Enlarge image

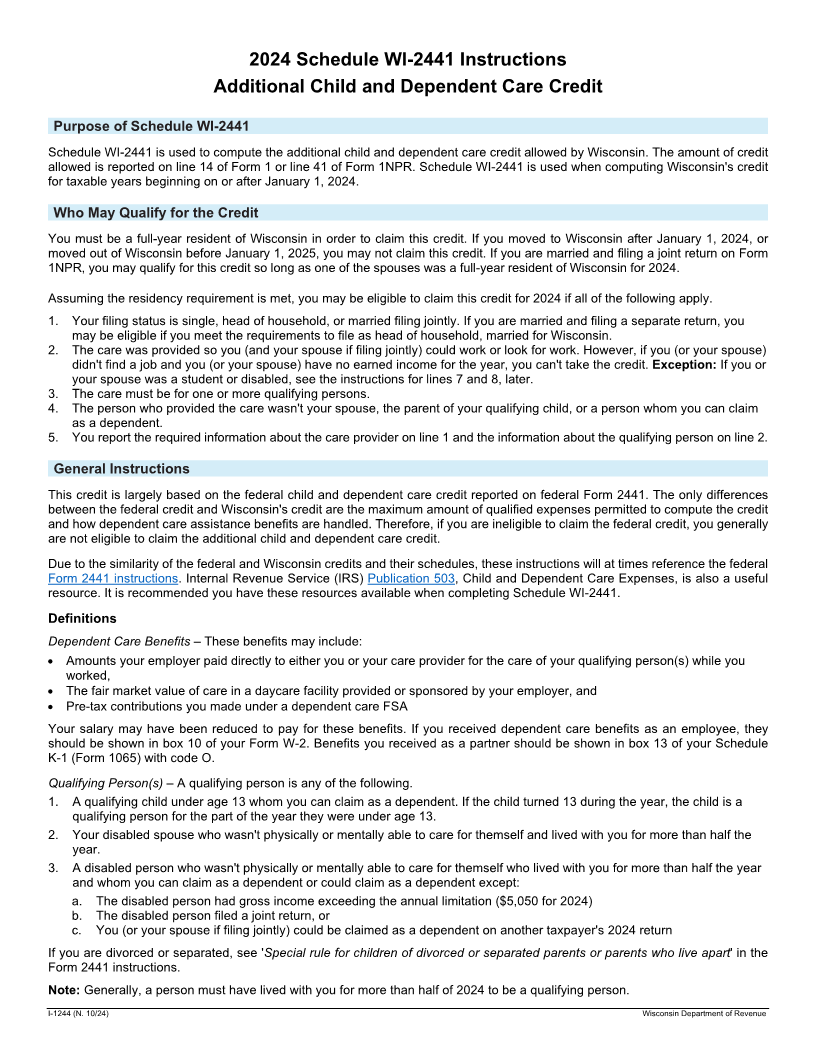

2024 Schedule WI-2441 Instructions

Additional Child and Dependent Care Credit

Purpose of Schedule WI-2441

Schedule WI-2441 is used to compute the additional child and dependent care credit allowed by Wisconsin. The amount of credit

allowed is reported on line 14 of Form 1 or line 41 of Form 1NPR. Schedule WI-2441 is used when computing Wisconsin's credit

for taxable years beginning on or after January 1, 2024.

Who May Qualify for the Credit

You must be a full-year resident of Wisconsin in order to claim this credit. If you moved to Wisconsin after January 1, 2024, or

moved out of Wisconsin before January 1, 2025, you may not claim this credit. If you are married and filing a joint return on Form

1NPR, you may qualify for this credit so long as one of the spouses was a full-year resident of Wisconsin for 2024.

Assuming the residency requirement is met, you may be eligible to claim this credit for 2024 if all of the following apply.

1. Your filing status is single, head of household, or married filing jointly. If you are married and filing a separate return, you

may be eligible if you meet the requirements to file as head of household, married for Wisconsin.

2. The care was provided so you (and your spouse if filing jointly) could work or look for work. However, if you (or your spouse)

didn't find a job and you (or your spouse) have no earned income for the year, you can't take the credit. Exception: If you or

your spouse was a student or disabled, see the instructions for lines 7 and 8, later.

3. The care must be for one or more qualifying persons.

4. The person who provided the care wasn't your spouse, the parent of your qualifying child, or a person whom you can claim

as a dependent.

5. You report the required information about the care provider on line 1 and the information about the qualifying person on line 2.

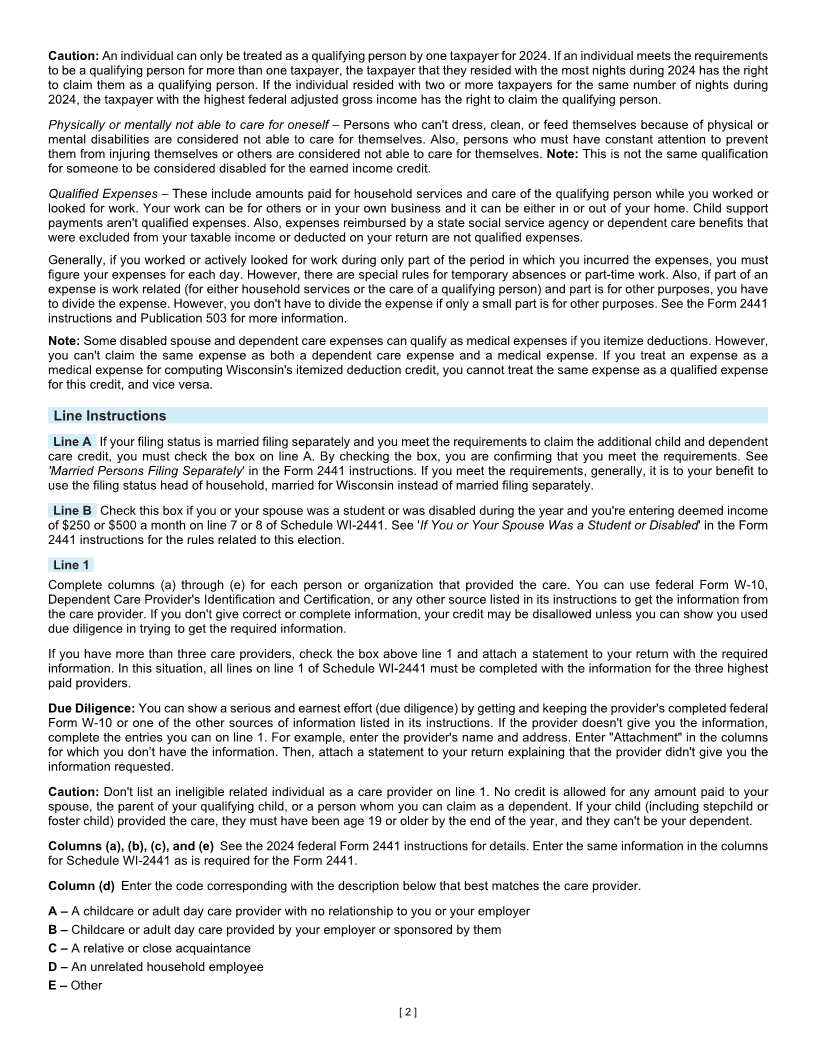

General Instructions

This credit is largely based on the federal child and dependent care credit reported on federal Form 2441. The only differences

between the federal credit and Wisconsin's credit are the maximum amount of qualified expenses permitted to compute the credit

and how dependent care assistance benefits are handled. Therefore, if you are ineligible to claim the federal credit, you generally

are not eligible to claim the additional child and dependent care credit.

Due to the similarity of the federal and Wisconsin credits and their schedules, these instructions will at times reference the federal

Form 2441 instructions. Internal Revenue Service (IRS) Publication 503, Child and Dependent Care Expenses, is also a useful

resource. It is recommended you have these resources available when completing Schedule WI-2441.

Definitions

Dependent Care Benefits – These benefits may include:

• Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you

worked,

• The fair market value of care in a daycare facility provided or sponsored by your employer, and

• Pre-tax contributions you made under a dependent care FSA

Your salary may have been reduced to pay for these benefits. If you received dependent care benefits as an employee, they

should be shown in box 10 of your Form W-2. Benefits you received as a partner should be shown in box 13 of your Schedule

K-1 (Form 1065) with code O.

Qualifying Person(s) – A qualifying person is any of the following.

1. A qualifying child under age 13 whom you can claim as a dependent. If the child turned 13 during the year, the child is a

qualifying person for the part of the year they were under age 13.

2. Your disabled spouse who wasn't physically or mentally able to care for themself and lived with you for more than half the

year.

3. A disabled person who wasn't physically or mentally able to care for themself who lived with you for more than half the year

and whom you can claim as a dependent or could claim as a dependent except:

a. The disabled person had gross income exceeding the annual limitation ($5,050 for 2024)

b. The disabled person filed a joint return, or

c. You (or your spouse if filing jointly) could be claimed as a dependent on another taxpayer's 2024 return

If you are divorced or separated, see 'Special rule for children of divorced or separated parents or parents who live apart' in the

Form 2441 instructions.

Note: Generally, a person must have lived with you for more than half of 2024 to be a qualifying person.

I-1244 (N. 10/24) Wisconsin Department of Revenue