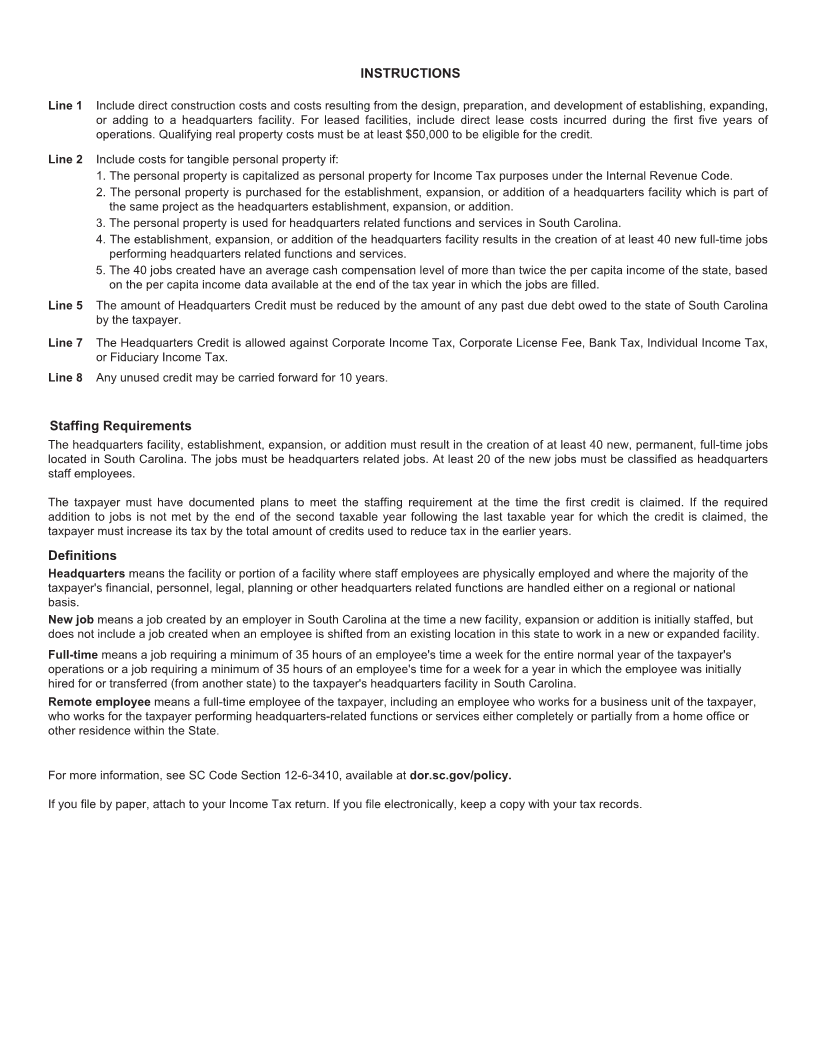

Enlarge image

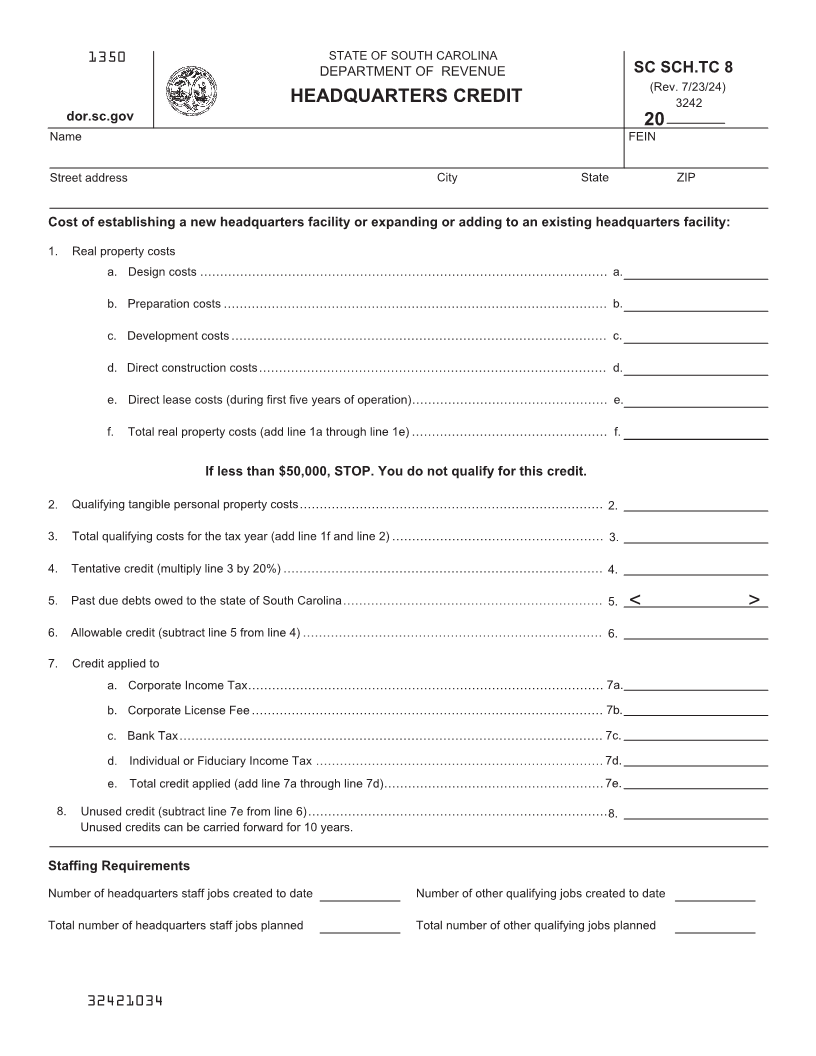

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC 8

(Rev. 7/23/24)

HEADQUARTERS CREDIT 3242

dor.sc.gov 20

Name FEIN

Street address City State ZIP

Cost of establishing a new headquarters facility or expanding or adding to an existing headquarters facility:

1. Real property costs

a. Design costs ...................................................................................................... a.

b. Preparation costs ................................................................................................ b.

c. Development costs .............................................................................................. c.

d. Direct construction costs....................................................................................... d.

e. Direct lease costs (during first five years of operation)................................................. e.

f. Total real property costs (add line 1a through line 1e) ................................................. f.

If less than $50,000, STOP. You do not qualify for this credit.

2. Qualifying tangible personal property costs............................................................................ 2.

3. Total qualifying costs for the tax year (add line 1f and line 2) ..................................................... 3.

4. Tentative credit (multiply line 3 by 20%) ................................................................................ 4.

5. Past due debts owed to the state of South Carolina................................................................. 5. < >

6. Allowable credit (subtract line 5 from line 4) ........................................................................... 6.

7. Credit applied to

a. Corporate Income Tax......................................................................................... 7a.

b. Corporate License Fee ........................................................................................ 7b.

c. Bank Tax.......................................................................................................... 7c.

d. Individual or Fiduciary Income Tax ........................................................................ 7d.

e. Total credit applied (add line 7a through line 7d)....................................................... 7e.

8. Unused credit (subtract line 7e from line 6)............................................................................8.

Unused credits can be carried forward for 10 years.

Staffing Requirements

Number of headquarters staff jobs created to date Number of other qualifying jobs created to date

Total number of headquarters staff jobs planned Total number of other qualifying jobs planned

32421034