Enlarge image

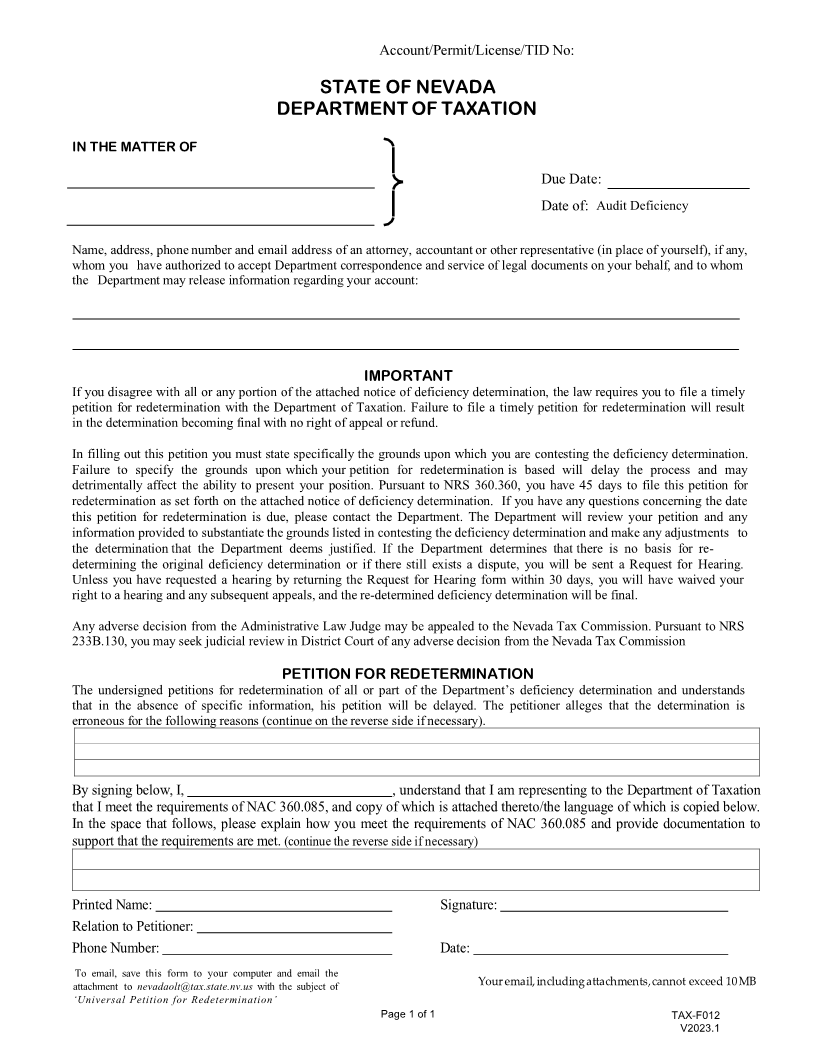

Account/Permit/License/TID No:

STATE OF NEVADA

DEPARTMENT OF TAXATION

IN THE MATTER OF

Due Date:

Date of : Audit Deficiency

Name, address, phone number and email address of an attorney, accountant or other representative (in place of yourself), if any,

whom you have authorized to accept Department correspondence and service of legal documents on your behalf, and to whom

the Department may release information regarding your account:

IMPORTANT

If you disagree with all or any portion of the attached notice of deficiency determination, the law requires you to file a timely

petition for redetermination with the Department of Taxation. Failure to file a timely petition for redetermination will result

in the determination becoming final with no right of appeal or refund.

In filling out this petition you must state specifically the grounds upon which you are contesting the deficiency determination.

Failure to specify the grounds upon which your petition for redetermination is based will delay the process and may

detrimentally affect the ability to present your position. Pursuant to NRS 360.360, you have 45 days to file this petition for

redetermination as set forth on the attached notice of deficiency determination. If you have any questions concerning the date

this petition for redetermination is due, please contact the Department. The Department will review your petition and any

information provided to substantiate the grounds listed in contesting the deficiency determination and make any adjustments to

the determination that the Department deems justified. If the Department determines that there is no basis for re-

determining the original deficiency determination or if there still exists a dispute, you will be sent a Request for Hearing.

Unless you have requested a hearing by returning the Request for Hearing form within 30 days, you will have waived your

right to a hearing and any subsequent appeals, and the re-determined deficiency determination will be final.

Any adverse decision from the Administrative Law Judge may be appealed to the Nevada Tax Commission. Pursuant to NRS

233B.130, you may seek judicial review in District Court of any adverse decision from the Nevada Tax Commission

PETITION FOR REDETERMINATION

The undersigned petitions for redetermination of all or part of the Department’s deficiency determination and understands

that in the absence of specific information, his petition will be delayed. The petitioner alleges that the determination is

erroneous for the following reasons (continue on the reverse side if necessary).

By signing below, I, , understand that I am representing to the Department of Taxation

that I meet the requirements of NAC 360.085, and copy of which is attached thereto/the language of which is copied below.

In the space that follows, please explain how you meet the requirements of NAC 360.085 and provide documentation to

support that the requirements are met. (continue the reverse side if necessary)

Printed Name: Signature:

Relation to Petitioner:

Phone Number: Date:

To email, save this form to your computer and email the

attachment to nevadaolt@tax.state.nv.us with the subject of Your email, including attachments, cannot exceed 10 MB

‘Universal Petition for Redetermination’

Page 1 of 1 TAX-F012

V2023.1