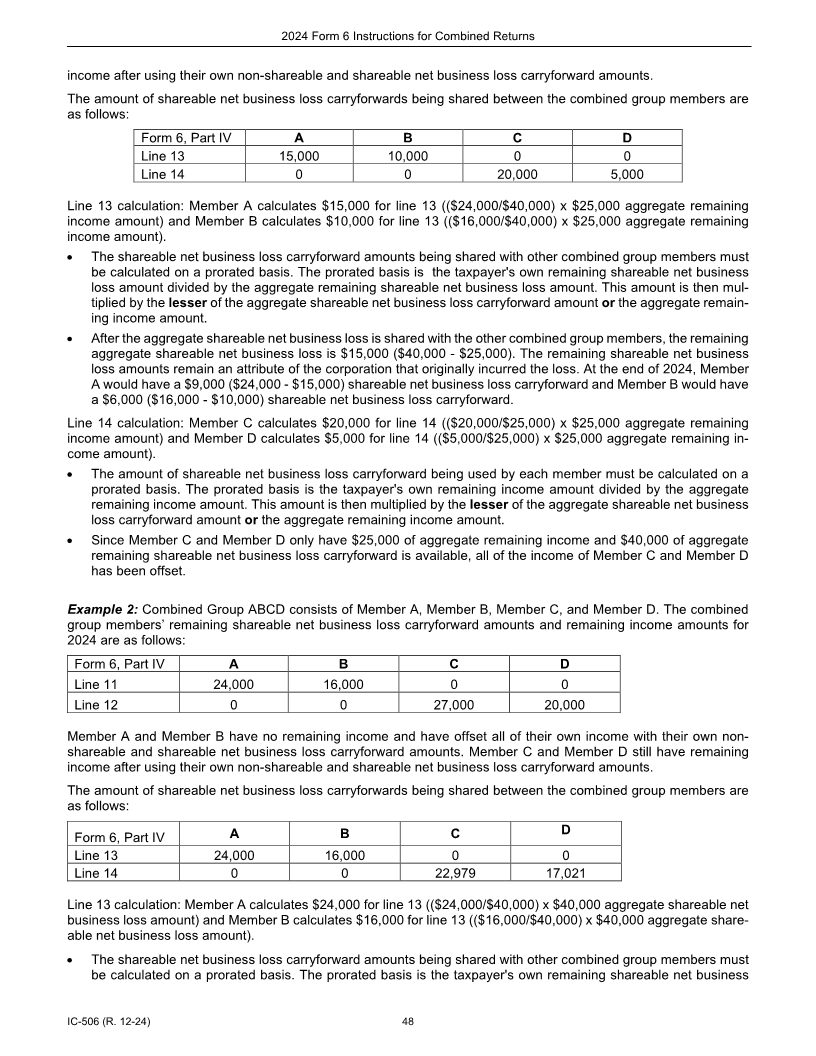

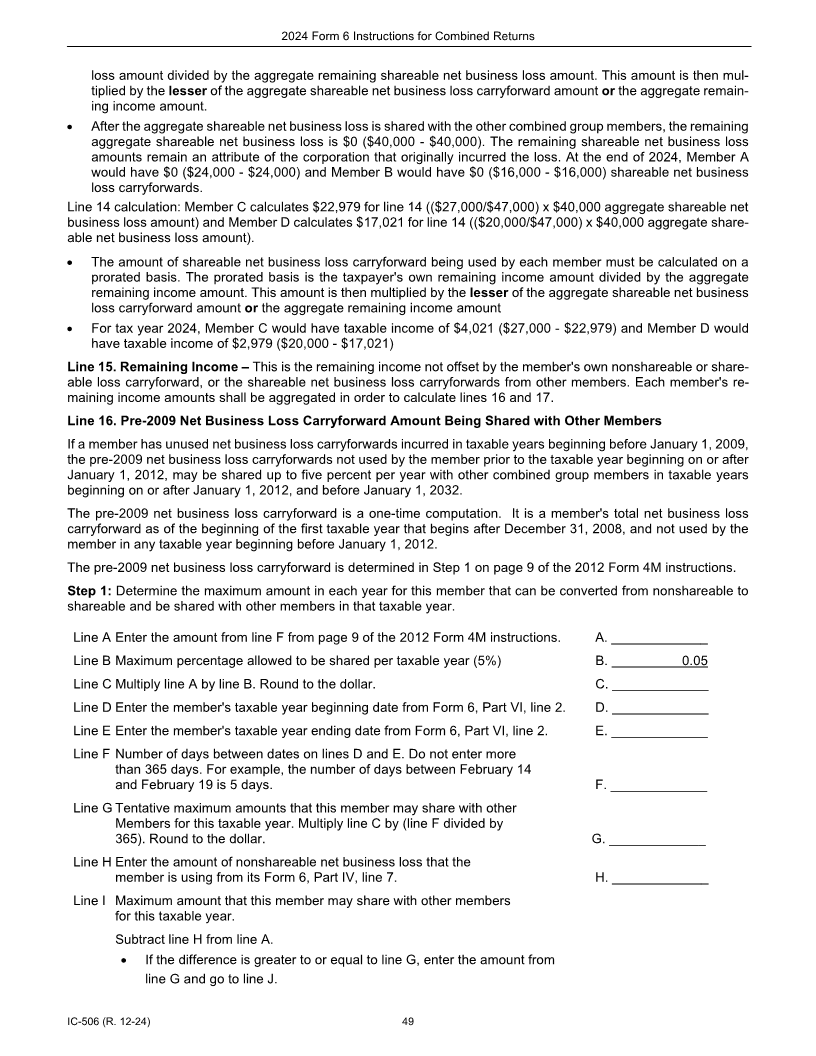

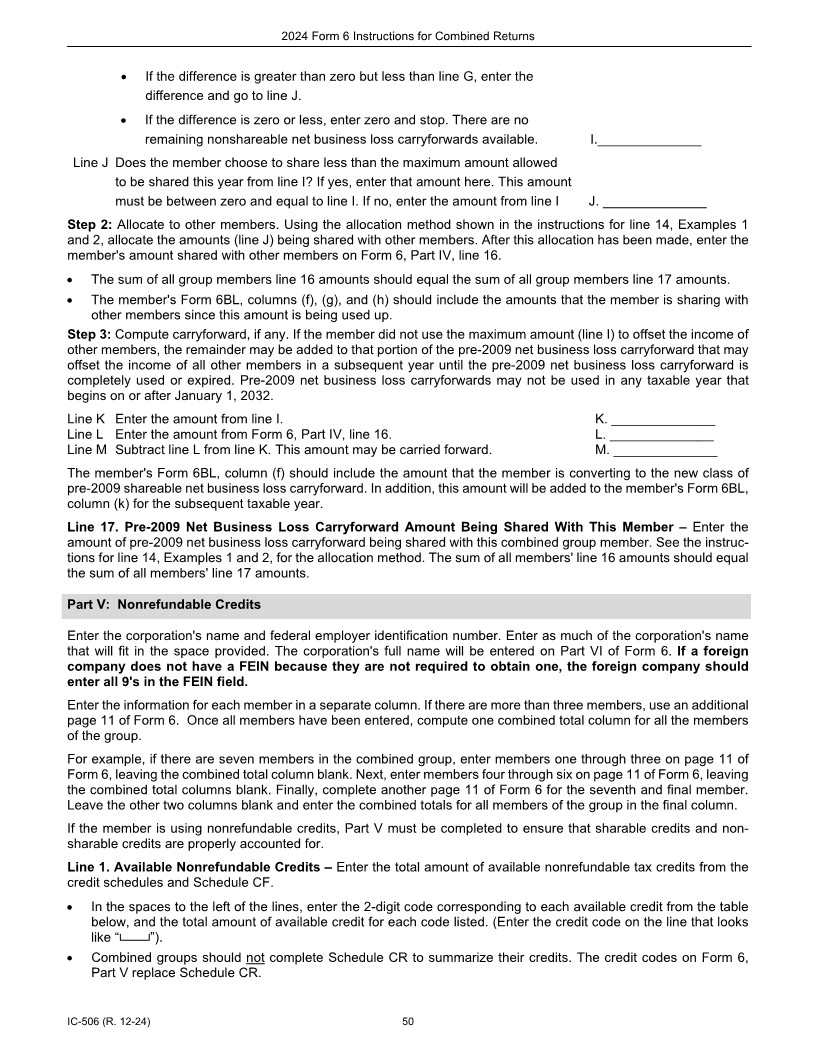

Part IV: Wisconsin Net Business Loss Carryforward ............................................................................................................ 46

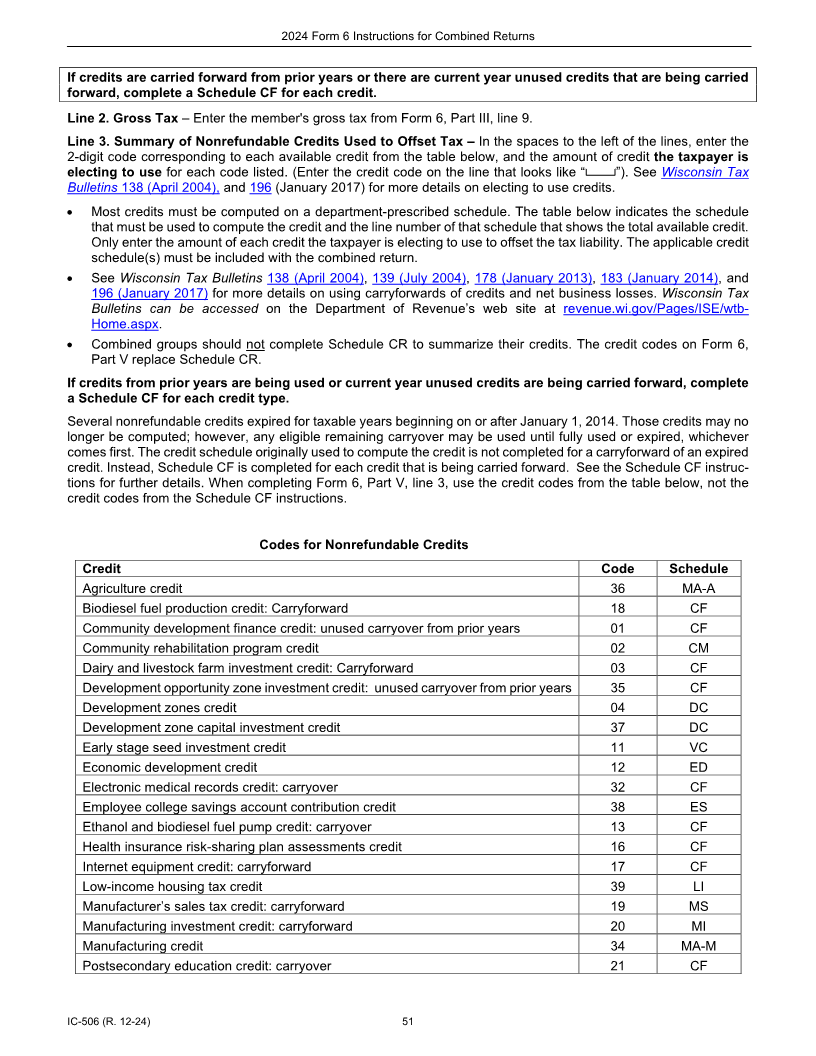

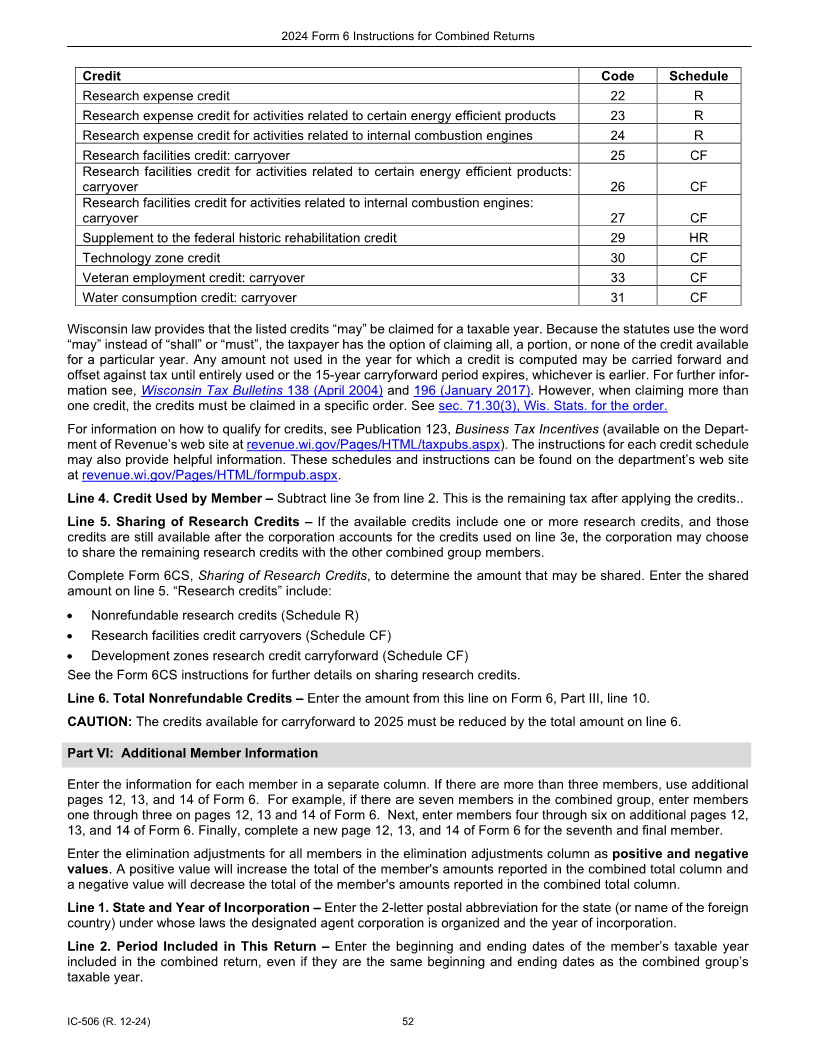

Part V: Nonrefundable Credits .............................................................................................................................................. 50

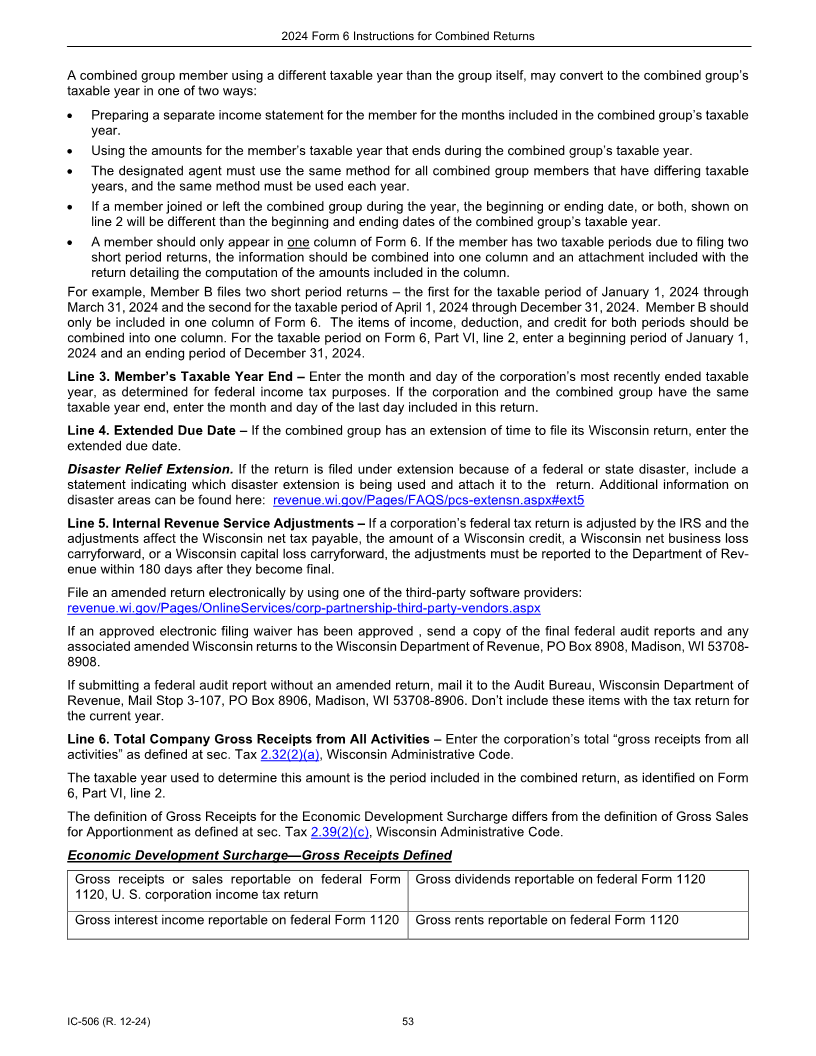

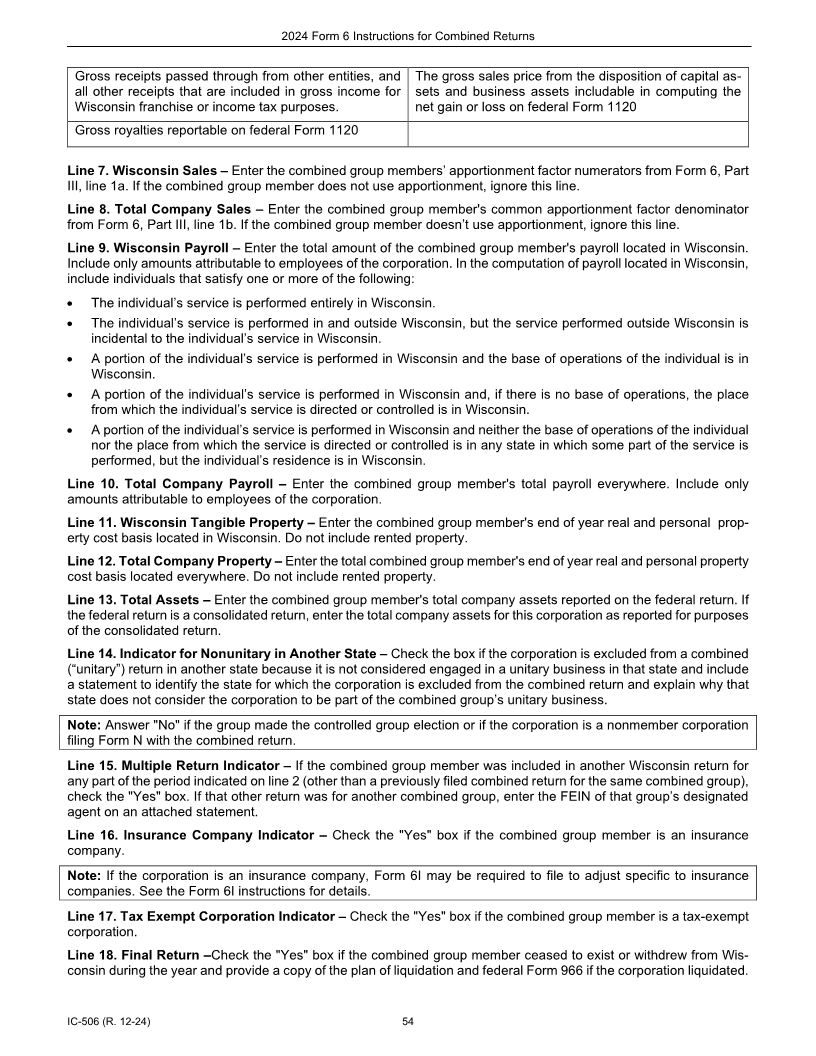

Part VI: Additional Member Information ................................................................................................................................ 52

Required Attachments ........................................................................................................................................... 55

Web Resources .................................................................................................................................................................... 56

Contact Information ............................................................................................................................................................. 56

Obtaining Forms .................................................................................................................................................................. 56