Enlarge image

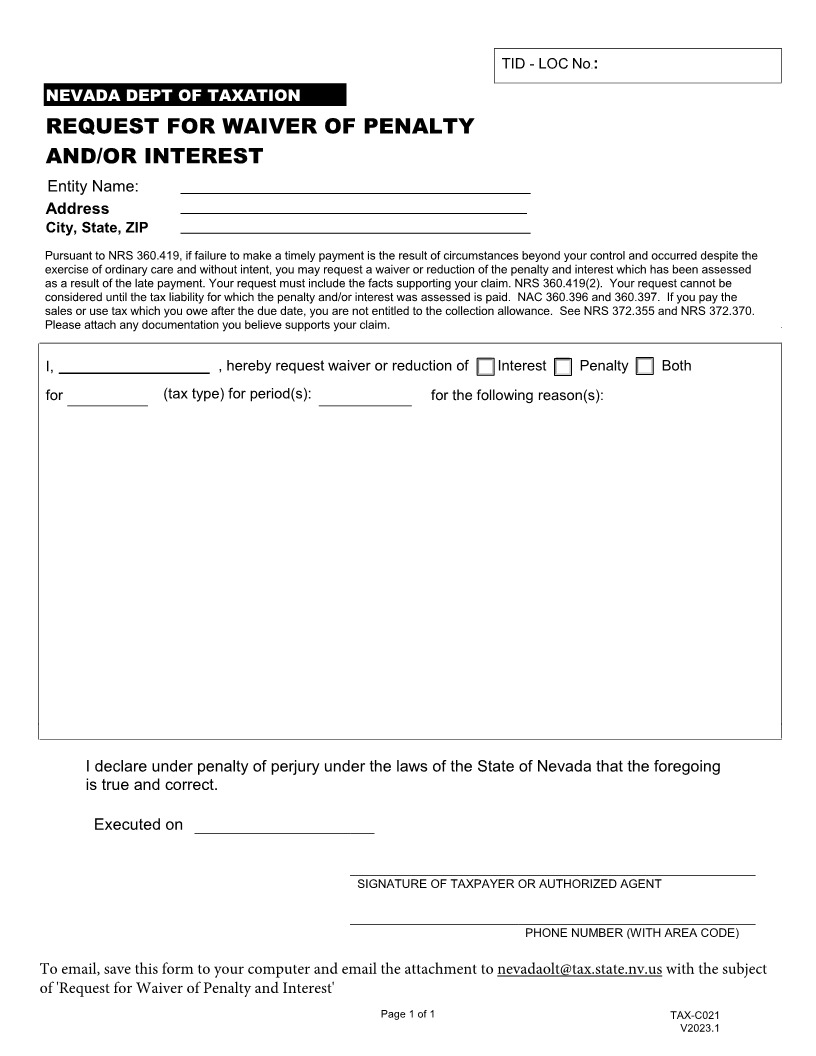

TID - LOC No.:

NEVADA DEPT OF TAXATION

REQUEST FOR WAIVER OF PENALTY

AND/OR INTEREST

Entity Name:

Address

City, State, ZIP

Pursuant to NRS 360.419, if failure to make a timely payment is the result of circumstances beyond your control and occurred despite the

exercise of ordinary care and without intent, you may request a waiver or reduction of the penalty and interest which has been assessed

as a result of the late payment. Your request must include the facts supporting your claim. NRS 360.419(2). Your request cannot be

considered until the tax liability for which the penalty and/or interest was assessed is paid. NAC 360.396 and 360.397. If you pay the

sales or use tax which you owe after the due date, you are not entitled to the collection allowance. See NRS 372.355 and NRS 372.370.

Please attach any documentation you believe supports your claim.

I, , hereby request waiver or reduction of Interest Penalty Both

for (tax type) for period(s): for the following reason(s):

I declare under penalty of perjury under the laws of the State of Nevada that the foregoing

is true and correct.

Executed on

SIGNATURE OF TAXPAYER OR AUTHORIZED AGENT

PHONE NUMBER (WITH AREA CODE)

To email, save this form to your computer and email the attachment to nevadaolt@tax.state.nv.us with the subject

of 'Request for Waiver of Penalty and Interest'

Page 1 of 1 TAX-C021

V2023.1