Enlarge image

W-2 and 1099 Filing Instructions and Specifications For Tax Year 2024 South Carolina Department of Revenue | dor.sc.gov | December 2024

Enlarge image | W-2 and 1099 Filing Instructions and Specifications For Tax Year 2024 South Carolina Department of Revenue | dor.sc.gov | December 2024 |

Enlarge image | Contents Important Notices � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1 Highlights � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1 Combined Federal/State Filing Program � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 1 Quarterly Withholding Returns and Withholding Payments � � � � � � � � � � � � � � � � � � � � � � � � � � � � 1 Avoid Duplicate Filing � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 Additional Federal Information � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 South Carolina Requirements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 Who Must File W-2 forms � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 Who Must File 1099 forms � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 Who Must File the WH-1612 forms � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 Electronic Filing � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �2 EFW2/EFW2c Record Requirements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 3 File Requirements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3 How to File an Extension � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4 Frequently Asked Questions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4 WH1612 Transmittal Form � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 6 RS Record Specifications � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 Code RS - State Record (Required) � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 Common Filing Errors to Avoid � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 South Carolina: RS--State Record � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 9 South Carolina: RS Record Specification � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �10 Appendix A: Postal Abbreviations and Numeric Codes � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �13 Questions? We're here to help. Contact us at WithholdingTax@dor.sc.gov For additional information and tutorials about the electronic filing of W-2 and 1099 forms, visit dor.sc.gov/w2-upload� For Federal Information, see Social Security Administration Publications No. 42-007 (W-2), No. 42-014 (W-2c), and Internal Revenue Service Publication 1220 (W-2G and 1099 forms). SSA website: ssa.gov/employer IRS website: irs.gov |

Enlarge image |

Important Notices

Highlights

● Beginning with tax year 2023 filings, you can now submit the following forms electronically

through MyDORWAY using IRS Publication 1220 or SSA EFW2/EFW2c specifications:

■ W-2

■ W-2c

■ W-2G

■ 1099-R

■ 1099-MISC

■ 1099- NEC

● Files must contain the state record.

● The SCDOR only accepts text (.txt) and zipped text (.zip) files. We no longer accept comma

delimited files (.csv).

● We will not accept files that contain truncated SSNs (for example, xxx-xx-1234).

● If you file 10 or more W-2 or 1099 forms in a calendar year (or the amount the IRS prescribes

to be mandated to file electronically, whichever is lower), you must file electronically using the

W-2 portal at MyDORWAY.dor.sc.gov. You can use the direct entry method or the file upload

method�

● Electronic filing is always the preferred method, but if you file fewer than 10 W-2 or 1099 forms,

the SCDOR will accept paper forms.

● All filers must file W-2 and 1099 forms by January 31 of the following year.

● The SC Withholding Tax Tables (WH-1603) and the SC Withholding Tax Formula (WH-1603F) are

updated annually. These forms are available at dor.sc.gov/withholding�

● Do not submit 1099 forms with zero SC Income Tax withheld.

● Carriage Return and Line Feeds are required in the EFW2 file.

Combined Federal/State Filing Program

The SCDOR participates in the Combined Federal/State Filing Program for reporting non-wage

statements that do not have South Carolina Income Tax withholding. Statements containing South

Carolina Income Tax withholding must be reported directly to the SCDOR.

Quarterly Withholding Returns and Withholding Payments

To prevent posting errors, do not mail withholding payments, WH-1605, or WH-1606 forms with your

WH-1612, W-2 forms, and 1099 forms.

1 SCDOR | RS-1 W2/1099 Filing Instructions

|

Enlarge image |

Avoid Duplicate Filing

Do not mail paper forms that have been filed electronically.

Additional Federal Information

● W-2: SSA Publication No. 42-007

● W-2c: SSA Publication No. 42-014

● W-2G and 1099: IRS Publication 1220

South Carolina Requirements

Who Must File W-2 forms

If you are an employer with employees that earn income in South Carolina, you are subject to South

Carolina Withholding Tax laws.

If you withhold Income Tax from your employees or independent contractors, you must give them a

W-2 or 1099 form by January 31 of the following year. You must also submit the W-2 and 1099 forms to

the SCDOR by January 31 of the following year.

Who Must File 1099 forms

If you make reportable transactions during the calendar year, you must file information returns with

the IRS. If the information returns have South Carolina Income Tax withholding, you are also required to

directly submit 1099 forms to the SCDOR by January 31 of the following year.

Who Must File the WH-1612 forms

If you file W-2, W-2c, W-2G, and/or 1099 forms with South Carolina withholding by paper, you must file

the WH-1612 with the SCDOR. The WH-1612 is available in this manual and at dor.sc.gov/forms�

Do not file or mail the WH-1612 if you:

● filed electronically through the W-2 Portal at MyDORWAY.dor.sc.gov or

● did not issue W-2, W-2c, W-2G, or 1099 forms.

Electronic Filing

General Requirements

● The preferred method of filing W-2 and 1099 forms is electronically at MyDORWAY.dor.sc.gov�

● You are required to file electronically if you issue 10 or more W-2 or 1099 forms in a calendar

year (or the amount of W-2s and 1099 forms the IRS prescribes to be mandated to file

electronically, whichever is lower).

2 SCDOR | RS-1 W2/1099 Filing Instructions

|

Enlarge image |

● If you file fewer than 10 W-2 or 1099 forms, you may submit them by paper.

W-2 and 1099 forms

● You can electronically file W-2, W-2c, W-2G, 1099-R, 1099-MISC, or 1099-NEC forms using the

direct entry or file upload methods at MyDORWAY.dor.sc.gov�

● MyDORWAY only supports files in a text (.txt) or zipped text (.zip) format.

● Do not upload password-protected files.

● Additional information and instructions are available at dor.sc.gov/withholding�

EFW2/EFW2c Record Requirements

Code RA (RCA) Submitter Record Required

Code RE (RCE) Employer Record Required

Code RW (RCW) Employee Wage Record Required

Code RO (RCO) Employee Wage Record Non-Required

Code RS (RCS) State Record Required

Code RT (RCT) Total Record Required

Code RU (RCU) Total Record Non-Required

Code RV (RCV) State Total Record Non-Required

Code RF (RCF) Final Record Required

Non-required numeric fields should be filled with zeros. Non-required non-numeric fields should be

filled with blank spaces.

File Requirements

W-2 forms

● The preferred file name is W2Report_XX.txt. XX refers to the last two digits of the tax year. You

may add alphanumeric characters to the front of the file name to assist you with identifying your

file.

● The RS (RCS) record must be included in the file.

● South Carolina will accept a copy of the information submitted to the Social Security

Administration if:

■ the RS (RCS) and RT (RCT) records are included,

■ the file does not contain truncated SSNs (xxx-xx-1234),

■ the file is submitted electronically, and

■ the file contains Carriage Return/Line Feeds (CR/LF)

● The SCDOR will accept files with multiple states' information as long as the state code for South

Carolina (45) is present.

3 SCDOR | RS-1 W2/1099 Filing Instructions

|

Enlarge image |

1099 forms

● The preferred file name is SC1099_XX.txt. XX refers to the last two digits of the tax year. You may

add alphanumeric characters to the front of the file name to assist you with identifying your file.

● South Carolina will accept a copy of the information submitted to the Social Security

Administration if:

■ the State K Record is included on the file, and

■ the Special Data Entries Field in the B record is used for the SC Withholding Number (File

Number). This field should be right justified.

How to File an Extension

If you need additional time to file W-2 or 1099 forms, you can request a 30-day extension in writing to

the SCDOR.

You must send a letter to the SCDOR to request an extension. The letter must include your reason for

requesting an extension, along with the following information:

● Tax year

● FEIN

● Withholding account file numbers

● Business mailing address

● Contact person’s name, phone number, and email address

● Verification of federal extension approval

Mail this letter to:

SCDOR, Withholding, PO Box 125, Columbia, SC 29214-0400

Frequently Asked Questions

Can I file wage information (W-2) and information returns (1099) by CD-ROM?

No. If you need to file W-2 or 1099 forms for which electronic filing is not offered, you must submit

them by paper along with the WH-1612.

How do I register before filing electronically?

You must register at dor.sc.gov/MyDORWAY-signup to electronically submit W-2 information.

Should I provide test files?

No, you should not submit test files. They will not be processed or returned to you.

Will the SCDOR accept an electronic file containing wage information for multiple companies?

Yes.

Will the SCDOR accept an electronic file containing wage information from multiple states?

Yes, as long as there are records with the state code for South Carolina (45).

4 SCDOR | RS-1 W2/1099 Filing Instructions

|

Enlarge image |

Will the SCDOR accept a copy of the SSA filing?

Yes, as long as Carriage Returns/Line Feeds (CR/LF), RS (RCS) and RT (RCT) Records, and the state code

for South Carolina (45) are included in the SSA file.

Where can I find additional information about the SCDOR's electronic filing options?

Visit dor.sc.gov/w2-upload�

Should I mail any additional information regarding my W-2 or 1099 forms if I file electronically?

You are not required to mail additional information to the SCDOR.

Do I need to keep a copy of the W-2 information I send to the SCDOR?

Yes. The SCDOR requires that you retain a copy of your W-2 forms or your W-2 data for at least six years

after the due date of the report.

Am I still required to file the WH-1606 after electronically filing W-2 forms?

Yes. The WH-1606 is due by January 31 of the following year.

5 SCDOR | RS-1 W2/1099 Filing Instructions

|

Enlarge image |

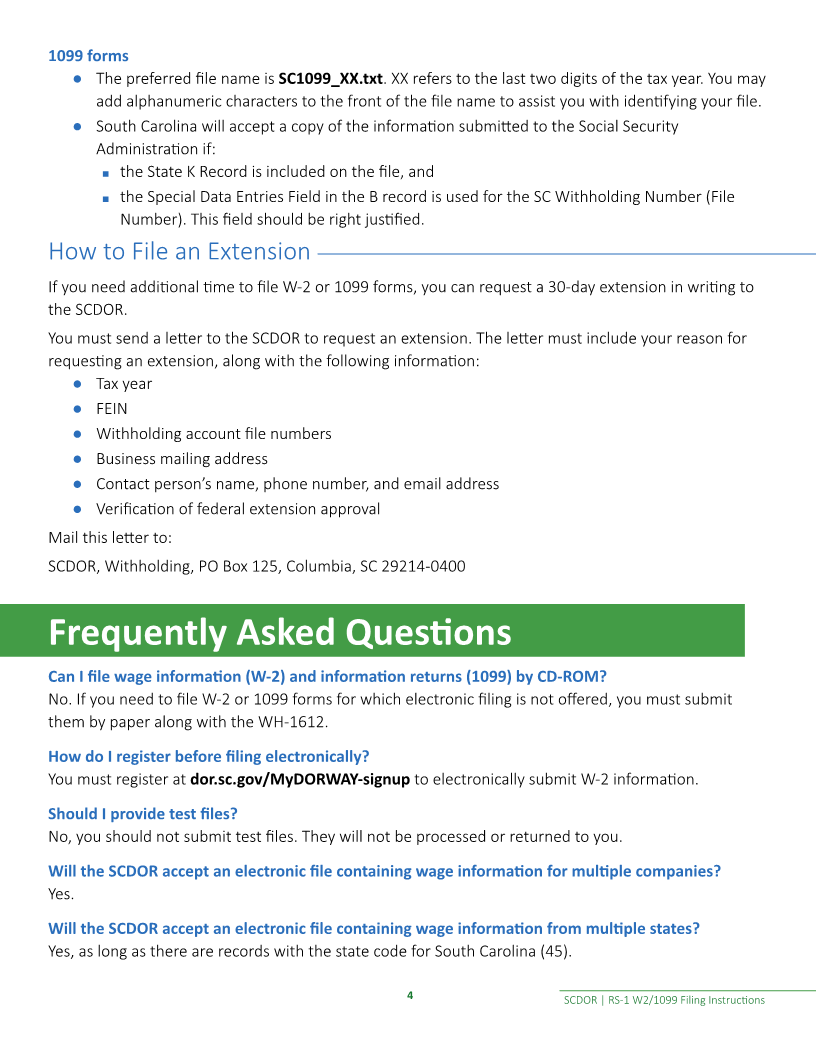

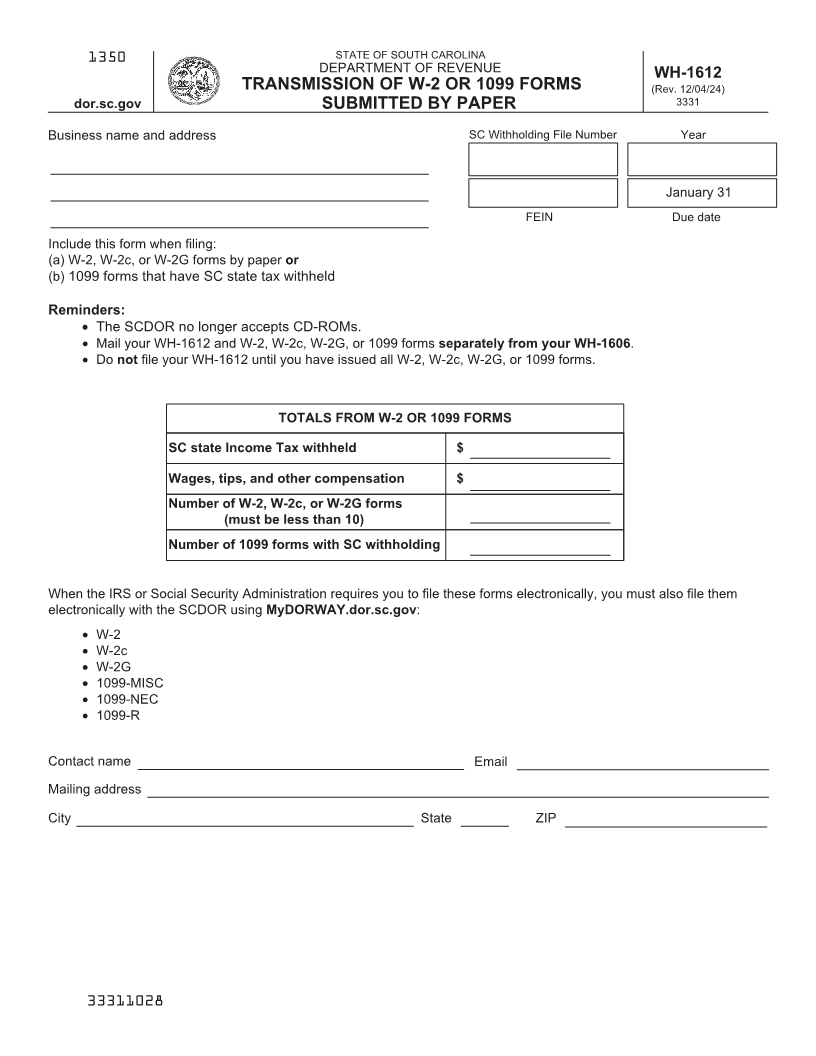

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE WH-1612

TRANSMISSION OF W-2 OR 1099 FORMS (Rev. 12/04/24)

dor.sc.gov SUBMITTED BY PAPER 3331

Business name and address SC Withholding File Number Year

January 31

FEIN Due date

Include this form when filing:

(a) W-2, W-2c, or W-2G forms by paper or

(b) 1099 forms that have SC state tax withheld

Reminders:

• The SCDOR no longer accepts CD-ROMs.

• Mail your WH-1612 and W-2, W-2c, W-2G, or 1099 forms separately from your WH-1606.

• Do not file your WH-1612 until you have issued all W-2, W-2c, W-2G, or 1099 forms.

TOTALS FROM W-2 OR 1099 FORMS

SC state Income Tax withheld $

Wages, tips, and other compensation $

Number of W-2, W-2c, or W-2G forms

(must be less than 10)

Number of 1099 forms with SC withholding

When the IRS or Social Security Administration requires you to file these forms electronically, you must also file them

electronically with the SCDOR using MyDORWAY.dor.sc.gov:

• W-2

• W-2c

• W-2G

• 1099-MISC

• 1099-NEC

• 1099-R

Contact name Email

Mailing address

City State ZIP

33311028

|

Enlarge image |

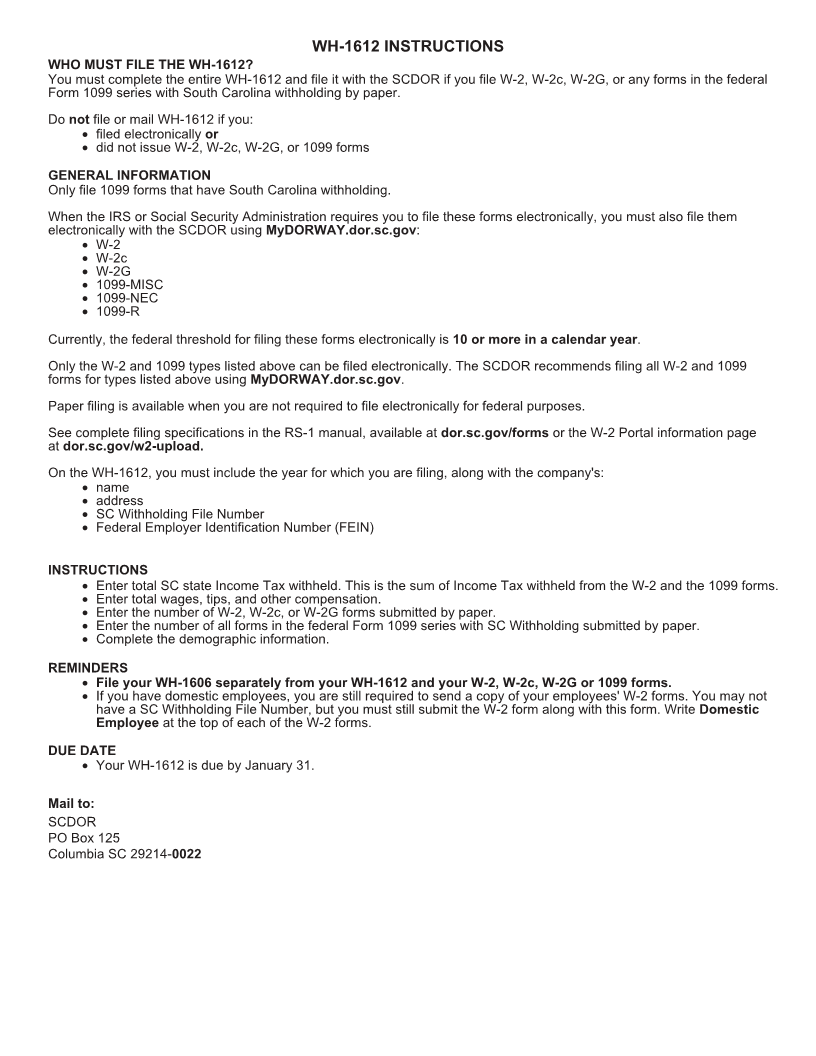

WH-1612 INSTRUCTIONS

WHO MUST FILE THE WH-1612?

You must complete the entire WH-1612 and file it with the SCDOR if you file W-2, W-2c, W-2G, or any forms in the federal

Form 1099 series with South Carolina withholding by paper.

Do not file or mail WH-1612 if you:

• filed electronically or

• did not issue W-2, W-2c, W-2G, or 1099 forms

GENERAL INFORMATION

Only file 1099 forms that have South Carolina withholding.

When the IRS or Social Security Administration requires you to file these forms electronically, you must also file them

electronically with the SCDOR using MyDORWAY.dor.sc.gov:

• W-2

• W-2c

• W-2G

• 1099-MISC

• 1099-NEC

• 1099-R

Currently, the federal threshold for filing these forms electronically is 10 or more in a calendar year.

Only the W-2 and 1099 types listed above can be filed electronically. The SCDOR recommends filing all W-2 and 1099

forms for types listed above using MyDORWAY.dor.sc.gov.

Paper filing is available when you are not required to file electronically for federal purposes.

See complete filing specifications in the RS-1 manual, available at dor.sc.gov/forms or the W-2 Portal information page

at dor.sc.gov/w2-upload.

On the WH-1612, you must include the year for which you are filing, along with the company's:

• name

• address

• SC Withholding File Number

• Federal Employer Identification Number (FEIN)

INSTRUCTIONS

• Enter total SC state Income Tax withheld. This is the sum of Income Tax withheld from the W-2 and the 1099 forms.

• Enter total wages, tips, and other compensation.

• Enter the number of W-2, W-2c, or W-2G forms submitted by paper.

• Enter the number of all forms in the federal Form 1099 series with SC Withholding submitted by paper.

• Complete the demographic information.

REMINDERS

• File your WH-1606 separately from your WH-1612 and your W-2, W-2c, W-2G or 1099 forms.

• If you have domestic employees, you are still required to send a copy of your employees' W-2 forms. You may not

have a SC Withholding File Number, but you must still submit the W-2 form along with this form. Write Domestic

Employee at the top of each of the W-2 forms.

DUE DATE

• Your WH-1612 is due by January 31.

Mail to:

SCDOR

PO Box 125

Columbia SC 29214-0022

|

Enlarge image |

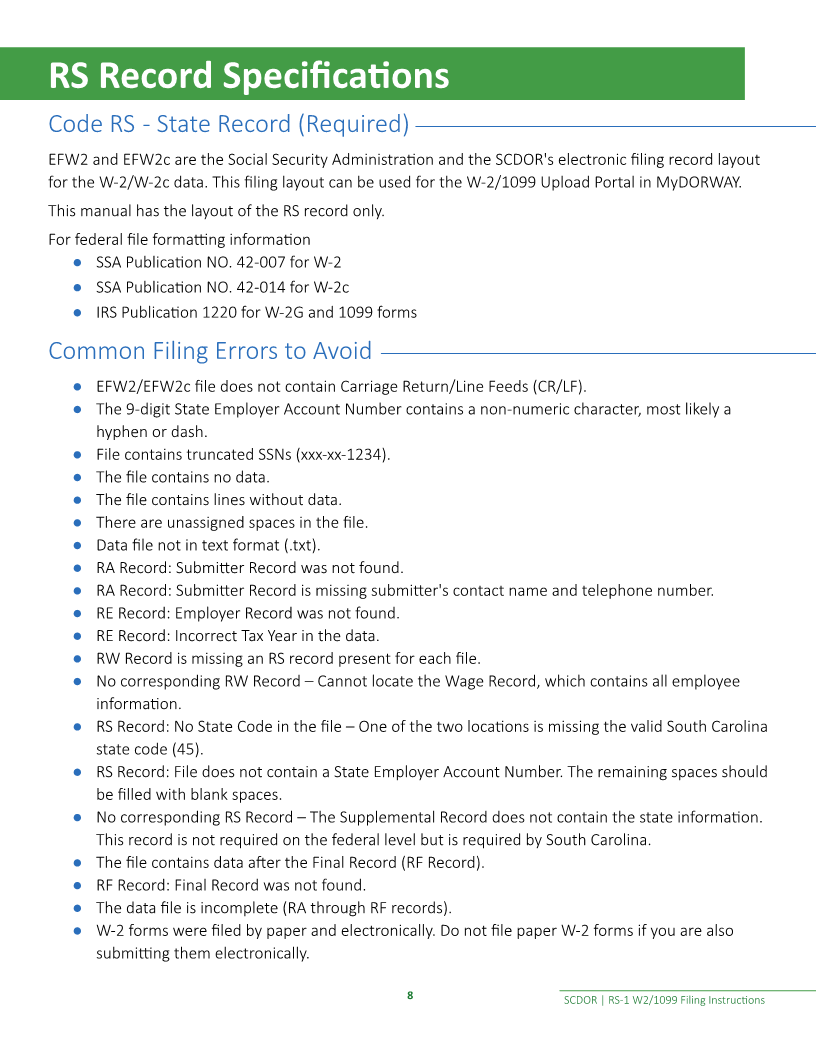

RS Record Specifications

Code RS - State Record (Required)

EFW2 and EFW2c are the Social Security Administration and the SCDOR's electronic filing record layout

for the W-2/W-2c data. This filing layout can be used for the W-2/1099 Upload Portal in MyDORWAY.

This manual has the layout of the RS record only.

For federal file formatting information

● SSA Publication NO. 42-007 for W-2

● SSA Publication NO. 42-014 for W-2c

● IRS Publication 1220 for W-2G and 1099 forms

Common Filing Errors to Avoid

● EFW2/EFW2c file does not contain Carriage Return/Line Feeds (CR/LF).

● The 9-digit State Employer Account Number contains a non-numeric character, most likely a

hyphen or dash.

● File contains truncated SSNs (xxx-xx-1234).

● The file contains no data.

● The file contains lines without data.

● There are unassigned spaces in the file.

● Data file not in text format (.txt).

● RA Record: Submitter Record was not found.

● RA Record: Submitter Record is missing submitter's contact name and telephone number.

● RE Record: Employer Record was not found.

● RE Record: Incorrect Tax Year in the data.

● RW Record is missing an RS record present for each file.

● No corresponding RW Record – Cannot locate the Wage Record, which contains all employee

information.

● RS Record: No State Code in the file – One of the two locations is missing the valid South Carolina

state code (45).

● RS Record: File does not contain a State Employer Account Number. The remaining spaces should

be filled with blank spaces.

● No corresponding RS Record – The Supplemental Record does not contain the state information.

This record is not required on the federal level but is required by South Carolina.

● The file contains data after the Final Record (RF Record).

● RF Record: Final Record was not found.

● The data file is incomplete (RA through RF records).

● W-2 forms were filed by paper and electronically. Do not file paper W-2 forms if you are also

submitting them electronically.

8 SCDOR | RS-1 W2/1099 Filing Instructions

|

Enlarge image |

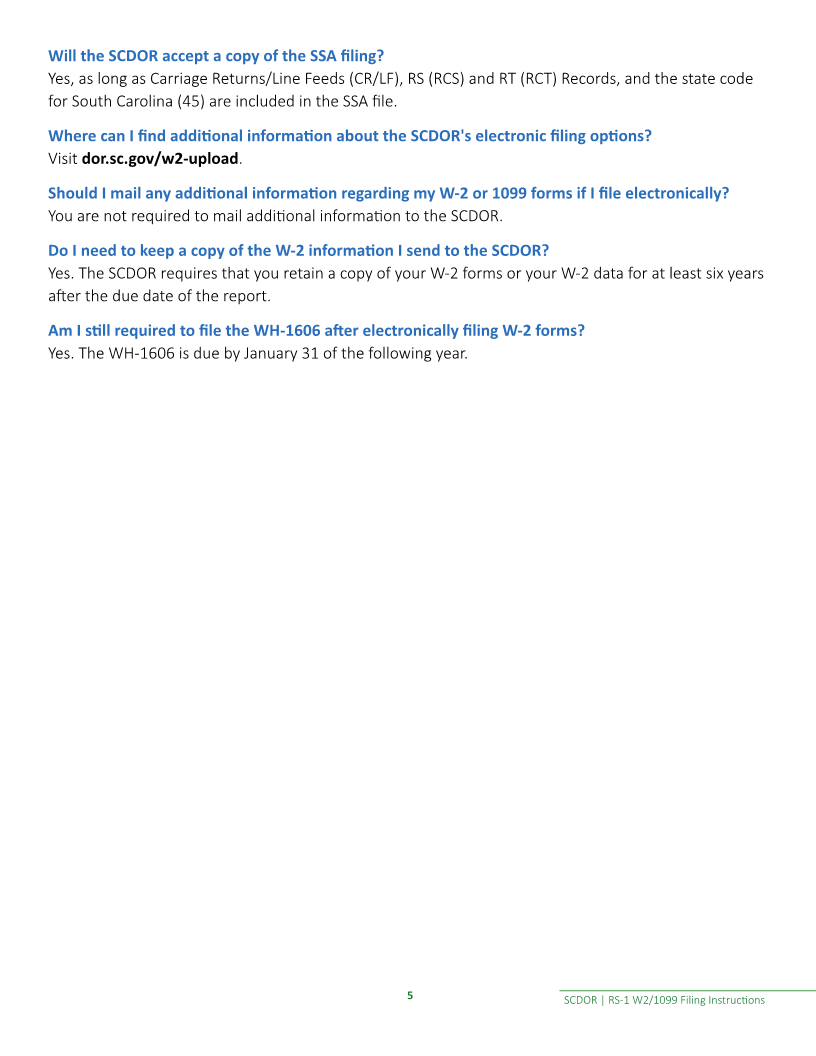

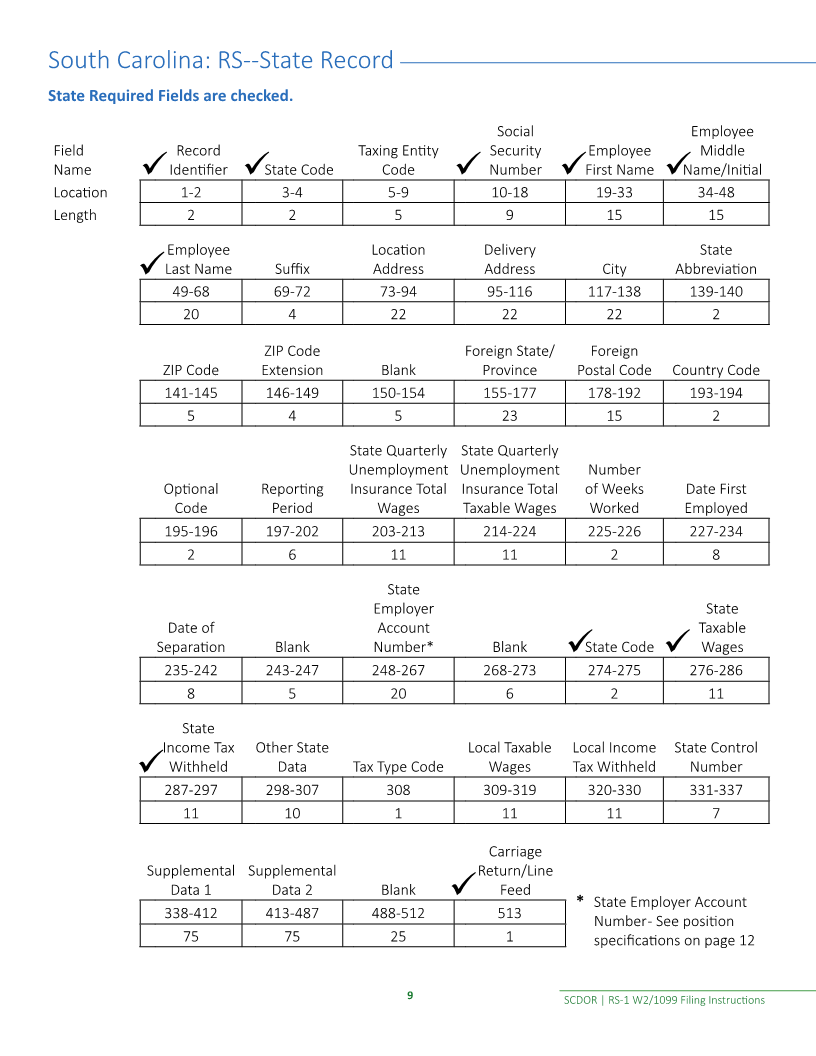

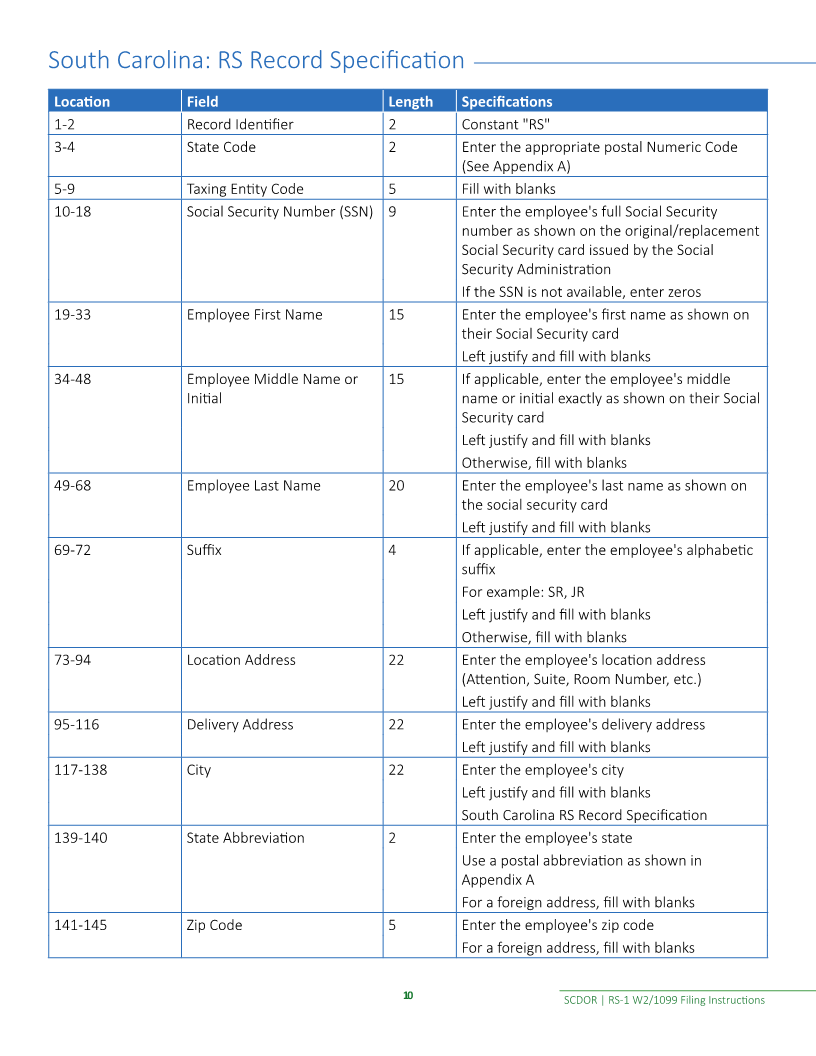

South Carolina: RS--State Record

State Required Fields are checked.

Social Employee

Field Record Taxing Entity Security Employee Middle

Name Identifier State Code Code Number First Name Name/Initial

Location 1-2 3-4 5-9 10-18 19-33 34-48

Length 2 2 5 9 15 15

Employee Location Delivery State

Last Name Suffix Address Address City Abbreviation

49-68 69-72 73-94 95-116 117-138 139-140

20 4 22 22 22 2

ZIP Code Foreign State/ Foreign

ZIP Code Extension Blank Province Postal Code Country Code

141-145 146-149 150-154 155-177 178-192 193-194

5 4 5 23 15 2

State Quarterly State Quarterly

Unemployment Unemployment Number

Optional Reporting Insurance Total Insurance Total of Weeks Date First

Code Period Wages Taxable Wages Worked Employed

195-196 197-202 203-213 214-224 225-226 227-234

2 6 11 11 2 8

State

Employer State

Date of Account Taxable

Separation Blank Number* Blank State Code Wages

235-242 243-247 248-267 268-273 274-275 276-286

8 5 20 6 2 11

State

Income Tax Other State Local Taxable Local Income State Control

Withheld Data Tax Type Code Wages Tax Withheld Number

287-297 298-307 308 309-319 320-330 331-337

11 10 1 11 11 7

Carriage

Supplemental Supplemental Return/Line

Data 1 Data 2 Blank Feed

* State Employer Account

338-412 413-487 488-512 513

Number - See position

75 75 25 1 specifications on page 12

9 SCDOR | RS-1 W2/1099 Filing Instructions

|

Enlarge image |

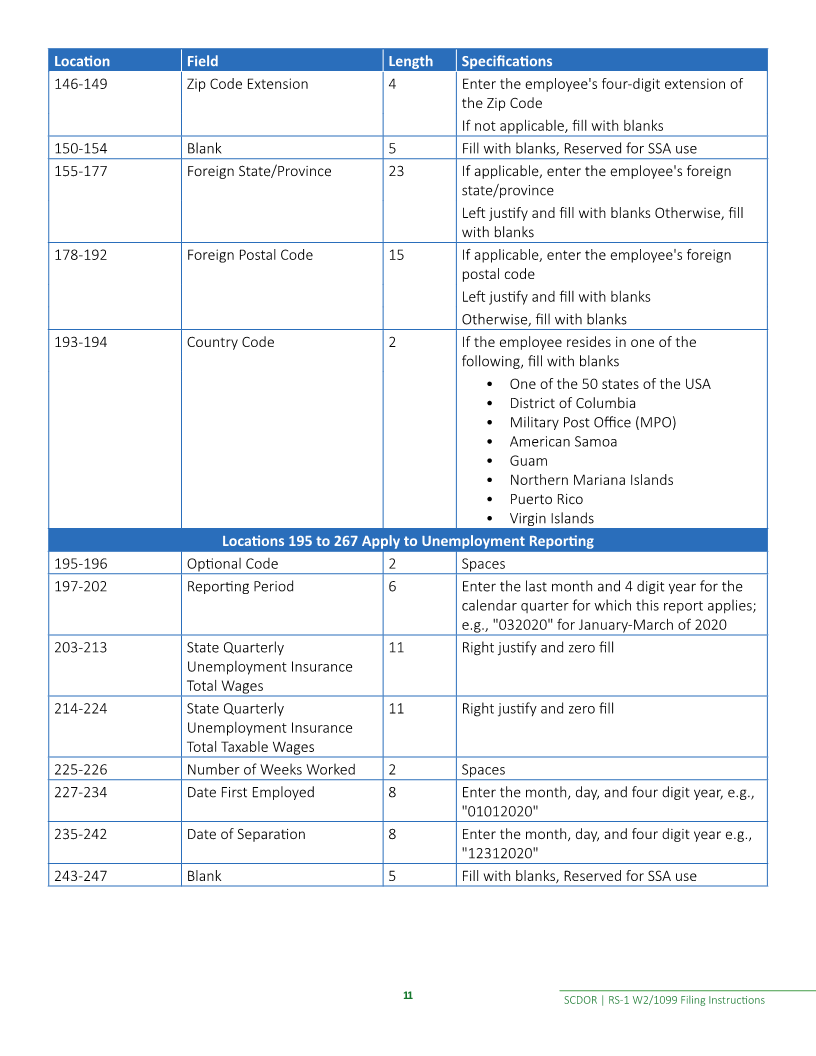

South Carolina: RS Record Specification

Location Field Length Specifications

1-2 Record Identifier 2 Constant "RS"

3-4 State Code 2 Enter the appropriate postal Numeric Code

(See Appendix A)

5-9 Taxing Entity Code 5 Fill with blanks

10-18 Social Security Number (SSN) 9 Enter the employee's full Social Security

number as shown on the original/replacement

Social Security card issued by the Social

Security Administration

If the SSN is not available, enter zeros

19-33 Employee First Name 15 Enter the employee's first name as shown on

their Social Security card

Left justify and fill with blanks

34-48 Employee Middle Name or 15 If applicable, enter the employee's middle

Initial name or initial exactly as shown on their Social

Security card

Left justify and fill with blanks

Otherwise, fill with blanks

49-68 Employee Last Name 20 Enter the employee's last name as shown on

the social security card

Left justify and fill with blanks

69-72 Suffix 4 If applicable, enter the employee's alphabetic

suffix

For example: SR, JR

Left justify and fill with blanks

Otherwise, fill with blanks

73-94 Location Address 22 Enter the employee's location address

(Attention, Suite, Room Number, etc.)

Left justify and fill with blanks

95-116 Delivery Address 22 Enter the employee's delivery address

Left justify and fill with blanks

117-138 City 22 Enter the employee's city

Left justify and fill with blanks

South Carolina RS Record Specification

139-140 State Abbreviation 2 Enter the employee's state

Use a postal abbreviation as shown in

Appendix A

For a foreign address, fill with blanks

141-145 Zip Code 5 Enter the employee's zip code

For a foreign address, fill with blanks

10 SCDOR | RS-1 W2/1099 Filing Instructions

|

Enlarge image |

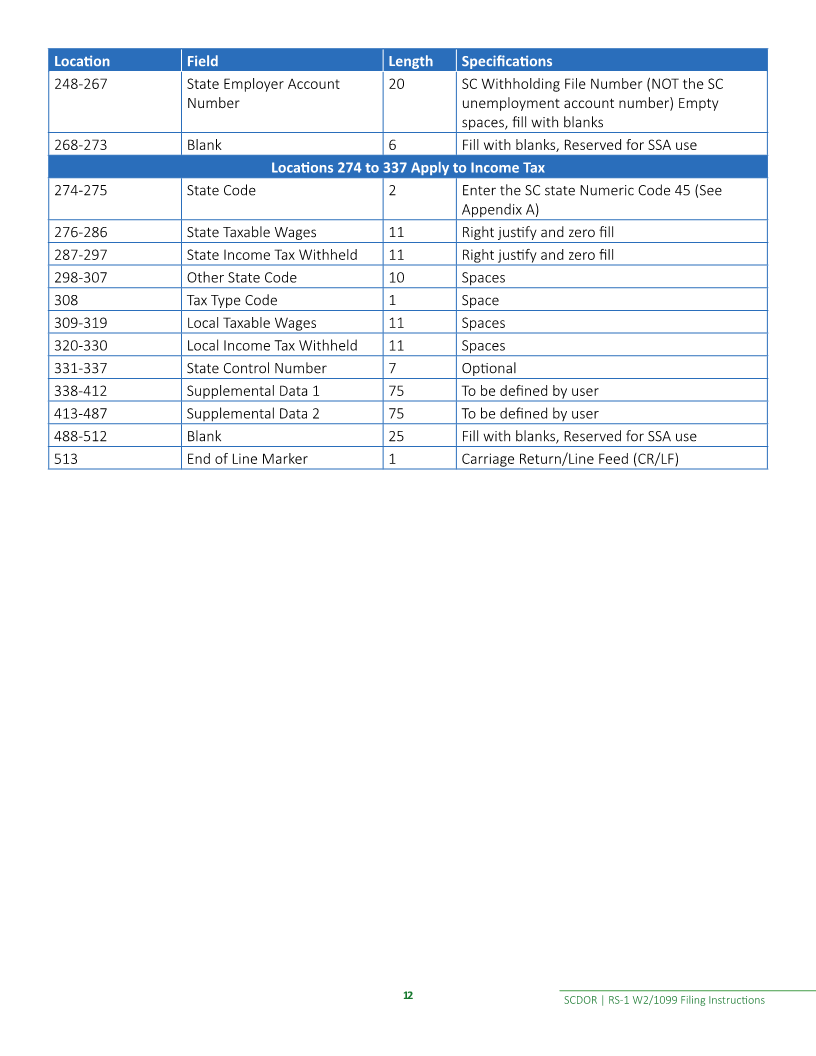

Location Field Length Specifications

146-149 Zip Code Extension 4 Enter the employee's four-digit extension of

the Zip Code

If not applicable, fill with blanks

150-154 Blank 5 Fill with blanks, Reserved for SSA use

155-177 Foreign State/Province 23 If applicable, enter the employee's foreign

state/province

Left justify and fill with blanks Otherwise, fill

with blanks

178-192 Foreign Postal Code 15 If applicable, enter the employee's foreign

postal code

Left justify and fill with blanks

Otherwise, fill with blanks

193-194 Country Code 2 If the employee resides in one of the

following, fill with blanks

• One of the 50 states of the USA

• District of Columbia

• Military Post Office (MPO)

• American Samoa

• Guam

• Northern Mariana Islands

• Puerto Rico

• Virgin Islands

Locations 195 to 267 Apply to Unemployment Reporting

195-196 Optional Code 2 Spaces

197-202 Reporting Period 6 Enter the last month and 4 digit year for the

calendar quarter for which this report applies;

e.g., "032020" for January-March of 2020

203-213 State Quarterly 11 Right justify and zero fill

Unemployment Insurance

Total Wages

214-224 State Quarterly 11 Right justify and zero fill

Unemployment Insurance

Total Taxable Wages

225-226 Number of Weeks Worked 2 Spaces

227-234 Date First Employed 8 Enter the month, day, and four digit year, e.g.,

"01012020"

235-242 Date of Separation 8 Enter the month, day, and four digit year e.g.,

"12312020"

243-247 Blank 5 Fill with blanks, Reserved for SSA use

11 SCDOR | RS-1 W2/1099 Filing Instructions

|

Enlarge image |

Location Field Length Specifications

248-267 State Employer Account 20 SC Withholding File Number (NOT the SC

Number unemployment account number) Empty

spaces, fill with blanks

268-273 Blank 6 Fill with blanks, Reserved for SSA use

Locations 274 to 337 Apply to Income Tax

274-275 State Code 2 Enter the SC state Numeric Code 45 (See

Appendix A)

276-286 State Taxable Wages 11 Right justify and zero fill

287-297 State Income Tax Withheld 11 Right justify and zero fill

298-307 Other State Code 10 Spaces

308 Tax Type Code 1 Space

309-319 Local Taxable Wages 11 Spaces

320-330 Local Income Tax Withheld 11 Spaces

331-337 State Control Number 7 Optional

338-412 Supplemental Data 1 75 To be defined by user

413-487 Supplemental Data 2 75 To be defined by user

488-512 Blank 25 Fill with blanks, Reserved for SSA use

513 End of Line Marker 1 Carriage Return/Line Feed (CR/LF)

12 SCDOR | RS-1 W2/1099 Filing Instructions

|

Enlarge image |

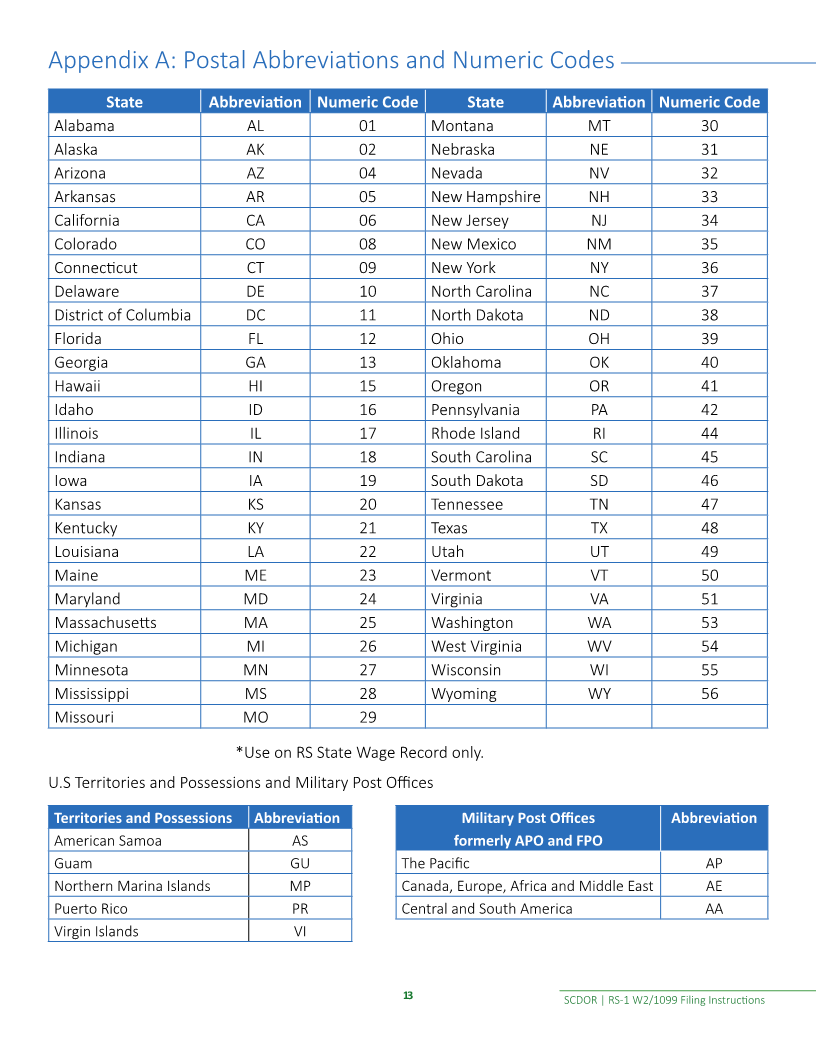

Appendix A: Postal Abbreviations and Numeric Codes

State Abbreviation Numeric Code State Abbreviation Numeric Code

Alabama AL 01 Montana MT 30

Alaska AK 02 Nebraska NE 31

Arizona AZ 04 Nevada NV 32

Arkansas AR 05 New Hampshire NH 33

California CA 06 New Jersey NJ 34

Colorado CO 08 New Mexico NM 35

Connecticut CT 09 New York NY 36

Delaware DE 10 North Carolina NC 37

District of Columbia DC 11 North Dakota ND 38

Florida FL 12 Ohio OH 39

Georgia GA 13 Oklahoma OK 40

Hawaii HI 15 Oregon OR 41

Idaho ID 16 Pennsylvania PA 42

Illinois IL 17 Rhode Island RI 44

Indiana IN 18 South Carolina SC 45

Iowa IA 19 South Dakota SD 46

Kansas KS 20 Tennessee TN 47

Kentucky KY 21 Texas TX 48

Louisiana LA 22 Utah UT 49

Maine ME 23 Vermont VT 50

Maryland MD 24 Virginia VA 51

Massachusetts MA 25 Washington WA 53

Michigan MI 26 West Virginia WV 54

Minnesota MN 27 Wisconsin WI 55

Mississippi MS 28 Wyoming WY 56

Missouri MO 29

*Use on RS State Wage Record only.

U.S Territories and Possessions and Military Post Offices

Territories and Possessions Abbreviation Military Post Offices Abbreviation

American Samoa AS formerly APO and FPO

Guam GU The Pacific AP

Northern Marina Islands MP Canada, Europe, Africa and Middle East AE

Puerto Rico PR Central and South America AA

Virgin Islands VI

13 SCDOR | RS-1 W2/1099 Filing Instructions

|