Enlarge image

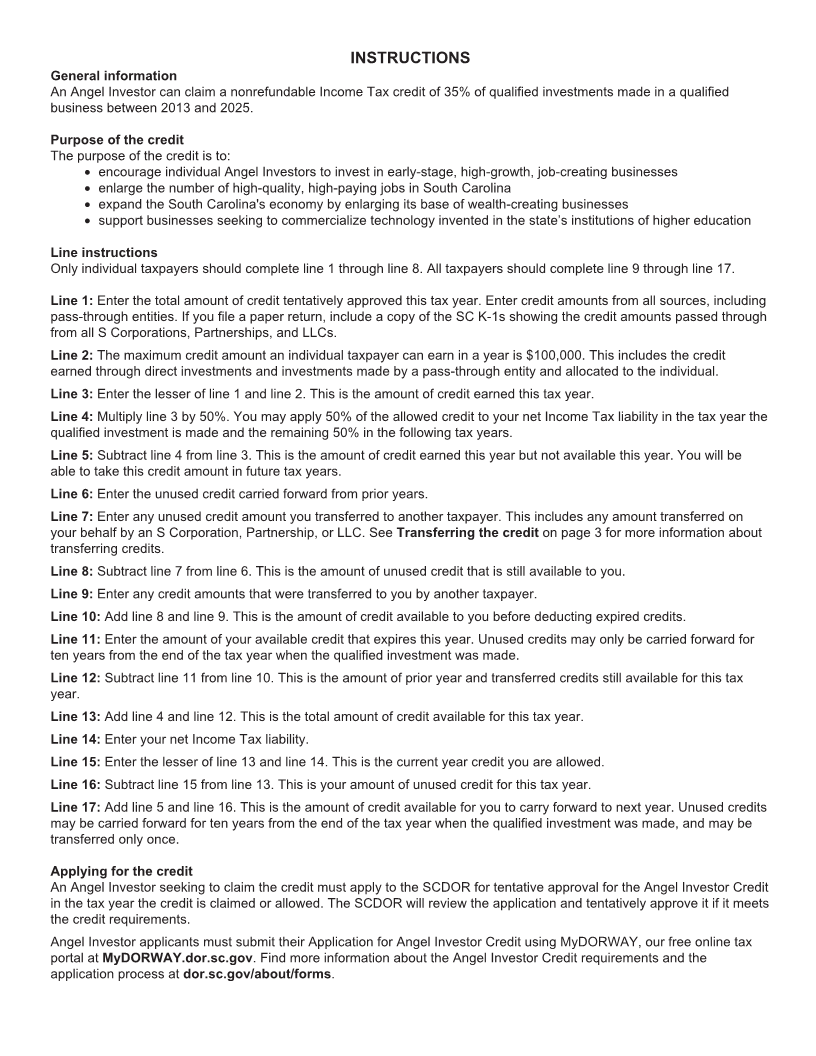

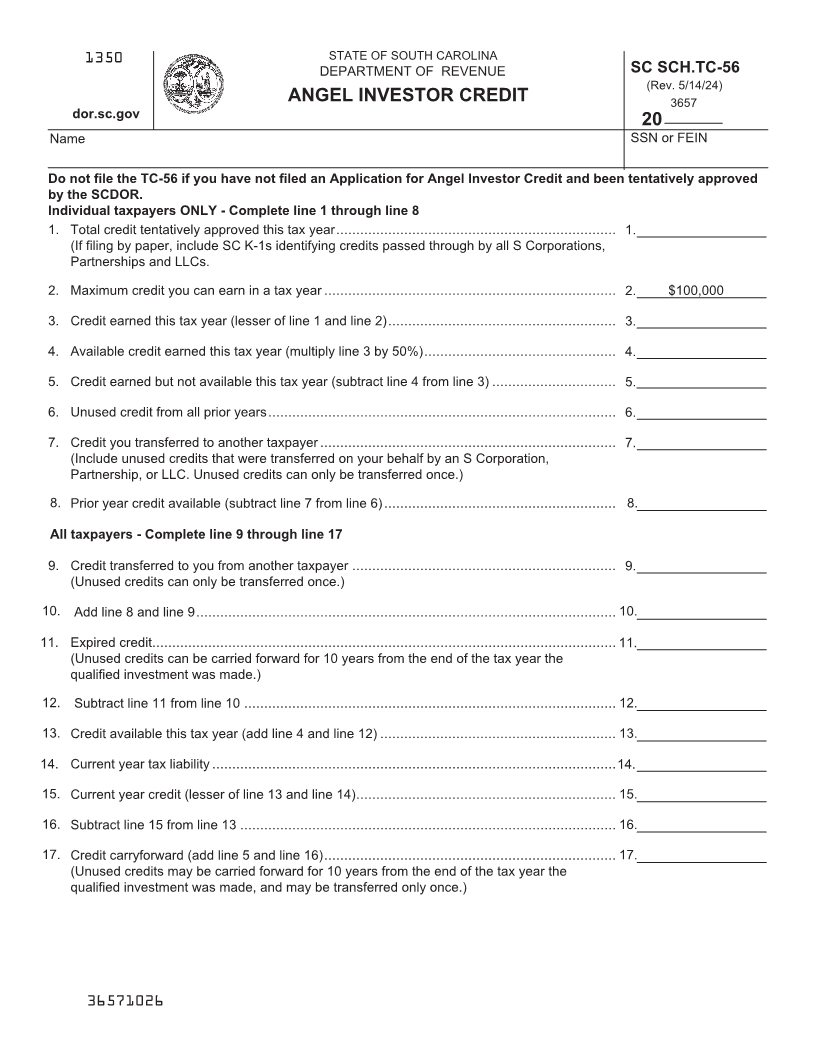

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-56

(Rev. 5/14/24)

ANGEL INVESTOR CREDIT 3657

dor.sc.gov

20

Name SSN or FEIN

Do not file the TC-56 if you have not filed an Application for Angel Investor Credit and been tentatively approved

by the SCDOR.

Individual taxpayers ONLY - Complete line 1 through line 8

1. Total credit tentatively approved this tax year...................................................................... 1.

(If filing by paper, include SC K-1s identifying credits passed through by all S Corporations,

Partnerships and LLCs.

2. Maximum credit you can earn in a tax year ......................................................................... 2. $100,000

3. Credit earned this tax year (lesser of line 1 and line 2)......................................................... 3.

4. Available credit earned this tax year (multiply line 3 by 50%)................................................ 4.

5. Credit earned but not available this tax year (subtract line 4 from line 3) ............................... 5.

6. Unused credit from all prior years....................................................................................... 6.

7. Credit you transferred to another taxpayer .......................................................................... 7.

(Include unused credits that were transferred on your behalf by an S Corporation,

Partnership, or LLC. Unused credits can only be transferred once.)

8. Prior year credit available (subtract line 7 from line 6).......................................................... 8.

All taxpayers - Complete line 9 through line 17

9. Credit transferred to you from another taxpayer .................................................................. 9.

(Unused credits can only be transferred once.)

10. Add line 8 and line 9......................................................................................................... 10.

11. Expired credit.................................................................................................................... 11.

(Unused credits can be carried forward for 10 years from the end of the tax year the

qualified investment was made.)

12. Subtract line 11 from line 10 ............................................................................................. 12.

13. Credit available this tax year (add line 4 and line 12) ........................................................... 13.

14. Current year tax liability .....................................................................................................14.

15. Current year credit (lesser of line 13 and line 14)................................................................. 15.

16. Subtract line 15 from line 13 .............................................................................................. 16.

17. Credit carryforward (add line 5 and line 16)......................................................................... 17.

(Unused credits may be carried forward for 10 years from the end of the tax year the

qualified investment was made, and may be transferred only once.)

36571026