Enlarge image

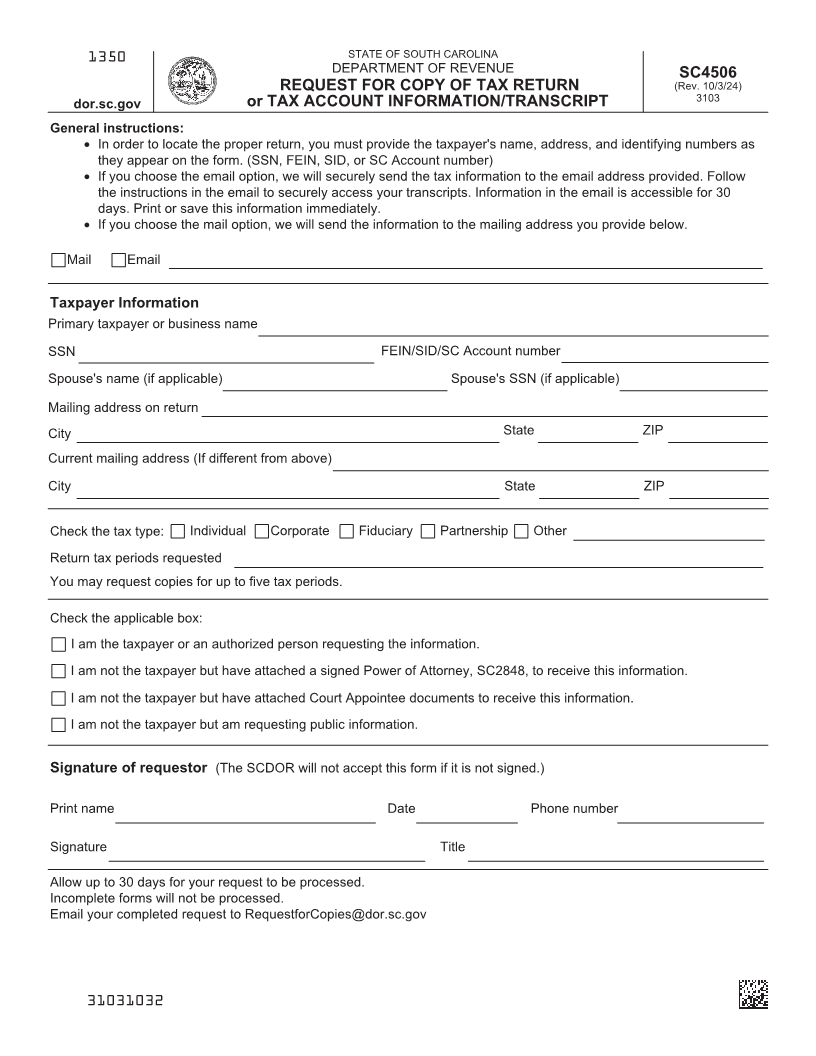

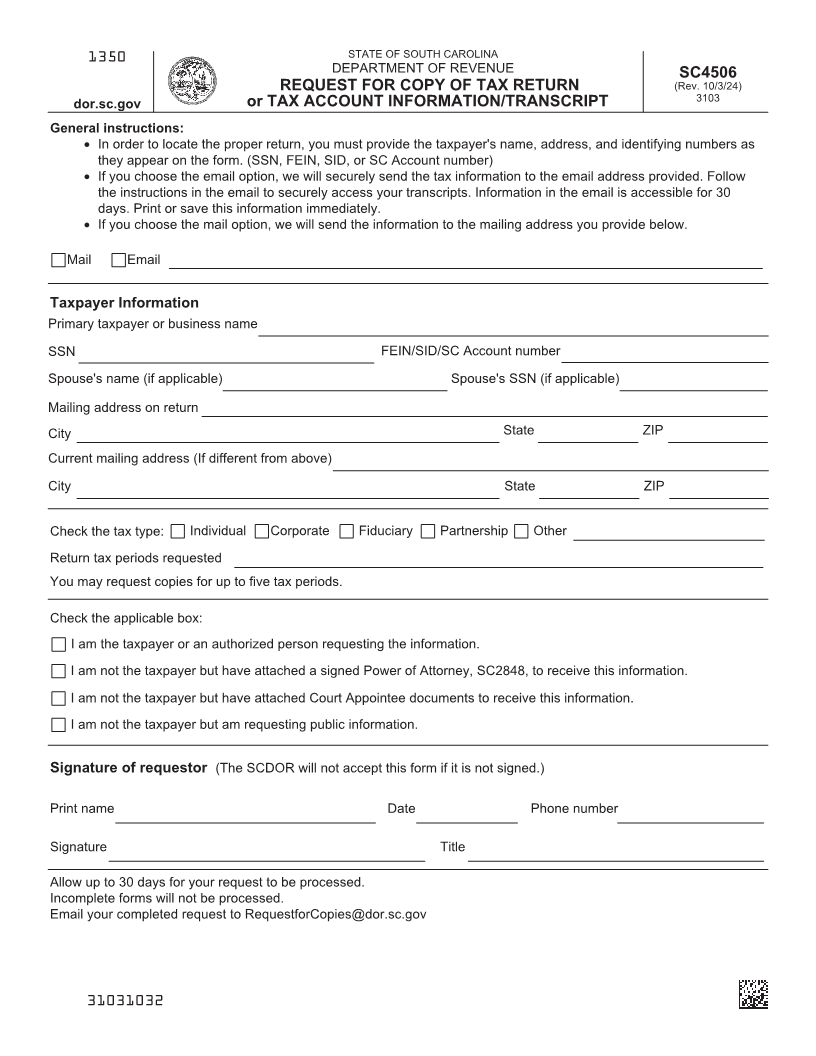

Enlarge image | 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SC4506 REQUEST FOR COPY OF TAX RETURN (Rev. 10/3/24) dor.sc.gov or TAX ACCOUNT INFORMATION/TRANSCRIPT 3103 General instructions: • In order to locate the proper return, you must provide the taxpayer's name, address, and identifying numbers as they appear on the form. (SSN, FEIN, SID, or SC Account number) • If you choose the email option, we will securely send the tax information to the email address provided. Follow the instructions in the email to securely access your transcripts. Information in the email is accessible for 30 days. Print or save this information immediately. • If you choose the mail option, we will send the information to the mailing address you provide below. Mail Email Taxpayer Information Primary taxpayer or business name SSN FEIN/SID/SC Account number Spouse's name (if applicable) Spouse's SSN (if applicable) Mailing address on return City State ZIP Current mailing address (If different from above) City State ZIP Check the tax type: Individual Corporate Fiduciary Partnership Other Return tax periods requested You may request copies for up to five tax periods. Check the applicable box: I am the taxpayer or an authorized person requesting the information. I am not the taxpayer but have attached a signed Power of Attorney, SC2848, to receive this information. I am not the taxpayer but have attached Court Appointee documents to receive this information. I am not the taxpayer but am requesting public information. Signature of requestor (The SCDOR will not accept this form if it is not signed.) Print name Date Phone number Signature Title Allow up to 30 days for your request to be processed. Incomplete forms will not be processed. Email your completed request to RequestforCopies@dor.sc.gov 31031032 |