Enlarge image

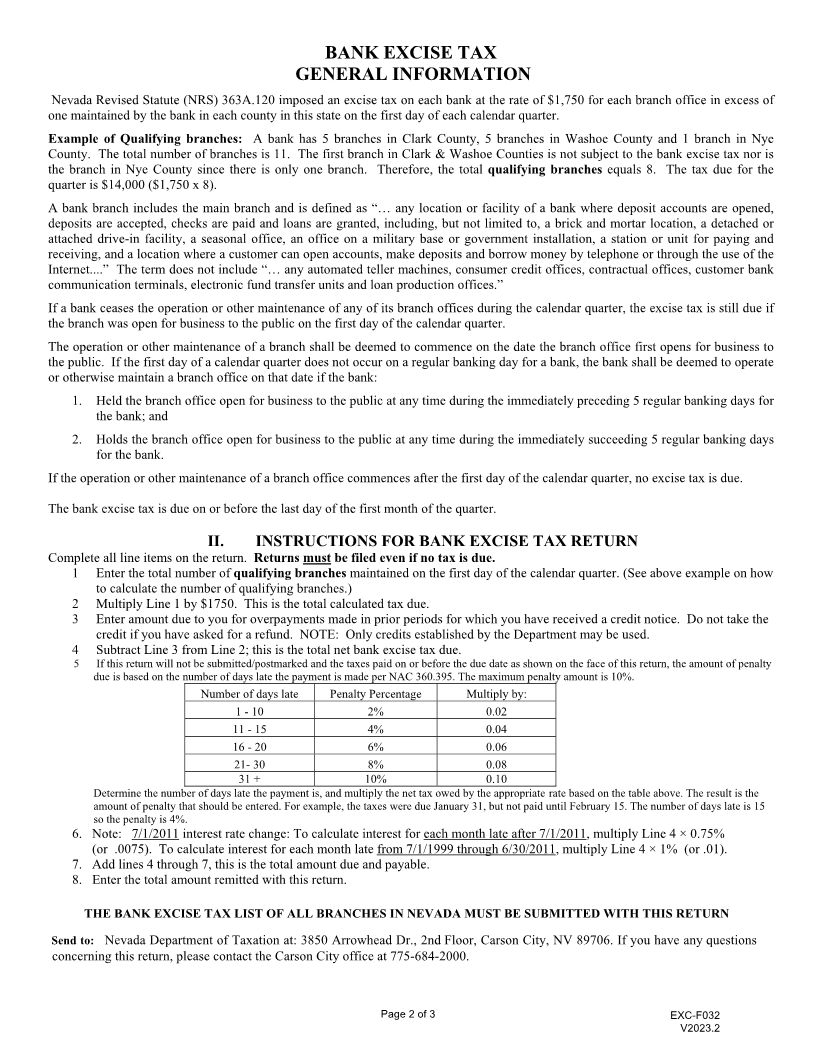

NEVADA DEPT OF TAXATION TID No:

BANK EXCISE TAX RETURN

FOR DEPARTMENT USE ONLY

Mail to: Nevada Department of Taxation Postmark Date:

3850 Arrowhead Dr., 2nd. Floor Amount: Check #:

Carson City, NV 89706

Period End Date: Choose Date

Due on or before:

If postmarked after due date ,

penalty and interest will apply

*NOTE: PLEASE READ INSTRUCTIONS ON REVERSE SIDE BEFORE COMPLETING RETURN.

A RETURN MUST BE FILED EVEN IF NO TAX IS DUE*

1. TOTAL NUMBER OF QUALIFYING BRANCHES IN NEVADA (See Information on Reverse) 1.

2. TAX DUE (MULTIPLY LINE 1 BY $1750) 2.

3. LESS CREDITS APPROVED BY THE DEPARTMENT 3.

4. TOTAL BANK EXCISE TAX DUE (LINE 2 MINUS LINE 3) 4.

5. PENALTY (For periods prior to April 1, 2007 the penalty is 10%) 5.

6. INTEREST (Note: To calculate interest for each month late, multiply Line 4 × 0.75% (or .0075)

6.

7. PLUS LIABILITIES ESTABLISHED BY THE DEPARTMENT

7.

8. TOTAL AMOUNT DUE AND PAYABLE (ADD LINES 4 THROUGH 7)

8.

9. TOTAL AMOUNT REMITTED WITH RETURN

9.

THE BANK EXCISE TAX LIST OF ALL BRANCHES IN NEVADA (FORM BET-02) MUST BE FILED

WITH RETURN

I hereby certify that this return including any accompanying schedules and statements has been examined by me and to the

best of my knowledge and belief is a true, correct and complete return.

Signature Name Of Preparer

Title Federal Identification Number Phone Number Date

To email, save this form to your computer and email the attachment to nevadaolt@tax.state.nv.us with the subject

of 'Bank Excise Tax Return'

Page 1 of 3 EXC-F032

V2023.2