Enlarge image

RESET CALCULATION

Texas Franchise Tax

RESET CALCULATION

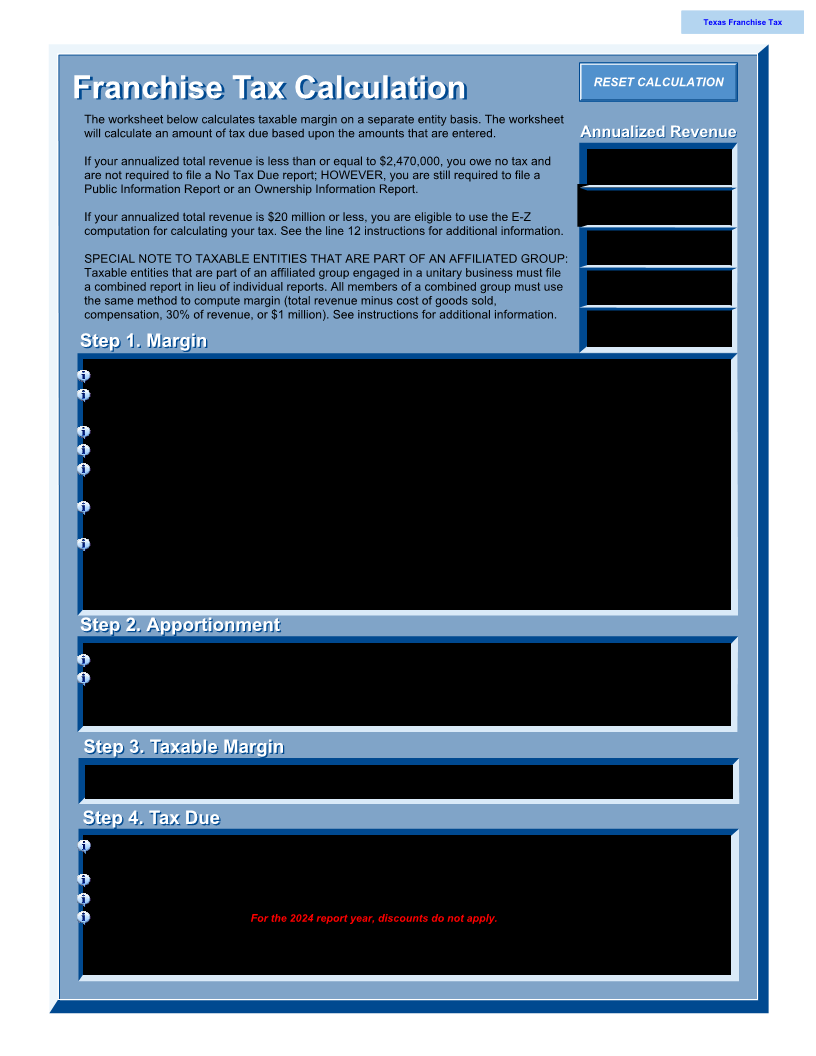

Franchise Tax CalculationFranchise Tax Calculation

The worksheet below calculates taxable margin on a separate entity basis. The worksheet

will calculate an amount of tax due based upon the amounts that are entered. Annualized RevenueAnnualized Revenue

If your annualized total revenue is less than or equal to $2,470,000, you owe no tax and Report year

are not required to file a No Tax Due report; HOWEVER, you are still required to file a 2024

Public Information Report or an Ownership Information Report.

Accounting month day year

year begin

If your annualized total revenue is $20 million or less, you are eligible to use the E-Z date

computation for calculating your tax. See the line 12 instructions for additional information. Accounting month day year

year end

SPECIAL NOTE TO TAXABLE ENTITIES THAT ARE PART OF AN AFFILIATED GROUP: date

Taxable entities that are part of an affiliated group engaged in a unitary business must file Total revenue for the report period

a combined report in lieu of individual reports. All members of a combined group must use

the same method to compute margin (total revenue minus cost of goods sold,

compensation, 30% of revenue, or $1 million). See instructions for additional information. Annualized amount

Step 1. MarginStep 1. Margin

1a. Total revenue ...................................................................................................................................... ____________________

1b. Cost of goods sold ............................................................................................................................... ____________________

1c. Cost of goods sold margin - Line 1a minus Line 1b ............................................................................. ____________________

2a. Total revenue ........................................................................................................................................ ____________________

2b. Wages and cash compensation ............................................................................................................ ____________________

2c. Employee benefits ................................................................................................................................ ____________________

2d. Compensation margin - Line 2a minus (Lines 2b and 2c) ................................................................... ____________________

3a. Total revenue ....................................................................................................................................... ____________________

3b. % margin - Equals 70% of Line 3a ....................................................................................................... ____________________

4a. Total revenue ....................................................................................................................................... ____________________

4b. Total revenue less $1,000,000 - Line 4a minus $1,000,000 ............................................................... ____________________

5. Margin - Enter the least of Lines 1c, 2d, 3b or 4b .............................................................................. ____________________

Step 2. ApportionmentStep 2. Apportionment

6. Texas gross receipts ............................................................................................................................ ____________________

7. Everywhere gross receipts ................................................................................................................... ____________________

8. Apportionment factor - Line 6 divided by Line 7 ............................................................................... ____________________

Step 3. Taxable MarginStep 3. Taxable Margin

9. Taxable margin - Line 5 multiplied by Line 8...................................................................................... ____________________

Step 4. Tax DueStep 4. Tax Due

10. Tax due before discount or credits

- Multiply Line 9 by .00375 for wholesalers and retailers or .00750 for other taxable entities ____________________

11. Credits ................................................................................................................................................ .. ____________________

12. E-Z computation (if eligible) - Line 3a times Line 8 times 0.00331 ....................................................... ____________________

13. Discount ...............................................................................................................................................For the 2024 report year, discounts do not apply. ____________________

14. Net tax due - Line 10 minus (Lines 11 and 13) OR Line 12 minus Line 13.

(If less than $1,000, you owe no tax. Cannot be less than zero.) ......................................................... ____________________