Enlarge image

Tab to navigate within form. Use mouse to check Save Print Clear

applicable boxes, press spacebar or press Enter.

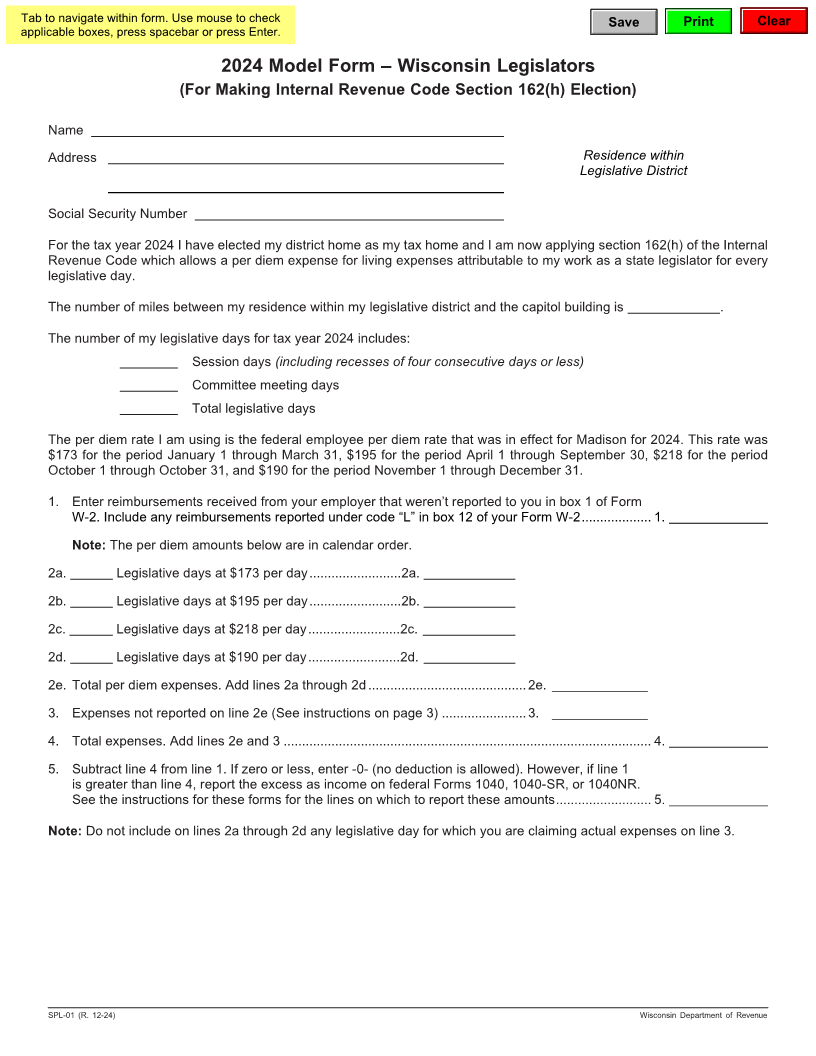

2024 Model Form – Wisconsin Legislators

(For Making Internal Revenue Code Section 162(h) Election)

Name

Address Residence within

Legislative District

Social Security Number

For the tax year 2024 I have elected my district home as my tax home and I am now applying section 162(h) of the Internal

Revenue Code which allows a per diem expense for living expenses attributable to my work as a state legislator for every

legislative day.

The number of miles between my residence within my legislative district and the capitol building is .

The number of my legislative days for tax year 2024 includes:

Session days (including recesses of four consecutive days or less)

Committee meeting days

Total legislative days

The per diem rate I am using is the federal employee per diem rate that was in effect for Madison for 2024. This rate was

$173 for the period January 1 through March 31, $195 for the period April 1 through September 30, $218 for the period

October 1 through October 31, and $190 for the period November 1 through December 31.

1. Enter reimbursements received from your employer that weren’t reported to you in box 1 of Form

W-2. Include any reimbursements reported under code “L” in box 12 of your Form W-2 ................... 1.

Note: The per diem amounts below are in calendar order.

2a. Legislative days at $173 per day ......................... 2a.

2b. Legislative days at $195 per day ......................... 2b.

2c. Legislative days at $218 per day ......................... 2c.

2d. Legislative days at $190 per day ......................... 2d.

2e. Total per diem expenses. Add lines 2a through 2d ........................................... 2e. _____________

3. Expenses not reported on line 2e (See instructions on page 3) ....................... 3. _____________

4. Total expenses. Add lines 2e and 3 .................................................................................................... 4.

5. Subtract line 4 from line 1. If zero or less, enter -0- (no deduction is allowed). However, if line 1

is greater than line 4, report the excess as income on federal Forms 1040, 1040-SR, or 1040NR.

See the instructions for these forms for the lines on which to report these amounts .......................... 5.

Note: Do not include on lines 2a through 2d any legislative day for which you are claiming actual expenses on line 3.

SPL-01 (R. 12-24) Wisconsin Department of Revenue