Enlarge image

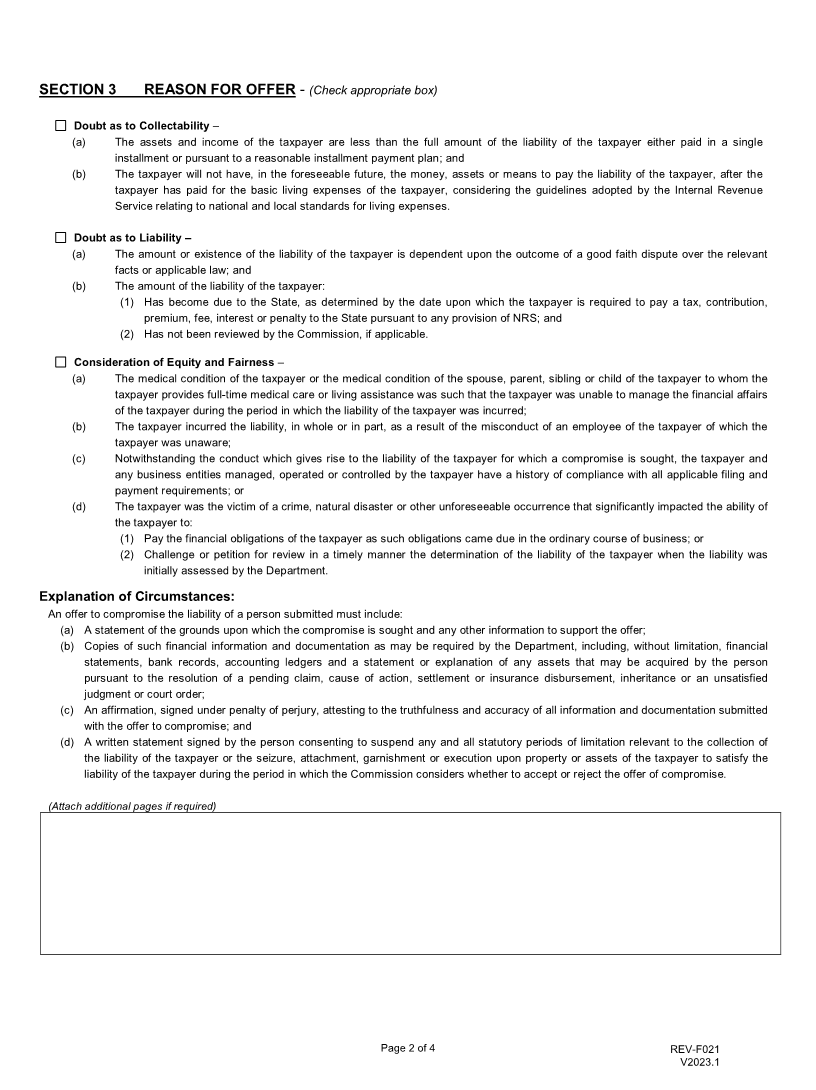

TID#:

NEVADA DEPARTMENT OF TAXATION Date:

OFFER IN COMPROMISE Dept. Rcvd Stamp

SECTION 1 YOUR CONTACT INFORMATION

First Name, Middle Initial, Last Name:

SSN: Phone:

If a Joint Offer, Spouse's First Name, Middle Initial, Last Name:

SSN: Phone:

Physical Home Address (Street, City, State, and ZIP Code):

Mailing Address (if different from above or Post Office Box number):

Business Name / DBA:

Business Address:

Taxpayer Identification Number (TID): Secondary TID (if any)

Federal Identification Number (FID): Secondary FID (if any)

SECTION 2 TAX AND PERIODS

In the following agreement, the pronoun "we" may be assumed in place of "I" when there are joint liabilities and both parties

are signing this agreement.

I submit this offer to compromise the tax liabilities plus any interest, penalties, additions to tax, and additional amounts

required by law for the tax type and period(s) marked below:

Sales and/ or Use Tax:

Modified Business Tax:

Live Entertainment Tax:

Short Term Lessor/ Governmental Service Tax:

Other Tobacco Products Tax:

Net Proceeds of Minerals:

Other Excise Tax [specify type(s) and period(s)]:

Note: If you need more space, use an attachment sheet. Make sure to sign and date the attachment

Page 1 of 4 REV-F021

V2023.1