Enlarge image

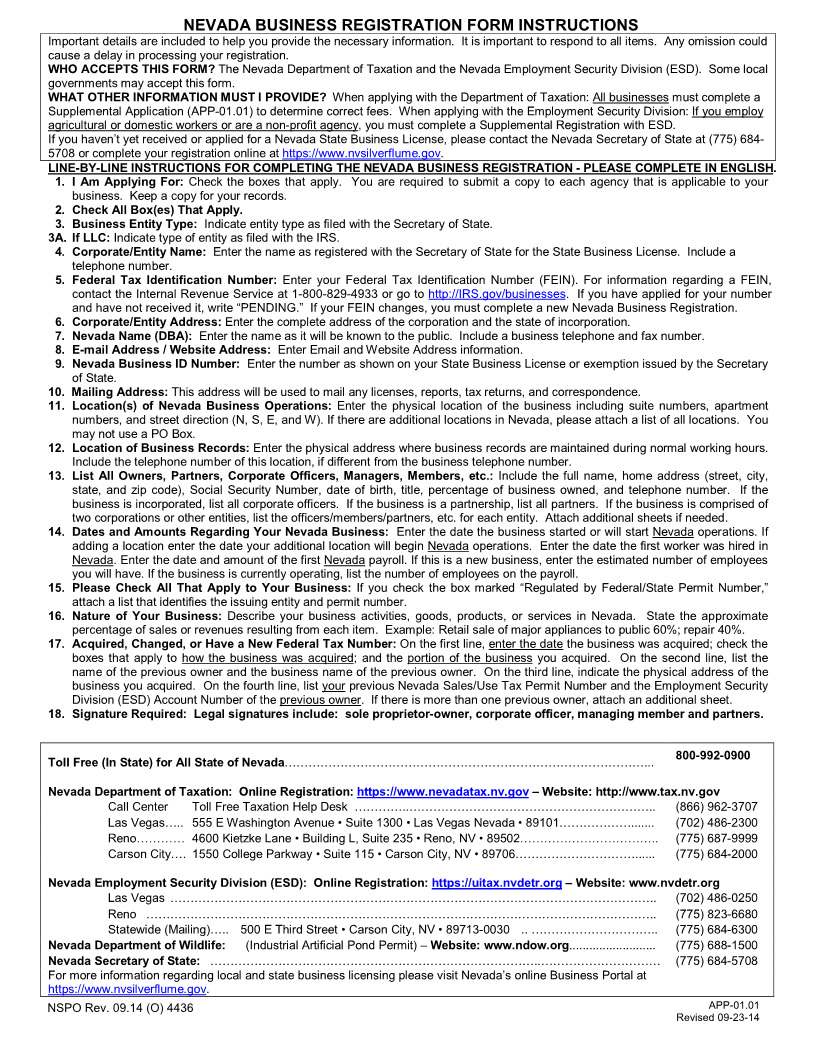

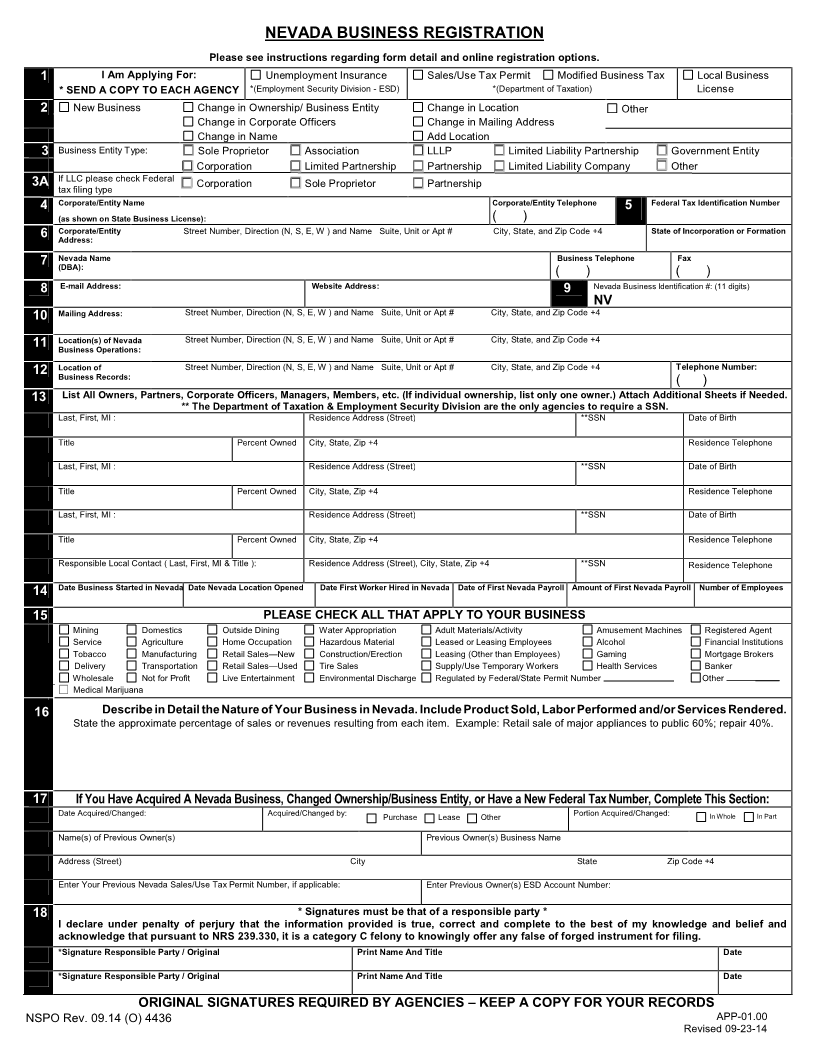

NEVADA BUSINESS REGISTRATION

Please see instructions regarding form detail and online registration options.

1 I Am Applying For: Unemployment Insurance Sales/Use Tax Permit Modified Business Tax Local Business

* SEND A COPY TO EACH AGENCY *(Employment Security Division - ESD) *(Department of Taxation) License

New Business Change in Ownership/ Business Entity Change in Location Other

2

Change in Corporate Officers Change in Mailing Address

Change in Name Add Location

3 Business Entity Type: Sole Proprietor Association LLLP Limited Liability Partnership Government Entity

Corporation Limited Partnership Partnership Limited Liability Company Other

3A tax filing type

If LLC please check Federal Corporation Sole Proprietor Partnership

4 Corporate/Entity Name Corporate/Entity Telephone 5 Federal Tax Identification Number

(as shown on State Business License): ( )

6 Corporate/Entity Street Number, Direction (N, S, E, W ) and Name Suite, Unit or Apt # City, State, and Zip Code +4 State of Incorporation or Formation

Address:

7 Nevada Name Business Telephone Fax

(DBA): ( ) ( )

8 E-mail Address: Website Address: 9 Nevada Business Identification #: (11 digits)

NV

10 Mailing Address: Street Number, Direction (N, S, E, W ) and Name Suite, Unit or Apt # City, State, and Zip Code +4

11 Location(s) of Nevada Street Number, Direction (N, S, E, W ) and Name Suite, Unit or Apt # City, State, and Zip Code +4

Business Operations:

Street Number, Direction (N, S, E, W ) and Name Suite, Unit or Apt # City, State, and Zip Code +4 Telephone Number:

12 Location of

Business Records: ( )

List All Owners, Partners, Corporate Officers, Managers, Members, etc. (If individual ownership, list only one owner.) Attach Additional Sheets if Needed.

13

** The Department of Taxation & Employment Security Division are the only agencies to require a SSN.

Last, First, MI : Residence Address (Street) **SSN Date of Birth

Title Percent Owned City, State, Zip +4 Residence Telephone

Last, First, MI : Residence Address (Street) **SSN Date of Birth

Title Percent Owned City, State, Zip +4 Residence Telephone

Last, First, MI : Residence Address (Street) **SSN Date of Birth

Title Percent Owned City, State, Zip +4 Residence Telephone

Responsible Local Contact ( Last, First, MI & Title ): Residence Address (Street), City, State, Zip +4 **SSN Residence Telephone

Date Business Started in Nevada Date Nevada Location Opened Date First Worker Hired in Nevada Date of First Nevada Payroll Amount of First Nevada Payroll Number of Employees

14

15 PLEASE CHECK ALL THAT APPLY TO YOUR BUSINESS

Mining Domestics Outside Dining Water Appropriation Adult Materials/Activity Amusement Machines Registered Agent

Service Agriculture Home Occupation Hazardous Material Leased or Leasing Employees Alcohol Financial Institutions

Tobacco Manufacturing Retail Sales—New Construction/Erection Leasing (Other than Employees) Gaming Mortgage Brokers

Delivery Transportation Retail Sales—Used Tire Sales Supply/Use Temporary Workers Health Services Banker

Wholesale Not for Profit Live Entertainment Environmental Discharge Regulated by Federal/State Permit Number Other ____

Medical Marijuana

16 16 Describe in Detail the Nature of Your Business in Nevada. Include Product Sold, Labor Performed and/or Services Rendered.

State the approximate percentage of sales or revenues resulting from each item. Example: Retail sale of major appliances to public 60%; repair 40%.

17 If You Have Acquired A Nevada Business, Changed Ownership/Business Entity, or Have a New Federal Tax Number, Complete This Section:

Date Acquired/Changed: Acquired/Changed by: Purchase Lease Other Portion Acquired/Changed: In Whole In Part

Name(s) of Previous Owner(s) Previous Owner(s) Business Name

Address (Street) City State Zip Code +4

Enter Your Previous Nevada Sales/Use Tax Permit Number, if applicable: Enter Previous Owner(s) ESD Account Number:

18 * Signatures must be that of a responsible party *

I declare under penalty of perjury that the information provided is true, correct and complete to the best of my knowledge and belief and

acknowledge that pursuant to NRS 239.330, it is a category C felony to knowingly offer any false of forged instrument for filing.

*Signature Responsible Party / Original Print Name And Title Date

*Signature Responsible Party / Original Print Name And Title Date

ORIGINAL SIGNATURES REQUIRED BY AGENCIES – KEEP A COPY FOR YOUR RECORDS

NSPO Rev. 09.14 (O) 4436 APP-01.00

Revised 09-23 -14