Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

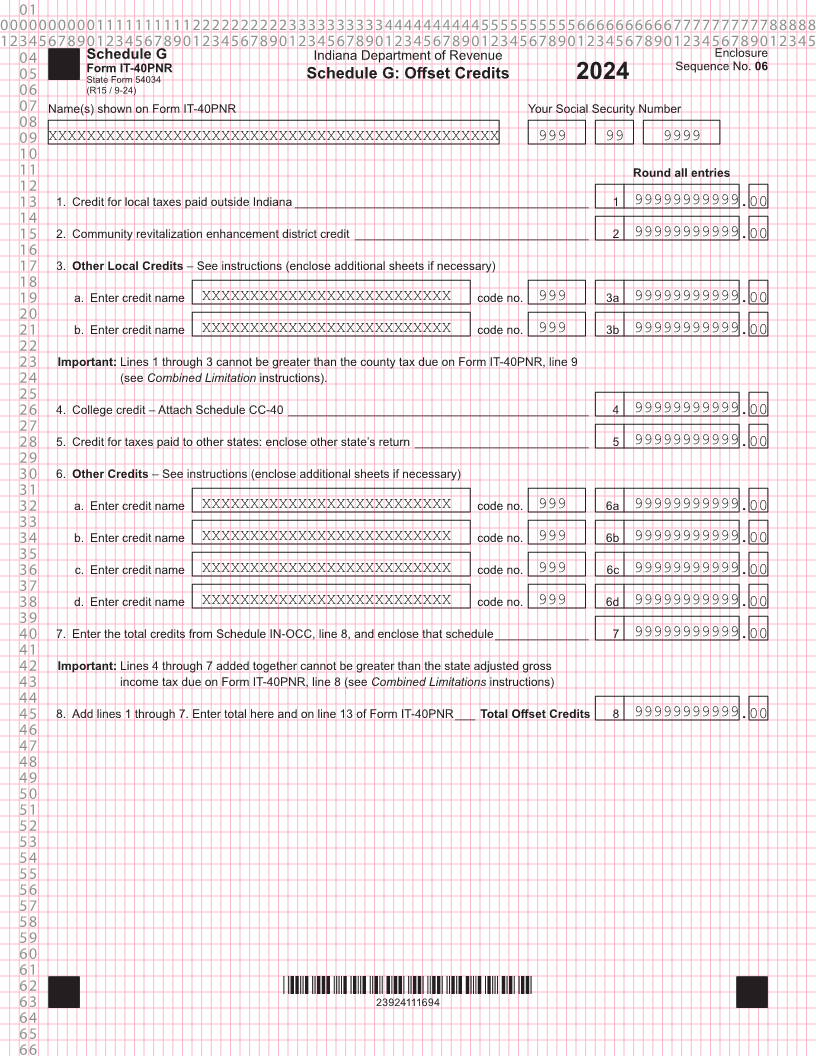

04 Schedule G Indiana Department of Revenue Enclosure

Form IT-40PNR Sequence No. 06

05 State Form 54034 Schedule G: Offset Credits 2024

06 (R15 / 9-24)

07 Name(s) shown on Form IT-40PNR Your Social Security Number

08

09 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

10

11 Round all entries

12

13 1. Credit for local taxes paid outside Indiana ____________________________________________ 1 99999999999.00

14

15 2. Community revitalization enhancement district credit ___________________________________ 2 99999999999.00

16

17 3. Other Local Credits – See instructions (enclose additional sheets if necessary)

18

19 a. Enter credit name XXXXXXXXXXXXXXXXXXXXXXXXXX code no. 999 3a 99999999999.00

20

21 b. Enter credit name XXXXXXXXXXXXXXXXXXXXXXXXXX code no. 999 3b 99999999999.00

22

23 Important: Lines 1 through 3 cannot be greater than the county tax due on Form IT-40PNR, line 9

24 (seeCombined Limitation instructions).

25

26 4. College credit – Attach Schedule CC-40 _____________________________________________ 4 99999999999.00

27

28 5. Credit for taxes paid to other states: enclose other state’s return __________________________ 5 99999999999.00

29

30 6. Other Credits – See instructions (enclose additional sheets if necessary)

31

32 a. Enter credit name XXXXXXXXXXXXXXXXXXXXXXXXXX code no. 999 6a 99999999999.00

33

34 b. Enter credit name XXXXXXXXXXXXXXXXXXXXXXXXXX code no. 999 6b 99999999999.00

35

36 c. Enter credit name XXXXXXXXXXXXXXXXXXXXXXXXXX code no. 999 6c 99999999999.00

37

38 d. Enter credit name XXXXXXXXXXXXXXXXXXXXXXXXXX code no. 999 6d 99999999999.00

39

40 7. Enter the total credits from Schedule IN-OCC, line 8, and enclose that schedule ______________ 7 99999999999.00

41

42 Important: Lines 4 through 7 added together cannot be greater than the state adjusted gross

43 income tax due on Form IT-40PNR, line 8 (seeCombined Limitations instructions)

44

45 8. Add lines 1 through 7. Enter total here and on line 13 of Form IT-40PNR ___ Total Offset Credits 8 99999999999.00

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62 *23924111694*

63 23924111694

64

65

66