Enlarge image

Print Form Reset Form

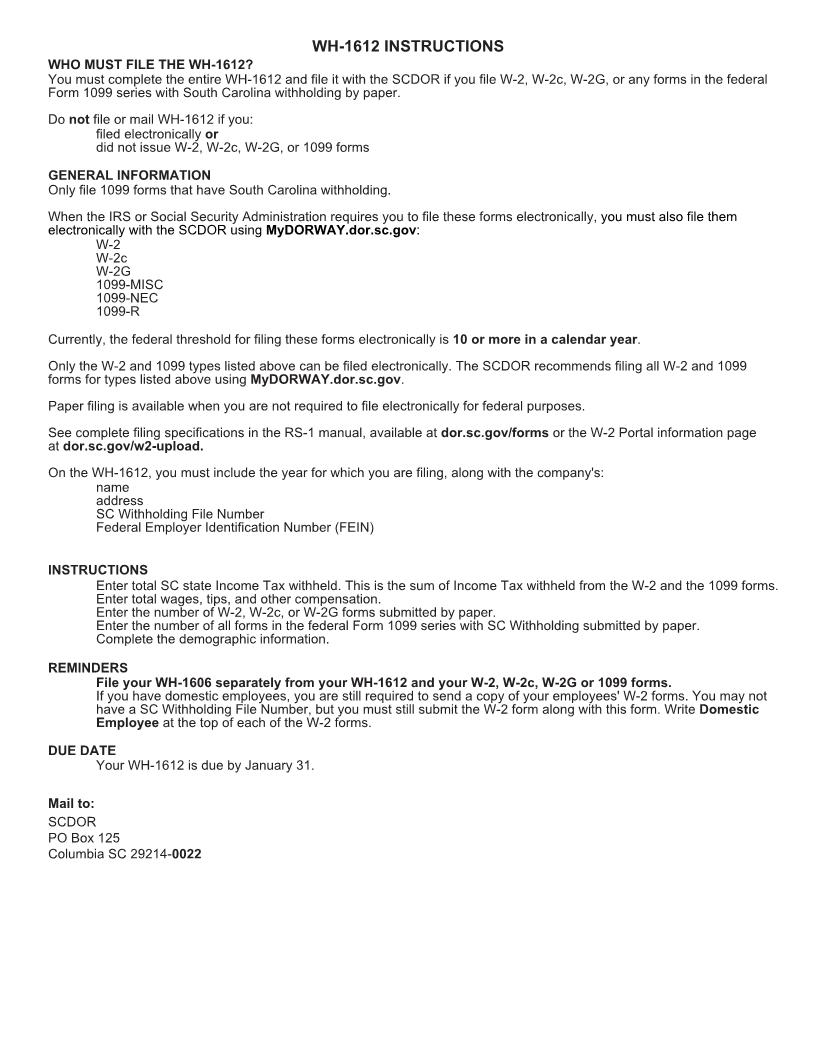

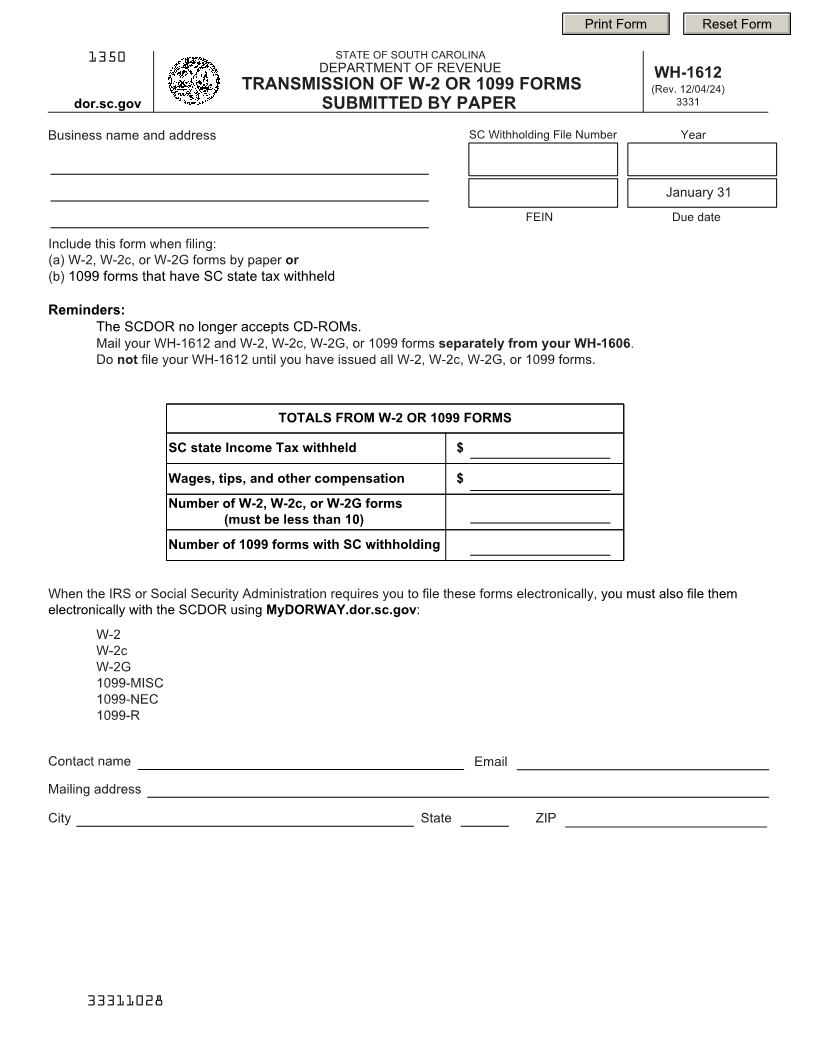

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

WH-1612

TRANSMISSION OF W-2 OR 1099 FORMS (Rev. 12/04/24)

dor.sc.gov SUBMITTED BY PAPER 3331

Business name and address SC Withholding File Number Year

January 31

FEIN Due date

Include this form when filing:

(a) W-2, W-2c, or W-2G forms by paper or

(b) 1099 forms that have SC state tax withheld

Reminders:

· The SCDOR no longer accepts CD-ROMs.

· Mail your WH-1612 and W-2, W-2c, W-2G, or 1099 forms separately from your WH-1606.

· Do not file your WH-1612 until you have issued all W-2, W-2c, W-2G, or 1099 forms.

TOTALS FROM W-2 OR 1099 FORMS

SC state Income Tax withheld $

Wages, tips, and other compensation $

Number of W-2, W-2c, or W-2G forms

(must be less than 10)

Number of 1099 forms with SC withholding

When the IRS or Social Security Administration requires you to file these forms electronically, you must also file them

electronically with the SCDOR using MyDORWAY.dor.sc.gov:

· W-2

· W-2c

· W-2G

· 1099-MISC

· 1099-NEC

· 1099-R

Contact name Email

Mailing address

City State ZIP

33311028