Enlarge image

Tab to navigate within form. Use mouse to check Save Print Clear

applicable boxes, press spacebar or press Enter.

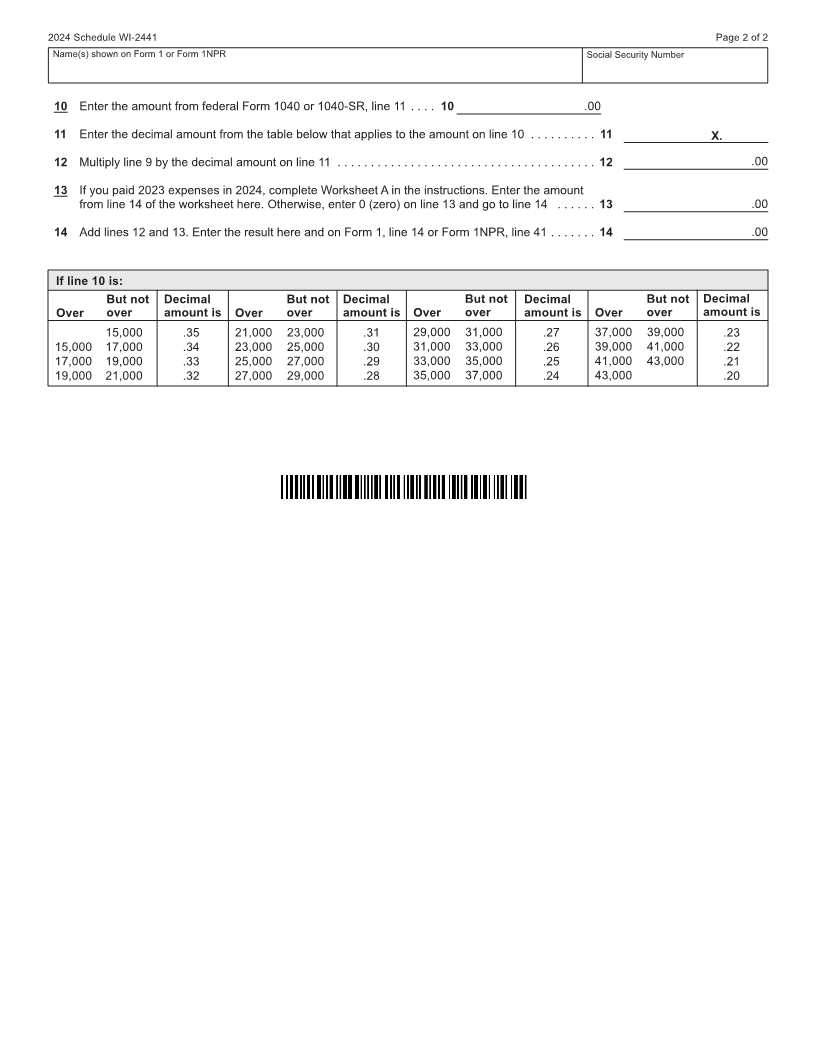

Schedule

Additional Child and Dependent

WI-2441 Care Credit

Wisconsin 2024

Department of Revenue File with Wisconsin Form 1 or 1NPR

Name(s) shown on Form 1 or Form 1NPR Social Security Number

A You can’t claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet

the requirements listed in the instructions under Married Persons Filing Separately. If you meet these requirements, check this box

B If you or your spouse was a student or was disabled during 2024 and you’re entering deemed income of $250 or $500 a month

on this schedule, check this box (See rules listed in the instructions under If You or Your Spouse Was a Student or Disabled.) ....

Part I Persons or Organizations Who Provided the Care – You must complete this part.

If you have more than three care providers, see the instructions and check this box ..........................

1 (a) (b) (c) (d) (e)

Care provider’s Address Identifying number Care provider code Amount paid

name (number, street, apt. no., city, state, and ZIP code) (SSN or EIN) (see instructions) (see instructions)

Caution: If you incurred care expenses in 2024 but didn’t pay them until 2025, or if you prepaid in 2024 for care to be

provided in 2025, don’t include those expenses in column (d) of line 2 for 2024. See instructions.

Part II Credit for Child and Dependent Care Expenses

2 Information about your qualifying person(s). If you have more than three qualifying persons, see instructions and check box.

(a) (b) (c) (d)

Qualified expenses

Qualifying person’s name Qualifying person’s Qualifying person you incurred and paid

social security code in 2024 for the person

Last First number (see instructions) listed in column (a)

.00

.00

.00

3 Add the amounts in column (d) of line 2 ............................................... 3 .00

4 Enter the total amount of dependent care benefits excluded from your taxable wages or deducted

from income on federal Schedule C, E, or F (see instructions) ............................. 4 .00

5 Subtract line 4 from line 3. If zero or less, stop. See line 13; otherwise, no credit is allowable ..... 5 .00

6 Enter the smaller of line 5 or $10,000 if you had one qualifying person or $20,000 if you had two

or more persons ................................................................. 6 .00

7 Enter your earned income. See instructions ........................................... 7 .00

8 If married filing jointly, enter your spouse’s earned income (if you or your spouse was a student

or was disabled, see instructions); all others, enter the amount from line 7 ................... 8 .00

9 Enter the smallest of line 6, 7, or 8 ................................................... 9 .00

I-244 (N. 10-24)