Enlarge image

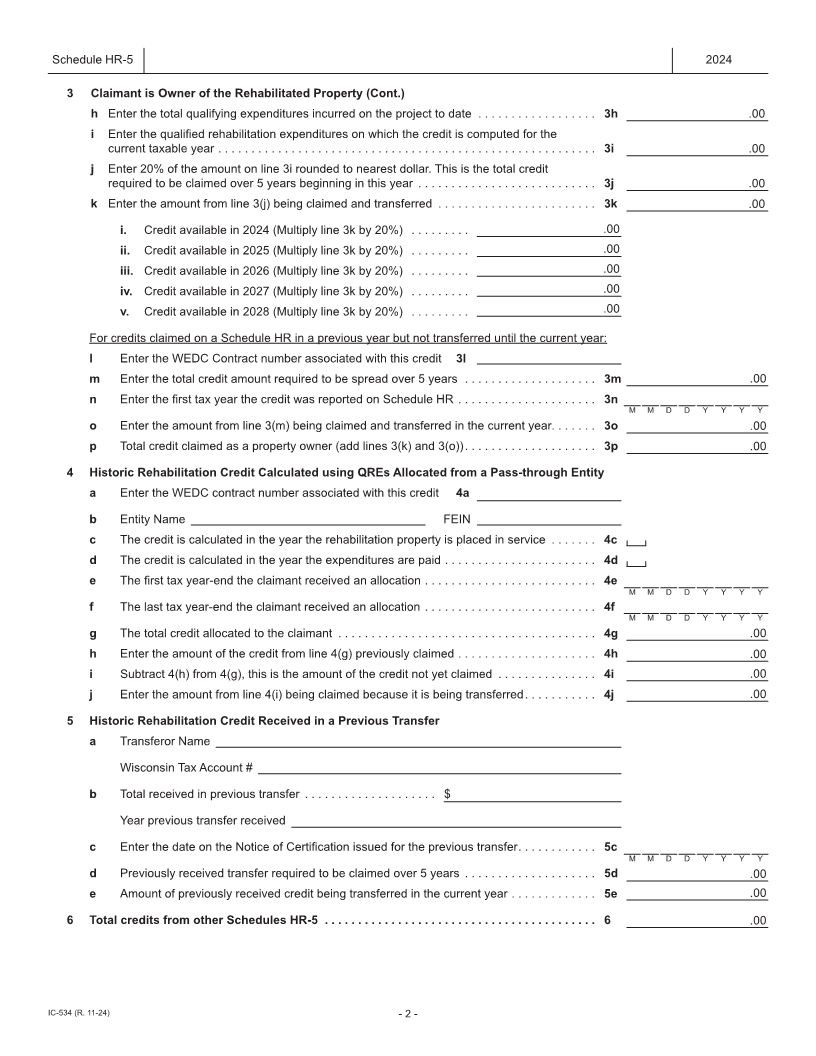

Schedule Wisconsin Supplement to the Federal Historic

HR-5 Rehabilitation Tax Credit – Five-Year Credit Claim

Wisconsin Department 2024

of Revenue File with Wisconsin Form HR-T

A. Claimant Information

1 . Name 2. FEIN or SSN

XX - XXX -

3 . Address Suite Number

4 . City State Zip Code

5 . Email Phone Number

7. Disregarded entity FEIN

6 . Check if the credit is being transferred by a single owner of a disregarded entity: XX - XXX -

8. Check if you want to allow the contact person listed below to discuss information about this form with the department:

9. Contact Person (May need Power of Attorney. See Instructions) Email

B. Rehabilitated Property

1. Name of the Property

2. Address of the Rehabilitated Property

3 . City State Zip Code

C. Credit Information

1 Total credit being claimed (add lines 3k or 3o, 4j, 5e and 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 .00

Fiduciaries Only:

a Prorate the credit from line 1 between the entity and its beneficiaries in proportion to the

income allocable to each. Enter the beneficiary’s portion . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a .00

b Subtract line 1a from line 1. This is the estate’s or trust’s portion of the credit . . . . . . . . . . . . 1b .00

2 The credit being claimed is the total of the following: Check all that apply

a The credit was calculated from rehabilitation expenditures incurred by the claimant as

owner of the historic property. If this box is checked, line 3 is completed . . . . . . . . . . . . . . . . 2a

b The credit was allocated to the claimant as owner of a pass-through entity.

If this box is checked line 4 is completed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

c The claimant received the credit as a transferee in a credit transfer approved by the

Department of Revenue. If this box is checked line 5 is completed . . . . . . . . . . . . . . . . . . . . . . . . . 2c

3 Claimant is Owner of the Rehabilitated Property

For credits claimed for the first time on this form:

a Enter the WEDC Contract number associated with this credit . . 3a

b Enter adjusted basis in the historic property prior to incurring QREs . . . . . . . . . . . . . . . . . . . . 3b .00

c The credit is calculated in the year the expenditures are paid . . . . . . . . . . . . . . . . . . . . . . . . . 3c

d The credit is calculated in the year the rehabilitation property is placed in service . . . . . . . . . 3d

e Enter the adjusted basis at the beginning of the measuring period (see the instructions) . . . . 3e .00

f Enter the date on which the 24- or 60-month measuring period begins . . . . . . . . . . . . . . . . . . 3f

M M D D Y Y Y Y

g Enter the date on which the 24- or 60-month measuring period ends . . . . . . . . . . . . . . . . . . . 3g

M M D D Y Y Y Y

IC-534 (R. 11-24) - 1 -