Enlarge image

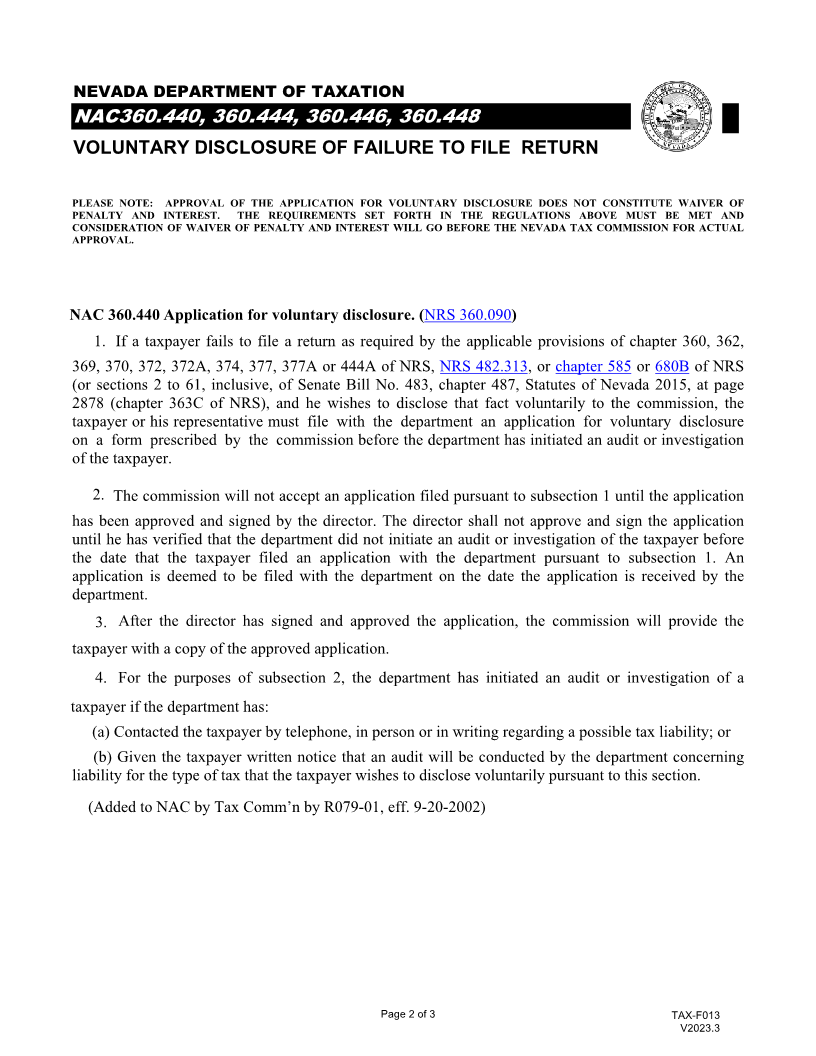

STATE OF NEVADA

DEPARTMENT OF TAXATION LAS VEGAS OFFICE

700 E. Warm Springs Rd., Ste. 200

Web Site: https://tax.nv.gov Las Vegas, Nevada 89119

Call Center: (866) 962-3707 Phone: (702) 486-2300

Fax: (702) 486-2373

JOE LOMBARDO

Governor CARSON CITY OFFICE RENO OFFICE

GEORGE KELESIS 3850 Arrowhead Dr., 2nd Floor 4600 Kietzke Lane, Suite L235

Chair, Nevada Tax Co mm ission Carson City, Nevada 89706 Reno, Nevada 89502

SHELLIE HUGHES Phone: (775) 684-2000 Phone: (775) 687-9999

Executive Director Fax: (775) 684-2020 Fax: (775) 688-1303

APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE

TO FILE RETURN

(Must be submitted in conjunction with the Nevada Business Registration Form)

Owner / Entity Name : DBA:

Business Address: Mailing Address:

Nature of Business: Email Address:

In accordance with Nevada Administrative Codes 360.440, 360.444, 360.446, and 360.448, I/we are applying for

voluntary disclosure of failure to file return(s) and request waiver of the penalty and interest.

Please state reason for failure to file (Please attach separate sheet if more space needed):

I/we are filing for the following reporting periods (please show periods as either, quarterlymonthlyor fiscal Commerce Tax yeare.g.end,01/18, 03/18 or 06/18)

I/we hereby agree to the requirements set forth in the regulations noted above.

Print Name Phone Number

Signature Title Date

For Department Use Only: Account has been reviewed as required by NAC 360.440.2

The Department has not initiated nor is there in progress an audit or investigation on this business.

An audit and or investigation has been initiated or is currently in progress on this account.

Reviewed by: __________________________________

APPLICATION FOR VOLUNTARY DISCLOSURE IS HERE BY: APPROVED DENIED

Executive Approval By: ____________________________________________ DATE:_____________

____________________________________________

Title

To email, save this form to your computer and

email the attachment to nevadaolt@tax.state.nv.us

Page 1 of 3

with the subject of ‘Application for Voluntary TAX-F013

V2023.3

Disclosure’