- 16 -

Enlarge image

|

PMS # 320 15% below

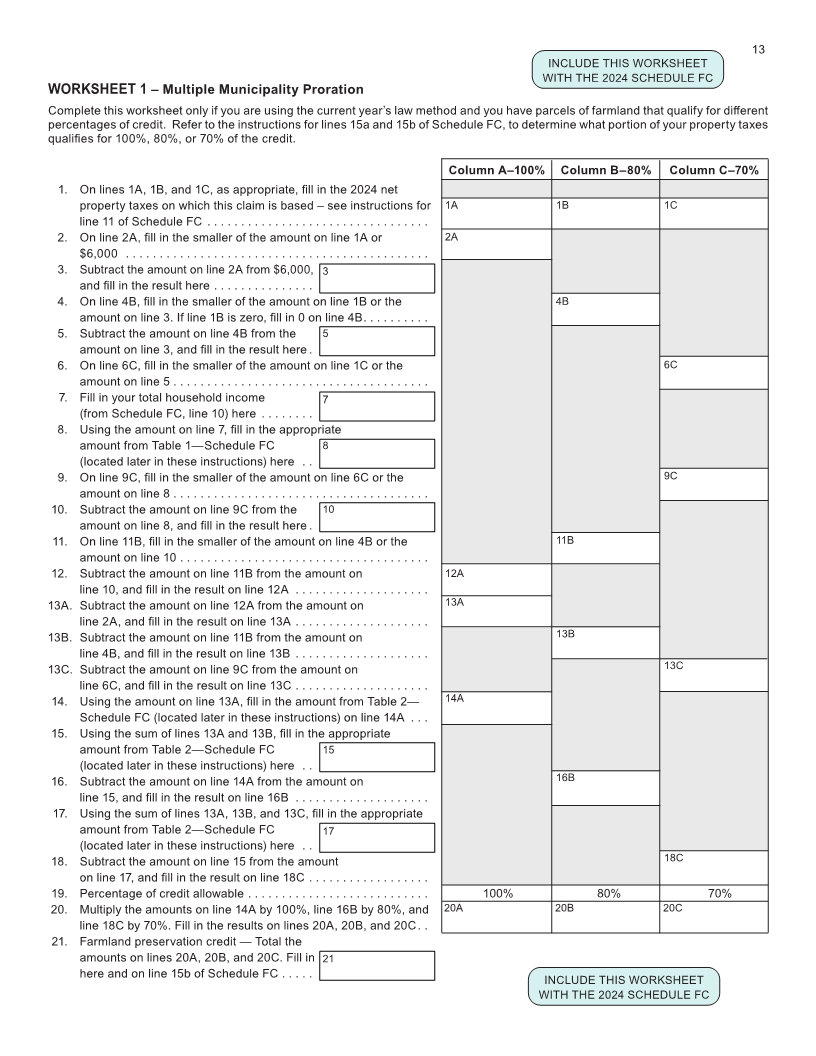

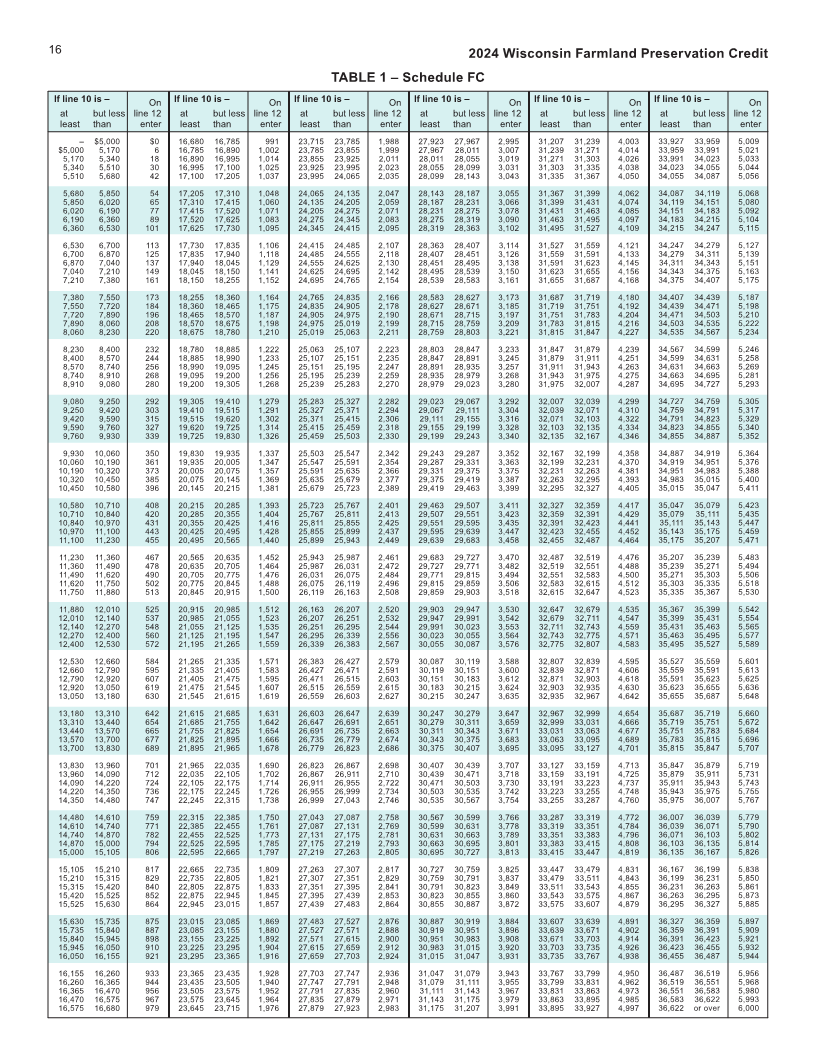

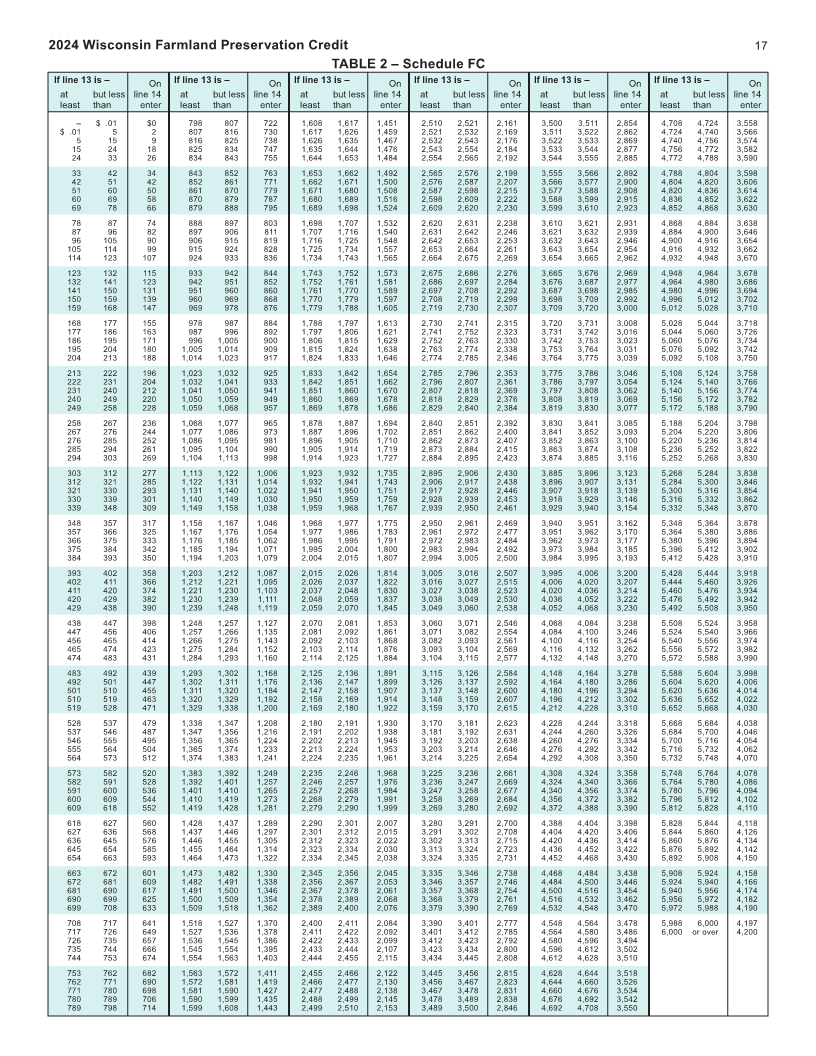

16 2024 Wisconsin Farmland Preservation Credit

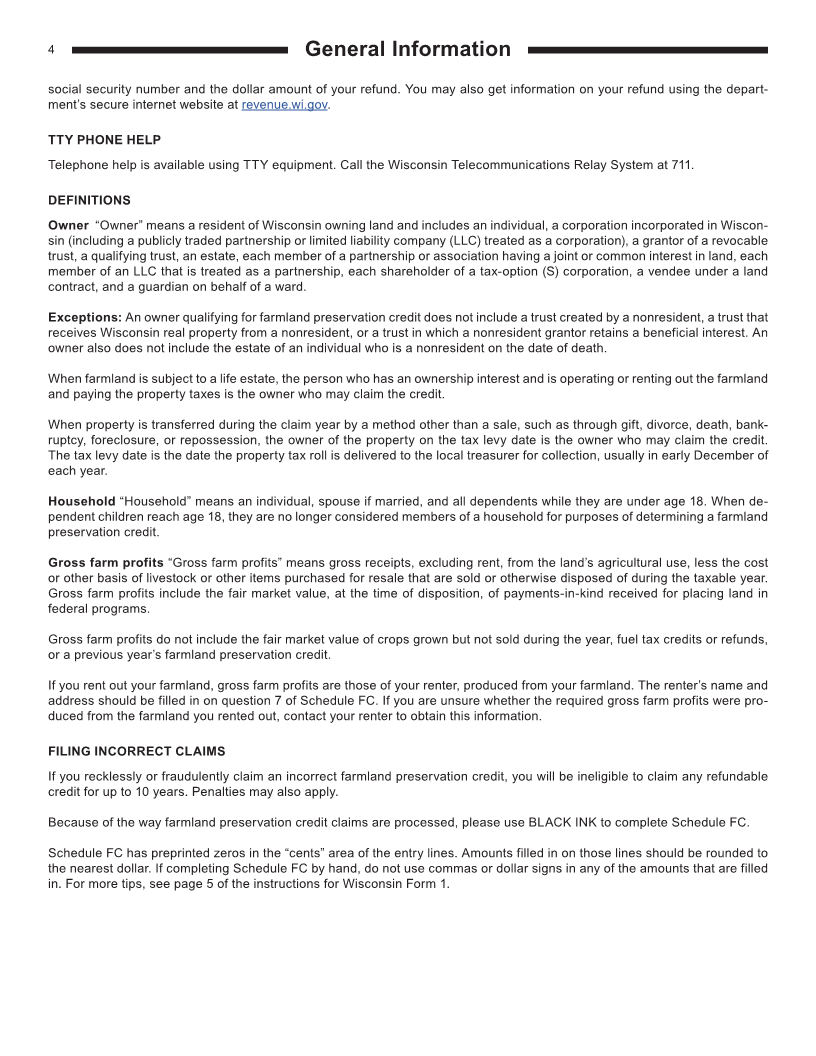

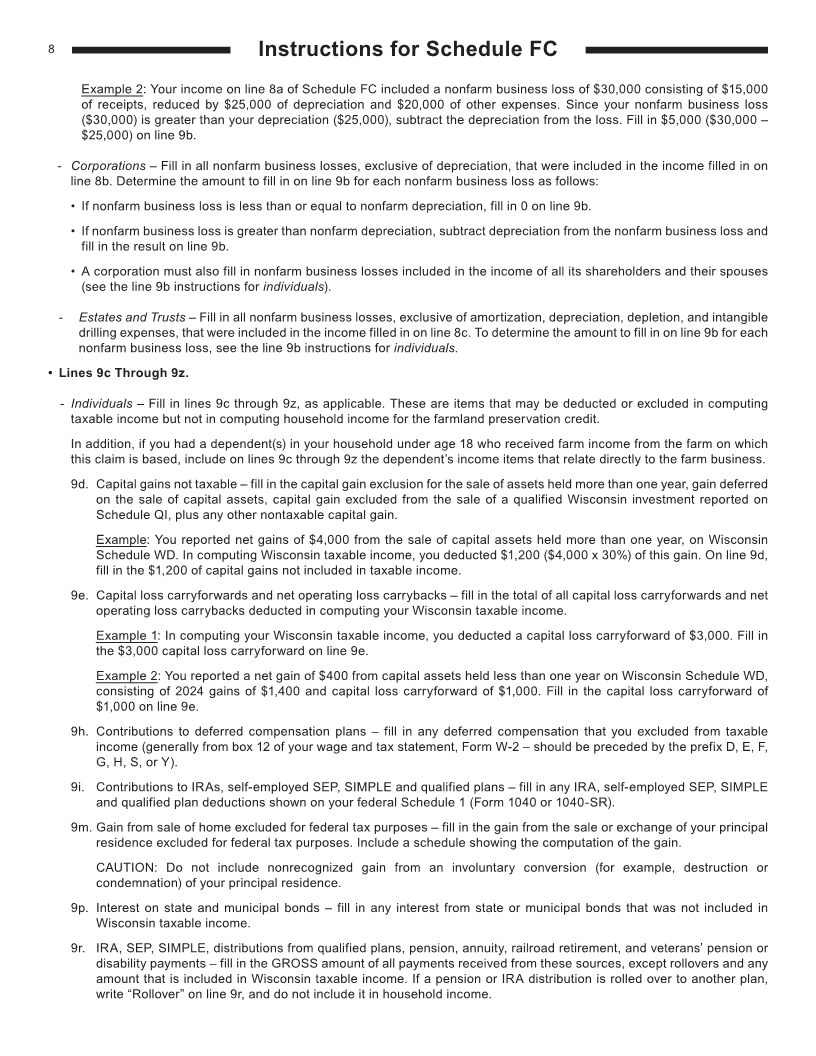

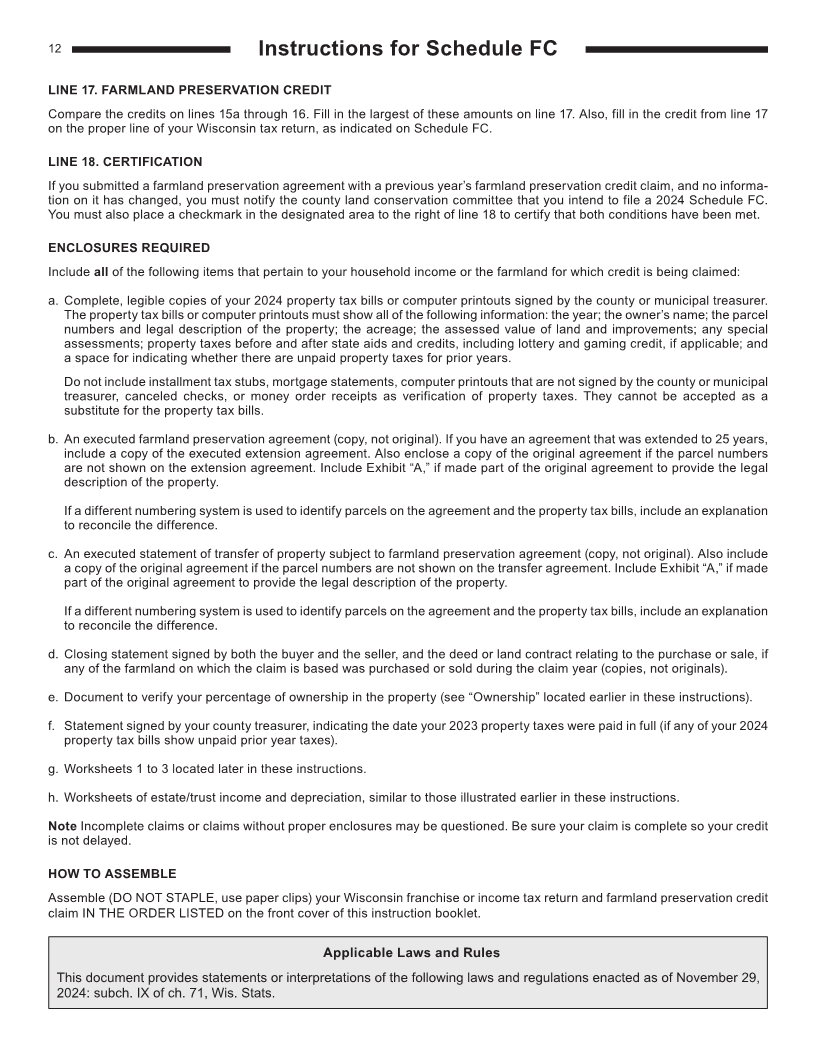

TABLE 1 – Schedule FC

If line 10 is – On If line 10 is – On If line 10 is – On If line 10 is – On If line 10 is – On If line 10 is – On

at but less line 12 at but less line 12 at but less line 12 at but less line 12 at but less line 12 at but less line 12

least than enter least than enter least than enter least than enter least than enter least than enter

– $5,000 $0 16,680 16,785 991 23,715 23,785 1,988 27,923 27,967 2,995 31,207 31,239 4,003 33,927 33,959 5,009

$5,000 5,170 6 16,785 16,890 1,002 23,785 23,855 1,999 27,967 28,011 3,007 31,239 31,271 4,014 33,959 33,991 5,021

5,170 5,340 18 16,890 16,995 1,014 23,855 23,925 2,011 28,011 28,055 3,019 31,271 31,303 4,026 33,991 34,023 5,033

5,340 5,510 30 16,995 17,100 1,025 23,925 23,995 2,023 28,055 28,099 3,031 31,303 31,335 4,038 34,023 34,055 5,044

5,510 5,680 42 17,100 17,205 1,037 23,995 24,065 2,035 28,099 28,143 3,043 31,335 31,367 4,050 34,055 34,087 5,056

5,680 5,850 54 17,205 17,310 1,048 24,065 24,135 2,047 28,143 28,187 3,055 31,367 31,399 4,062 34,087 34,119 5,068

5,850 6,020 65 17,310 17,415 1,060 24,135 24,205 2,059 28,187 28,231 3,066 31,399 31,431 4,074 34,119 34,151 5,080

6,020 6,190 77 17,415 17,520 1,071 24,205 24,275 2,071 28,231 28,275 3,078 31,431 31,463 4,085 34,151 34,183 5,092

6,190 6,360 89 17,520 17,625 1,083 24,275 24,345 2,083 28,275 28,319 3,090 31,463 31,495 4,097 34,183 34,215 5,104

6,360 6,530 101 17,625 17,730 1,095 24,345 24,415 2,095 28,319 28,363 3,102 31,495 31,527 4,109 34,215 34,247 5,115

6,530 6,700 113 17,730 17,835 1,106 24,415 24,485 2,107 28,363 28,407 3,114 31,527 31,559 4,121 34,247 34,279 5,127

6,700 6,870 125 17,835 17,940 1,118 24,485 24,555 2,118 28,407 28,451 3,126 31,559 31,591 4,133 34,279 34,311 5,139

6,870 7,040 137 17,940 18,045 1,129 24,555 24,625 2,130 28,451 28,495 3,138 31,591 31,623 4,145 34,311 34,343 5,151

7,040 7,210 149 18,045 18,150 1,141 24,625 24,695 2,142 28,495 28,539 3,150 31,623 31,655 4,156 34,343 34,375 5,163

7,210 7,380 161 18,150 18,255 1,152 24,695 24,765 2,154 28,539 28,583 3,161 31,655 31,687 4,168 34,375 34,407 5,175

7,380 7,550 173 18,255 18,360 1,164 24,765 24,835 2,166 28,583 28,627 3,173 31,687 31,719 4,180 34,407 34,439 5,187

7,550 7,720 184 18,360 18,465 1,175 24,835 24,905 2,178 28,627 28,671 3,185 31,719 31,751 4,192 34,439 34,471 5,198

7,720 7,890 196 18,465 18,570 1,187 24,905 24,975 2,190 28,671 28,715 3,197 31,751 31,783 4,204 34,471 34,503 5,210

7,890 8,060 208 18,570 18,675 1,198 24,975 25,019 2,199 28,715 28,759 3,209 31,783 31,815 4,216 34,503 34,535 5,222

8,060 8,230 220 18,675 18,780 1,210 25,019 25,063 2,211 28,759 28,803 3,221 31,815 31,847 4,227 34,535 34,567 5,234

8,230 8,400 232 18,780 18,885 1,222 25,063 25,107 2,223 28,803 28,847 3,233 31,847 31,879 4,239 34,567 34,599 5,246

8,400 8,570 244 18,885 18,990 1,233 25,107 25,151 2,235 28,847 28,891 3,245 31,879 31,911 4,251 34,599 34,631 5,258

8,570 8,740 256 18,990 19,095 1,245 25,151 25,195 2,247 28,891 28,935 3,257 31,911 31,943 4,263 34,631 34,663 5,269

8,740 8,910 268 19,095 19,200 1,256 25,195 25,239 2,259 28,935 28,979 3,268 31,943 31,975 4,275 34,663 34,695 5,281

8,910 9,080 280 19,200 19,305 1,268 25,239 25,283 2,270 28,979 29,023 3,280 31,975 32,007 4,287 34,695 34,727 5,293

9,080 9,250 292 19,305 19,410 1,279 25,283 25,327 2,282 29,023 29,067 3,292 32,007 32,039 4,299 34,727 34,759 5,305

9,250 9,420 303 19,410 19,515 1,291 25,327 25,371 2,294 29,067 29,111 3,304 32,039 32,071 4,310 34,759 34,791 5,317

9,420 9,590 315 19,515 19,620 1,302 25,371 25,415 2,306 29,111 29,155 3,316 32,071 32,103 4,322 34,791 34,823 5,329

9,590 9,760 327 19,620 19,725 1,314 25,415 25,459 2,318 29,155 29,199 3,328 32,103 32,135 4,334 34,823 34,855 5,340

9,760 9,930 339 19,725 19,830 1,326 25,459 25,503 2,330 29,199 29,243 3,340 32,135 32,167 4,346 34,855 34,887 5,352

9,930 10,060 350 19,830 19,935 1,337 25,503 25,547 2,342 29,243 29,287 3,352 32,167 32,199 4,358 34,887 34,919 5,364

10,060 10,190 361 19,935 20,005 1,347 25,547 25,591 2,354 29,287 29,331 3,363 32,199 32,231 4,370 34,919 34,951 5,376

10,190 10,320 373 20,005 20,075 1,357 25,591 25,635 2,366 29,331 29,375 3,375 32,231 32,263 4,381 34,951 34,983 5,388

10,320 10,450 385 20,075 20,145 1,369 25,635 25,679 2,377 29,375 29,419 3,387 32,263 32,295 4,393 34,983 35,015 5,400

10,450 10,580 396 20,145 20,215 1,381 25,679 25,723 2,389 29,419 29,463 3,399 32,295 32,327 4,405 35,015 35,047 5,411

10,580 10,710 408 20,215 20,285 1,393 25,723 25,767 2,401 29,463 29,507 3,411 32,327 32,359 4,417 35,047 35,079 5,423

10,710 10,840 420 20,285 20,355 1,404 25,767 25,811 2,413 29,507 29,551 3,423 32,359 32,391 4,429 35,079 35,111 5,435

10,840 10,970 431 20,355 20,425 1,416 25,811 25,855 2,425 29,551 29,595 3,435 32,391 32,423 4,441 35,111 35,143 5,447

10,970 11,100 443 20,425 20,495 1,428 25,855 25,899 2,437 29,595 29,639 3,447 32,423 32,455 4,452 35,143 35,175 5,459

11,100 11,230 455 20,495 20,565 1,440 25,899 25,943 2,449 29,639 29,683 3,458 32,455 32,487 4,464 35,175 35,207 5,471

11,230 11,360 467 20,565 20,635 1,452 25,943 25,987 2,461 29,683 29,727 3,470 32,487 32,519 4,476 35,207 35,239 5,483

11,360 11,490 478 20,635 20,705 1,464 25,987 26,031 2,472 29,727 29,771 3,482 32,519 32,551 4,488 35,239 35,271 5,494

11,490 11,620 490 20,705 20,775 1,476 26,031 26,075 2,484 29,771 29,815 3,494 32,551 32,583 4,500 35,271 35,303 5,506

11,620 11,750 502 20,775 20,845 1,488 26,075 26,119 2,496 29,815 29,859 3,506 32,583 32,615 4,512 35,303 35,335 5,518

11,750 11,880 513 20,845 20,915 1,500 26,119 26,163 2,508 29,859 29,903 3,518 32,615 32,647 4,523 35,335 35,367 5,530

11,880 12,010 525 20,915 20,985 1,512 26,163 26,207 2,520 29,903 29,947 3,530 32,647 32,679 4,535 35,367 35,399 5,542

12,010 12,140 537 20,985 21,055 1,523 26,207 26,251 2,532 29,947 29,991 3,542 32,679 32,711 4,547 35,399 35,431 5,554

12,140 12,270 548 21,055 21,125 1,535 26,251 26,295 2,544 29,991 30,023 3,553 32,711 32,743 4,559 35,431 35,463 5,565

12,270 12,400 560 21,125 21,195 1,547 26,295 26,339 2,556 30,023 30,055 3,564 32,743 32,775 4,571 35,463 35,495 5,577

12,400 12,530 572 21,195 21,265 1,559 26,339 26,383 2,567 30,055 30,087 3,576 32,775 32,807 4,583 35,495 35,527 5,589

12,530 12,660 584 21,265 21,335 1,571 26,383 26,427 2,579 30,087 30,119 3,588 32,807 32,839 4,595 35,527 35,559 5,601

12,660 12,790 595 21,335 21,405 1,583 26,427 26,471 2,591 30,119 30,151 3,600 32,839 32,871 4,606 35,559 35,591 5,613

12,790 12,920 607 21,405 21,475 1,595 26,471 26,515 2,603 30,151 30,183 3,612 32,871 32,903 4,618 35,591 35,623 5,625

12,920 13,050 619 21,475 21,545 1,607 26,515 26,559 2,615 30,183 30,215 3,624 32,903 32,935 4,630 35,623 35,655 5,636

13,050 13,180 630 21,545 21,615 1,619 26,559 26,603 2,627 30,215 30,247 3,635 32,935 32,967 4,642 35,655 35,687 5,648

13,180 13,310 642 21,615 21,685 1,631 26,603 26,647 2,639 30,247 30,279 3,647 32,967 32,999 4,654 35,687 35,719 5,660

13,310 13,440 654 21,685 21,755 1,642 26,647 26,691 2,651 30,279 30,311 3,659 32,999 33,031 4,666 35,719 35,751 5,672

13,440 13,570 665 21,755 21,825 1,654 26,691 26,735 2,663 30,311 30,343 3,671 33,031 33,063 4,677 35,751 35,783 5,684

13,570 13,700 677 21,825 21,895 1,666 26,735 26,779 2,674 30,343 30,375 3,683 33,063 33,095 4,689 35,783 35,815 5,696

13,700 13,830 689 21,895 21,965 1,678 26,779 26,823 2,686 30,375 30,407 3,695 33,095 33,127 4,701 35,815 35,847 5,707

13,830 13,960 701 21,965 22,035 1,690 26,823 26,867 2,698 30,407 30,439 3,707 33,127 33,159 4,713 35,847 35,879 5,719

13,960 14,090 712 22,035 22,105 1,702 26,867 26,911 2,710 30,439 30,471 3,718 33,159 33,191 4,725 35,879 35,911 5,731

14,090 14,220 724 22,105 22,175 1,714 26,911 26,955 2,722 30,471 30,503 3,730 33,191 33,223 4,737 35,911 35,943 5,743

14,220 14,350 736 22,175 22,245 1,726 26,955 26,999 2,734 30,503 30,535 3,742 33,223 33,255 4,748 35,943 35,975 5,755

14,350 14,480 747 22,245 22,315 1,738 26,999 27,043 2,746 30,535 30,567 3,754 33,255 33,287 4,760 35,975 36,007 5,767

14,480 14,610 759 22,315 22,385 1,750 27,043 27,087 2,758 30,567 30,599 3,766 33,287 33,319 4,772 36,007 36,039 5,779

14,610 14,740 771 22,385 22,455 1,761 27,087 27,131 2,769 30,599 30,631 3,778 33,319 33,351 4,784 36,039 36,071 5,790

14,740 14,870 782 22,455 22,525 1,773 27,131 27,175 2,781 30,631 30,663 3,789 33,351 33,383 4,796 36,071 36,103 5,802

14,870 15,000 794 22,525 22,595 1,785 27,175 27,219 2,793 30,663 30,695 3,801 33,383 33,415 4,808 36,103 36,135 5,814

15,000 15,105 806 22,595 22,665 1,797 27,219 27,263 2,805 30,695 30,727 3,813 33,415 33,447 4,819 36,135 36,167 5,826

15,105 15,210 817 22,665 22,735 1,809 27,263 27,307 2,817 30,727 30,759 3,825 33,447 33,479 4,831 36,167 36,199 5,838

15,210 15,315 829 22,735 22,805 1,821 27,307 27,351 2,829 30,759 30,791 3,837 33,479 33,511 4,843 36,199 36,231 5,850

15,315 15,420 840 22,805 22,875 1,833 27,351 27,395 2,841 30,791 30,823 3,849 33,511 33,543 4,855 36,231 36,263 5,861

15,420 15,525 852 22,875 22,945 1,845 27,395 27,439 2,853 30,823 30,855 3,860 33,543 33,575 4,867 36,263 36,295 5,873

15,525 15,630 864 22,945 23,015 1,857 27,439 27,483 2,864 30,855 30,887 3,872 33,575 33,607 4,879 36,295 36,327 5,885

15,630 15,735 875 23,015 23,085 1,869 27,483 27,527 2,876 30,887 30,919 3,884 33,607 33,639 4,891 36,327 36,359 5,897

15,735 15,840 887 23,085 23,155 1,880 27,527 27,571 2,888 30,919 30,951 3,896 33,639 33,671 4,902 36,359 36,391 5,909

15,840 15,945 898 23,155 23,225 1,892 27,571 27,615 2,900 30,951 30,983 3,908 33,671 33,703 4,914 36,391 36,423 5,921

15,945 16,050 910 23,225 23,295 1,904 27,615 27,659 2,912 30,983 31,015 3,920 33,703 33,735 4,926 36,423 36,455 5,932

16,050 16,155 921 23,295 23,365 1,916 27,659 27,703 2,924 31,015 31,047 3,931 33,735 33,767 4,938 36,455 36,487 5,944

16,155 16,260 933 23,365 23,435 1,928 27,703 27,747 2,936 31,047 31,079 3,943 33,767 33,799 4,950 36,487 36,519 5,956

16,260 16,365 944 23,435 23,505 1,940 27,747 27,791 2,948 31,079 31,111 3,955 33,799 33,831 4,962 36,519 36,551 5,968

16,365 16,470 956 23,505 23,575 1,952 27,791 27,835 2,960 31,111 31,143 3,967 33,831 33,863 4,973 36,551 36,583 5,980

16,470 16,575 967 23,575 23,645 1,964 27,835 27,879 2,971 31,143 31,175 3,979 33,863 33,895 4,985 36,583 36,622 5,993

16,575 16,680 979 23,645 23,715 1,976 27,879 27,923 2,983 31,175 31,207 3,991 33,895 33,927 4,997 36,622 or over 6,000

|