Enlarge image

Instructions for C and S Corporation Income Tax Returns South Carolina Department of Revenue | dor.sc.gov |September 2024

Enlarge image | Instructions for C and S Corporation Income Tax Returns South Carolina Department of Revenue | dor.sc.gov |September 2024 |

Enlarge image | Contents Forms � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1 What's New? � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1 Filing Guidelines � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �1 General Instructions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4 Filing Requirements � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4 Extensions and Estimated Payments � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 6 Penalties and Interest � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �6 Amended Returns � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �7 Consolidated Returns � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �8 Definitions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �9 Policy Resources � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �9 Use Tax � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �10 SC1120 C Corporation Instructions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �10 Line Instructions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �10 PART I: Computation of Income Tax Liability � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �11 PART II: Computation of License Fee � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �14 Schedules A through G � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �16 Apportionment � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �18 Schedules J through N � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �22 S Corporation Instructions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �23 Line Instructions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �24 PART I: Computation of Income Tax Liability � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �25 PART II: Computation of License Fee � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �26 Schedules for SC1120S � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �27 Schedules A through N � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �27 Nonresident Shareholder Withholding � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �29 Composite Filing � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �29 Reminders � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �36 |

Enlarge image |

Forms

Which form do I use to file my return?

● SC1120 - C Corporation ● SC1120U - Public Utility

● SC1120S - S Corporation ● CL-4 - Electric Cooperative

● SC1101B - Bank ● SC990-T - Nonprofit Organization with

● SC1104 - Savings & Loan Association unrelated business income

Taxpayers filing a federal 1120-F, 1120-H, 1120-POL, 1120-REIT, or a similar variation of the federal 1120

should file the SC1120. An insurance company must file with the Department of Insurance.

Forms are available at dor.sc.gov/forms. References to form numbers and line descriptions on the

federal Corporate Income Tax forms were correct at the time of printing. If, due to federal form

changes, you are unable to determine the proper line to use, contact the SCDOR Corporate Tax section

at 1-844-898-8542. Use these instructions as a guide when preparing your SC Corporate Income Tax

return. They are not intended to cover all provisions of the law.

What's New?

Conformity

South Carolina recognizes the Internal Revenue Code (IRC) as amended through December 31, 2023,

except as otherwise provided. If IRC sections adopted by South Carolina that expired on December

31, 2023 are extended, but otherwise not amended, by congressional enactment during 2024, these

sections are also extended for South Carolina purposes in the same manner that they are extended for

federal Income Tax purposes�

2024 Legislative Update

A list of significant changes in tax and regulatory laws and regulations enacted during the 2024

legislative session is available at dor.sc.gov/policy�

Filing Guidelines

Electronic Mandate

If you owe $15,000 or more in connection with any SCDOR return, you must file and pay electronically

according to SC Code Sections 12-54-250 and 12-54-210, available at dor.sc.gov/policy�

Abbreviated Instructions

● If all of the corporation's activities are in South Carolina, use Schedules A and B to make

adjustments to federal taxable income to determine South Carolina taxable income� Then

complete Part 1, page 1, to arrive at the income (loss) and compute the tax.

1 SCDOR | C & S Corporation Instructions

|

Enlarge image |

● Complete the SC1120TC for any nonrefundable credits and carry the totals to the applicable line

on your tax return.

● Complete line 14 of the Schedule D and take the total stated capital amount to Part II, page 2 to

compute the License Fee� Then complete the remainder of the Schedule D�

● Corporations doing business in South Carolina and other states are required to allocate and

apportion the federal taxable income after the Schedule A and B adjustments.

■ Complete Schedule F to directly allocate dividends, capital gains on real estate, and income

items not related to the business of the corporation.

■ Complete Schedule H to apportion the business income (loss) of the corporation.

■ Manufacturers, retailers, and others dealing with tangible personal property generally use

the sales apportionment method of the Schedule H-1.

■ Service providers, construction contractors, renters of real estate, and others not dealing

with tangible personal property use the gross receipts apportionment of Schedule H-2.

● After allocation and apportionment, complete Schedule G to arrive at the total South Carolina

income (loss). Take the Schedule G amount to Part I, page 1 to compute the tax. Complete the

SC1120TC for any nonrefundable credits, and carry the totals to the applicable line on your tax

return�

● For License Fee purposes, take the total stated capital on line 14, Schedule D to Schedule E for

apportionment. Take this amount as apportioned to Part II, page 2 to compute the License Fee.

Mailing requirements

To be considered on time, your return must be postmarked by the due date.

Income Tax Period Ending

The Income Tax period ending date for the South Carolina Corporate Tax return is the same as for your

federal return. If you have elected for federal purposes to use a 52-53 week tax year that ends on

the same day of the week nearest to the last day of the calendar month, indicate the last day of the

calendar month as your end date for South Carolina purposes.

For example, if the federal 52-53 week tax year ends on January 3, enter December 31. If you enter an

incorrect date, you could receive a Failure to File Notice. The federal taxable income entered on Line 1,

Part 1 is not affected.

License Fee Period Ending

This period is one year in advance of the Income Tax period. For instance, if the Income Tax period ends

December 31, 2024, the License Fee period ends December 31, 2025.

Federal Employer Identification Number (FEIN)

For the SCDOR to process your return, you must include your FEIN.

Name

Enter the name of the corporation.

Mailing Address

Enter the address to be used on all Corporate Income Tax correspondence�

2 SCDOR | C & S Corporation Instructions

|

Enlarge image |

The SCDOR has identified several common errors that result in processing delays:

● We will not process a faxed or emailed return�

● A corporation that does not file an Application for Certificate of Authority with the South

Carolina Secretary of State (SCSOS) must file an Initial Annual Report (CL-1) and pay a $25

License Fee to the SCDOR within 60 days of initially doing business or using a portion of its

capital in this state�

● You are required to file a South Carolina Corporate Tax return, regardless of activity, from the

date the charter/authority is granted by the SCSOS until the date of voluntary dissolution or

withdrawal� Failure to file may result in administrative dissolution�

● If any Corporate Income Tax or License Fee is due, you must make your payment and include

the SC1120-T, Application for Automatic Extension of Time to File a Corporate Tax Return, by the

original due date. There is no extension for payment for Corporate Income Tax or License Fee.

Any Income Tax or License Fee due must be paid by the due date to avoid late penalties and

interest�

■ You can request your extension to file by paying your balance due on our free online tax

portal, MyDORWAY, at dor.sc.gov/pay� Select Business Income Tax Payment to get started�

Your payment on MyDORWAY automatically submits your filing extension request. No

additional form or paperwork is required.

■ If no Income Tax or License Fee is due, and you have requested a federal extension, the

federal extension will be accepted as a South Carolina extension if the Corporate Tax return is

received within the time as extended by the IRS.

■ If you requested a federal or state extension, check the Extension box on the front of the

return�

● Corporations filing a consolidated return should file a single South Carolina extension. A federal

extension will be accepted if all corporations filing in South Carolina are included in one or more

federal extensions. The period covered by the South Carolina Corporate Tax return must be

the same as the period covered by the federal return in most instances. However, you should

enter the last day of the calendar month as the end date if your 52-53 week tax year ends on a

weekday nearest to the last day of the calendar month.

● The License Fee is calculated using Capital Stock and Paid-in or Capital Surplus. Do not use

Retained Earnings in the calculation. The minimum License Fee is $25.

● A consolidated return must include the calculation of a separate License Fee for the parent and

each subsidiary. A separate annual report and profit-and-loss statement are also required using

each member's own apportionment ratio.

● When claiming withholding, provide all necessary withholding statements (1099s or I-290s). If

the corporation uses a fiscal year, include a schedule showing payments made to South Carolina

during the year. You cannot use a K-1 to claim withholding�

● To avoid a declaration penalty for underpayment of Corporate Tax, a corporation filing its first

South Carolina Corporate Tax return or having federal taxable income of $1 million or more in

3 SCDOR | C & S Corporation Instructions

|

Enlarge image |

any of the previous three tax years must pay 100% of the tax shown on the current year tax

return (or 100% of the tax if no return is filed). All other corporations must pay 100% of the

current year or prior year.

● Corporations must use their FEIN on their Corporate Income Tax return.

● Send appropriate forms with all payments. Make checks payable to SCDOR and include your

name, FEIN, tax year, and the type of tax in the memo. Do not send cash�

● Close your business with the SCSOS before filing your final return with the SCDOR.

● Round all amounts to the nearest dollar�

● Corporations conducting business in South Carolina are subject to all corporate filing

requirements set forth in the South Carolina Code of Laws�

For more information about Corporate Income Tax, visit dor.sc.gov/corporate. Questions? We're here

to help. Contact us at 1-844-898-8542.

General Instructions

Filing Requirements

You are required to file if you are transacting or conducting business within South Carolina. See page

1 for the correct form to use for your organization. Insurance companies file with the South Carolina

Department of Insurance. Homeowners associations and political organizations with no taxable income

are not required to file an Income Tax return. Forms are available at dor.sc.gov/forms�

Attach a copy of your federal form and supporting schedules to each return � Regardless of the activity

of the corporation, you must file a return and pay the License Fee until the charter or qualification is

canceled with the SCSOS.

Final return

Follow the steps listed below when filing a Final Return and ceasing to exist or when withdrawing from

this state. When making an S election only, do not check the Final box on the front of the return�

1� A domestic corporation must file Articles of Dissolution with the SCSOS.

2� A corporation other than a domestic corporation must file an Application to Surrender Authority

to do Business with the SCSOS.

3� After filing the Articles of Dissolution or Application to Surrender Authority to do Business, the

corporation must file a final tax return by the 15th day of the fourth month (15th day of the

third month if an S Corporation) after the end of the tax year. The final return must include a

schedule showing the distribution of the assets to the stockholders.

4� If you owe and need an extension of time to file your Corporate Tax return, you must file

the SC1120-T prior to the expiration of the filing period. If you do not anticipate owing an

Income Tax or License Fee, and you requested an extension of time to file your federal Income

Tax return, the SCDOR will accept a copy of the properly-filed federal extension as long as

4 SCDOR | C & S Corporation Instructions

|

Enlarge image |

the Corporate Tax return is received within the extended time allowed by the IRS. Mark the

Extension box on the front of the Corporate Tax return�

5� Check the Final box on the front of the return�

Basis of return

The taxable income as shown on your federal tax return is the basis of your South Carolina return,

with certain adjustments for federal and state differences. Attach a copy of your federal return and

all supporting schedules. The South Carolina gross income and taxable income of a corporation is the

corporation's gross income and taxable income as determined under the Internal Revenue Code subject

to the modifications required by state law.

When to file:

● A C Corporation must file its Income Tax return by the 15th day of the fourth month after the

end of the tax year.

● An S Corporation must file its Income Tax return by the 15th day of the third month after the end

of the tax year.

● A new C Corporation filing a short period return must generally file by the 15th day of the fourth

month after the short period ends.

● A new S Corporation filing a short period return must generally file by the 15th day of the third

month after the short period ends.

Transfers to a corporation controlled by the transferor:

If a person receives stock and securities of a corporation in exchange for property and does not

recognize a gain or loss under IRC Section 351, the person (transferor) and the transferee must attach

the same information as required by Internal Revenue Regulation 1.351-3.

Signature

The return must be signed by an officer of the corporation who is duly authorized to make the report

on behalf of the corporation. Print the officer's name under the signature.

The signature section of the return contains an authorization for release of confidential information.

A check in the Yes box authorizes the SCDOR Director to delegate and to discuss the return, its

attachments, and any notices, adjustments, or assessments with the preparer.

Accounting Method

Use the same method of accounting under this chapter for federal Income Tax purposes. If your

method of accounting is changed for federal Income Tax purposes, the method of accounting for South

Carolina Income Tax must also be changed�

Provide the SCDOR with a copy of the written permission form received from the IRS. When written

permission is not required to change a method of accounting, provide the SCDOR with a copy of the

election or statement provided to the IRS.

Make necessary adjustments to federal taxable income by adding or subtracting South Carolina changes

resulting from the change in accounting method.

5 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Extensions and Estimated Payments

Request your extension to file by paying your balance due on our free online tax portal, MyDORWAY,

at dor.sc.gov/pay� Select Business Income Tax Payment to get started. Your payment on MyDORWAY

automatically submits your filing extension request. No additional form or paperwork is required.

If filing the SC1120-T by paper, include your name, FEIN, tax year, and SC1120-T in the memo of the

check. Do not send cash.

Attach your payment to the SC1120-T and mail to: SCDOR, Corporate Voucher, PO Box 100153,

Columbia, SC 29202.

If you do not anticipate owing tax, and you requested an extension of time to file your federal Income

Tax return, the SCDOR will accept a copy of your properly-filed federal extension as long as the

Corporate Tax return is received within the extended time allowed by the IRS.

Corporations filing a consolidated return should file a single South Carolina extension. A federal

extension will be accepted if all corporations filing in South Carolina are included in one or more federal

extensions�

Check the Extension box on the front of the return if you have requested a South Carolina or federal

extension�

There is no extension of time for payment of Corporate Income Tax or License Fee. Any Income Tax or

License Fee due must be paid by the due date to avoid late penalties and interest.

An extension of time to file the SC1120 does not extend the due date for your Business Personal

Property Return. File the Business Personal Property Return (PT-100) separately.

Declaration of Estimated Tax: Corporations must make Estimated Tax (or declaration) payments if their

Estimated Tax (Income Tax less credits) is determined to be $100 or more. Quarterly installments are

due by the 15th day of the 4th, 6th, 9th, and 12th months of the year. Use the SC1120-CDP, Corporation

Declaration of Estimated Income Tax, to file and pay your quarterly Estimated Tax payments by paper.

Pay online using our free online tax portal, MyDORWAY, at dor.sc.gov/pay� Select Business Income Tax

Payment to get started. Do not mail the SC1120-CDP if you pay online.

If filing by paper, include your name, FEIN, tax year, and SC1120-CDP in the memo of the check. Do

not send cash. Mail payment with the SC1120-CDP to: SCDOR, Corporate Voucher, PO Box 100153,

Columbia, SC 29202. Complete the SC2220, Underpayment of Estimated Tax by Corporations, to

compute the underpayment penalties. Forms are available at dor.sc.gov/forms�

Penalties and Interest

Calculate penalty and interest using the Penalty and Interest Calculator at dor.sc.gov/calculator� Avoid

penalties and interest by filing and paying the tax when it is due.

● South Carolina Code Section 12-54-210 requires a corporation to keep books, papers,

memoranda, and records; plus render statements, make returns, and comply with all regulations

as the SCDOR prescribes. If a corporation fails to comply with the provisions of this section,

6 SCDOR | C & S Corporation Instructions

|

Enlarge image |

a failure to comply penalty must be added, not to exceed $500 for the period covered by the

return in addition to other penalties provided by law.

● If a corporation fails to file its tax return when due (including any extension), it will be subject

to a failure to file penalty. The penalty will be 5% of the tax due per month, up to 25% total. The

penalty is calculated on the tax due on the return less any amounts paid on or before the due

date. The SCDOR may also assess a late filing penalty of up to $500.

● If a corporation owes $15,000 or more in connection with any SCDOR return, it must file and pay

electronically for that return and any future tax return filed with the SCDOR. If it does not file

and pay electronically, it will be assessed a $500 penalty.

● If a corporation fails to pay tax by the due date, a failure to pay penalty must be added to the tax.

The penalty will be 0.5% of the tax per month, up to 25% total.

● If a corporation underpays its tax liability and the underpayment is due to negligence or

disregard of regulations, it will be charged a negligence penalty of 5% of the underpayment plus

50% of the interest payable.

● If a corporation substantially understates its tax, it will be charged a substantial understatement

penalty of 25% of the understatement. A substantial understatement is the greater of 10%

of the tax liability or $10,000. In the case of an S Corporation or personal holding company, a

substantial understatement is the greater of $5,000 or 10% of the tax liability.

● If the corporation fails to pay the tax due, it will be charged interest at the rate provided under

IRC Sections 6621 and 6622. The interest will be calculated on the full amount of tax or portion

thereof, not including penalties, from the time the tax was due until paid in its entirety.

Amended Returns

Amended returns

To amend a previously-filed SC1120 or SC1120S, complete a new form and check the Amended Return

box on the front of the return. Include an explanation of the adjustments, a copy of the federal 1120X,

and a copy of the original return filed with the amended return. If you do not provide a copy of your

original return, the SCDOR cannot process your amended return. You must submit your amended

return within 36 months of the date the original return was filed or due to be filed, whichever is later,

as required by SC Code Section 12-54-85, available at dor.sc.gov/policy�

Amended South Carolina return required based on IRS audit

Once the IRS has completed its audit, a corporation has 180 days to file an amended return with the

SCDOR. The signed and dated IRS forms 4549 and 870 must be included with the amended return,

along with the 1574 letter, if available. Include an explanation of the adjustments and a copy of the

original return with the amended return. If you do not provide a copy of your original return, we cannot

process your amended return.

7 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Consolidated Returns

A consolidated return is a single Income Tax return filed by two or more corporations subject to

Corporate Income Tax. On a consolidated return, income or loss is determined separately for each

corporation and combined and reported on a single return for the controlled group. Credits and credit

carry-forwards are used on a consolidated basis.

An S Corporation may NOT participate in a consolidated return.

A consolidated return may be filed on behalf of:

● a parent and one or more substantially-controlled subsidiaries, or

● two or more corporations under substantially the entire control of the same interest.

Substantial control means the ownership by one corporation of 80% or more of the total combined

voting power of all classes of stock of the other corporations. Check the Consolidated Return box on

the front of your SC1120 and complete Schedule J and Schedule M as required. The Schedule M must

have all three parts completed. The totals should match the figures reported on page 1 and page 2 of

the return�

All corporations included in a consolidated return or combined return must use the same accounting

year.

If you elect to file a consolidated return, you must make your election on an original, timely-filed return.

You cannot change your election to file a consolidated return after the return is filed. Once an election

is made, it must be adhered to on all subsequent returns until the SCDOR grants permission to file

separate returns�

A multi-state corporation must compute and use a separate apportionment ratio in arriving at the

South Carolina taxable income and License Fee for each entity included in the consolidation.

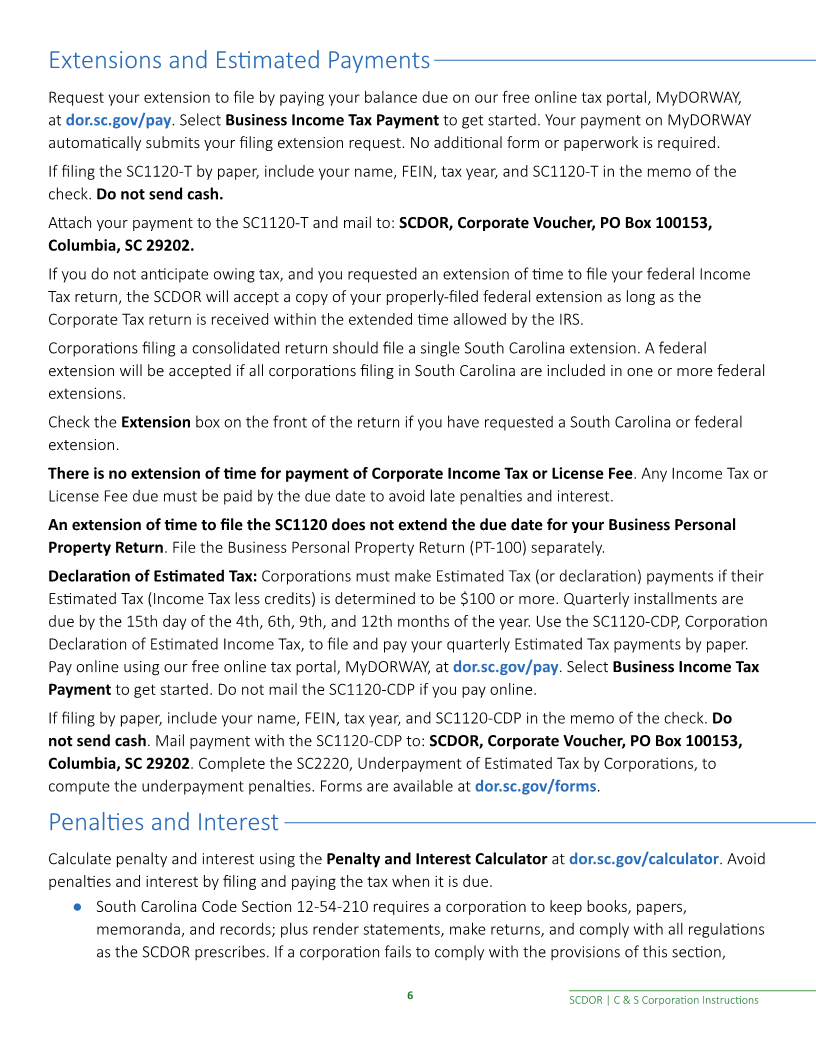

The following is an example of a multi-state consolidated return:

Income Calculation

SC Taxable Income

Corporation Taxable Income SC Apportionment Ratio (Column 1 x Column 2)

A 45,000 80% 36,000

B (15,000) 90% (13,500)

Total SC Taxable Income 22,500

License Fee Calculation

License Fee

Corporation Capital SC Apportionment Ratio (SC Capital x .001 + 15)

Not less than $25

A 150,000 80% 135

B 1,000 90% 25

Total SC License Fee 160

8 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Include a pro forma federal return rather than the actual federal return if

● the federal consolidated group is not the same as the South Carolina consolidated group, or

● the federal consolidated group does not apply because only one of the corporations included in

the federal filing is subject to South Carolina tax

Attach a copy of pages 1-6 of the federal return and the federal Form 851, Affiliations Schedule.

Definitions

● Tangible property is real property and corporeal personal property. It does not mean money,

bank deposits, shares of stock, bonds, credits, evidences of debt, choses in action, or evidence of

an interest in property.

● Intangible property is all property other than tangible property.

● Income year is the calendar year or the fiscal year used as the basis to compute federal net

income�

● Fiscal year is an income year ending on the last day of any month other than December.

● Received for the purpose of the computations of net income under this chapter means received

and accrued�

● Received and accrued is defined based on the method of accounting used to compute net

income�

● Foreign corporation is any corporation chartered outside of South Carolina.

● Domestic corporation is a corporation charted in South Carolina.

● Property having actual situs in this state includes real property physically located within this

state and personal property of a bona fide resident of this state wherever situated.

● Resident corporation is a corporation whose principal place of business is located within this

state�

● Non-resident corporation is any corporation other than a resident corporation.

All of the various terms defined in Sections 7701-7703 of the Internal Revenue Code have the same

meaning for South Carolina Income Tax purposes, unless a different meaning is clearly required.

Policy Resources

The SCDOR issues policy documents on a variety of tax related topics. Some documents which may be

of interest to corporate taxpayers are:

● New Jobs Credit: County Ranking - SC Information Letter

● Policy Document Index - SC Information Letter

● New Jobs Credit: Computation and Examples - SC Revenue Ruling #99-5

● Per Capita Income of Counties - SC Information Letter

● Quarterly Interest Rate - SC Information Letter

● Single Member Limited Liability Company - SC Revenue Ruling #98-11

● Nexus for Income Tax - (Geoffrey Implications) - SC Revenue Ruling #08-1

9 SCDOR | C & S Corporation Instructions

|

Enlarge image |

● Public Law 86-272 and South Carolina Income Tax - SC Revenue Ruling #97-15

● License Fee Based on Capital Stock and Paid-In or Capital Surplus: Computation and Proration

Questions - South Carolina Revenue Ruling #05-11

● Active Trade or Business Income - Annual Election by Pass-Through Entity to Pay Tax at Entity

Level - Revenue Ruling #21-15

● South Carolina's Guide to IRC Conformity form 2021-2023 (Publication)

● SC Tax Incentives for Economic Development (Publication)

Policy documents are available at dor.sc.gov/policy�

Use Tax

If you buy goods from out-of-state and bring those goods into South Carolina, you owe 6% state Use

Tax (or applicable rate if you operate in a county with a local tax). The Use Tax is complementary to the

Sales Tax. If you paid Sales Tax to another state, you are allowed a credit for the tax you already paid

equal to the amount due in South Carolina�

For example, if you bought goods in North Carolina and paid 6% Sales Tax there, you would not owe

Use Tax to South Carolina. If you operate in a South Carolina county with a local tax, then you would

owe the additional local tax due in that county.

For corporations, Use Tax is usually paid under the corporation's Retail License or Use Tax Registration

Number. If your corporation makes regular purchases of goods from out-of-state for use in South

Carolina, you should obtain a Use Tax Registration Number. For assistance, contact the SCDOR at

1-803-896-1350 or RegistrationforTaxes@dor.sc.gov� Learn more about Use Tax at dor.sc.gov/tax/use�

SC1120 C Corporation Instructions

Line Instructions

Check boxes

● Check all boxes that apply.

● If you have a change of Address, Accounting Period, or Officers, mark the appropriate box.

● Check the Extension box to let us know if you filed a federal or state extension.

● Check the appropriate box to let us know if the return is an Initial Return, Consolidated Return,

Amended Return, or if the return Includes Disregarded LLCs� You must complete Schedule M

if this is a consolidated return� You must complete Schedule L if this return includes disregarded

LLCs. If you do not include a complete Schedule M or Schedule L, you could receive Failure to

File notices for the corporations or LLCs not included.

● Check the box if the corporation is Merged, Reorganized, or if the return is the Final return for

the corporation.

10 SCDOR | C & S Corporation Instructions

|

Enlarge image |

● Check the box to let us know if the corporation was included in a federal consolidated return for

this tax year. If Yes, enter the name and FEIN of the federal parent company. Include pages 1-6

of the consolidated federal return and a copy of the federal Form 851, Affiliations Schedule, with

your return.

Total gross receipts

Enter the amount from Line 1c of your federal Form 1120 or 1120S. If there is no entry for Line 1c,

enter total income from all other sources�

Total cost of depreciable personal property in SC

Enter the total original cost of furniture, fixtures, machinery, equipment, and vehicles. Do not deduct

depreciation.

If filing a consolidated return, enter the total cost of these respective amounts for all members of the

consolidated group. Attach a schedule showing the separate amounts for each corporation.

County or counties in SC where the corporation's property is located

Enter the county or counties in SC where the corporation's property is located.

Audit location

Enter the street address of the audit location.

PART I: Computation of Income Tax Liability

Line 1

Enter the amount of taxable income from your federal return.

Line 2

Complete Schedule A and B, page 2, and enter the net adjustment amount from Line 12.

Some of the additions to federal taxable income are:

● Interest on other states' obligations. Interest on obligations from this state and any of its political

subdivisions is exempt�

● State and local Income Taxes, state and local Franchise taxes measured by net income, any

Income Taxes, or any taxes measured by or with respect to net income.

● South Carolina law allows the same depletion as IRC Sections 611 through 613. A corporation

that allocates or apportions income has the option of adding back depletion before

apportionment and of deducting depletion after apportionment on mines, oil and gas wells,

and other natural deposits located in this state. The allowances may not exceed 50% of the net

income apportioned to South Carolina.

● Any taxpayer who is reporting income or deducting expenses over a time period as a result of a

change of accounting method or accounting year must continue to report income and deduct

expenses in the manner provided in the Internal Revenue Code and approved by the IRS. When

the authorized adjustment period expires, continue to report the remaining income or expenses

for South Carolina purposes until they have been fully reported or deducted.

11 SCDOR | C & S Corporation Instructions

|

Enlarge image |

● Transitional adjustment on items of prepaid income or deferred expenses. See the instructions

on Accounting Method and attach a schedule showing how the addition was derived.

● Federal net operating losses are additions to income.

● Reduce the basis of certain property to the extent the Headquarters Credit (SCH. TC-8) is

claimed. Make an addition for the resulting reduction in depreciation.

● Reduce the basis of qualifying property to the extent the Economic Impact Zone or Capital

Investment Credit (SCH. TC-11) is claimed. Make an addition to federal taxable income for the

resulting reduction in depreciation.

● You are not allowed a deduction for donations to a nonprofit South Carolina corporation

providing child care services if you claim a Child Care Program Credit (SC SCH. TC-9) for the

donations. Add the disallowed deductions to federal taxable income.

● South Carolina does not recognize the federal election for special taxation of income from

qualifying shipping activities provided in IRC Section 1354. Add back the income taxed at the

special rate�

Some of the deductions from federal income are:

● The gross-up of dividends received from a Foreign Corporation located outside of the US

required by a domestic US corporation electing the foreign tax credit as provided for in IRC

Section 78 is subtracted from federal net taxable income.

● Reduction in depreciable property due to investment credit election will result in an ordinary

expense for South Carolina purposes�

● If a corporation disposes of an asset that has a different South Carolina basis and federal basis,

adjust South Carolina gain or loss to reflect the difference in the basis of the assets.

● Transitional adjustment for items of prepaid income or deferred expenses. (See the instructions

for Accounting Method and attach a schedule showing how the deduction was derived).

● If a taxpayer is reporting income from the liquidation of a corporation under IRC Section 337

using the installment method of reporting or from an installment sale under IRC Section 453 and

the corporation has previously reported all the gain for South Carolina tax purposes, then reduce

South Carolina income by the amount of the installment gain.

● Subtract any salaries and wages that were reduced due to the federal job credit.

● Dividends received from foreign corporations (located outside of the US) that are included

in federal taxable income may be reduced in the same manner that dividends received from

domestic corporations are deducted under IRC Section 243.

● South Carolina does not recognize the limitation on business interest expense required by IRC

Section 163(j). Interest expense not allowed on the federal return is subtracted in arriving at

South Carolina taxable income�

● For tax years beginning January 1, 2023 through December 31, 2028, South Carolina does

not tax income from a grant or subgrant received for the purpose of making investments in

broadband infrastructure, provided the grant or subgrant is included in the corporation’s taxable

income as defined under the IRC.

12 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Special rules for certain federal items:

● South Carolina does not recognize any of the federal special depreciation allowances, including

bonus depreciation, provided in IRC Section 168(k) through (n) or regional benefits provided

in IRC Sections 1400 through 1400U-3. A taxpayer electing one or more of the special or

regional depreciation allowances must have a separate depreciation schedule for South

Carolina purposes. Add back the difference between federal depreciation and South Carolina

depreciation for the tax year in which the property was placed in service. You will be able

to claim an additional depreciation deduction for each remaining tax year of the property's

depreciable life�

● South Carolina does not recognize the deferrable and ratable inclusion of either income arising

from business indebtedness under IRC Section 108(i) or original issue discount of high yield

discount obligations under IRC Section 163(e)(5)(F). The income is reported to South Carolina

immediately. Income deferred for federal purposes is deductible in subsequent years for South

Carolina purposes since it was already taxed in the first year.

Line 5

South Carolina recognizes the federal NOL with modifications as provided in SC Code Section 12-6-

1130(4). South Carolina follows the federal NOL carry-forward period, but no carry-backs are allowed.

Add the federal NOL back on Schedule A and subtract the South Carolina NOL on Schedule B. Do not

make an adjustment on Schedule G for the NOL.

On line 5, enter the NOL carryover from the previous years as a positive number. Subtract the NOL

carryover (line 5) from the South Carolina net income (line 4) to arrive at the South Carolina income

subject to tax (line 6).

Line 8

If a corporation has receipts from invoices issued by a seller directly to an unrelated purchaser outside

the United States (foreign trade receipts) and wishes to defer state Income Tax, use the TD-1 to

compute the deferred tax. Also include any deferred LIFO recapture tax based on IRC Section 1363.

Line 10

Enter the amount of nonrefundable credits being taken against Income Tax this year. This amount

comes from Line 13 of the SC1120TC�

Attach the SC1120TC and all supporting tax credit schedules to your tax return.

Line 12

South Carolina recognizes the shareholders deferral of foreign trade receipts by a Domestic

International Sales Corporation (DISC). Multiply the deferred federal foreign trade income by 5% to

determine the South Carolina deferred Income Tax liability.

The interest for South Carolina is calculated by using the same interest rate used on the federal form.

Enter only the interest determined on Line 12 of the SC1120. Also, enter the interest applicable to

deferred tax on Line 8�

13 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Also include on Line 12 any interest attributable to payments received on installment sales of certain

timeshares and residential lots. Write "Section 453(I)(3)" to the left of the amount. Attach a statement

showing the computations.

Line 14(a)

To get credit for withholding done on your behalf, attach all federal 1099s and I-290s. South Carolina

K-1s or partnership statements will not be accepted as withholding verification. If you are a fiscal year

taxpayer, include a schedule of amounts withheld on a monthly basis.

Line 14(b)

Enter the total of the prior year overpayments and all estimated payments made during the year.

Line 17

See the instructions on page 7 or use the Penalty and Interest Calculator, available at

dor.sc.gov/calculator.

Line 19

If Line 15 is larger than Line 18, enter the overpayment amount and indicate how it is to be applied.

PART II: Computation of License Fee

The License Fee is required for:

● every corporation organized under the laws of the state of South Carolina

● every corporation organized to do business under the laws of another state, territory, or country

that is qualified to do business in South Carolina

● any other corporation required to file an Income Tax return that is listed as not being exempt

The following companies are exempt from License Fee requirements:

● corporations organized for tax exempt purposes and exempt income form Income Tax pursuant

to IRC Section 501

● volunteer fire departments and rescue squads

● cooperatives under Chapters 45 and 47 of Title 33 of the South Carolina Code of Laws

● building and loan associations or credit unions conducting a strictly mutual business

● insurance, fraternal, beneficial, or mutual protection insurance companies

● foreign corporations whose entire income is not included in gross income for federal Income Tax

due to any treaty obligation of the United States

● homeowners' associations within the definition of IRC Section 528(c)(1) and filing federal Form

1120-H

● community development entities certified by the Department of Treasury

● political organizations as defined in IRC Section 527

● REITS (real estate investment trusts) organized as trusts and taxed under IRC Section 857 (not

REITS organized as corporations and taxed under Subchapters C or S of the Internal Revenue

Code)

14 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Compute the License Fee on the total capital stock and paid in or capital surplus. Paid in or capital

surplus means the entire surplus of a corporation other than earned surplus.

On a consolidated return, the License Fee is measured by the total capital and paid in surplus for each

corporation considered separately without offset for investment of one corporation in the capital

or surplus of another corporation in the consolidated group. Do not file separate returns paying the

License Fee if you are filing a consolidated return for Income Tax purposes.

The License Fee for a bank holding company, a savings and loan holding company, or an insurance

holding company is measured by the capital stock and paid in surplus of the holding company minus

the capital stock and paid in surplus of any bank, savings and loan association, or insurance company

that is a subsidiary of the holding company.

A corporation may prorate its License Fee when its tax year is changed and a return of less than 12

months is required. This proration applies only to short periods due to a change in accounting period

and does not apply to short periods due to initial or final returns. The prorated License Fee cannot be

less that $25 per return. A License Fee is not generally required on final returns. Refer to SC Revenue

Ruling #05-11, available at dor.sc.gov/policy�

Express, street railway, navigation, waterworks, power, light, gas, telegraph, and telephone companies

must file a SC1120U, Public Utility Tax Return. Electric Cooperatives must file a CL-4, Annual Report of

Electric Cooperative Corporation Property and Gross Receipts. The License Fee for these companies is

based on gross receipts from regulated business and South Carolina property used in the conduct of

business instead of capital stock and paid in capital.

Line 20

Enter the total capital and paid in surplus. If the corporation is subject to apportionment, complete

Schedule E and enter the amount�

Line 21

Multiply the total capital and paid in surplus by 0.001, then add $15. The License Fee cannot be

less than $25. For a consolidated taxpayer, apply the above computation to each corporation in the

consolidated group and then total them. The License Fee for each of the corporations cannot be less

than $25.

Line 22

Enter the amount of nonrefundable credits being taken against the License Fee tax this year. This

amount comes from Part II, Column C of your SC1120TC. Attach your SC1120TC and all supporting tax

credit schedules to your tax return.

Line 24

Enter any amount paid with an extension or transferred from the declaration of taxes.

Line 25

Enter the total payments for the License Fee.

15 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Line 27

See the instructions on page 7 or use the Penalty and Interest Calculator, available at

dor.sc.gov/calculator�

Line 29

If line 25 is larger than line 28, enter the overpayment amount and indicate how the overpayment is to

be applied�

Getting a refund? Direct deposit is fast, accurate, and secure!

With direct deposit, you:

● get your refund deposited directly into your bank account, giving you the fastest access to your

refund�

● help save tax dollars�

● get your refund sooner.

Under Refund Options, select Direct Deposit and enter your bank information.

You must enter complete and correct account information. If you are requesting direct deposit of your

refund and your account information is not complete and correct, we will mail a paper check to the

address listed on your return.

You cannot have the funds directly deposited into an account located outside the United States.

Enter your account information

1� Check checking or savings account.

2� Enter your 9-digit routing transit number (RTN). The RTN should begin with 01 through 12 or 21

through 32. Do not use a deposit slip to verify the RTN.

3� Enter your bank account number (BAN). The BAN contains 17 or fewer alphanumeric digits and

contains no hyphens, spaces, special symbols, or check numbers. Enter the BAN from left to

right�

Schedules A through G

Schedule A: Additions to Federal Taxable Income

Refer to the instructions for line 2.

Schedule B: Deductions from Federal Taxable Income

Refer to the instructions for line 2.

Schedule C: Summary of Income Tax Credit

Complete the SC1120TC and enter the totals. You must attach your SC1120TC along with all supporting

tax credit schedules. See the SC1120TC, available at dor.sc.gov/forms, for more information on tax

credits�

Schedule D: Annual Report

Complete all information requested, including a list of directors and principal officers. Only officers

listed on Schedule D will be considered authorized to act on behalf of the corporation.

16 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Schedule E: Computation of License Fee of Multi-State Corporation

Enter the total capital and paid in surplus on line 1. Multiply line 1 by the apportionment ratio from

Schedule H-1, H-2, or H-3, as appropriate.

Schedule F: Income Subject to Direct Allocation

Definitions:

● Income property not connected with the business means income other than income from

property connected with the business.

● Principal place of business means the domicile of a corporation. If none of the business of

the corporation is conducted in the state of domicile, the SCDOR will determine, based on the

available evidence, the principal place of business.

● Related expenses means any cost incurred, directly or indirectly, in connection with the

investment for the production of allocable income.

Line 1

Allocate interest from intangible property not connected with the taxpayer's business, less all related

expenses, to the corporation's principal place of business.

Line 2

Allocate dividends received from corporate stock not connected with the taxpayer's business after the

dividends received deduction under IRC Section 243 and less all related expenses, to the corporation's

principal place of business�

Line 3

Allocate rents received from the lease or rental of real or tangible personal property and royalties from

tangible property that were not used in or connected with the taxpayer's business, less all related

expenses, to the state where the property is located.

Line 4

Allocate gains or losses from the sale of real property to the state where the property is located.

Line 5

Allocate gains or losses from the sale of intangible personal property not connected with the taxpayer's

business, less all related expenses, to the corporation's principal place of business.

Line 6

Allocate any other investment income, less all related expenses, which is not included in the net

apportionable income because it is unrelated to the taxpayer's business, to the state where the

business situs of the investment is located. Apportion the income if the business situs of the investment

is partly within and partly outside of South Carolina.

Attach an explanation for income that is not allocated to South Carolina.

Schedule G: Computation of Taxable Income of Multi-State Corporations

Only multi-state businesses complete Schedule G.

17 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Line 1

Enter the amount of total net income as reconciled from your SC1120, page 1, line 3.

Line 2

Enter the amount of income directly allocated from Schedule F, line 7.

Line 3

Subtract line 2 from line 1. This is your net income subject to apportionment.

Line 4

Multiply line 3 by the appropriate ratio from H-1, line 3; H-2, line 7; or H-3, line 3.

Line 5

Enter the amount of income directly allocated to South Carolina from Schedule F, line 8.

Line 6

Add line 4 and line 5. This is your total South Carolina net income. Enter this amount on your SC1120,

line 4�

Apportionment

Taxpayers doing business in South Carolina and other states must apportion the income remaining after

allocation using the sales factor on Schedule H-1, the gross receipts factor on Schedule H-2, or one of

the special methods on Schedule H-3.

Sales and gross receipts include, but are not limited to:

● receipts from the sale or rental of property to customers in the ordinary course of the taxpayer's

business, including inventory.

● receipts from the sale of accounts receivable acquired in the ordinary course of business.

Receivables must be for services, sales, or rental in the ordinary course of the taxpayer's

business. The accounts receivable must have been created by the taxpayer or a related party.

The related party includes a person bearing a relationship to the taxpayer as described in IRC

Section 2673.

● receipts from the use of intangible property in the state, including royalties from patents,

copyrights, trademarks, and trade names.

● net gain from the sale of property used in the trade or business. Property used in the trade or

business means property subject to the allowance for depreciation, real property used in the

trade or business, and intangible property used in the trade or business which is:

■ not property that would be includible in the inventory of the business if on hand at the end

of the tax year, or

■ held by the business primarily for sale to customers in the ordinary course of the trade or

business�

● receipts from services if the entire income-producing activity is within the state. If the income-

producing activity is performed partly within and partly outside of South Carolina, sales are

18 SCDOR | C & S Corporation Instructions

|

Enlarge image |

attributable to the state to the extent of the income-producing activity performed within South

Carolina�

● receipts from the sale of intangible property which cannot be attributed to any particular state

or states are excluded from the numerator and the denominator of the factor�

● the proportion of receipts from the operation of cable systems, video services, and direct

satellite services that are attributable to the cost of performing services in South Carolina. Costs

of performing the service include acquiring programming distribution rights and constructing

and maintaining distribution infrastructure.

Sales and gross receipts do not include:

● repayment, maturity, or redemption of the principal of a loan, bond, or mutual fund or

certificate of deposit or similar marketable instrument.

● the principal amount received under a repurchase agreement or other transaction properly

characterized as a loan.

● proceeds from the issuance of the taxpayer's stock or from sale of treasury stock.

● damages and other amounts received as the result of litigation.

● property acquired by an agent on behalf of another.

● tax refunds and other tax benefit recoveries.

● pension reversions�

● contributions to capital, except for sales of securities by securities dealers.

● income from forgiveness of debt�

● amounts realized from exchanges of inventory not recognized by the Internal Revenue Code.

Refer to SC Code Section 12-6-2295, available at dor.sc.gov/policy, for more information about sales

and gross receipts�

Schedule H-1: Computation of Sales Ratio

A multi-state taxpayer must use a sales-only factor to apportion to South Carolina the net income

remaining after allocation if their principal business in South Carolina is:

● manufacturing or any form of collecting, buying, assembling, or processing goods and materials

within South Carolina or

● selling, distributing, or dealing in tangible personal property within South Carolina.

The sales factor is a fraction in which the numerator is the total sales of the taxpayer in South Carolina

during the tax year and the denominator is the total sales of the taxpayer everywhere during the tax

year. The term sales in South Carolina includes sales of goods, merchandise, or property received by a

purchaser in South Carolina. Goods are considered received by the purchaser after all transportation

has been completed. Direct delivery into South Carolina by the taxpayer to a person designated by a

purchaser is considered delivery to the purchaser in South Carolina.

Sales of tangible personal property to the US government are not included in the numerator or the

denominator of the sales factor. Only sales for which the US government makes direct payment to the

seller based on the terms of a contract are considered sales to the US government�

19 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Line 1

Enter the sales attributable to South Carolina.

Line 2

Enter the total sales from everywhere.

Line 3

Divide line 1 by line 2 and enter the result. This is your South Carolina apportionment percentage using

the sales factor method�

If a sales factor does not exist, apportion income (loss) to the corporation's principal place of business.

Schedule H-2: Computation of Gross Receipts Ratio

If a taxpayer's principal profits or income are derived from sources other than manufacturing,

producing, collecting, buying, assembling, processing, selling, distributing, or dealing in tangible

property, the taxpayer must apportion income to South Carolina using a gross receipts factor. This is the

ratio of gross receipts from within the state during the income year to the total gross receipts of such

year within and outside the state.

Examples of corporations subject to gross receipts method of apportionment include:

● construction contractors

● service companies other than public service corporations

● corporations primarily engaged in rental real estate activities

Public service corporations, utilities, and electric cooperatives should use Schedule H-3 to apportion

income�

Line 1

Enter your total gross receipts from within South Carolina.

Line 2

Enter amounts included in line 1 that were directly allocated to South Carolina.

Line 3

Subtract line 2 from line 1. These are your adjusted South Carolina gross receipts.

Line 4

Enter your total gross receipts from everywhere.

Line 5

Enter amounts included in line 4 that were directly allocated to South Carolina or to other states.

Line 6

Subtract line 5 from line 4. These are your total adjusted gross receipts.

20 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Line 7

Divide line 3 by line 6 and enter the result. This is your South Carolina apportionment percentage using

the gross receipts method�

Schedule H-3: Computation of Ratio

Public service corporations (defined in SC Code Section 12-6-2310) apportion income remaining after

the allocation using the following factors:

● Railroad companies use the following fractions:

■ Numerator: Railway operating revenue from business done within South Carolina during a

taxable year.

■ Denominator: Total railway operating revenue from all business done by the taxpayer.

Records must be kept in accordance with the Uniform System of Accounts prescribed by the

Interstate Commerce Commission. If the SCDOR determines accounting records of a taxpayer

do not accurately reflect the division of revenue by state lines, the SCDOR may adopt rules

and regulations to determine averages to reasonably approximate the proportion of interstate

revenue actually earned upon lines in South Carolina.

Railway operating revenue from business done within South Carolina means railway operating

revenue from business wholly within South Carolina, plus the equal mileage proportion within

South Carolina of each item of railway operating revenue from the interstate business of the

taxpayer.

Equal mileage proportion means the proportion of the distance of movement of property

and passengers over lines in South Carolina to the total distance of movement of property and

passengers over lines of the taxpayer receiving the revenues.

Interstate business means railway operating revenue from the interstate transportation of

persons or property into, out of, or through South Carolina.

● Motor carriers of property and passengers use the following fraction:

■ Numerator: Vehicle miles within South Carolina during the taxable year.

■ Denominator: Total vehicle miles everywhere during the taxable year.

● Telephone service companies use the following fraction:

■ Numerator: Gross receipts in South Carolina during the taxable year.

■ Denominator: Total gross receipts everywhere.

Gross receipts in South Carolina includes gross revenues derived from services rendered wholly

within South Carolina, plus the portion of the company's interstate revenue attributable to South

Carolina, based on the Federal Communications Standard Classification Accounts.

● Pipeline companies use the following fraction:

■ Numerator: Revenue ton miles, revenue barrel miles, or revenue cubic foot miles within

South Carolina during the tax year.

■ Denominator: Total revenue ton miles, revenue barrel miles, or revenue cubic foot miles

everywhere during the tax year.

Ton mile is one ton of solid property transported one mile.

21 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Barrel mile is one barrel of liquid property transported one mile.

Cubic foot mile is one cubic foot of gaseous property transported one mile.

● Airline companies use the following fraction:

■ Numerator: Revenue tons loaded and unloaded in South Carolina during the tax year.

■ Denominator: Revenue tons loaded and unloaded everywhere during the tax year.

Revenue ton is a short ton (2,000 pounds) computed by using a standard weight of 190 pounds

per passenger (including free baggage) multiplied by the number of passengers loaded and

unloaded, plus the tons of animal, express, and freight loaded and unloaded.

● Shipping lines use the following fraction:

■ Numerator: Revenue tons loaded and unloaded in South Carolina during the year.

■ Denominator: Revenue tons loaded and unloaded everywhere during the year.

Schedules J through N

Schedule J: Corporations Included in Consolidated Return

Each corporation included in a consolidated return must complete Schedule J.

Schedule L: Disregarded LLCs Included in Return

Each single-member limited liability company (LLC) that is not taxed as a corporation is not regarded as

an entity separate from its owner for tax purposes. Provide on Schedule L the name and FEIN of each

disregarded LLC doing business in or registered with South Carolina and included in the corporation's

South Carolina return. Include additional Schedule Ls as needed. Disregarded LLCs that are doing

business in or are registered with South Carolina may receive a Failure to File Notice from the SCDOR if

they are not included on the Schedule L.

Schedule M: Consolidated Return Affiliations Schedule

A consolidated return may be filed by a parent corporation and subsidiaries over which it has

substantial control (at least 80% ownership) or by two or more corporations under substantially the

entire control of the same interest. S Corporations and corporations not subject to South Carolina

Corporate Income Tax may not join in a consolidated return.

Your election to file a consolidated return or separate returns must be made on an original, timely-filed

return� You cannot amend the return to change the consolidated group�

On Schedule M, check the Yes or No box to indicate if the parent corporation is included in the

consolidated return. Provide the parent corporation's name and FEIN whether the parent corporation is

included In the consolidated return or not�

Each corporation in the consolidated group computes its South Carolina income or loss, apportionment

ratio, and License Fee separately. Enter the information on the Schedule M for each corporation

included in the consolidated return. Include additional Schedule Ms as needed. Corporations not

included on the Schedule M are not considered part of the consolidated return and may receive a

Failure to File Notice from the SCDOR if they do not file a separate return.

22 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Schedule N: Property Information

In Column 1, enter the value of property in South Carolina at the beginning of the tax year. In Column

2, enter the value of the property in South Carolina at the end of the tax year. In each instance, include

only South Carolina property and use the original value of the property, disregarding depreciation or

expensing�

Line 1

Enter the value of all land�

Line 2

Enter the value of all buildings�

Line 3

Enter the value of all machinery and equipment.

Line 4

Enter the value of all construction in progress.

Line 5

Enter the value of all tangible personal property not entered above.

Total

Enter the totals of line 1 through line 5 for each column�

Description of line property: Individually list and describe each item of property included on line 5 and

enter its beginning and end of the year values.

S Corporation Instructions

Filing requirements

Generally, a corporation with a valid S election doing business in South Carolina must file the SC1120S,

S Corporation Income Tax Return. An S Corporation that has met the Transitional Rule requirements and

elected to be treated as a C Corporation must file the SC1120, C Corporation Income Tax Return. Public

utilities must file the SC1120U, Public Utility Tax return.

Beginning with the 2021 tax year, a qualifying S Corporation, including an LLC taxed as an S Corporation,

can elect to have its active trade or business income taxed at the entity level instead of the shareholder

level�

A qualifying S Corporation is one whose owners are all:

● individuals

● estates

● trusts

● entities not included in SC Code Section 12-6-530 through 12-6-540

23 SCDOR | C & S Corporation Instructions

|

Enlarge image |

● entities not included in SC Code Section 12-6-550, or

● other entities not exempt from South Carolina Income Tax

This election is made annually at the S Corporation level on the SC1120S on behalf of all shareholders.

Mark the box on page 1 of the SC1120S to make your Active Trade or Business election.

Electing qualified S Corporations must use the I-435, Active Trade or Business Income For Electing

Partnerships and S Corporations, to identify active trade or business income and calculate the tax due.

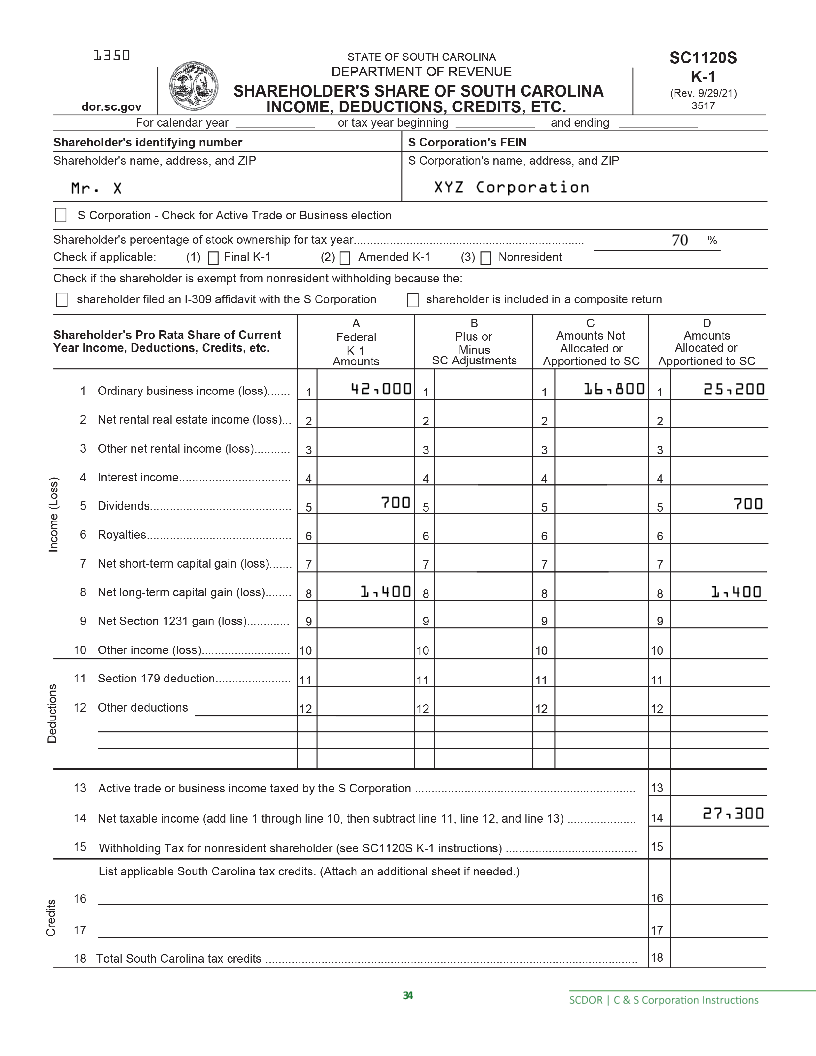

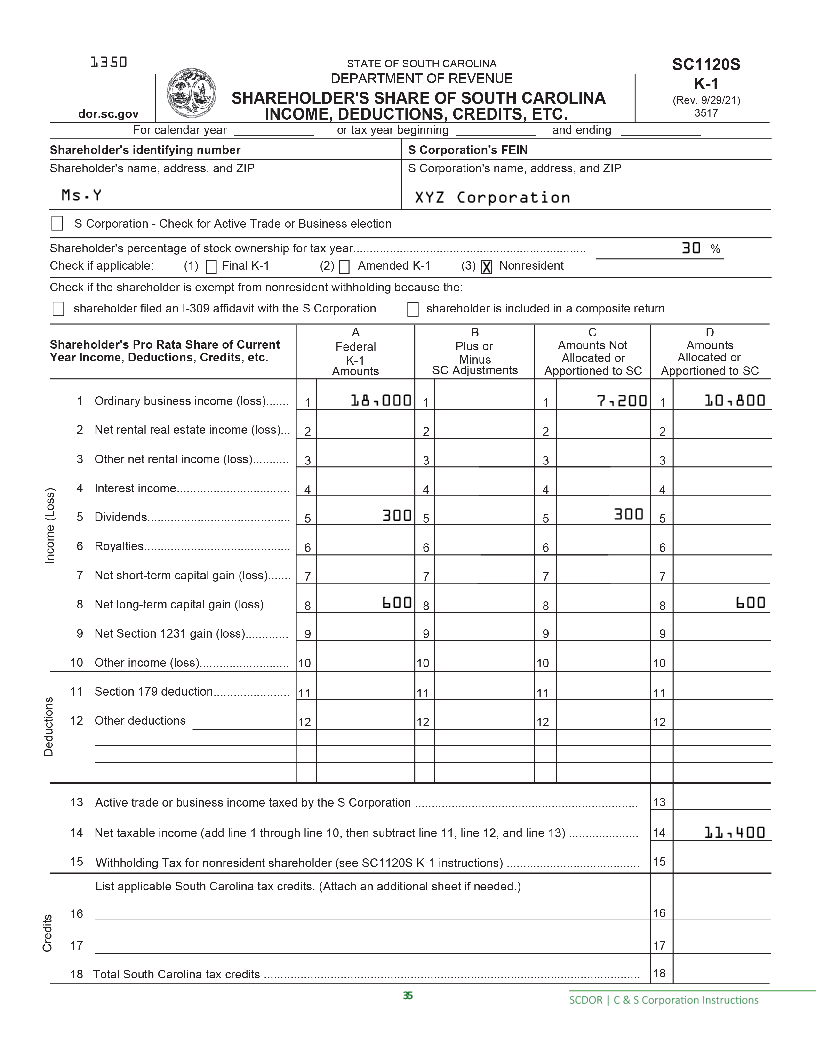

S Corporations will use the SC1120S K-1, Shareholder's Share of South Carolina Income, Deductions,

Credits, Etc., to report to each shareholder their share of the active trade or business income taxed at

the S Corporation level.

For more information, SC Code Sections are available at dor.sc.gov/policy�

Line Instructions

Check boxes

Check all boxes that apply:

● If you have a change of Address, Accounting Period, or Officers, mark the appropriate box.

● Check the Extension box to indicate that you filed a federal or state extension.

● Check the box to make the Active Trade electionor Business �

● Check the appropriate box to let us know if the return anis Initial Return ReturnAmended , ,

or if the return QSSSsincludes or Disregarded LLCs � Complete Schedule L if the return includes

QSSSs or Disregarded LLCs�

● Check the box theif corporation is ReorganizedMerged , if or , the return is the Finalreturn for

the corporation.

● Check the box to let us know if the corporation has any shareholders who are nonresidents of

South Carolina�

● Total gross receipts: Enter the amount from Line 1c of your federal Form 1120 or 1120S. If there

is no entry for Line 1c, enter your total income from all other sources.

● Total cost of depreciable personal property in SC: Enter the total original cost of furniture,

fixtures, machinery, equipment, and vehicles. Do not deduct depreciation.

● County or counties in SC where the corporation's property is located: Enter the county or

counties in SC where the corporation's property is located.

● Audit location: Enter the street address of the audit location.

● Audit contact: Enter the name and phone number of the audit contact�

● Number of nonresident shareholders: Enter the number of shareholders who are not residents

of South Carolina�

● Number of nonresident shareholders with an I-309 affidavit: Enter the number of nonresident

shareholders who filed an I-309 affidavit.

● Number of nonresident shareholders included in composite return: Enter the number of

nonresident shareholders who are included in a composite return�

24 SCDOR | C & S Corporation Instructions

|

Enlarge image |

PART I: Computation of Income Tax Liability

Line 1

Enter the total of federal Schedule K line 1 through line 12 income (loss) amounts.

Line 2

Enter the net amount of South Carolina adjustments to all of the income (loss) amounts included in

the line 1 total. Additions and subtractions from federal taxable income include the same adjustments

possible for a C Corporation. It also includes:

● excess net passive income under IRC Section 1375 when taxed on the federal return,

● built in gains, and

● certain capital gains under IRC Section 1374 when taxed on the federal return.

Line 4

Multi-state S Corporations must use Schedule F and Schedule G to allocate and apportion income. Enter

the total South Carolina net income amount from line 6 of Schedule G and line 4 of the SC1120S� If not

a multi-state S Corporation, enter the amount from line 3.

Line 5

S Corporations electing to pay tax on active trade or business income at the entity level enter the active

trade or business income from line 14 of the I-435.

Line 6

Enter the 3% tax on active trade or business income calculated on line 17 of the I-435.

Line 7

Subtract income on line 4 that is taxed to the shareholders. This is generally the South Carolina income

amount from line 4 minus the Active Trade or Business income amount from line 5. However, any

income subject to tax on the federal 1120S under IRC Sections 1374 and 1375 would not be subtracted

on this line�

Line 8

Subtract line 5 and line 7 from line 4. This is the amount of income taxed to the S Corporation.

Line 9

Multiply line 8 by 5%. South Carolina imposes a Corporate Tax on the excess net passive income and

built-in gains added to federal income. Also include any deferred LIFO recapture under IRC Section

1363�

Line 11

Enter any nonrefundable tax credits taken at the S Corporation Income Tax level. Tax credits taken by

the S Corporation are not passed through to the shareholders on their SC1120S K-1s.

25 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Line 13(a)

Attach all federal 1099s and I-290s. South Carolina K-1s or partnership statements will not be accepted

as withholding verification. If you are a fiscal year taxpayer, include a schedule of amounts withheld

on a monthly basis. Only include amounts withheld on the S Corporation's behalf. Do not include any

amounts you reported on the SC1120S-WH.

Line 13(b)

Include the total of prior year overpayments and estimated payments.

Line 16

See the instructions on page 7 or use the Penalty and Interest Calculator, available at

dor.sc.gov/calculator�

Line 18

If line 14 is larger than line 17, enter the overpayment amount and indicate how it is to be applied

REMINDERS:

● S Corporations do not have a net operating loss carryover. The losses flow through to the

shareholders each year.

● Deferral of income and tax on foreign trade receipts flow through to the shareholders of an S

Corporation. Interest is also paid by the shareholders. If applicable, give a schedule of details.

PART II: Computation of License Fee

An S Corporation pays the same License Fee as a C Corporation. For tax purposes, Qualified Sub-chapter

S Subsidiaries (QSSSs) are treated as part of the S Corporation parent, and the parent corporation pays

the Corporate License Fee. List the Qualified Sub-chapter S Subsidiaries (QSSS) on Schedule L of the

SC1120S�

Line 19

Enter the total capital and paid in surplus. If the corporation is subject to apportionment, complete

Schedule E and enter the amount�

Line 20

Multiply the total capital and paid in surplus by 0.001, then add $15. The License Fee cannot be less

than $25.

Line 21

Enter the amount of nonrefundable credits being taken against the License Fee tax this year. This

amount comes from Part II, Column C of your SC1120TC.

Attach your SC1120TC and all supporting tax credit schedules to your tax return.

Line 23

Enter any amount paid with an extension or transferred from the declaration of taxes.

26 SCDOR | C & S Corporation Instructions

|

Enlarge image |

Line 24

Enter the total payments for the License Fee.

Line 26

See the instructions on page 7 or use the Penalty and Interest Calculator, available at

dor.sc.gov/calculator�

Line 28

If line 24 is larger than line 27, enter the overpayment amount and indicate how the overpayment is to

be applied�

Getting a refund? Direct deposit is fast, accurate, and secure!

With direct deposit, you:

● get your refund deposited directly into your bank account, giving you the fastest access to your

refund�

● help save tax dollars�

● get your refund sooner.

Under Refund Options, select Direct Deposit and enter your bank information.

You must enter complete and correct account information. If you are requesting direct deposit of your

refund and your account information is not complete and correct, we will mail a paper check to the

address listed on your return.

You cannot have the funds directly deposited into an account located outside the United States.

Enter your account information

Check checking or savings account.

1� Enter your 9-digit routing transit number (RTN). The RTN should begin with 01 through 12 or 21

through 32. Do not use a deposit slip to verify the RTN.

2� Enter your bank account number (BAN). The BAN contains 17 or fewer alphanumeric digits and

contains no hyphens, spaces, special symbols, or check numbers. Enter the BAN from left to

right�

Schedules for SC1120S

Schedules A through N

Except as indicated below, follow the SC1120 Instructions for C Corporations.

Schedule SC-K Worksheet

This schedule is used to make South Carolina adjustments to federal Schedule SC- K items and to show

the amount of these items that are apportioned or allocated to South Carolina.

● Column B amounts are the same as shown on the federal Schedule K�

27 SCDOR | C & S Corporation Instructions

|

Enlarge image |

● In Column C, account for differences between South Carolina and federal law.

● Column C adjustments include the same adjustments possible for a C Corporation. The items

appearing at numbers 1 through 10 on the federal Schedule K are generally classified as business

related using South Carolina apportionment and allocation rules.

● Column D includes the total of Column B and Column C�

If the S Corporation has multi-state operations, all Column D items are directly allocated on Schedule

F or apportioned according to the ratio from Schedule H-1, H-2, or H-3. Column E amounts are not

taxable to South Carolina� Column F amounts are taxable to South Carolina�

The total of line 1 through line 12d of Schedule SC-K Worksheet, Column F should equal the amount

shown on line 4 of page 1�

Line 11 through line 12d

If the S Corporation has multi-state operations, multiply the amounts in Column D by the

apportionment ratio determined in Schedule H to arrive at the same amount in Column F.

Nonrefundable credits

Distribute to shareholders in proportion to shares held.

Information to be furnished to shareholders

Shareholders who are residents of South Carolina must be provided with the total amount of their

proportionate share of the following items:

1� South Carolina adjustments from Schedule SC-K Worksheet, Column C, and

2� Schedule SC-K Worksheet Column E amounts that are allocated or apportioned to states other

than South Carolina�

This total amount is the shareholder's S Corporation modification to federal taxable income.

Shareholders who are nonresidents of South Carolina must be provided with their share of the

Schedule SC-K Worksheet, Column F items. These amounts are reportable to the state of South

Carolina�

S Corporations receiving rental and other passive activity income and losses based on IRC Section 469,

from investments located within and outside of South Carolina, must furnish shareholders with details

for proper reporting of these amounts. Similar information must be furnished to shareholders who did

not materially participate in the trade or business or an S Corporation with multi-state operations. (Such