Enlarge image

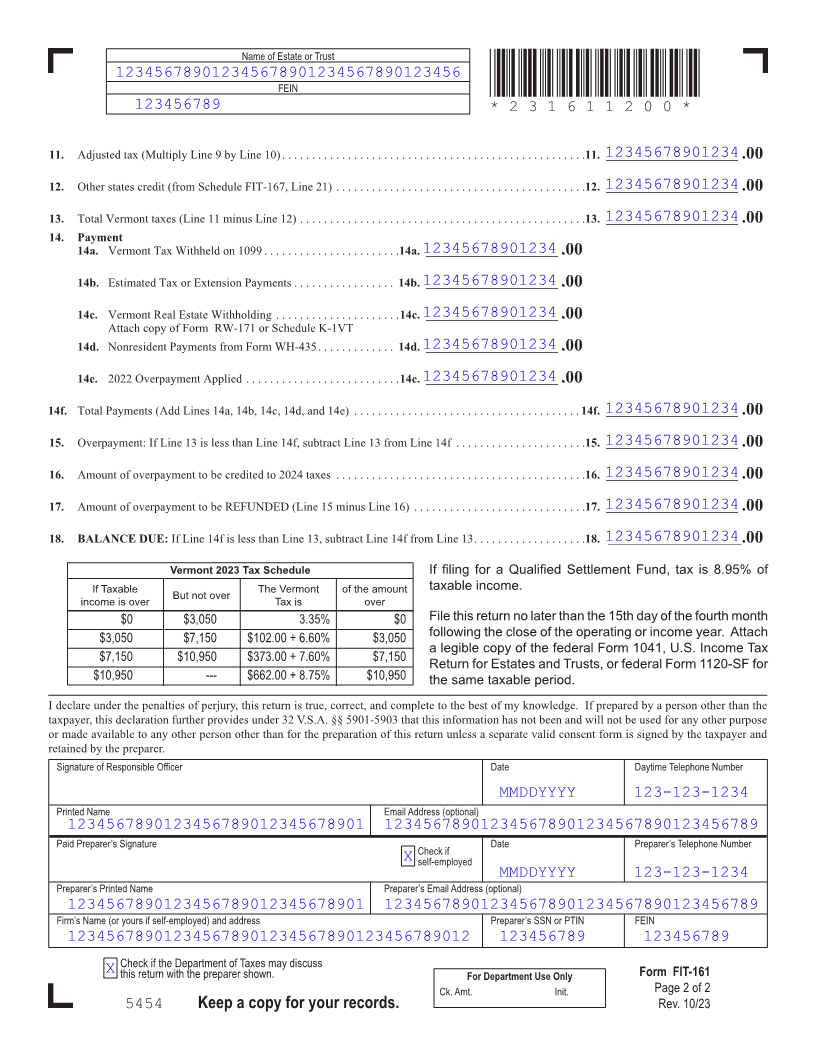

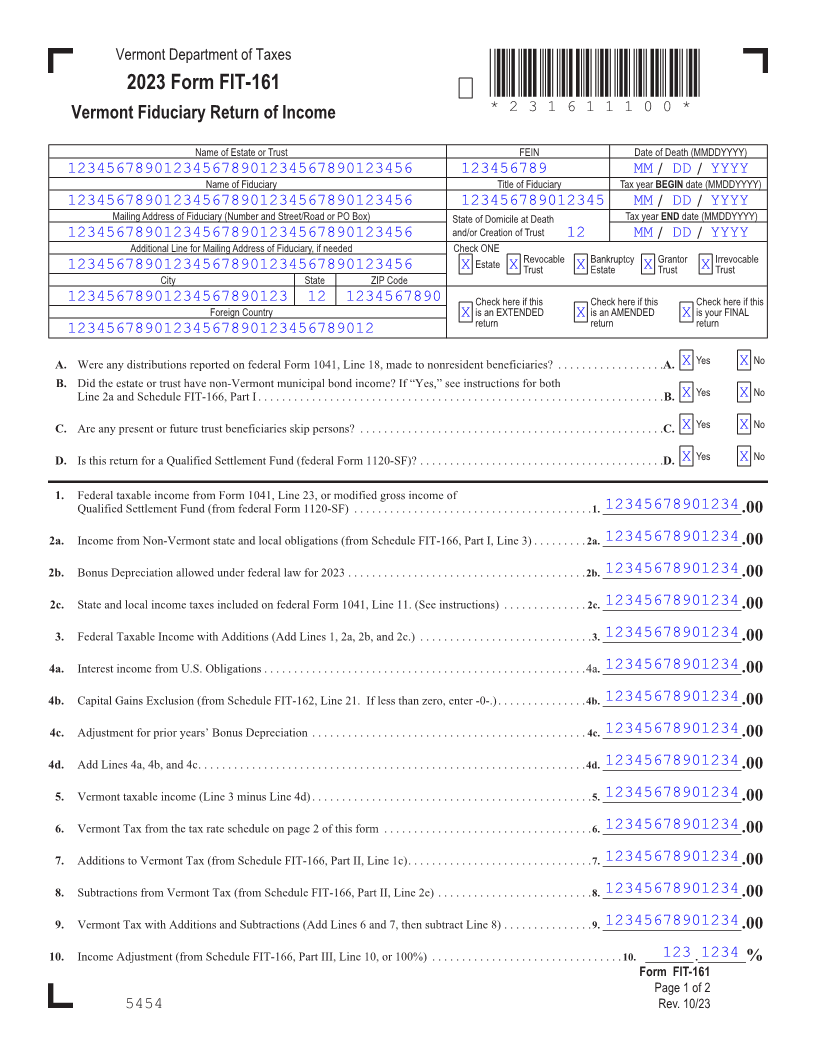

Vermont Department of Taxes

2023 Form FIT-161 *231611100*

Vermont Fiduciary Return of Income *231611100*

Page 7

Name of Estate or Trust FEIN Date of Death (MMDDYYYY)

123456789012345678901234567890123456 123456789 MM / DD / YYYY

Name of Fiduciary Title of Fiduciary Tax year BEGIN date (MMDDYYYY)

123456789012345678901234567890123456 123456789012345 MM / DD / YYYY

Mailing Address of Fiduciary (Number and Street/Road or PO Box) State of Domicile at Death Tax yearEND date (MMDDYYYY)

123456789012345678901234567890123456 and/or Creation of Trust 12 MM / DD / YYYY

Additional Line for Mailing Address of Fiduciary, if needed Check ONE

Estate Revocable Bankruptcy Grantor Irrevocable

123456789012345678901234567890123456 X X Trust X Estate X Trust X Trust

City State ZIP Code

12345678901234567890123 12 1234567890 Check here if this Check here if this Check here if this

Foreign Country X is an EXTENDED X is an AMENDED Xis your FINAL

return return return

12345678901234567890123456789012

A. Were any distributions reported on federal Form 1041, Line 18, made to nonresident beneficiaries? . . . . . . . . . . . . . . . . . A.. X Yes X No

B. Did the estate or trust have non-Vermont municipal bond income? If “Yes,” see instructions for both

Line 2a and Schedule FIT-166, Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B..X Yes X No FORM (Place atFIRST page)

Form pages

C. Are any present or future trust beneficiaries skip persons? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C.. X Yes X No

D. Is this return for a Qualified Settlement Fund (federal Form 1120-SF)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D.. X Yes X No

1. Federal taxable income from Form 1041, Line 23, or modified gross income of 7 - 8

12345678901234Qualified Settlement Fund (from federal Form 1120-SF) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1..__________________________.00

12345678901234 2a. Income from Non-Vermont state and local obligations (from Schedule FIT-166, Part I, Line 3) . . . . . . . . 2a.. __________________________.00

12345678901234 2b. Bonus Depreciation allowed under federal law for 2023 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b..__________________________ .00

12345678901234 2c. State and local income taxes included on federal Form 1041, Line 11 . (See instructions) . . . . . . . . . . . . . 2c.. __________________________.00

12345678901234 3. Federal Taxable Income with Additions (Add Lines 1, 2a, 2b, and 2c .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3..__________________________.00

12345678901234 4a. Interest income from U .S . Obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4a. __________________________.00

12345678901234 4b. Capital Gains Exclusion (from Schedule FIT-162, Line 21 . If less than zero, enter -0- .) . . . . . . . . . . . . .4b.. .__________________________ .00

12345678901234 4c. Adjustment for prior years’ Bonus Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4c. __________________________.00

12345678901234 4d. Add Lines 4a, 4b, and 4c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4d..__________________________.00

12345678901234 5. Vermont taxable income (Line 3 minus Line 4d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5..__________________________.00

12345678901234 6. Vermont Tax from the tax rate schedule on page 2 of this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6..__________________________.00

12345678901234 7. Additions to Vermont Tax (from Schedule FIT-166, Part II, Line 1c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7..__________________________.00

12345678901234 8. Subtractions from Vermont Tax (from Schedule FIT-166, Part II, Line 2e) . . . . . . . . . . . . . . . . . . . . . . . . . 8..__________________________.00

12345678901234 9. Vermont Tax with Additions and Subtractions (Add Lines 6 and 7, then subtract Line 8) . . . . . . . . . . . . . . 9..__________________________.00

10. Income Adjustment (from Schedule FIT-166, Part III, Line 10, or 100%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. . . _________. 123._________1234 %

Form FIT-161

Page 1 of 2

5454 Rev. 10/23