Enlarge image

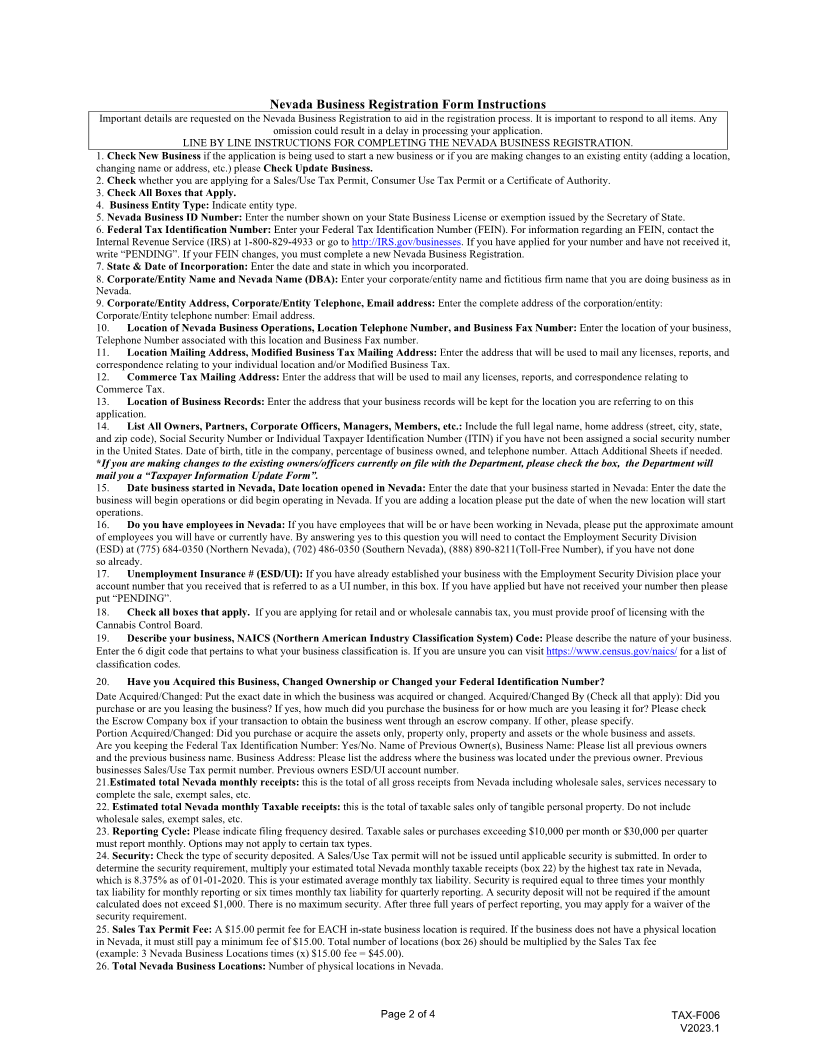

DEPT. OF TAXATION TID# _____________________

REPRESENTATIVE ACCEPTING DLN: _____________________

APPLICATION: ___________________ PROCESS DATE: ______________________

NEVADA BUSINESS REGISTRATION

Please Print Clearly – Use Black or Blue Ink Only

Please see instructions regarding form detail and online registration options.

1 New Business 2 Sales/Use Tax Permit 3 Change in Ownership/Entity/Officers Change in Entity/DBA Name

Update Business Consumer Use Tax Permit Change in Mailing Address Change in Location Address

Certificate of Authority Add Location Other _______________________

Nevada Business ID (11 Digits) Federal Tax ID Number State & Date of Incorporation

4 Business Entity: Sole Proprietor Partnership 5 6 7

Corporation Limited Liability Company

Limited Partnership Limited Liability Partnership NV -

Corporate/Entity Name (as shown on State Business License): Nevada Name (DBA):

8

9 Corporate/Entity Address : Street Number, Name Suite or Unit City, State, Zip Corporate/Entity Telephone: Email Address:

10 Location of Nevada Business Operations: Street Number, Name Suite or Unit City, State, Zip Location Telephone: Business Fax:

11 Location Mailing Address: Street Number, Name Suite or Unit City, State, Zip Modified Business Tax Mailing Address: Street Number, Name Suite or Unit City, State, Zip

Commerce Tax Mailing Address: Street Number, Name Suite or Unit City, State, Zip

12 13 Location of Business Records: Street Number, Name Suite or Unit City, State, Zip

14 List ALL Owners, Partners, Corporate Officers, Managers, Members, etc. Attach Additional Sheets if Needed.

Please check the box if making changes to existing officers and the Department will send you a “Taxpayer Information Update Form”.

Last, First, MI: If owned by another entity(s), then enter the owning entity(s) name and FID(s) Percent Owned SSN or ITIN Date of Birth

Title Residence Address: Street Number, Name Suite or Unit City, State, Zip Residence Telephone:

Last, First, MI: Percent Owned SSN or ITIN Date of Birth

Title Residence Address: Street Number, Name Suite or Unit City, State, Zip Residence Telephone:

Last, First, MI: Percent Owned SSN or ITIN Date of Birth

Title Residence Address: Street Number, Name Suite or Unit City, State, Zip Residence Telephone:

Date Business Started in Date location opened in Do you have employees in Nevada, if so how many? Unemployment Insurance # (ESD/UI):

15 NV: NV: 16 17

Service Retail Sales – New PLEASE CHECK ALL THAT APPLY TO YOUR BUSINESS Independent Cannabis Consumption Lounge *

18 Tobacco/OTP* Financial Institution Retail Sales – Used Manufacturing Wholesale Retail Cannabis Consumption Lounge*

MarketplaceFacilitator Cannabis Retail * Leasing (other than employees) Live Entertainment Tire Sales Retail Liquor*

Marketplace Seller Cannabis Wholesale * Peer to Peer Car Sharing Construction/Erection Other:

Nevada Transportation Authority # &/or Nevada Taxi Cab Authority #: ______________________ * Additional application required. See instruction page

Describe in detail the nature of your business in Nevada. Include product sold, labor performed and/or services rendered.

19

NAICS Code:___________ Don’t Know? Click Here https://www.census.gov/naics/ Preferred Language:

20 If you have acquired a Nevada Business, Changed Ownership/Business Entity, or have a new Federal Tax Identification number, complete this section:

Date Acquired/Changed: Acquired/Changed by (Check all that apply): Portion Acquired/Changed: Are you keeping the Federal Tax

Purchase $______________ Lease $______________MO Assets Only Property Only Identification number (Y/N):

Escrow Company Other: _________________ Property and Assets

Whole Business and Assets Yes No

Name(s) of Previous Owner(s): Previous Owner(s) Business Name:

Business Address: Street Number, Name Suite or Unit City, State, Zip Previous Business Sales/Use Tax Previous Owner(s) ESD/UI Account

Permit Number: Number:

FEES AND SECURITY DEPOSIT

Estimated total Nevada monthly receipts: Estimated total Nevada monthly TAXABLE receipts:

21 22

Reporting cycle (Please indicate filing frequency desired) Taxable sales or purchases exceeding $10,000 per month or $30,000 per quarter must report monthly.

23 Monthly Quarterly Annual

Sales/Use Tax

Consumer Use Tax

Certificate of Authority

Security (See Instructions)

24

Cash $__________________________ Surety # ______________________________________________

Sales Tax Fee (See Instructions) Total Nevada Business Locations:

25 26

Page 1 of 4 TAX-F006

V2023.1