Enlarge image

2024 Instructions for the Wisconsin Fiduciary Return

Form 2 and Schedule 2K-1

Form 2 and Schedule CC, Request for a Closing Certificate of Fiduciaries, may be filed electronically! Note Schedule CC must be

filed separately from Form 2.

• Form 2 may be filed electronically using modernized e-file software. See Third-Party Software for Fiduciary, Estate and Trust e-File Returns

on the department’s website.

• Schedule CC and required documents may be filed electronically directly from the department’s website at

https://tap.revenue.wi.gov/ClosingCertificate.

Important Notices

• Wisconsin did not adopt section 199A of the Internal Revenue Code (IRC), as created in the federal Tax Cuts and Jobs Act of

2017, which provides a taxpayer, other than a corporation, a federal deduction of up to 20 percent of qualified business income.

Any federal qualified business income deduction claimed under sec. 199A, IRC, that is included in the computation of federal

taxable income of a fiduciary or its beneficiaries must be added back to Wisconsin taxable income using Schedule B of Form

2. Note Nonresident and part-year resident estates and trusts may not use Schedule A for Form 2. They must instead use

Schedule NR to report adjustments.

• Wisconsin follows the final treasury regulations from the IRS under TD 9918, as they relate to secs. 67(e) and 642(h), IRC, for

determining the character, amount, and allocation of deductions in excess of gross income succeeded to by a beneficiary on

the termination of an estate or non-grantor trust for taxable years beginning after December 31, 2017.

Table of Contents

Page

General Instructions ...................................................................... 2

• Resident Estates or Trusts ................................................................. 2

• Situs of Income .......................................................................... 2

• Filing Requirements ...................................................................... 2

• Other Filing Requirements ................................................................. 3

• When and Where to File ................................................................... 4

• Withholding Requirement for Estates and Trusts Having Nonresident Beneficiaries ...................... 5

• Seven Steps to Filing the Fiduciary Income Tax Return ........................................... 5

• Requesting a Closing Certificate ............................................................ 6

• Tax Help or Additional Forms ............................................................... 6

Line Instructions ......................................................................... 6

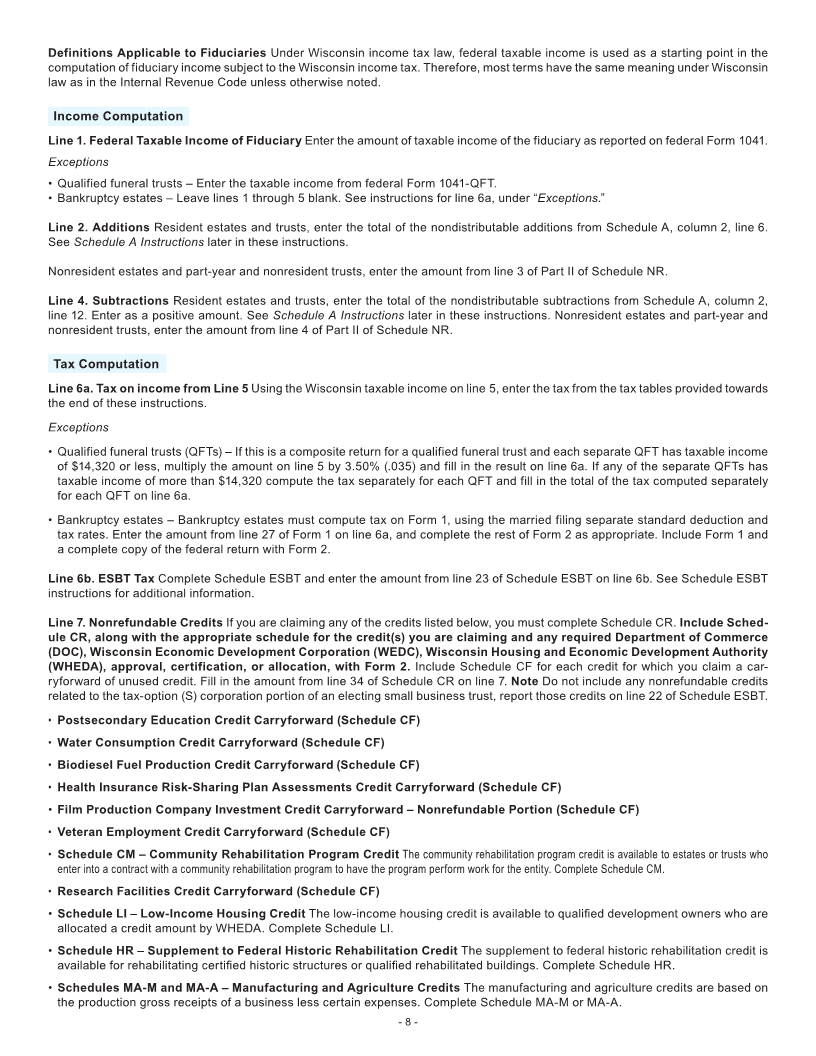

• Income Computation ...................................................................... 8

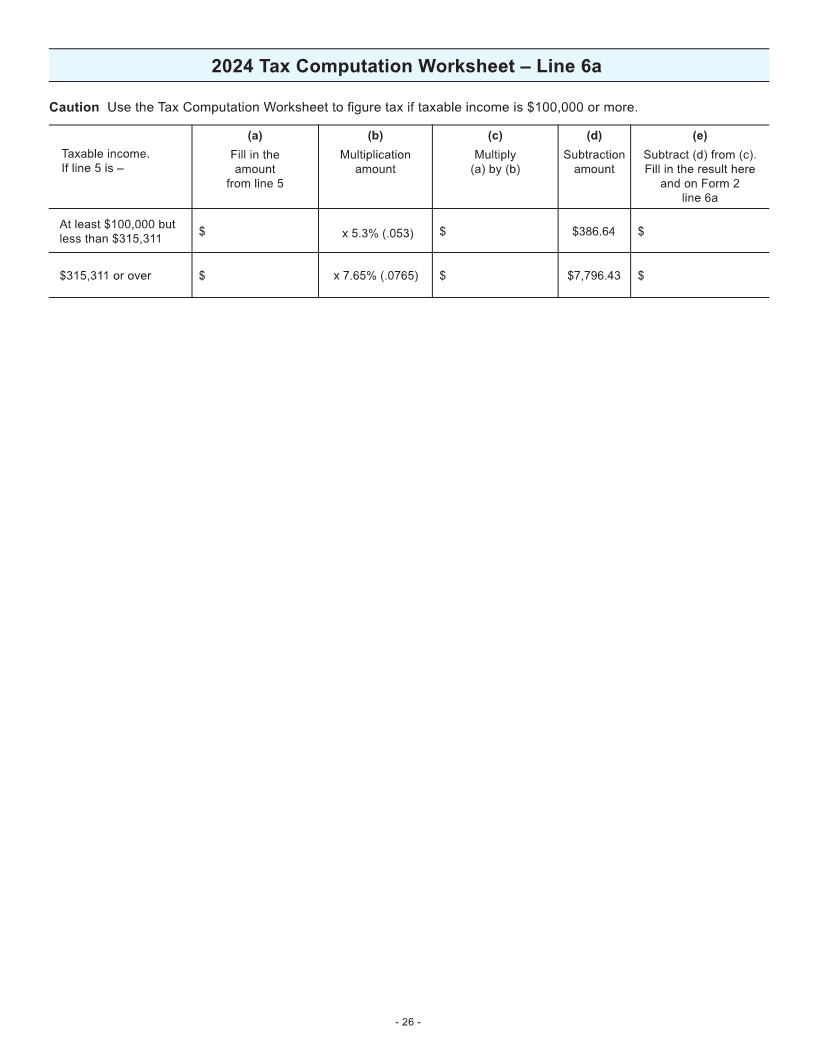

• Tax Computation ......................................................................... 8

Special Instructions ....................................................................... 12

• Third-Party Designee ..................................................................... 12

• Pass-Through Entity Representative .......................................................... 12

• Penalties and Interest ..................................................................... 12

• Fraudulent or Reckless Credit Claims ......................................................... 13

• Internal Revenue Service Adjustments and Amended Returns ..................................... 13

• Estimated Tax Payments ................................................................... 13

• Requesting Copies of Returns .............................................................. 13

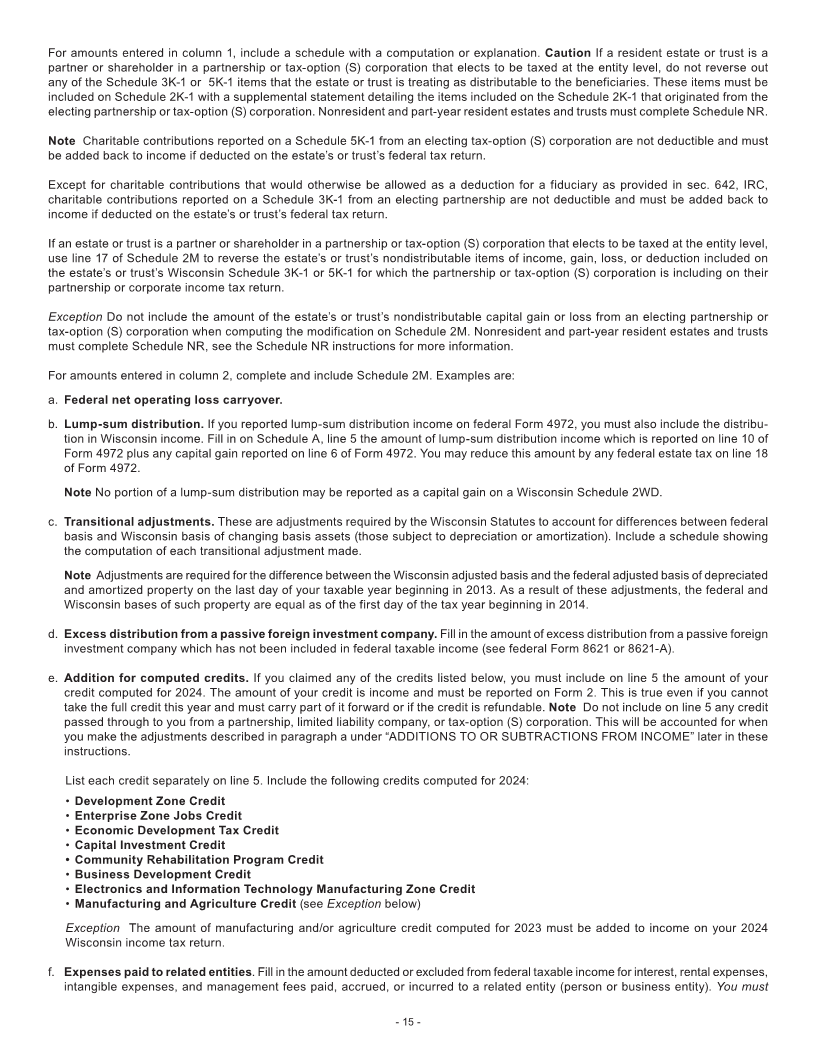

Schedule A Instructions – Additions and Subtractions .......................................... 13

• Additions ............................................................................... 13

• Subtractions ............................................................................ 16

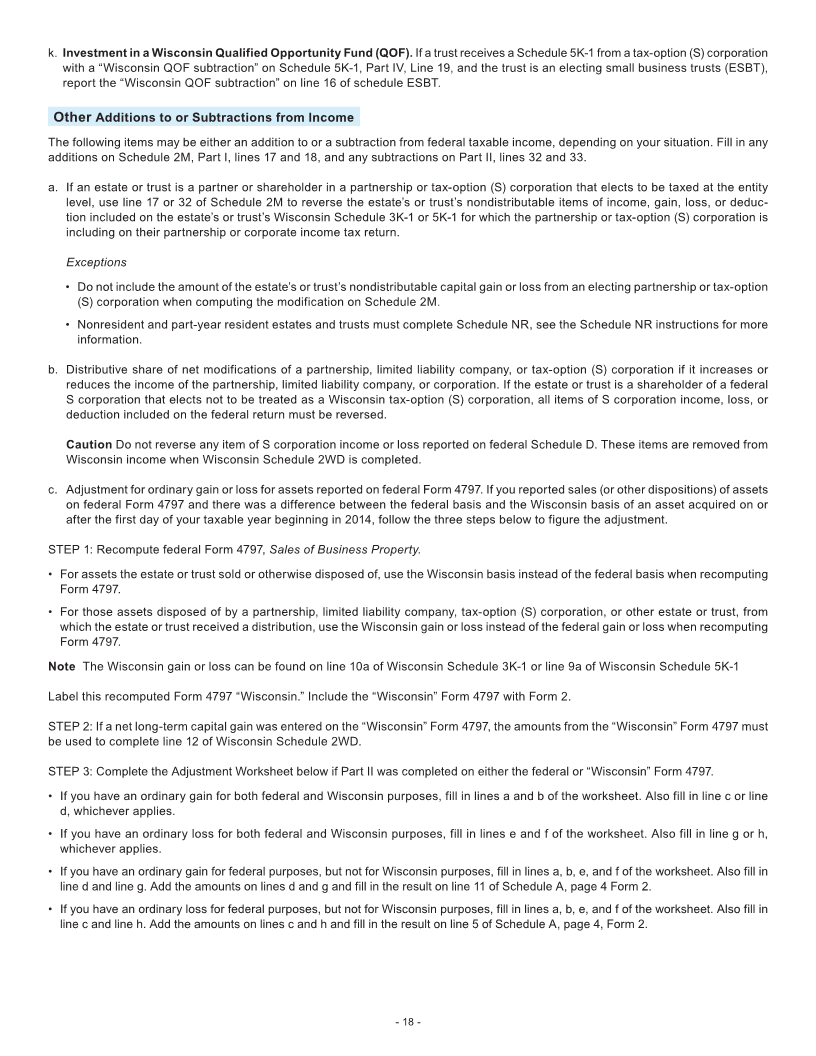

• Other Additions to or Subtractions from Income ................................................. 18

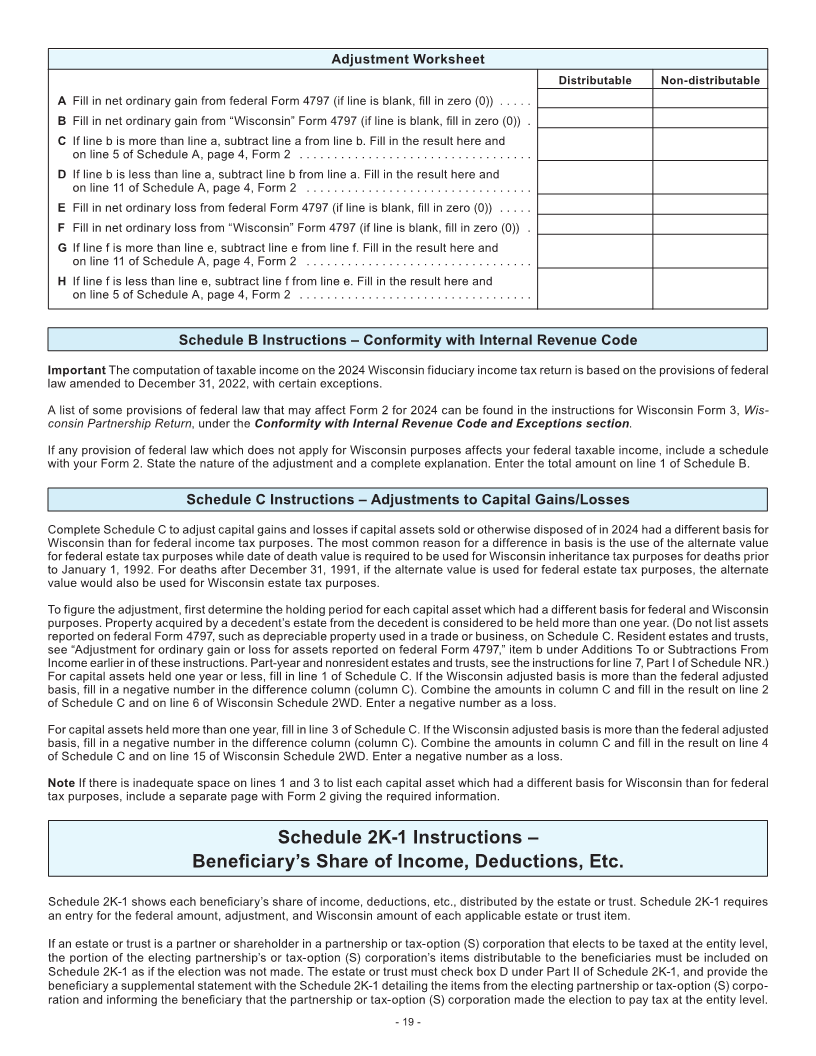

Schedule B Instructions – Conformity with Internal Revenue Code ............................... 19

Schedule C Instructions – Adjustments to Capital Gains/Losses ................................. 19

Schedule 2K-1 Instructions – Beneficiary’s Share of Income, Deductions, Etc ...................... 19

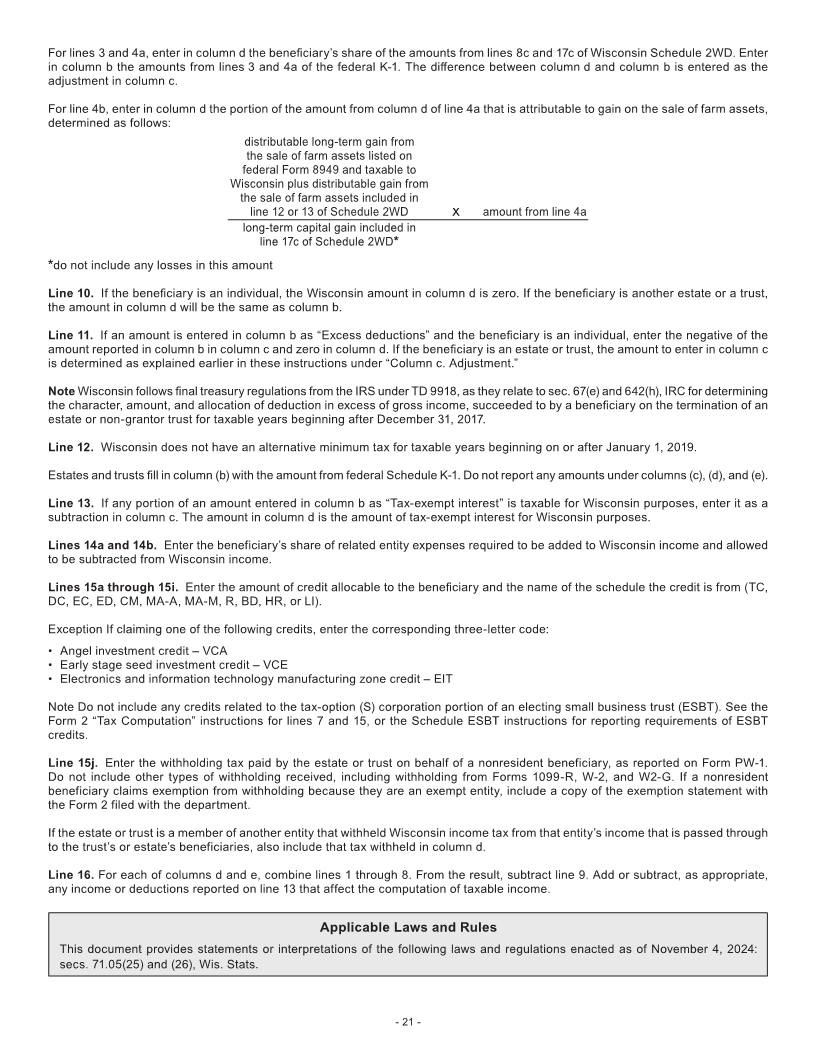

• Line Instructions ........................................................................ 20

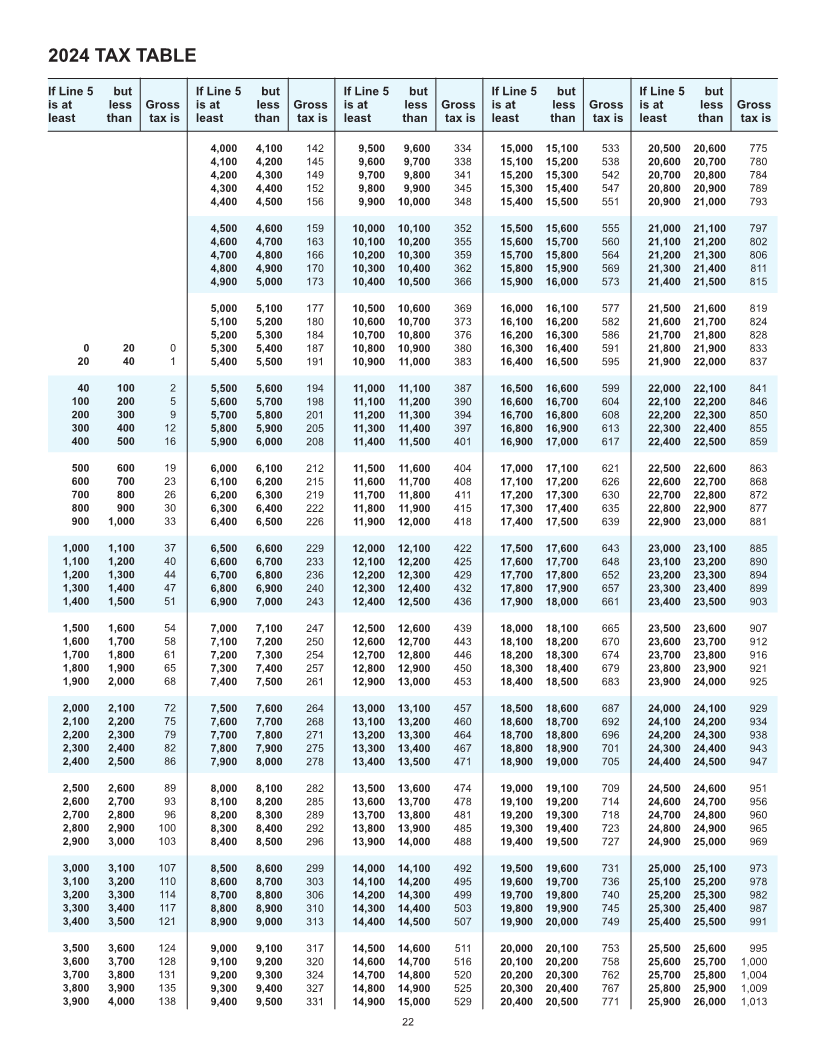

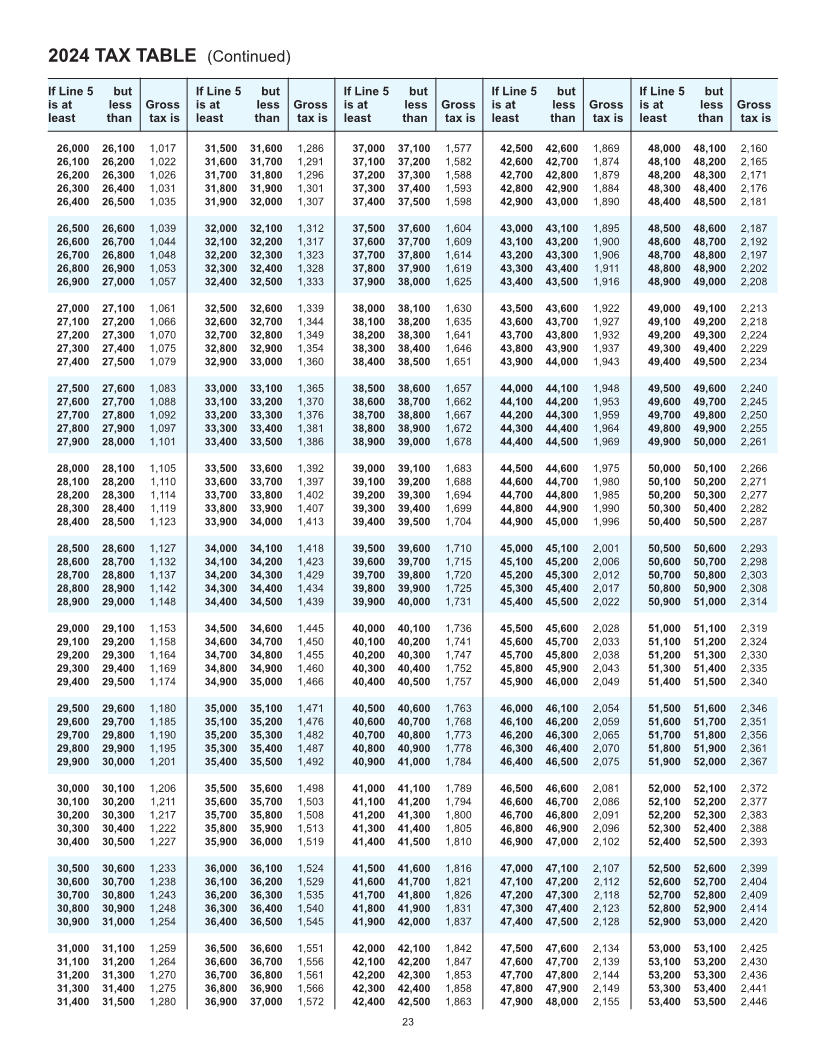

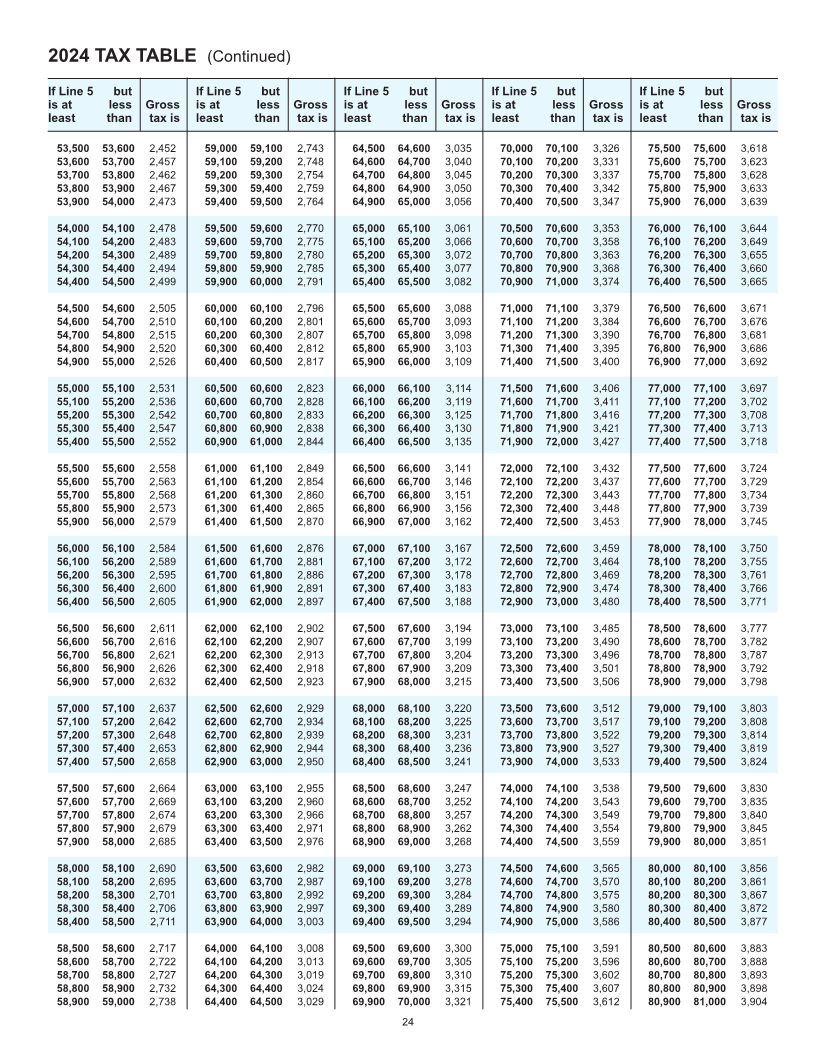

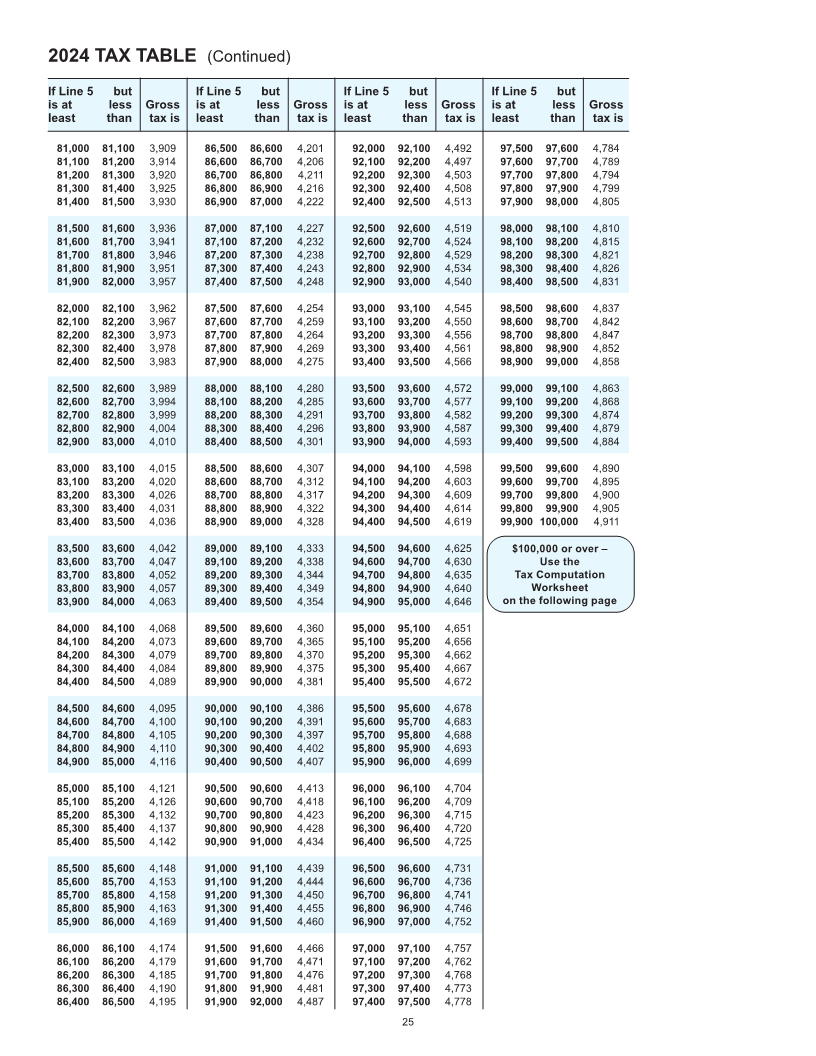

Tax Tables .............................................................................. 22

I-022 (R. 11-24) Wisconsin Department of Revenue