Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

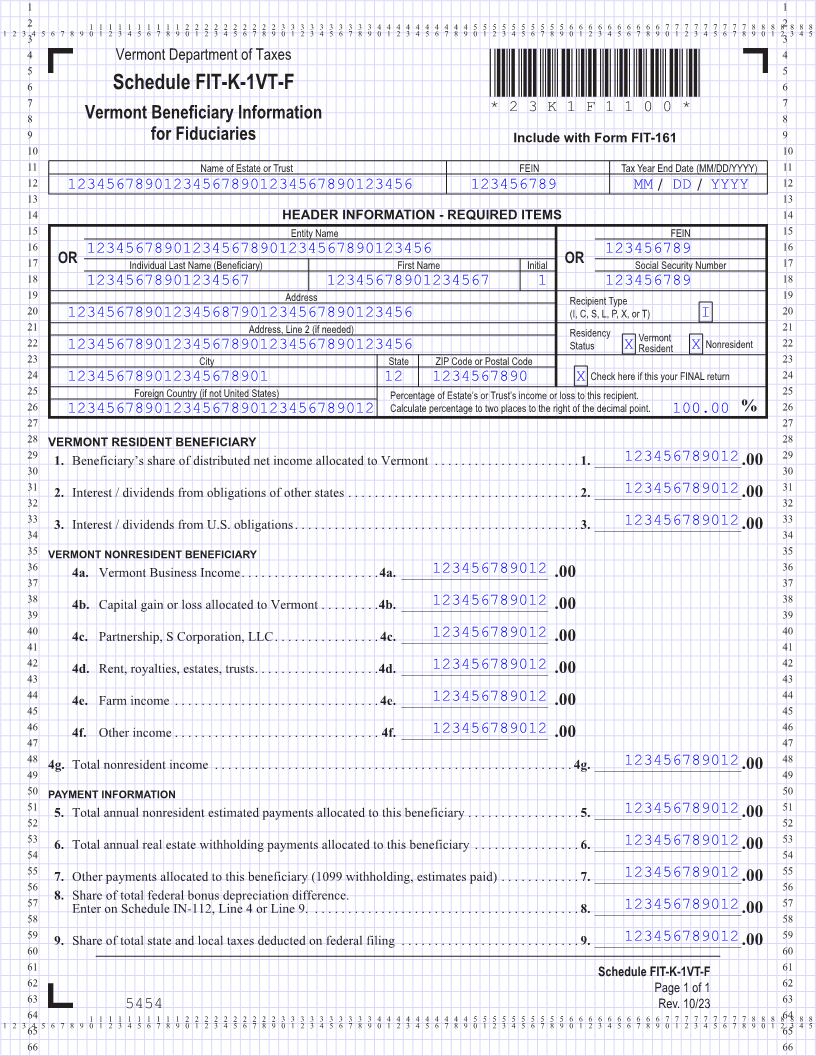

4 Vermont Department of Taxes 4

5 5

6 Schedule FIT-K-1VT-F *23K1F1100* 6

7 7

Vermont Beneficiary Information *23K1F1100*

8 8 Page 5

9 for Fiduciaries Include with Form FIT-161 9

10 10

11 Name of Estate or Trust FEIN Tax Year End Date (MM/DD/YYYY) 11

12 123456789012345678901234567890123456 123456789 MM / DD / YYYY 12

13 13

14 HEADER INFORMATION - REQUIRED ITEMS 14

15 Entity Name FEIN 15

16 16

123456789012345678901234567890123456 123456789

17 OR Individual Last Name (Beneficiary) First Name Initial OR Social Security Number 17

18 18

12345678901234567 12345678901234567 1 123456789

19 Address Recipient Type 19

20 123456789012345687901234567890123456 (I, C, S, L, P, X, or T) I 20

21 Address, Line 2 (if needed) Residency 21

Vermont

22 123456789012345678901234567890123456 Status X Resident XNonresident 22

23 City State ZIP Code or Postal Code 23

24 123456789012345678901 12 1234567890 X Check here if this your FINAL return 24

25 Foreign Country (if not United States) Percentage of Estate’s or Trust’s income or loss to this recipient. 25 FORM (Place at FIRST page)

26 12345678901234567890123456789012 Calculate percentage to two places to the right of the decimal point. 100.00 % 26 Form pages

27 27

28 VERMONT RESIDENT BENEFICIARY 28

29 29

123456789012 1. Beneficiary’s share of distributed net income allocated to Vermont . . . . . . . . . . . . . . . . . . . . . 1.. ______________________.00

30 30

31 31

123456789012 2. Interest / dividends from obligations of other states . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.. ______________________.00 5 - 5

32 32

33 33

123456789012 3. Interest / dividends from U .S . obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.. ______________________.00

34 34

35 VERMONT NONRESIDENT BENEFICIARY 35

36 36

123456789012 4a. Vermont Business Income . . . . . . . . . . . . . . . . . . . . 4a.. ______________________ .00

37 37

38 38

123456789012 4b. Capital gain or loss allocated to Vermont . . . . . . . . 4b.. ______________________ .00

39 39

40 40

123456789012 4c. Partnership, S Corporation, LLC . . . . . . . . . . . . . . . 4c.. ______________________ .00

41 41

42 42

123456789012 4d. Rent, royalties, estates, trusts . . . . . . . . . . . . . . . . . . 4d.. ______________________ .00

43 43

44 44

123456789012 4e. Farm income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4e. ______________________ .00

45 45

46 46

123456789012 4f. Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4f. ______________________ .00

47 47

48 48

123456789012 4g. Total nonresident income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4g.. ______________________.00

49 49

50 PAYMENT INFORMATION 50

51 51

123456789012 5. Total annual nonresident estimated payments allocated to this beneficiary . . . . . . . . . . . . . . . . 5.. ______________________.00

52 52

53 53

123456789012 6. Total annual real estate withholding payments allocated to this beneficiary . . . . . . . . . . . . . . . .6. ______________________.00

54 54

7. Other payments allocated to this beneficiary (1099 withholding, estimates paid) . . . . . . . . . . . . 7. ______________________.00 FORM

55 123456789012 55 (Place at LAST page)

56 56 Form pages

57 8. Share of total federal bonus depreciation difference . 57

123456789012Enter on Schedule IN-112, Line 4 or Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.. ______________________.00

58 58

59 59

123456789012 9. Share of total state and local taxes deducted on federal filing . . . . . . . . . . . . . . . . . . . . . . . . . . 9.. ______________________.00

60 60

61 Schedule FIT-K-1VT-F 61

5 - 5

62 Page 1 of 1 62

63 5454 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66