Enlarge image

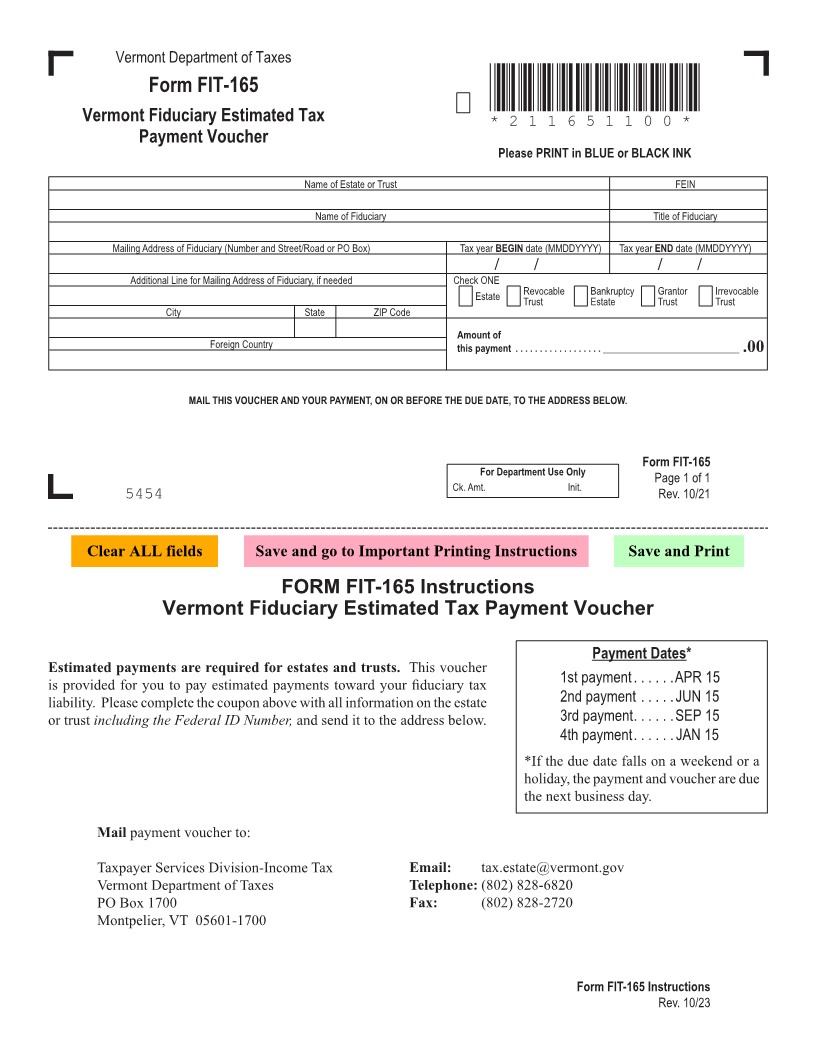

Vermont Department of Taxes

Form FIT-165

*211651100*

Vermont Fiduciary Estimated Tax

*211651100* Page 1

Payment Voucher

Please PRINT in BLUE or BLACK INK

Name of Estate or Trust FEIN

Name of Fiduciary Title of Fiduciary

Mailing Address of Fiduciary (Number and Street/Road or PO Box) Tax year BEGIN date (MMDDYYYY) Tax year END date (MMDDYYYY)

/ / / /

Additional Line for Mailing Address of Fiduciary, if needed Check ONE

Estate Revocable Bankruptcy Grantor Irrevocable

Trust Estate Trust Trust

City State ZIP Code

Amount of

Foreign Country this payment .................. ____________________________ .00

FORM (Place at FIRST page)

MAIL THIS VOUCHER AND YOUR PAYMENT, ON OR BEFORE THE DUE DATE, TO THE ADDRESS BELOW.

Form pages

Form FIT-165

For Department Use Only

Page 1 of 1

Ck. Amt. Init.

5454 Rev. 10/21 1 - 1

Clear ALL fields Save and go to Important Printing Instructions Save and Print

FORM FIT-165 Instructions

Vermont Fiduciary Estimated Tax Payment Voucher

Payment Dates*

Estimated payments are required for estates and trusts. This voucher

1st payment ......APR 15

is provided for you to pay estimated payments toward your fiduciary tax

liability. Please complete the coupon above with all information on the estate 2nd payment .....JUN 15

or trust including the Federal ID Number, and send it to the address below. 3rd payment ......SEP 15

4th payment ......JAN 15

*If the due date falls on a weekend or a

holiday, the payment and voucher are due

the next business day.

Mail payment voucher to: FORM (Place at LAST page)

Form pages

Taxpayer Services Division-Income Tax Email: tax.estate@vermont.gov

Vermont Department of Taxes Telephone: (802) 828-6820

PO Box 1700 Fax: (802) 828-2720

Montpelier, VT 05601-1700

1 - 1

Form FIT-165 Instructions

Rev. 10/23