Enlarge image

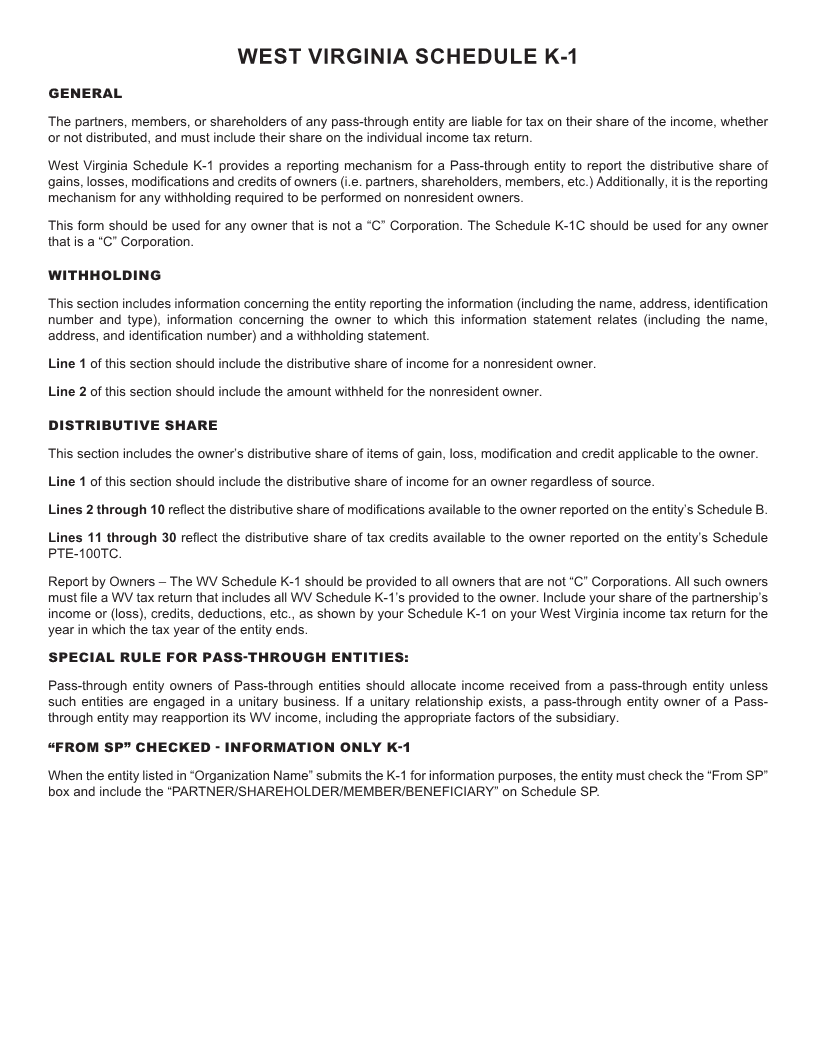

K-1 FROM SP Schedule of WV Partner/Shareholder/Member/Beneficiary

REV10-22 Income, Loss, Modification, Credits, and Withholding 2023

TAXABLE YEAR OF ORGANIZATION

BEGINNING ENDING

MM DD YYYY MM DD YYYY

ORGANIZATION NAME (please type or print) NAME OF PARTNER/SHAREHOLDER/MEMBER/BENEFICIARY

STREET or POST OFFICE BOX STREET or POST OFFICE BOX

CITY STATE ZIP CITY STATE ZIP

WV IDENTIFICATION NUMBER FEIN FEIN/SSN WV IDENTIFICATION NUMBER

CHECK ONE: WITHHOLDING

1. Income subject to withholding for nonresident as reported on

S Corporation organization’s S Corporation, Partnership or Fiduciary Return $ .00

2. Amount of West Virginia tax withheld (see instructions)

Limited Liability Company $ .00

PERCENTAGE OF OWNERSHIP

Partnership Fiduciary %

DISTRIBUTIVE SHARE

INCOME

1. Distributive pro rata share of income allocable to West Virginia........................................... 1 .00

ADDITIONS

2. Interest or dividend income on federal obligations which is exempt from federal tax but

subject to state tax............................................................................................................ 2 .00

3. Interest or dividend income on state and local bonds other than bonds from West Virginia

sources.............................................................................................................................. 3 .00

4. Interest on money borrowed to purchase bonds earning income exempt from West

Virginia tax......................................................................................................................... 4 .00

5. Any amount not included in federal income that was an eligible contribution for the

Neighborhood Investment Program Tax Credit ................................................................. 5 .00

6. Other Income deducted from federal adjusted gross income but subject to state tax...... 6 .00

SUBTRACTIONS

7. Interest or dividends received on United State or West Virginia obligations included in

federal adjusted gross income but exempt from state tax................................................. 7 .00

8. Refunds of state and local income taxes received and reported as income to the IRS.... 8 .00

9. Other income included into federal adjusted gross income but excluded from state

income tax......................................................................................................................... 9 .00

10. Allowance for governmental obligations secured by residential property ........................ 10 .00

*B54022301W*

B54022301W