Enlarge image

2023 West Virginia Personal Income Tax Forms & Instructions 2023 PERSONAL INCOME TAX IS DUE APRIL 15, 2024 W EST VIRGINIA TAX DIVISION

Enlarge image | 2023 West Virginia Personal Income Tax Forms & Instructions 2023 PERSONAL INCOME TAX IS DUE APRIL 15, 2024 W EST VIRGINIA TAX DIVISION |

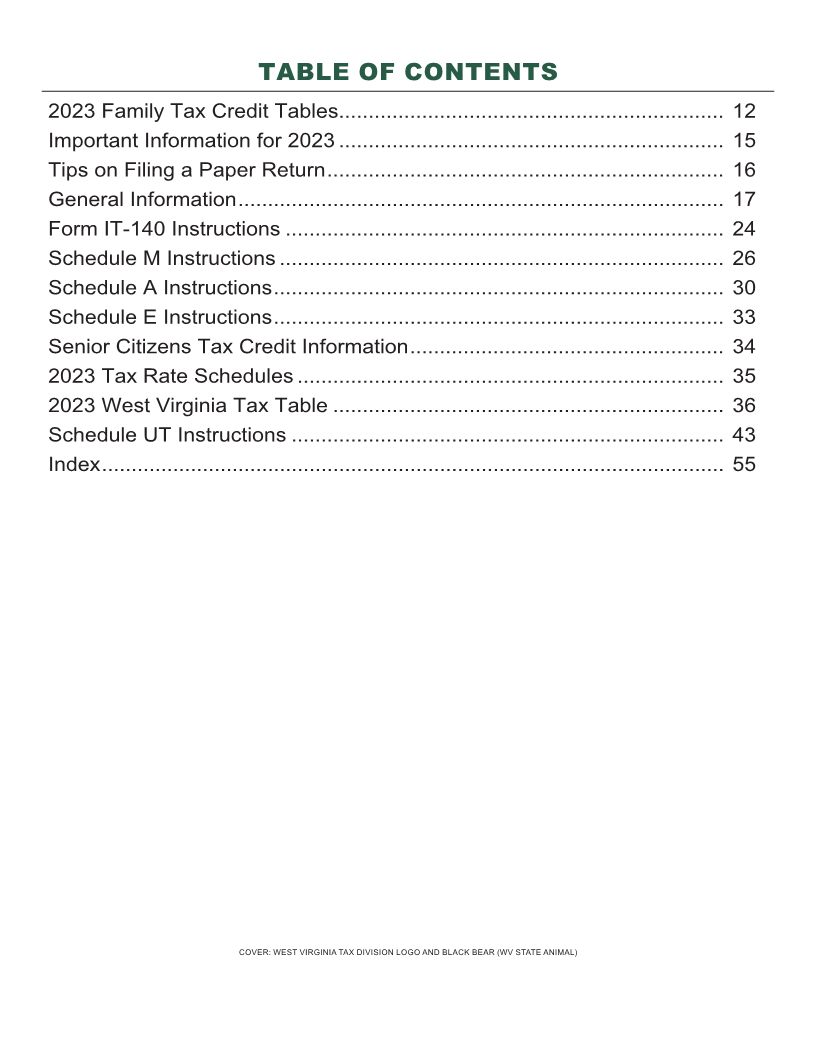

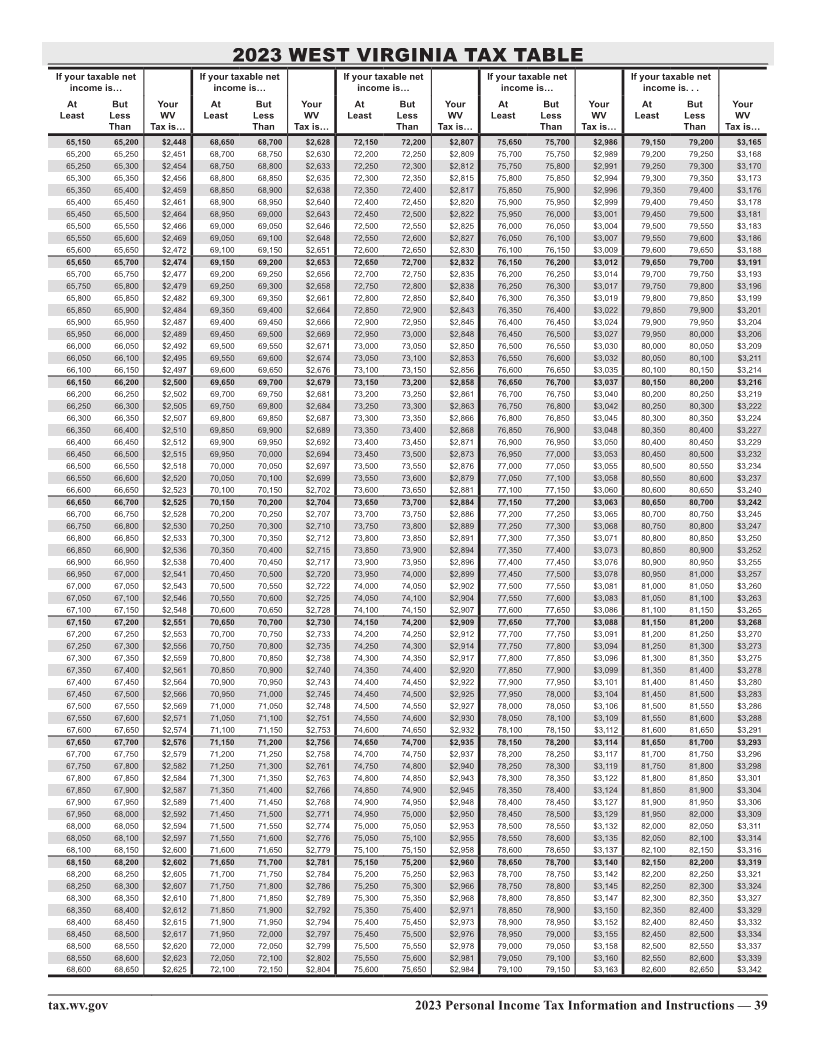

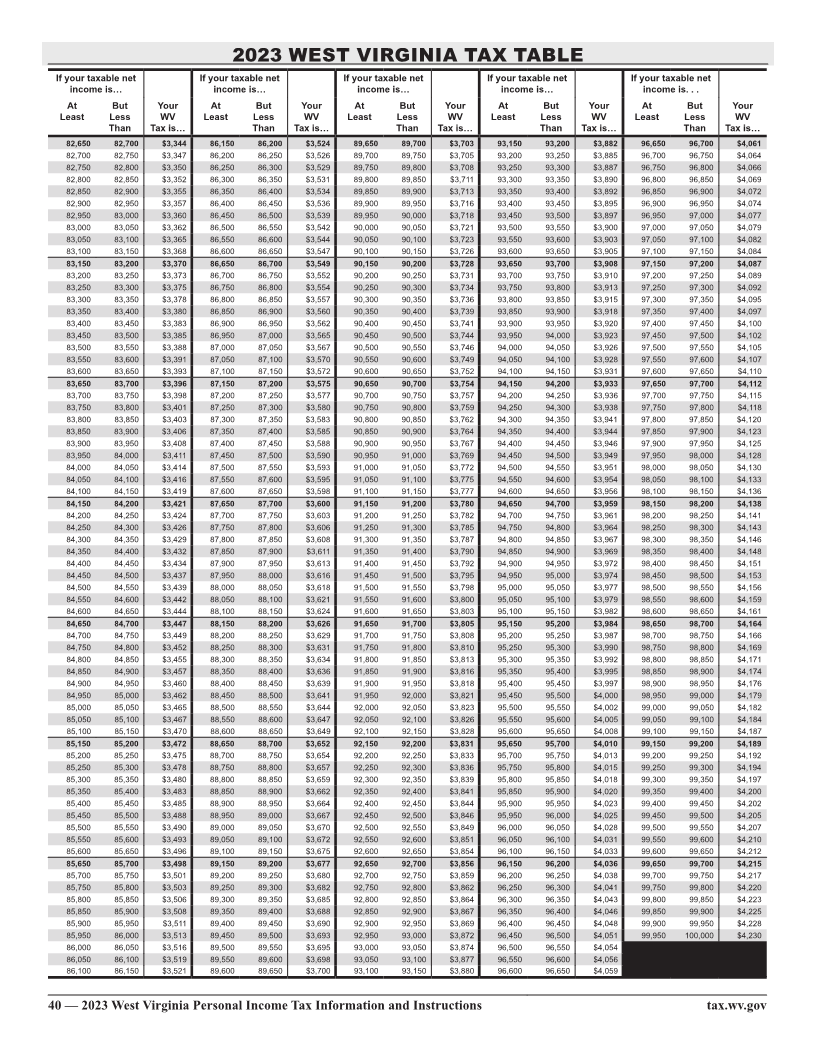

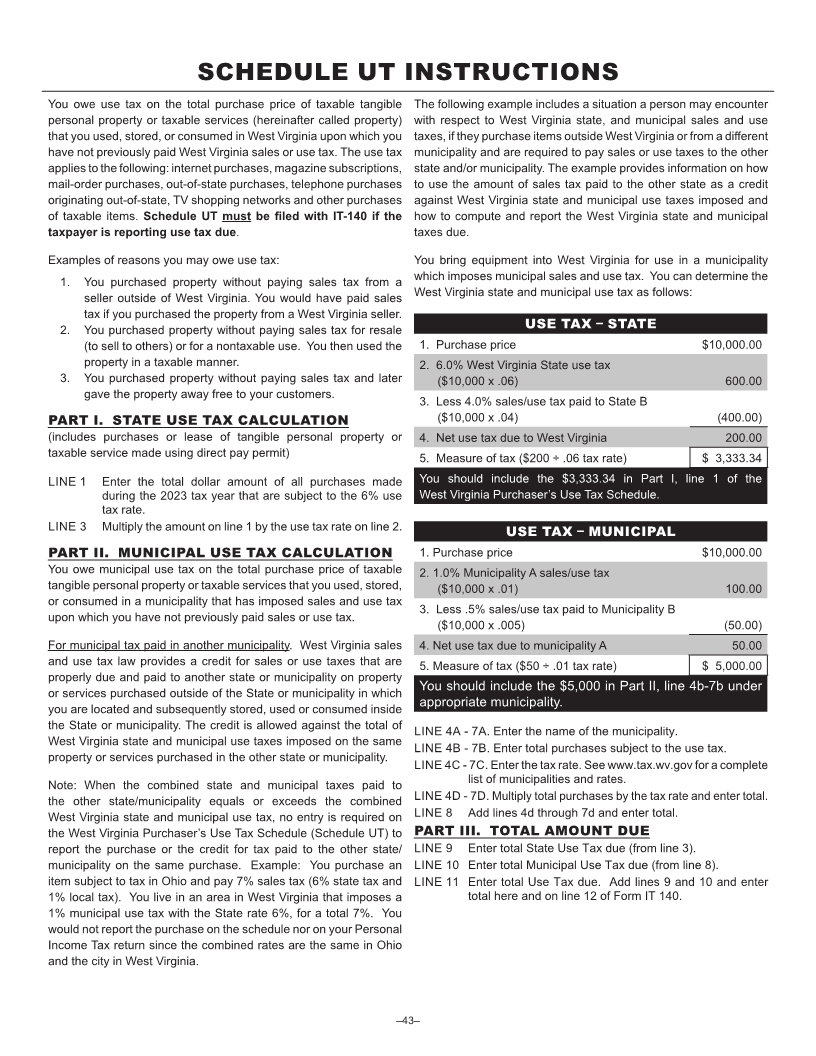

Enlarge image | TABLE OF CONTENTS 2023 Family Tax Credit Tables 12 Important Information for 2023 15 Tips on Filing a Paper Return 16 General Information 17 Form IT-140 Instructions 24 Schedule M Instructions 26 Schedule A Instructions 30 Schedule E Instructions 33 Senior Citizens Tax Credit Information 34 2023 Tax Rate Schedules 35 2023 West Virginia Tax Table 36 Schedule UT Instructions 43 Index 55 COVER: WEST VIRGINIA TAX DIVISION LOGO AND BLACK BEAR (WV STATE ANIMAL) |

Enlarge image |

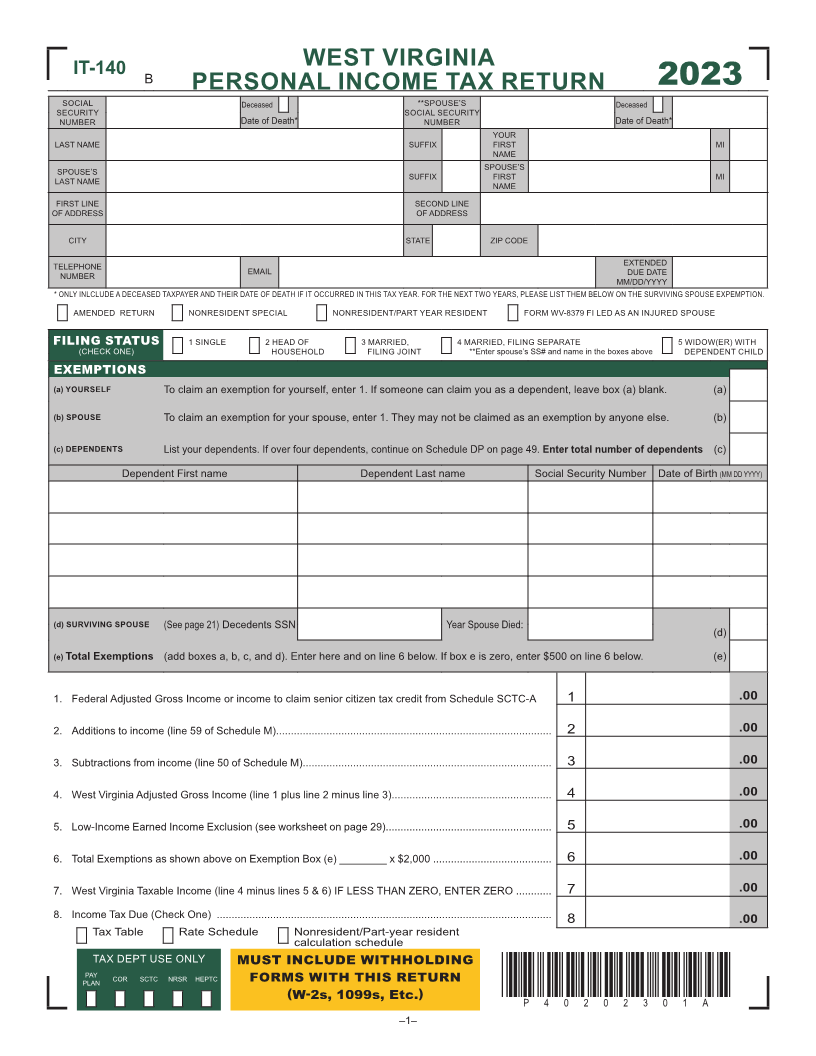

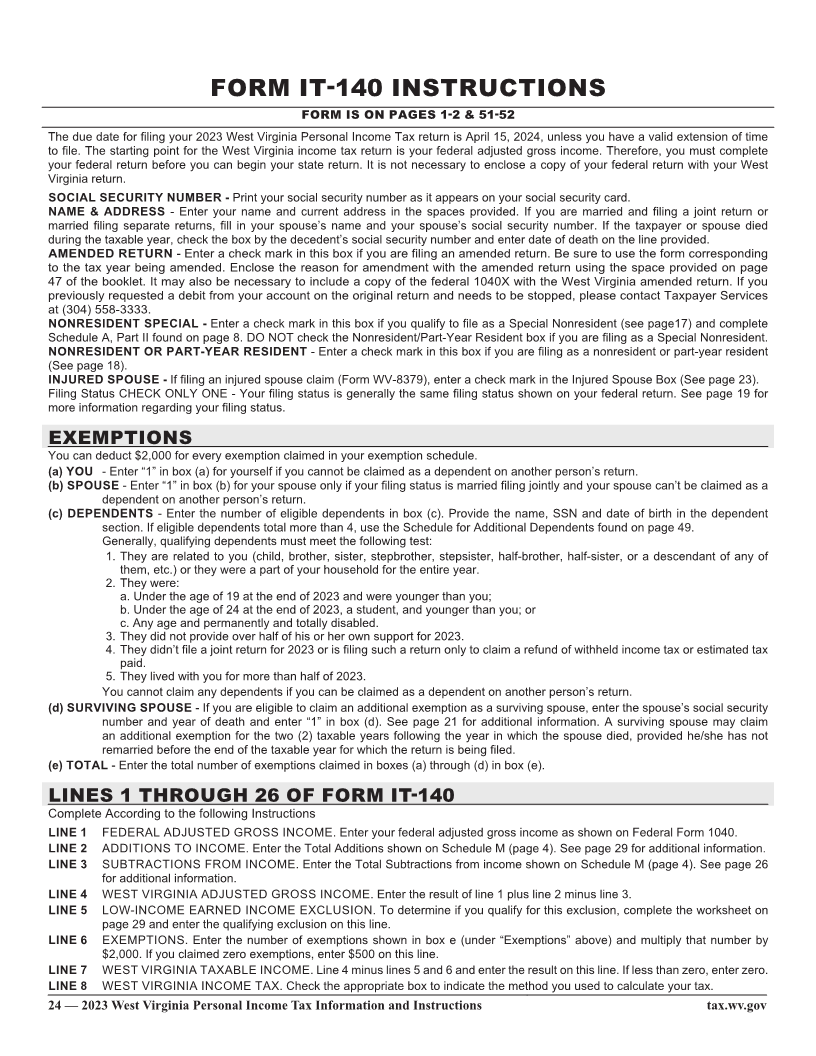

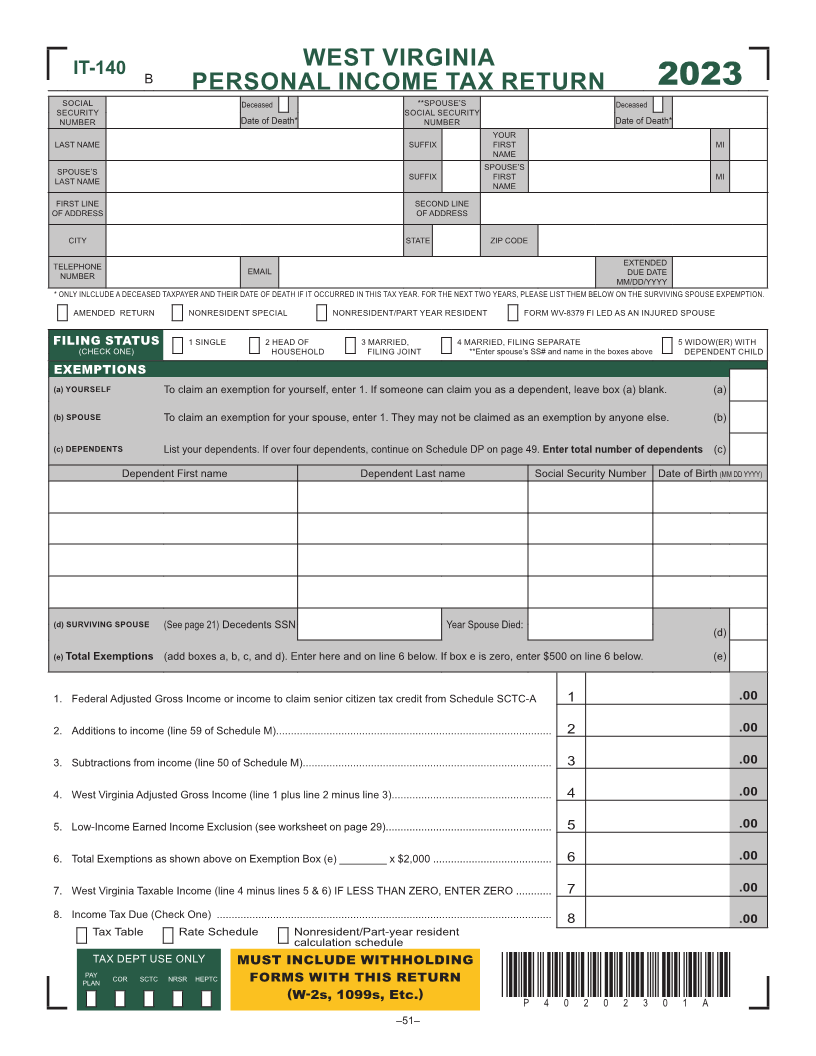

WEST VIRGINIA

IT-140 B

PERSONAL INCOME TAX RETURN 2023

SOCIAL Deceased **SPOUSE’S Deceased

SECURITY SOCIAL SECURITY

NUMBER Date of Death* NUMBER Date of Death*

YOUR

LAST NAME SUFFIX FIRST MI

NAME

SPOUSE’S

SPOUSE’S SUFFIX FIRST MI

LAST NAME NAME

FIRST LINE SECOND LINE

OF ADDRESS OF ADDRESS

CITY STATE ZIP CODE

EXTENDED

TELEPHONE EMAIL DUE DATE

NUMBER MM/DD/YYYY

* ONLY INLCLUDE A DECEASED TAXPAYER AND THEIR DATE OF DEATH IF IT OCCURRED IN THIS TAX YEAR FOR THE NEXT TWO YEARS, PLEASE LIST THEM BELOW ON THE SURVIVING SPOUSE EXPEMPTION

AMENDED RETURN NONRESIDENT SPECIAL NONRESIDENT/PART YEAR RESIDENT FORM WV-8379 FI LED AS AN INJURED SPOUSE

FILING STATUS 1 SINGLE 2 HEAD OF 3 MARRIED, 4 MARRIED, FILING SEPARATE 5 WIDOW(ER) WITH

(CHECK ONE) HOUSEHOLD FILING JOINT **Enter spouse’s SS# and name in the boxes above DEPENDENT CHILD

EXEMPTIONS

(a) YOURSELF To claim an exemption for yourself, enter 1 If someone can claim you as a dependent, leave box (a) blank (a)

(b) SPOUSE To claim an exemption for your spouse, enter 1 They may not be claimed as an exemption by anyone else (b)

(c) DEPENDENTS List your dependents If over four dependents, continue on Schedule DP on page 49 Enter total number of dependents (c)

Dependent First name Dependent Last name Social Security Number Date of Birth (MM DD YYYY)

(d) SURVIVING SPOUSE (See page 21) Decedents SSN Year Spouse Died:

(d)

(e) Total Exemptions (add boxes a, b, c, and d) Enter here and on line 6 below If box e is zero, enter $500 on line 6 below (e)

1 Federal Adjusted Gross Income or income to claim senior citizen tax credit from Schedule SCTC-A 1 .00

2 Additions to income (line 59 of Schedule M) 2 .00

3 Subtractions from income (line 50 of Schedule M) 3 .00

4 West Virginia Adjusted Gross Income (line 1 plus line 2 minus line 3) 4 .00

5 Low-Income Earned Income Exclusion (see worksheet on page 29) 5 .00

6 Total Exemptions as shown above on Exemption Box (e) ________ x $2,000 6 .00

7 West Virginia Taxable Income (line 4 minus lines 5 & 6) IF LESS THAN ZERO, ENTER ZERO 7 .00

8 Income Tax Due (Check One) 8 .00

Tax Table Rate Schedule Nonresident/Part-year resident

calculation schedule

TAX DEPT USE ONLY MUST INCLUDE WITHHOLDING

PAY COR SCTC NRSR HEPTC FORMS WITH THIS RETURN

PLAN

(W-2s, 1099s, Etc.) *P40202301A*

P40202301A

–1–

|

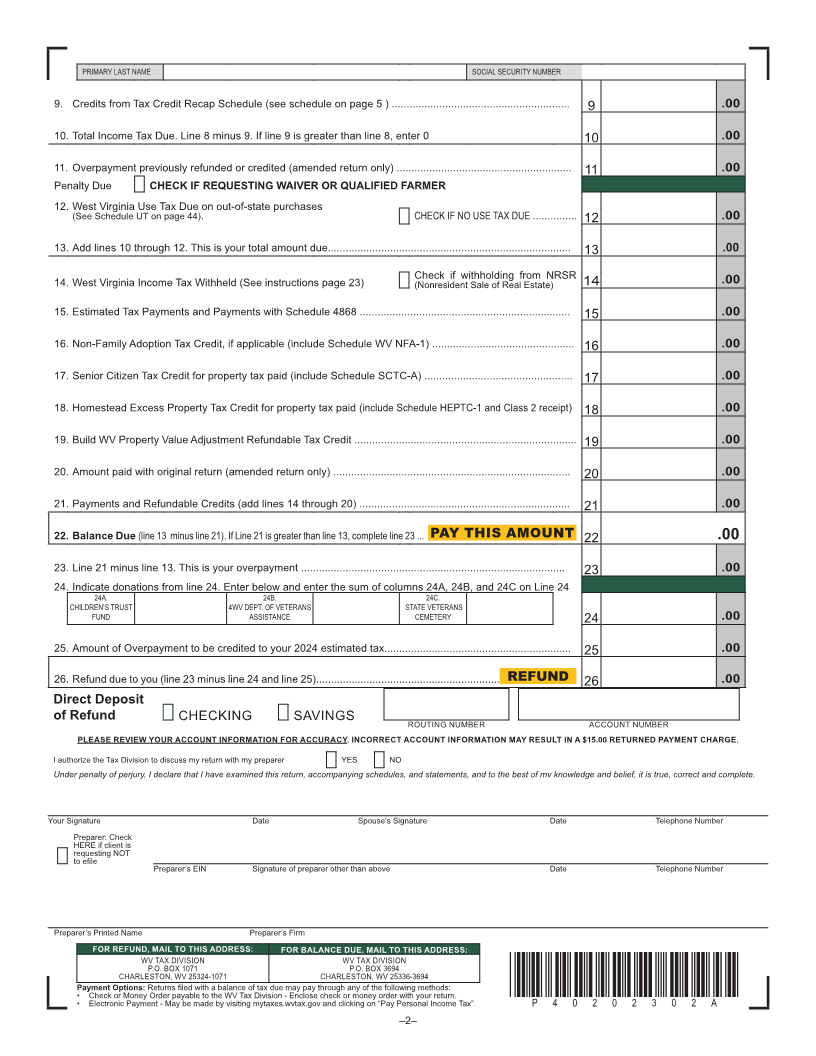

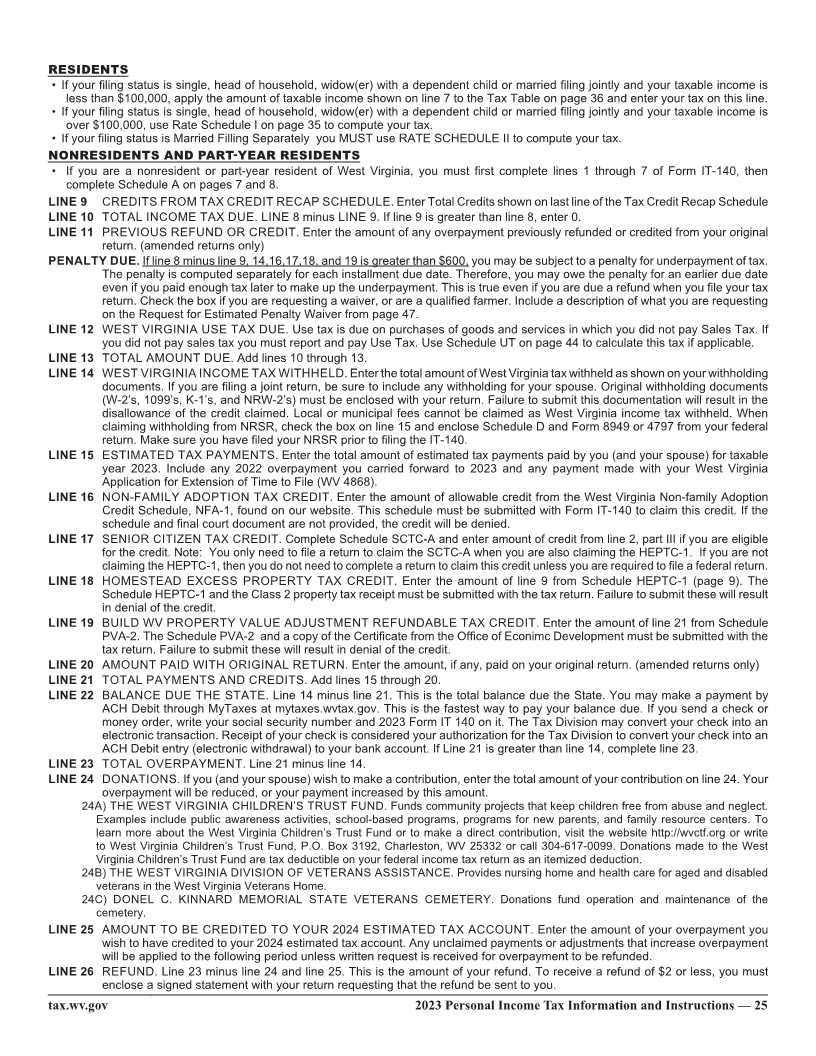

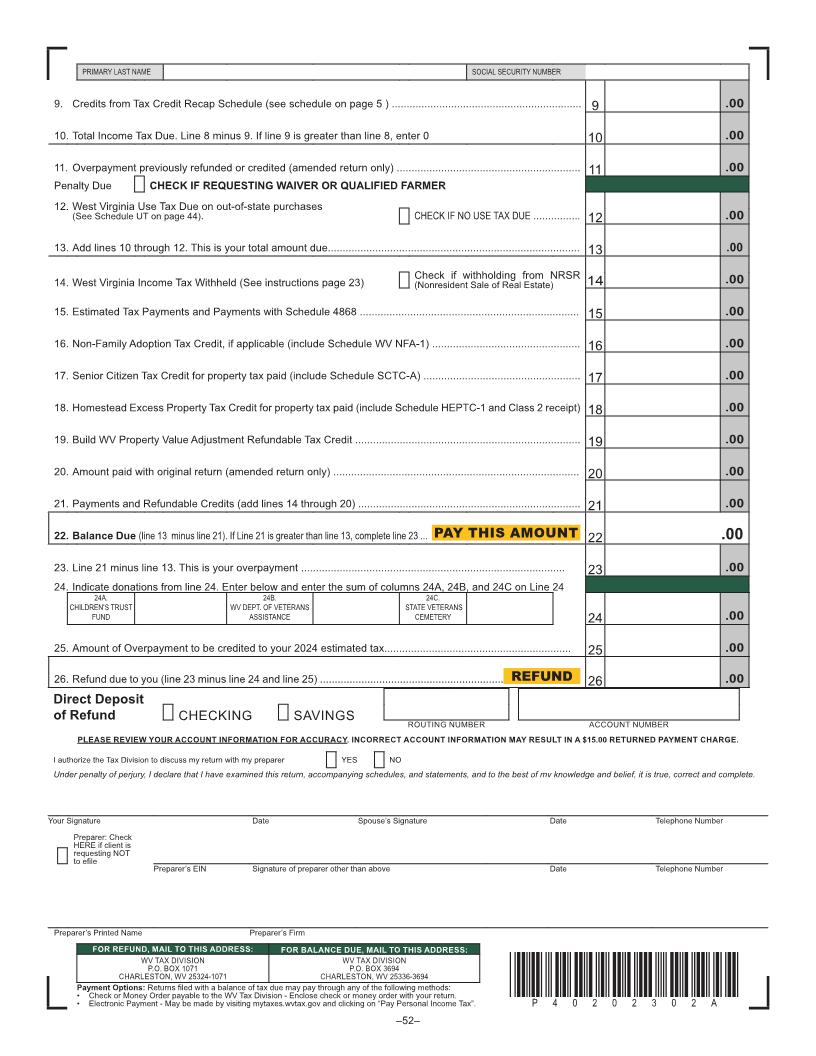

Enlarge image | PRIMARY LAST NAME SOCIAL SECURITY NUMBER 9 Credits from Tax Credit Recap Schedule (see schedule on page 5 ) 9 .00 10 Total Income Tax Due Line 8 minus 9 If line 9 is greater than line 8, enter 0 10 .00 11 Overpayment previously refunded or credited (amended return only) 11 .00 Penalty Due CHECK IF REQUESTING WAIVER OR QUALIFIED FARMER 12 West Virginia Use Tax Due on out-of-state purchases (See Schedule UT on page 44) CHECK IF NO USE TAX DUE . 12 .00 13 Add lines 10 through 12 This is your total amount due 13 .00 Check if withholding from NRSR 14 West Virginia Income Tax Withheld (See instructions page 23) (Nonresident Sale of Real Estate) 14 .00 15 Estimated Tax Payments and Payments with Schedule 4868 15 .00 16 Non-Family Adoption Tax Credit, if applicable (include Schedule WV NFA-1) 16 .00 17 Senior Citizen Tax Credit for property tax paid (include Schedule SCTC-A) 17 .00 18 Homestead Excess Property Tax Credit for property tax paid (include Schedule HEPTC-1 and Class 2 receipt) 18 .00 19 Build WV Property Value Adjustment Refundable Tax Credit 19 .00 20 Amount paid with original return (amended return only) 20 .00 21 Payments and Refundable Credits (add lines 14 through 20) 21 .00 22. Balance Due (line 13 minus line 21). If Line 21 is greater than line 13, complete line 23 ... PAY THIS AMOUNT 22 .00 23 Line 21 minus line 13 This is your overpayment 23 .00 24 Indicate donations from line 24 Enter below and enter the sum of columns 24A, 24B, and 24C on Line 24 24A. 24B. 24C. CHILDREN’S TRUST 4WV DEPT. OF VETERANS STATE VETERANS FUND ASSISTANCE CEMETERY 24 .00 25 Amount of Overpayment to be credited to your 2024 estimated tax 25 .00 26 Refund due to you (line 23 minus line 24 and line 25) REFUND 26 .00 Direct Deposit of Refund CHECKING SAVINGS ROUTING NUMBER ACCOUNT NUMBER PLEASE REVIEW YOUR ACCOUNT INFORMATION FOR ACCURACY. INCORRECT ACCOUNT INFORMATION MAY RESULT IN A $15.00 RETURNED PAYMENT CHARGE. I authorize the Tax Division to discuss my return with my preparer YES NO Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete. Your Signature Date Spouse’s Signature Date Telephone Number Preparer: Check HERE if client is requesting NOT to efile Preparer’s EIN Signature of preparer other than above Date Telephone Number Preparer’s Printed Name Preparer’s Firm FOR REFUND, MAIL TO THIS ADDRESS: FOR BALANCE DUE, MAIL TO THIS ADDRESS: WV TAX DIVISION WV TAX DIVISION PO BOX 1071 PO BOX 3694 CHARLESTON, WV 25324-1071 CHARLESTON, WV 25336-3694 Payment Options: Returns filed with a balance of tax due may pay through any of the following methods: *P40202302A* • Check or Money Order payable to the WV Tax Division - Enclose check or money order with your return • Electronic Payment - May be made by visiting mytaxeswvtaxgov and clicking on “Pay Personal Income Tax” P40202302A –2– |

Enlarge image |

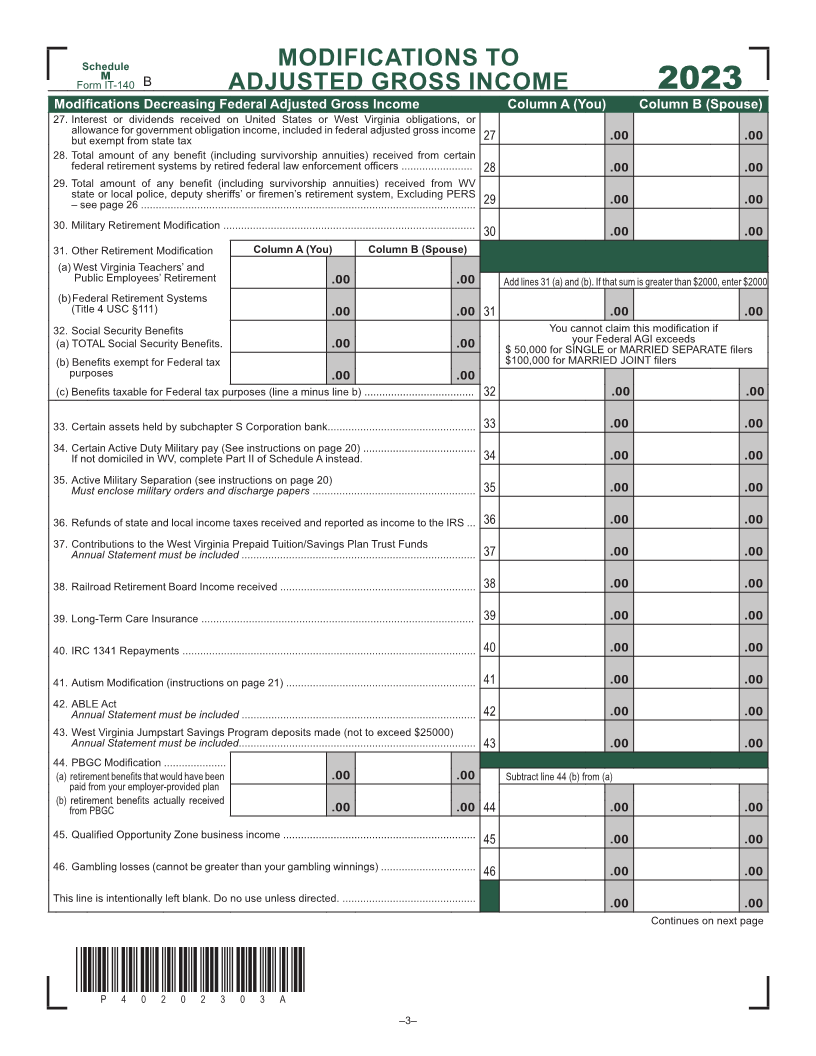

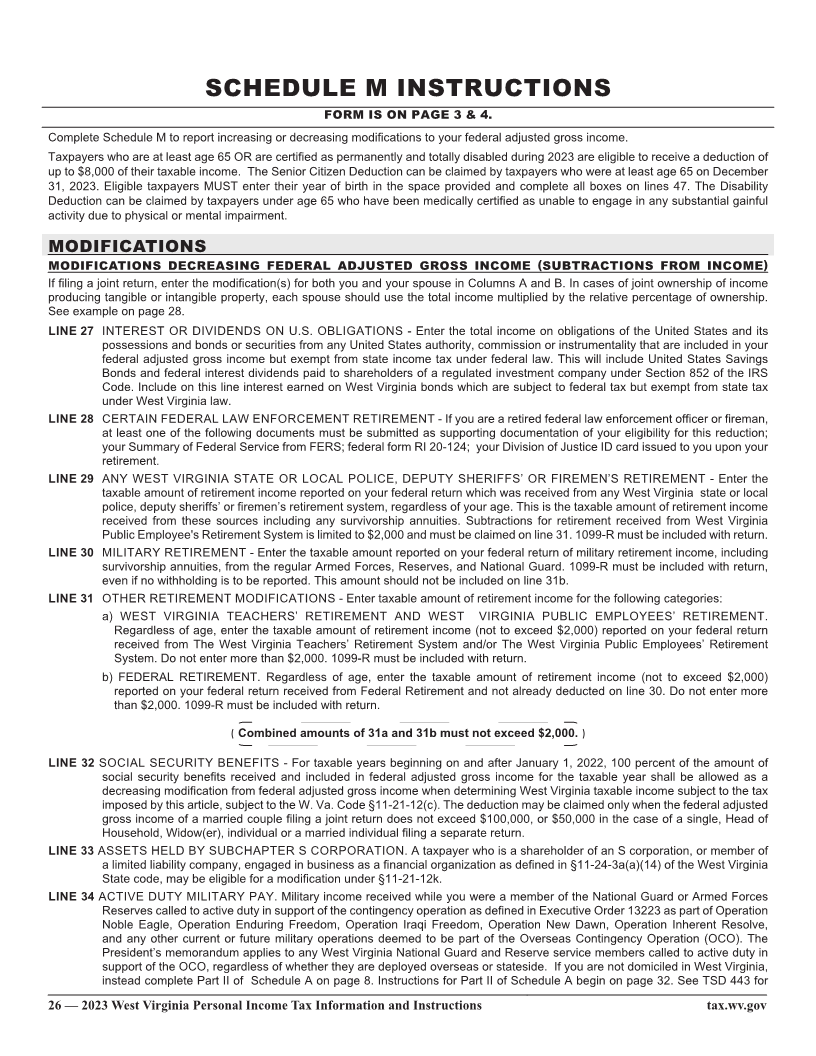

Schedule MODIFICATIONS TO

M

Form IT-140 B ADJUSTED GROSS INCOME 2023

Modifications Decreasing Federal Adjusted Gross Income Column A (You) Column B (Spouse)

27 Interest or dividends received on United States or West Virginia obligations, or

allowance for government obligation income, included in federal adjusted gross income

but exempt from state tax 27 .00 .00

28 Total amount of any benefit (including survivorship annuities) received from certain

federal retirement systems by retired federal law enforcement officers ........................ 28 .00 .00

29 Total amount of any benefit (including survivorship annuities) received from WV

state or local police, deputy sheriffs’ or firemen’s retirement system, Excluding PERS

– see page 26 29 .00 .00

30 Military Retirement Modification .....................................................................................

30 .00 .00

31 Other Retirement Modification Column A (You) Column B (Spouse)

(a) West Virginia Teachers’ and

Public Employees’ Retirement .00 .00 Add lines 31 (a) and (b). If that sum is greater than $2000, enter $2000

(b)Federal Retirement Systems

(Title 4 USC §111) .00 .00 31 .00 .00

32 Social Security Benefits You cannot claim this modification if

(a) TOTAL Social Security Benefits. .00 .00 your Federal AGI exceeds

$ 50,000 for SINGLE or MARRIED SEPARATE filers

(b) Benefits exempt for Federal tax $100,000 for MARRIED JOINT filers

purposes .00 .00

(c) Benefits taxable for Federal tax purposes (line a minus line b) ..................................... 32 .00 .00

33 Certain assets held by subchapter S Corporation bank 33 .00 .00

34 Certain Active Duty Military pay (See instructions on page 20)

If not domiciled in WV, complete Part II of Schedule A instead 34 .00 .00

35 Active Military Separation (see instructions on page 20)

Must enclose military orders and discharge papers 35 .00 .00

36 Refunds of state and local income taxes received and reported as income to the IRS 36 .00 .00

37 Contributions to the West Virginia Prepaid Tuition/Savings Plan Trust Funds

Annual Statement must be included ............................................................................... 37 .00 .00

38 Railroad Retirement Board Income received 38 .00 .00

39 Long-Term Care Insurance 39 .00 .00

40 IRC 1341 Repayments 40 .00 .00

41 Autism Modification (instructions on page 21) ................................................................ 41 .00 .00

42 ABLE Act

Annual Statement must be included 42 .00 .00

43 West Virginia Jumpstart Savings Program deposits made (not to exceed $25000)

Annual Statement must be included 43 .00 .00

44 PBGC Modification .....................

(a) retirement benefits that would have been .00 .00 Subtract line 44 (b) from (a)

paid from your employer-provided plan

(b) retirement benefits actually received

from PBGC .00 .00 44 .00 .00

45 Qualified Opportunity Zone business income ................................................................. 45 .00 .00

46 Gambling losses (cannot be greater than your gambling winnings) 46 .00 .00

This line is intentionally left blank Do no use unless directed .00 .00

Continues on next page

*P40202303A*

P40202303A

–3–

|

Enlarge image |

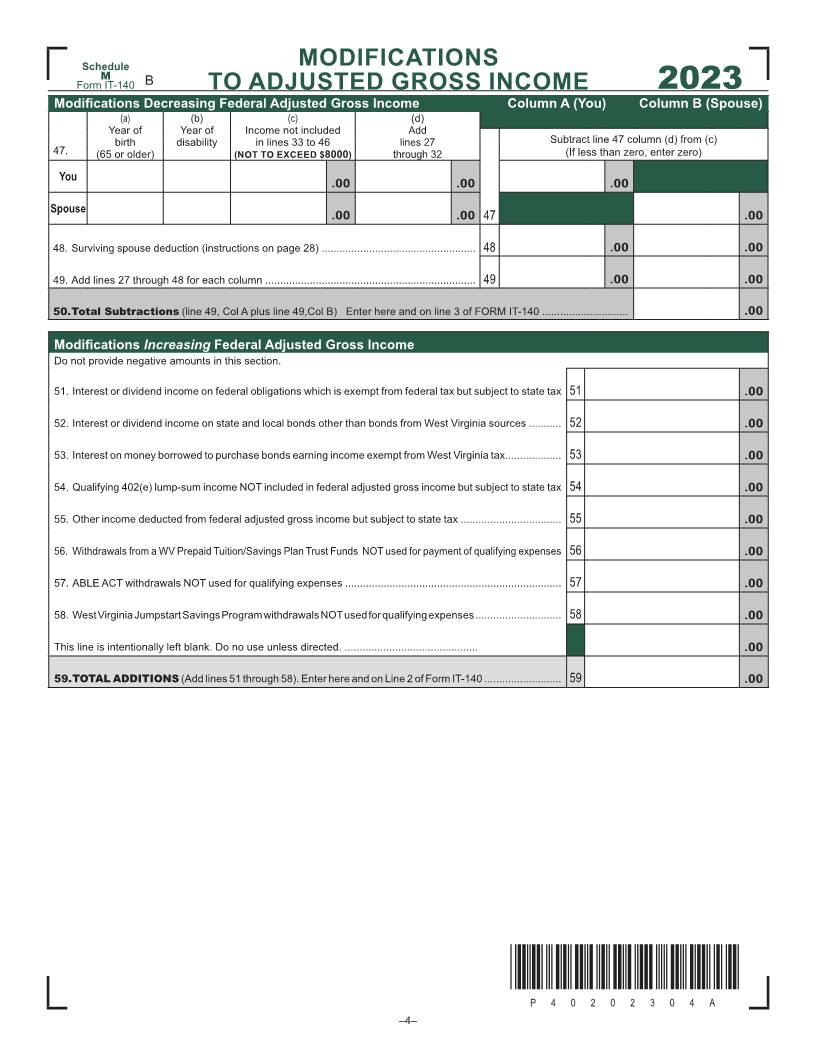

Schedule MODIFICATIONS

M B

Form IT-140 TO ADJUSTED GROSS INCOME 2023

Modifications Decreasing Federal Adjusted Gross Income Column A (You) Column B (Spouse)

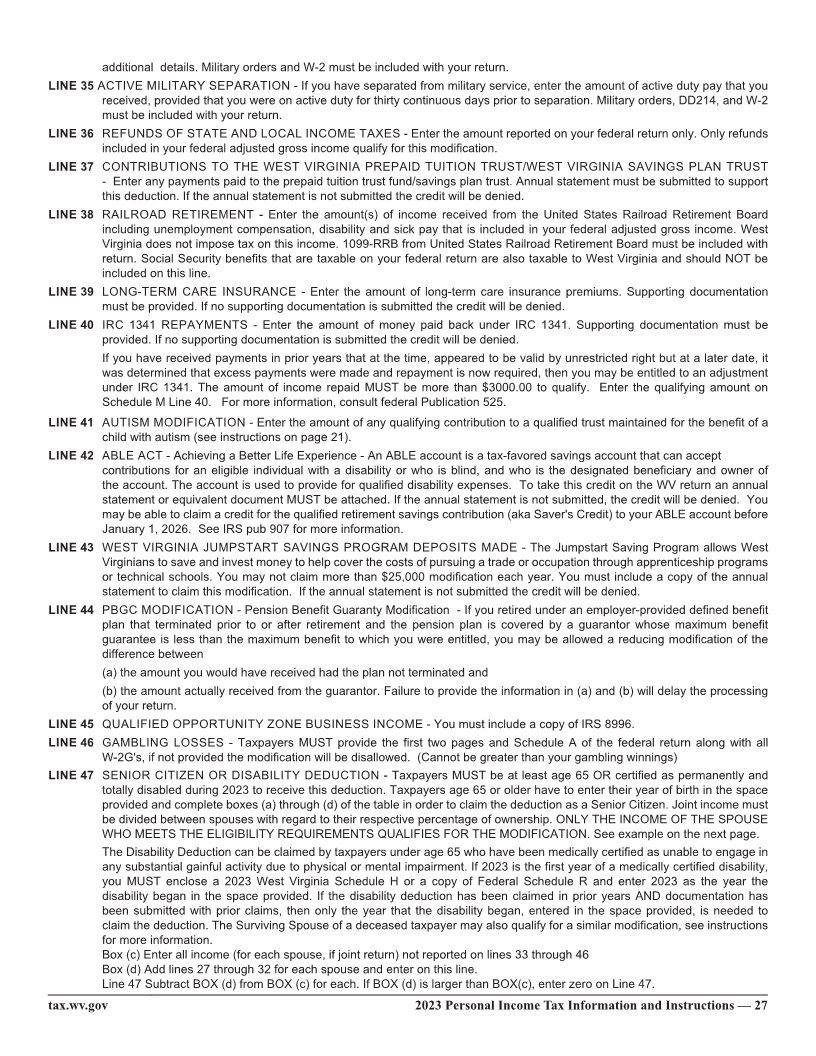

( a) (b) (c) (d)

Year of Year of Income not included Add

birth disability in lines 33 to 46 lines 27 Subtract line 47 column (d) from (c)

47 (65 or older) (NOT TO EXCEED $8000) through 32 (If less than zero, enter zero)

You

.00 .00 .00

Spouse

.00 .00 47 .00

48 Surviving spouse deduction (instructions on page 28) 48 .00 .00

49 Add lines 27 through 48 for each column 49 .00 .00

50. Total Subtractions (line 49, Col A plus line 49,Col B) Enter here and on line 3 of FORM IT-140 .00

Modifications Increasing Federal Adjusted Gross Income

Do not provide negative amounts in this section

51 Interest or dividend income on federal obligations which is exempt from federal tax but subject to state tax 51 .00

52 Interest or dividend income on state and local bonds other than bonds from West Virginia sources 52 .00

53 Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax 53 .00

54 Qualifying 402(e) lump-sum income NOT included in federal adjusted gross income but subject to state tax 54 .00

55 Other income deducted from federal adjusted gross income but subject to state tax 55 .00

56 Withdrawals from a WV Prepaid Tuition/Savings Plan Trust Funds NOT used for payment of qualifying expenses 56 .00

57 ABLE ACT withdrawals NOT used for qualifying expenses 57 .00

58 West Virginia Jumpstart Savings Program withdrawals NOT used for qualifying expenses 58 .00

This line is intentionally left blank Do no use unless directed .00

59. TOTAL ADDITIONS (Add lines 51 through 58) Enter here and on Line 2 of Form IT-140 59 .00

*P40202304A*

P40202304A

–4–

|

Enlarge image |

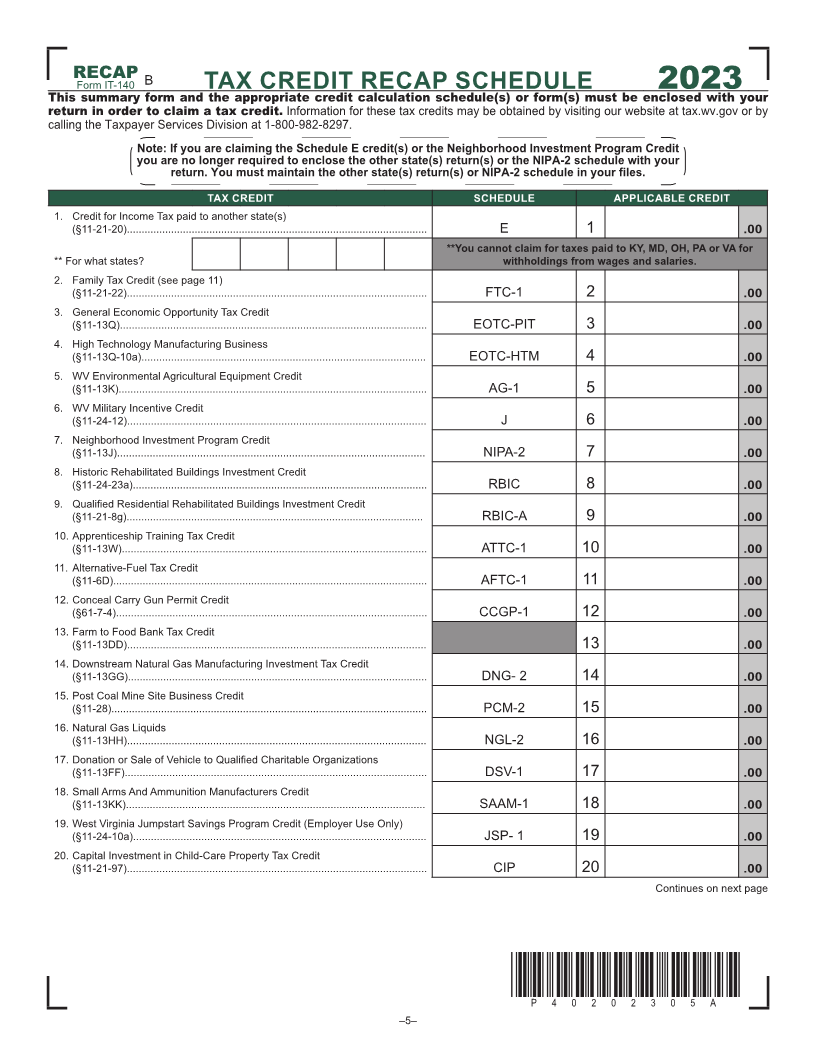

RECAP B

Form IT-140 TAX CREDIT RECAP SCHEDULE 2023

This summary form and the appropriate credit calculation schedule(s) or form(s) must be enclosed with your

return in order to claim a tax credit. Information for these tax credits may be obtained by visiting our website at taxwvgov or by

calling the Taxpayer Services Division at 1-800-982-8297

Note: If you are claiming the Schedule E credit(s) or the Neighborhood Investment Program Credit

you are no longer required to enclose the other state(s) return(s) or the NIPA-2 schedule with your

return. You must maintain the other state(s) return(s) or NIPA-2 schedule in your files.

TAX CREDIT SCHEDULE APPLICABLE CREDIT

1 Credit for Income Tax paid to another state(s)

(§11-21-20) E 1 .00

**You cannot claim for taxes paid to KY, MD, OH, PA or VA for

** For what states? withholdings from wages and salaries.

2 Family Tax Credit (see page 11)

(§11-21-22) FTC-1 2 .00

3 General Economic Opportunity Tax Credit

(§11-13Q) EOTC-PIT 3 .00

4 High Technology Manufacturing Business

(§11-13Q-10a) EOTC-HTM 4 .00

5 WV Environmental Agricultural Equipment Credit

(§11-13K) AG-1 5 .00

6 WV Military Incentive Credit

(§11-24-12) J 6 .00

7 Neighborhood Investment Program Credit

(§11-13J) NIPA-2 7 .00

8 Historic Rehabilitated Buildings Investment Credit

(§11-24-23a) RBIC 8 .00

9 Qualified Residential Rehabilitated Buildings Investment Credit

(§11-21-8g) RBIC-A 9 .00

10 Apprenticeship Training Tax Credit

(§11-13W) ATTC-1 10 .00

11 Alternative-Fuel Tax Credit

(§11-6D) AFTC-1 11 .00

12 Conceal Carry Gun Permit Credit

(§61-7-4) CCGP-1 12 .00

13 Farm to Food Bank Tax Credit

(§11-13DD) 13 .00

14 Downstream Natural Gas Manufacturing Investment Tax Credit

(§11-13GG) DNG- 2 14 .00

15 Post Coal Mine Site Business Credit

(§11-28) PCM-2 15 .00

16 Natural Gas Liquids

(§11-13HH) NGL-2 16 .00

17 Donation or Sale of Vehicle to Qualified Charitable Organizations

(§11-13FF) DSV-1 17 .00

18 Small Arms And Ammunition Manufacturers Credit

(§11-13KK) SAAM-1 18 .00

19 West Virginia Jumpstart Savings Program Credit (Employer Use Only)

(§11-24-10a) JSP- 1 19 .00

20 Capital Investment in Child-Care Property Tax Credit

(§11-21-97) CIP 20 .00

Continues on next page

*P40202305A*

P40202305A

–5–

|

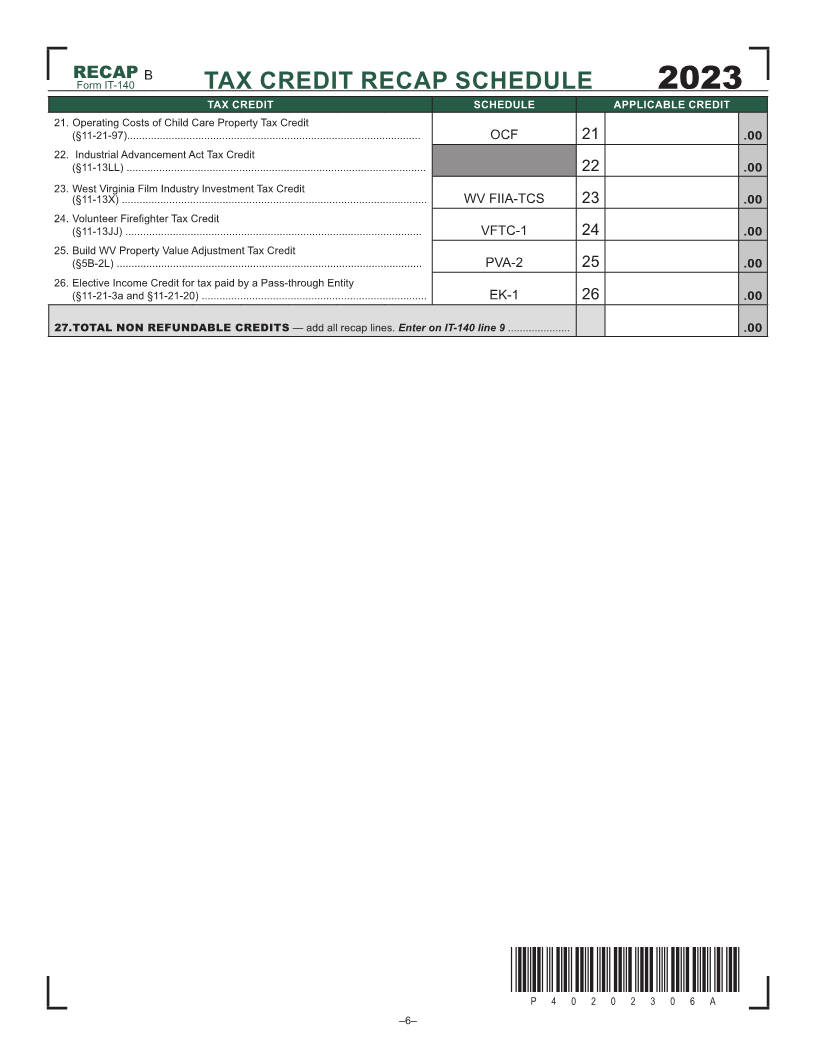

Enlarge image |

RECAP B

Form IT-140 TAX CREDIT RECAP SCHEDULE 2023

TAX CREDIT SCHEDULE APPLICABLE CREDIT

21 Operating Costs of Child Care Property Tax Credit

(§11-21-97) OCF 21 .00

22 Industrial Advancement Act Tax Credit

(§11-13LL) 22 .00

23 West Virginia Film Industry Investment Tax Credit

(§11-13X) WV FIIA-TCS 23 .00

24 Volunteer Firefighter Tax Credit

(§11-13JJ) VFTC-1 24 .00

25 Build WV Property Value Adjustment Tax Credit

(§5B-2L) PVA-2 25 .00

26 Elective Income Credit for tax paid by a Pass-through Entity

(§11-21-3a and §11-21-20) EK-1 26 .00

27. TOTAL NON REFUNDABLE CREDITS — add all recap lines Enter on IT-140 line 9 .00

*P40202306A*

P40202306A

–6–

|

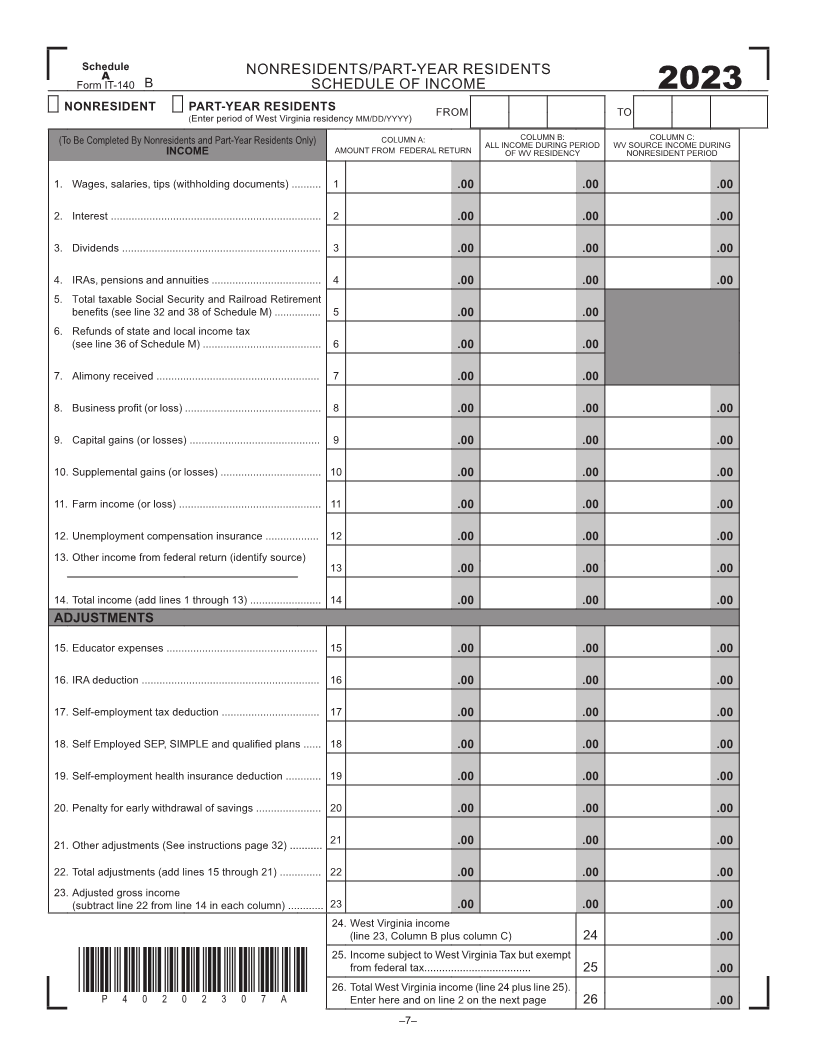

Enlarge image |

Schedule NONRESIDENTS/PART-YEAR RESIDENTS

A

Form IT-140 B SCHEDULE OF INCOME 2023

NONRESIDENT PART-YEAR RESIDENTS FROM TO

(Enter period of West Virginia residency MM/DD/YYYY)

(To Be Completed By Nonresidents and Part-Year Residents Only) COLUMN A: COLUMN B: COLUMN C:

INCOME AMOUNT FROM FEDERAL RETURN ALL INCOME DURING PERIOD WV SOURCE INCOME DURING

OF WV RESIDENCY NONRESIDENT PERIOD

1 Wages, salaries, tips (withholding documents) 1 .00 .00 .00

2 Interest 2 .00 .00 .00

3 Dividends 3 .00 .00 .00

4 IRAs, pensions and annuities 4 .00 .00 .00

5 Total taxable Social Security and Railroad Retirement

benefits (see line 32 and 38 of Schedule M) ................ 5 .00 .00

6 Refunds of state and local income tax

(see line 36 of Schedule M) 6 .00 .00

7 Alimony received 7 .00 .00

8 Business profit (or loss) .............................................. 8 .00 .00 .00

9 Capital gains (or losses) 9 .00 .00 .00

10 Supplemental gains (or losses) 10 .00 .00 .00

11 Farm income (or loss) 11 .00 .00 .00

12 Unemployment compensation insurance 12 .00 .00 .00

13 Other income from federal return (identify source)

13 .00 .00 .00

14 Total income (add lines 1 through 13) 14 .00 .00 .00

ADJUSTMENTS

15 Educator expenses 15 .00 .00 .00

16 IRA deduction 16 .00 .00 .00

17 Self-employment tax deduction 17 .00 .00 .00

18 Self Employed SEP, SIMPLE and qualified plans ...... 18 .00 .00 .00

19 Self-employment health insurance deduction 19 .00 .00 .00

20 Penalty for early withdrawal of savings 20 .00 .00 .00

21 Other adjustments (See instructions page 32) 21 .00 .00 .00

22 Total adjustments (add lines 15 through 21) 22 .00 .00 .00

23 Adjusted gross income

(subtract line 22 from line 14 in each column) 23 .00 .00 .00

24 West Virginia income

(line 23, Column B plus column C) 24 .00

25 Income subject to West Virginia Tax but exempt

from federal tax 25 .00

*P40202307A* 26 Total West Virginia income (line 24 plus line 25)

P40202307A Enter here and on line 2 on the next page 26 .00

–7–

|

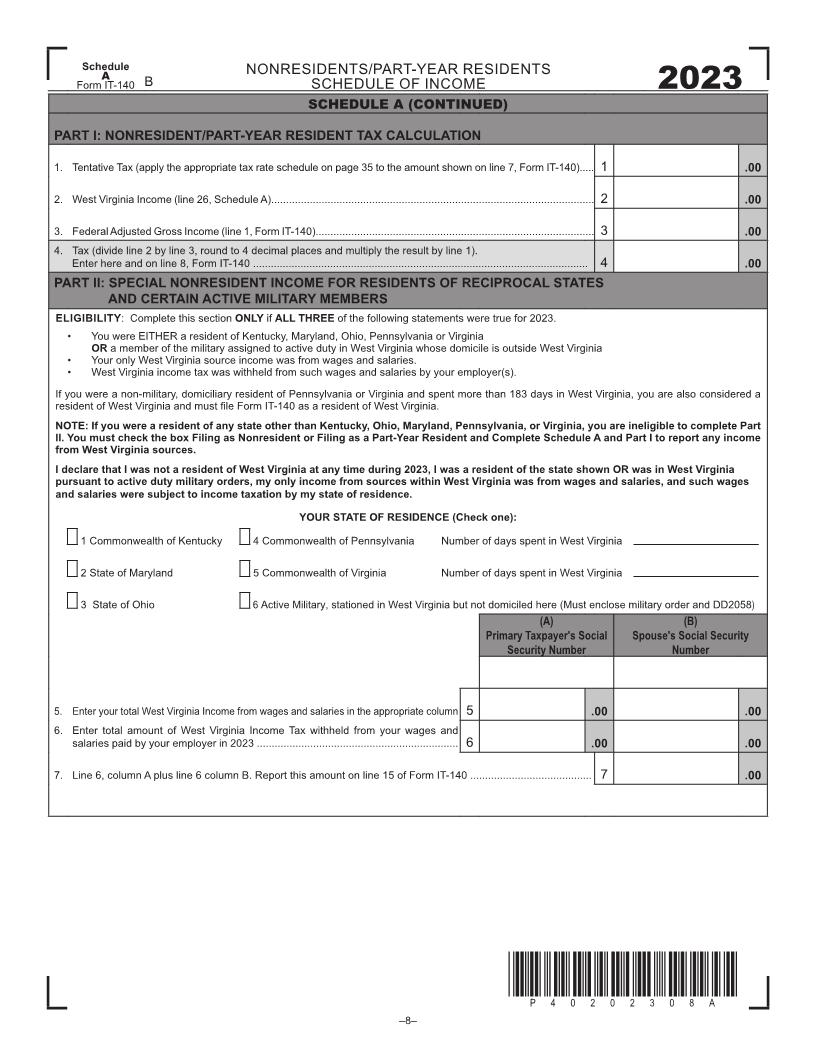

Enlarge image |

Schedule NONRESIDENTS/PART-YEAR RESIDENTS

A

Form IT-140 B SCHEDULE OF INCOME 2023

SCHEDULE A (CONTINUED)

PART I: NONRESIDENT/PART-YEAR RESIDENT TAX CALCULATION

1 Tentative Tax (apply the appropriate tax rate schedule on page 35 to the amount shown on line 7, Form IT-140) 1 .00

2 West Virginia Income (line 26, Schedule A) 2 .00

3 Federal Adjusted Gross Income (line 1, Form IT-140) 3 .00

4 Tax (divide line 2 by line 3, round to 4 decimal places and multiply the result by line 1)

Enter here and on line 8, Form IT-140 4 .00

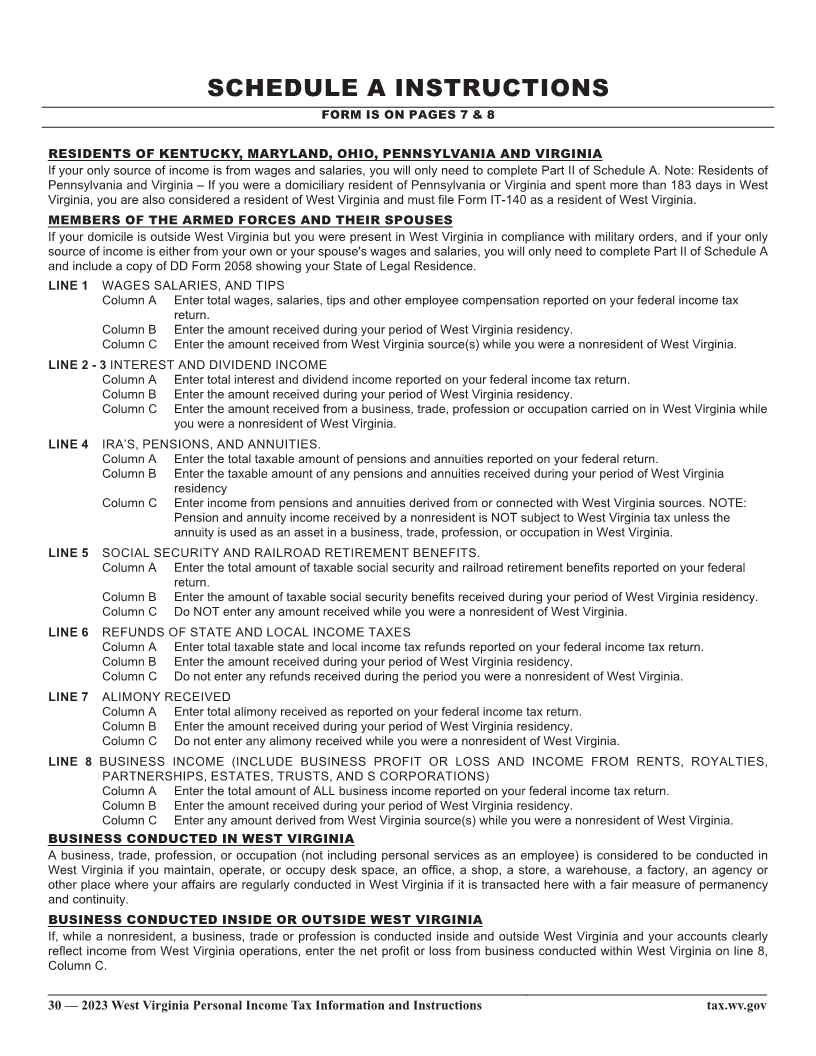

PART II: SPECIAL NONRESIDENT INCOME FOR RESIDENTS OF RECIPROCAL STATES

AND CERTAIN ACTIVE MILITARY MEMBERS

ELIGIBILITY: Complete this section ONLY if ALL THREE of the following statements were true for 2023

• You were EITHER a resident of Kentucky, Maryland, Ohio, Pennsylvania or Virginia

OR a member of the military assigned to active duty in West Virginia whose domicile is outside West Virginia

• Your only West Virginia source income was from wages and salaries

• West Virginia income tax was withheld from such wages and salaries by your employer(s)

If you were a non-military, domiciliary resident of Pennsylvania or Virginia and spent more than 183 days in West Virginia, you are also considered a

resident of West Virginia and must file Form IT-140 as a resident of West Virginia.

NOTE: If you were a resident of any state other than Kentucky, Ohio, Maryland, Pennsylvania, or Virginia, you are ineligible to complete Part

II. You must check the box Filing as Nonresident or Filing as a Part-Year Resident and Complete Schedule A and Part I to report any income

from West Virginia sources.

I declare that I was not a resident of West Virginia at any time during 2023, I was a resident of the state shown OR was in West Virginia

pursuant to active duty military orders, my only income from sources within West Virginia was from wages and salaries, and such wages

and salaries were subject to income taxation by my state of residence.

YOUR STATE OF RESIDENCE (Check one):

1 Commonwealth of Kentucky 4 Commonwealth of Pennsylvania Number of days spent in West Virginia

2 State of Maryland 5 Commonwealth of Virginia Number of days spent in West Virginia

3 State of Ohio 6 Active Military, stationed in West Virginia but not domiciled here (Must enclose military order and DD2058)

(A) (B)

Primary Taxpayer's Social Spouse's Social Security

Security Number Number

5 Enter your total West Virginia Income from wages and salaries in the appropriate column 5 .00 .00

6 Enter total amount of West Virginia Income Tax withheld from your wages and

salaries paid by your employer in 2023 6 .00 .00

7 Line 6, column A plus line 6 column B Report this amount on line 15 of Form IT-140 7 .00

*P40202308A*

P40202308A

–8–

|

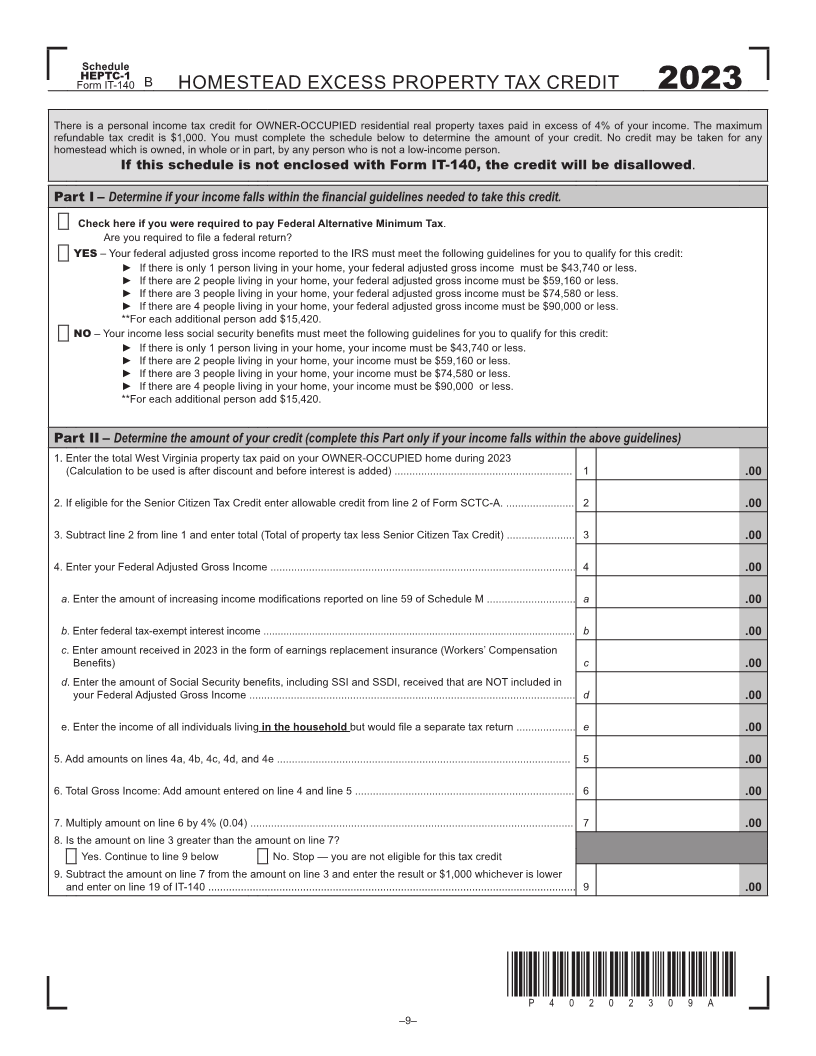

Enlarge image |

Schedule

HEPTC-1

Form IT-140 B HOMESTEAD EXCESS PROPERTY TAX CREDIT 2023

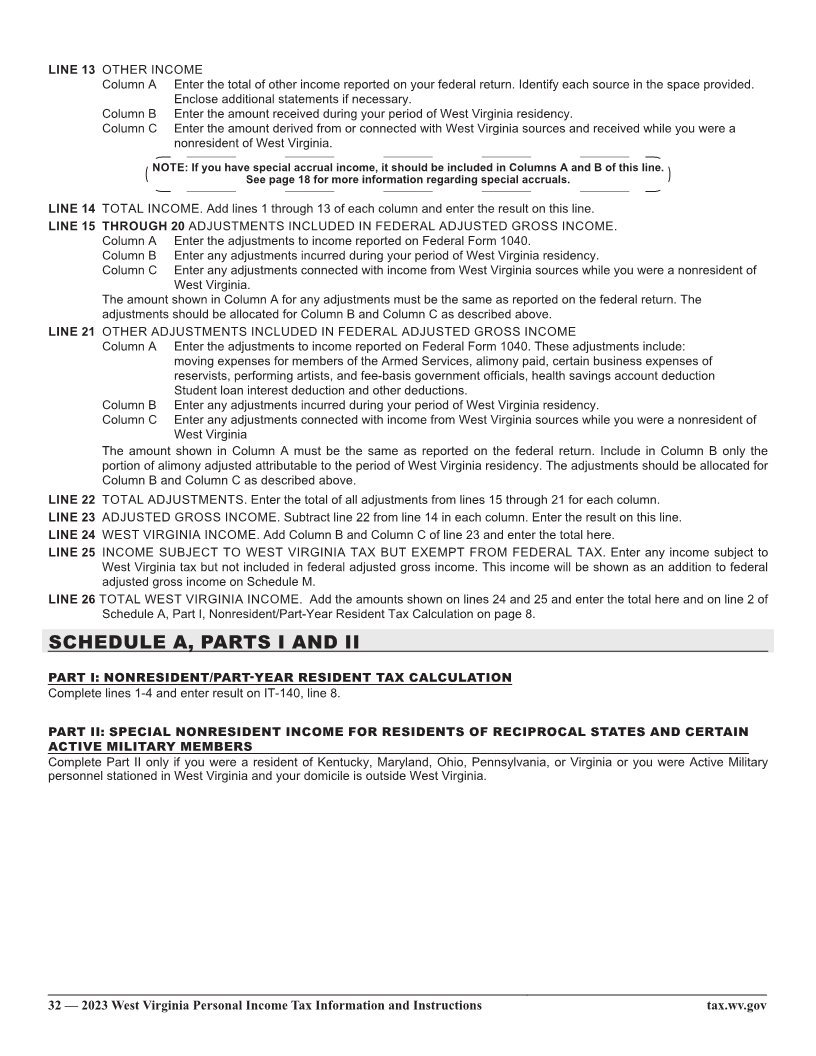

There is a personal income tax credit for OWNER-OCCUPIED residential real property taxes paid in excess of 4% of your income The maximum

refundable tax credit is $1,000 You must complete the schedule below to determine the amount of your credit No credit may be taken for any

homestead which is owned, in whole or in part, by any person who is not a low-income person

If this schedule is not enclosed with Form IT-140, the credit will be disallowed

Part I – Determine if your income falls within the financial guidelines needed to take this credit.

Check here if you were required to pay Federal Alternative Minimum Tax

Are you required to file a federal return?

YES – Your federal adjusted gross income reported to the IRS must meet the following guidelines for you to qualify for this credit:

► If there is only 1 person living in your home, your federal adjusted gross income must be $43,740 or less

► If there are 2 people living in your home, your federal adjusted gross income must be $59,160 or less

► If there are 3 people living in your home, your federal adjusted gross income must be $74,580 or less

► If there are 4 people living in your home, your federal adjusted gross income must be $90,000 or less

**For each additional person add $15,420

NO – Your income less social security benefits must meet the following guidelines for you to qualify for this credit:

► If there is only 1 person living in your home, your income must be $43,740 or less

► If there are 2 people living in your home, your income must be $59,160 or less

► If there are 3 people living in your home, your income must be $74,580 or less

► If there are 4 people living in your home, your income must be $90,000 or less

**For each additional person add $15,420

Part II – Determine the amount of your credit (complete this Part only if your income falls within the above guidelines)

1 Enter the total West Virginia property tax paid on your OWNER-OCCUPIED home during 2023

(Calculation to be used is after discount and before interest is added) 1 .00

2 If eligible for the Senior Citizen Tax Credit enter allowable credit from line 2 of Form SCTC-A 2 .00

3 Subtract line 2 from line 1 and enter total (Total of property tax less Senior Citizen Tax Credit) 3 .00

4 Enter your Federal Adjusted Gross Income 4 .00

a. Enter the amount of increasing income modifications reported on line 59 of Schedule M .............................. a .00

b Enter federal tax-exempt interest income b .00

c Enter amount received in 2023 in the form of earnings replacement insurance (Workers’ Compensation

Benefits) c .00

d. Enter the amount of Social Security benefits, including SSI and SSDI, received that are NOT included in

your Federal Adjusted Gross Income d .00

e Enter the income of all individuals living in the household but would file a separate tax return .................... e .00

5 Add amounts on lines 4a, 4b, 4c, 4d, and 4e 5 .00

6 Total Gross Income: Add amount entered on line 4 and line 5 6 .00

7 Multiply amount on line 6 by 4% (004) 7 .00

8 Is the amount on line 3 greater than the amount on line 7?

Yes Continue to line 9 below No Stop — you are not eligible for this tax credit

9 Subtract the amount on line 7 from the amount on line 3 and enter the result or $1,000 whichever is lower

and enter on line 19 of IT-140 9 .00

*P40202309A*

P40202309A

–9–

|

Enlarge image | THIS PAGE INTENTIONALLY LEFT BLANK. –10– |

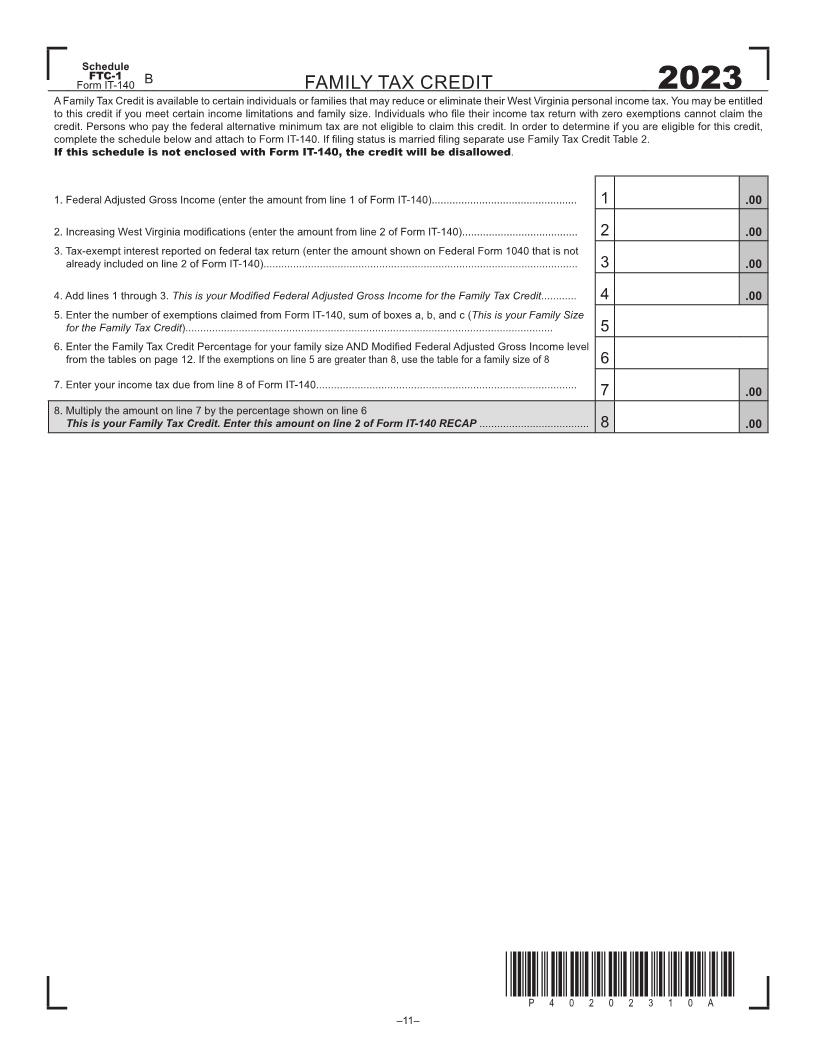

Enlarge image |

Schedule

FTC-1 B

Form IT-140 FAMILY TAX CREDIT 2023

A Family Tax Credit is available to certain individuals or families that may reduce or eliminate their West Virginia personal income tax You may be entitled

to this credit if you meet certain income limitations and family size. Individuals who file their income tax return with zero exemptions cannot claim the

credit Persons who pay the federal alternative minimum tax are not eligible to claim this credit In order to determine if you are eligible for this credit,

complete the schedule below and attach to Form IT-140. If filing status is married filing separate use Family Tax Credit Table 2.

If this schedule is not enclosed with Form IT-140, the credit will be disallowed

1 Federal Adjusted Gross Income (enter the amount from line 1 of Form IT-140) 1 .00

2. Increasing West Virginia modifications (enter the amount from line 2 of Form IT-140)....................................... 2 .00

3 Tax-exempt interest reported on federal tax return (enter the amount shown on Federal Form 1040 that is not

already included on line 2 of Form IT-140) 3 .00

4 Add lines 1 through 3 This is your Modified Federal Adjusted Gross Income for the Family Tax Credit 4 .00

5 Enter the number of exemptions claimed from Form IT-140, sum of boxes a, b, and c (This is your Family Size

for the Family Tax Credit) 5

6. Enter the Family Tax Credit Percentage for your family size AND Modified Federal Adjusted Gross Income level

from the tables on page 12 If the exemptions on line 5 are greater than 8, use the table for a family size of 8 6

7 Enter your income tax due from line 8 of Form IT-140

7 .00

8 Multiply the amount on line 7 by the percentage shown on line 6

This is your Family Tax Credit. Enter this amount on line 2 of Form IT-140 RECAP 8 .00

*P40202310A*

P40202310A

–11–

|

Enlarge image |

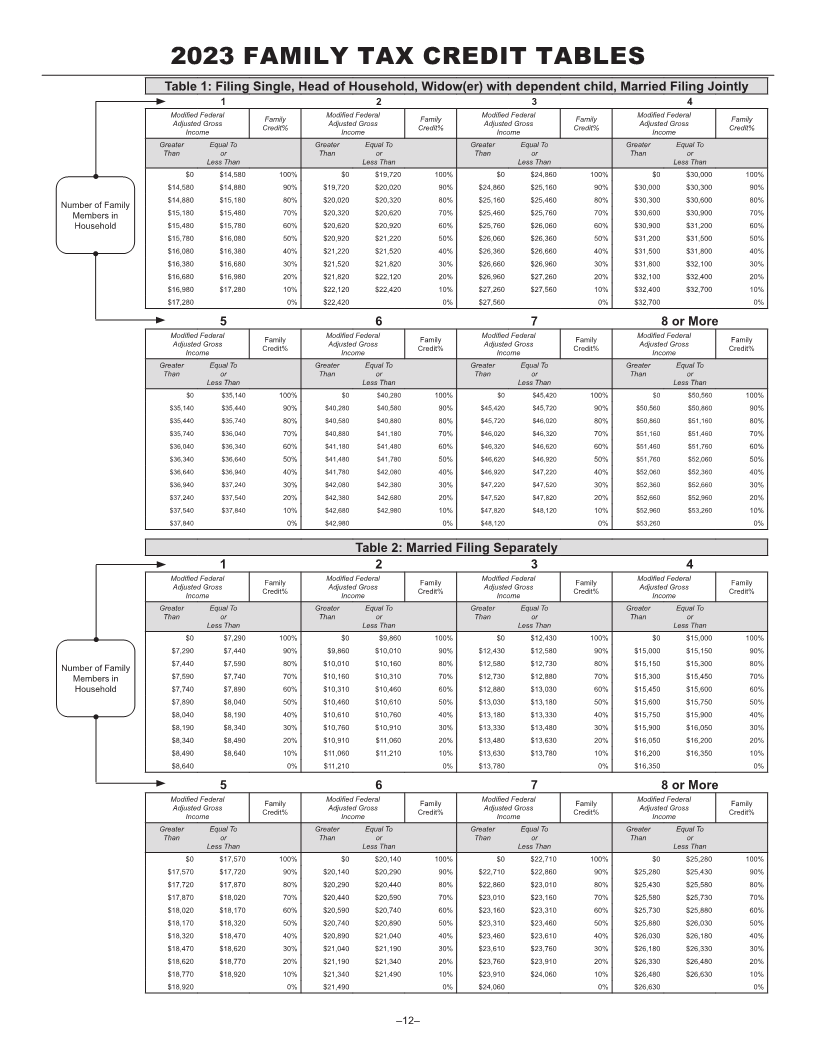

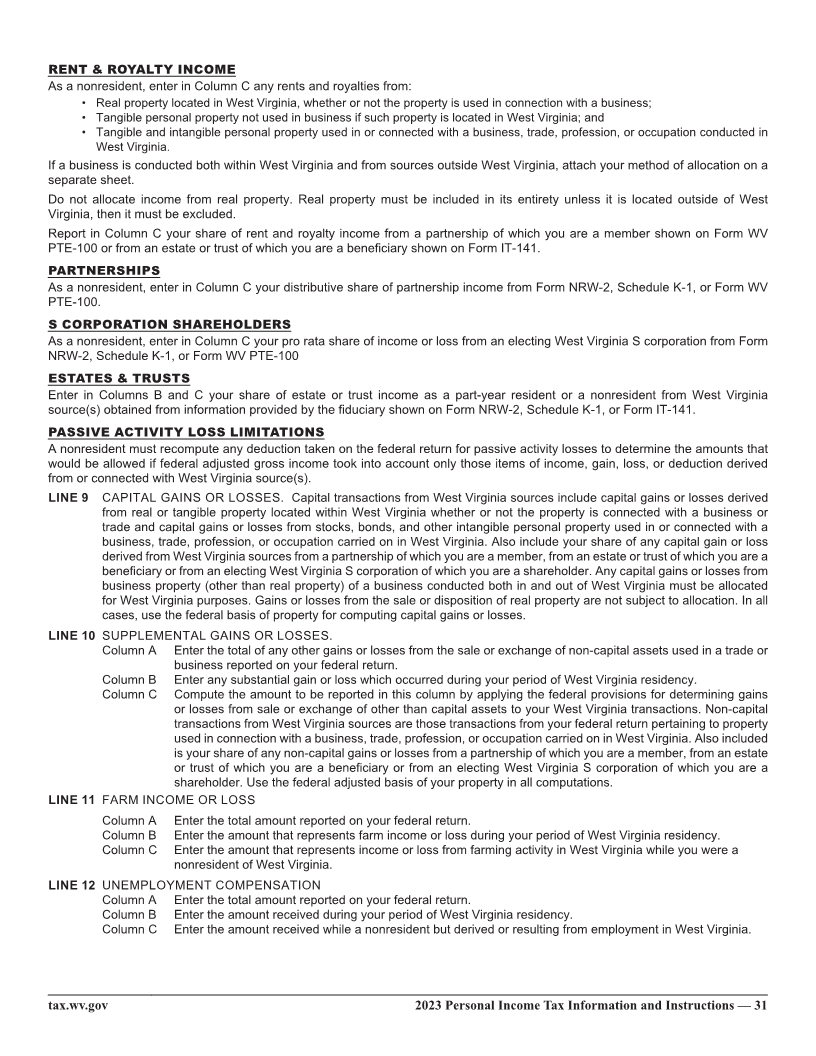

2023 FAMILY TAX CREDIT TABLES

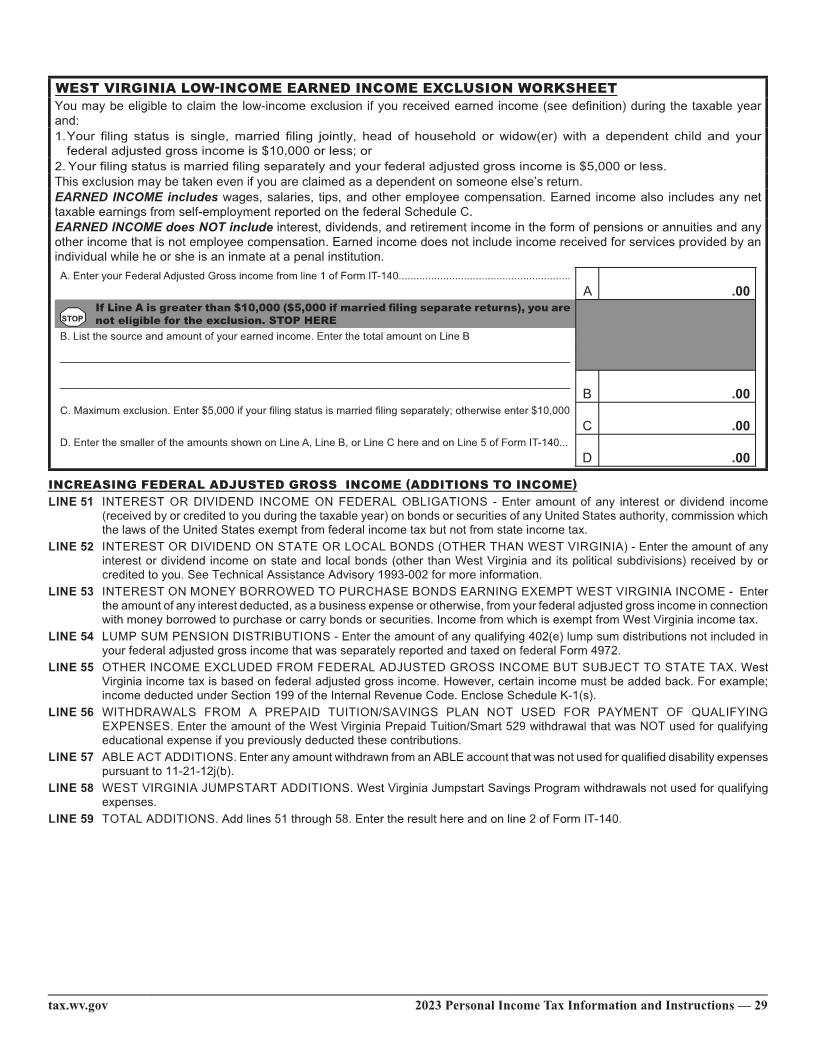

Table 1: Filing Single, Head of Household, Widow(er) with dependent child, Married Filing Jointly

1 2 3 4

ModifiedFamilyModifiedFamilyModifiedFamilyModifiedFamily FederalFederalFederalFederal

AdjustedCredit%AdjustedCredit%AdjustedCredit%AdjustedCredit% GrossGrossGrossGross

Income Income Income Income

GreaterEqual To GreaterEqual To GreaterEqual To GreaterEqual To

Than or Than or Than or Than or

Less Than Less Than Less Than Less Than

$0 $14,580 100% $0 $19,720 100% $0 $24,860 100% $0 $30,000 100%

$14,580 $14,880 90% $19,720 $20,020 90% $24,860 $25,160 90% $30,000 $30,300 90%

Number of Family $14,880 $15,180 80% $20,020 $20,320 80% $25,160 $25,460 80% $30,300 $30,600 80%

Members in $15,180 $15,480 70% $20,320 $20,620 70% $25,460 $25,760 70% $30,600 $30,900 70%

Household $15,480 $15,780 60% $20,620 $20,920 60% $25,760 $26,060 60% $30,900 $31,200 60%

$15,780 $16,080 50% $20,920 $21,220 50% $26,060 $26,360 50% $31,200 $31,500 50%

$16,080 $16,380 40% $21,220 $21,520 40% $26,360 $26,660 40% $31,500 $31,800 40%

$16,380 $16,680 30% $21,520 $21,820 30% $26,660 $26,960 30% $31,800 $32,100 30%

$16,680 $16,980 20% $21,820 $22,120 20% $26,960 $27,260 20% $32,100 $32,400 20%

$16,980 $17,280 10% $22,120 $22,420 10% $27,260 $27,560 10% $32,400 $32,700 10%

$17,280 0% $22,420 0% $27,560 0% $32,700 0%

5 6 7 8 or More

ModifiedFamily ModifiedFamily ModifiedFamily ModifiedFamily FederalFederalFederalFederal

AdjustedCredit% AdjustedCredit% AdjustedCredit% AdjustedCredit% GrossGrossGrossGross

Income Income Income Income

GreaterEqual To GreaterEqual To GreaterEqual To GreaterEqual To

Than or Than or Than or Than or

Less Than Less Than Less Than Less Than

$0 $35,140 100% $0 $40,280 100% $0 $45,420 100% $0 $50,560 100%

$35,140 $35,440 90% $40,280 $40,580 90% $45,420 $45,720 90% $50,560 $50,860 90%

$35,440 $35,740 80% $40,580 $40,880 80% $45,720 $46,020 80% $50,860 $51,160 80%

$35,740 $36,040 70% $40,880 $41,180 70% $46,020 $46,320 70% $51,160 $51,460 70%

$36,040 $36,340 60% $41,180 $41,480 60% $46,320 $46,620 60% $51,460 $51,760 60%

$36,340 $36,640 50% $41,480 $41,780 50% $46,620 $46,920 50% $51,760 $52,060 50%

$36,640 $36,940 40% $41,780 $42,080 40% $46,920 $47,220 40% $52,060 $52,360 40%

$36,940 $37,240 30% $42,080 $42,380 30% $47,220 $47,520 30% $52,360 $52,660 30%

$37,240 $37,540 20% $42,380 $42,680 20% $47,520 $47,820 20% $52,660 $52,960 20%

$37,540 $37,840 10% $42,680 $42,980 10% $47,820 $48,120 10% $52,960 $53,260 10%

$37,840 0% $42,980 0% $48,120 0% $53,260 0%

Table 2: Married Filing Separately

1 2 3 4

ModifiedFamily ModifiedFamily ModifiedFamily ModifiedFamily FederalFederalFederalFederal

AdjustedCredit% AdjustedCredit% AdjustedCredit% AdjustedCredit% GrossGrossGrossGross

Income Income Income Income

GreaterEqual To GreaterEqual To GreaterEqual To GreaterEqual To

Than or Than or Than or Than or

Less Than Less Than Less Than Less Than

$0 $7,290 100% $0 $9,860 100% $0 $12,430 100% $0 $15,000 100%

$7,290 $7,440 90% $9,860 $10,010 90% $12,430 $12,580 90% $15,000 $15,150 90%

Number of Family $7,440 $7,590 80% $10,010 $10,160 80% $12,580 $12,730 80% $15,150 $15,300 80%

Members in $7,590 $7,740 70% $10,160 $10,310 70% $12,730 $12,880 70% $15,300 $15,450 70%

Household $7,740 $7,890 60% $10,310 $10,460 60% $12,880 $13,030 60% $15,450 $15,600 60%

$7,890 $8,040 50% $10,460 $10,610 50% $13,030 $13,180 50% $15,600 $15,750 50%

$8,040 $8,190 40% $10,610 $10,760 40% $13,180 $13,330 40% $15,750 $15,900 40%

$8,190 $8,340 30% $10,760 $10,910 30% $13,330 $13,480 30% $15,900 $16,050 30%

$8,340 $8,490 20% $10,910 $11,060 20% $13,480 $13,630 20% $16,050 $16,200 20%

$8,490 $8,640 10% $11,060 $11,210 10% $13,630 $13,780 10% $16,200 $16,350 10%

$8,640 0% $11,210 0% $13,780 0% $16,350 0%

5 6 7 8 or More

ModifiedFamily ModifiedFamily ModifiedFamily ModifiedFamily FederalFederalFederalFederal

AdjustedCredit% AdjustedCredit% AdjustedCredit% AdjustedCredit% GrossGrossGrossGross

Income Income Income Income

GreaterEqual To GreaterEqual To GreaterEqual To GreaterEqual To

Than or Than or Than or Than or

Less Than Less Than Less Than Less Than

$0 $17,570 100% $0 $20,140 100% $0 $22,710 100% $0 $25,280 100%

$17,570 $17,720 90% $20,140 $20,290 90% $22,710 $22,860 90% $25,280 $25,430 90%

$17,720 $17,870 80% $20,290 $20,440 80% $22,860 $23,010 80% $25,430 $25,580 80%

$17,870 $18,020 70% $20,440 $20,590 70% $23,010 $23,160 70% $25,580 $25,730 70%

$18,020 $18,170 60% $20,590 $20,740 60% $23,160 $23,310 60% $25,730 $25,880 60%

$18,170 $18,320 50% $20,740 $20,890 50% $23,310 $23,460 50% $25,880 $26,030 50%

$18,320 $18,470 40% $20,890 $21,040 40% $23,460 $23,610 40% $26,030 $26,180 40%

$18,470 $18,620 30% $21,040 $21,190 30% $23,610 $23,760 30% $26,180 $26,330 30%

$18,620 $18,770 20% $21,190 $21,340 20% $23,760 $23,910 20% $26,330 $26,480 20%

$18,770 $18,920 10% $21,340 $21,490 10% $23,910 $24,060 10% $26,480 $26,630 10%

$18,920 0% $21,490 0% $24,060 0% $26,630 0%

–12–

|

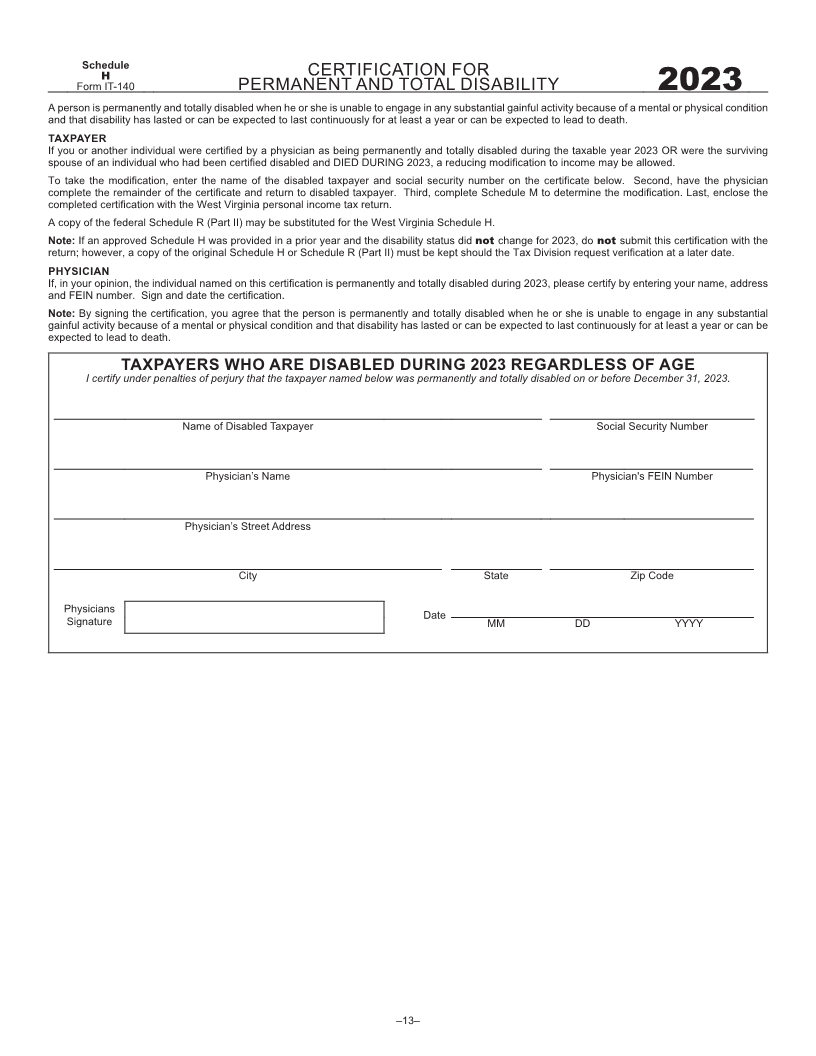

Enlarge image |

Schedule

H CERTIFICATION FOR

Form IT-140 PERMANENT AND TOTAL DISABILITY 2023

A person is permanently and totally disabled when he or she is unable to engage in any substantial gainful activity because of a mental or physical condition

and that disability has lasted or can be expected to last continuously for at least a year or can be expected to lead to death

TAXPAYER

If you or another individual were certified by a physician as being permanently and totally disabled during the taxable year 2023 OR were the surviving

spouse of an individual who had been certified disabled and DIED DURING 2023, a reducing modification to income may be allowed

To take the modification, enter the name of the disabled taxpayer and social security number on the certificate below Second, have the physician

complete the remainder of the certificate and return to disabled taxpayer Third, complete Schedule M to determine the modification Last, enclose the

completed certification with the West Virginia personal income tax return

A copy of the federal Schedule R (Part II) may be substituted for the West Virginia Schedule H

Note: If an approved Schedule H was provided in a prior year and the disability status did not change for 2023, do not submit this certification with the

return; however, a copy of the original Schedule H or Schedule R (Part II) must be kept should the Tax Division request verification at a later date

PHYSICIAN

If, in your opinion, the individual named on this certification is permanently and totally disabled during 2023, please certify by entering your name, address

and FEIN number Sign and date the certification

Note: By signing the certification, you agree that the person is permanently and totally disabled when he or she is unable to engage in any substantial

gainful activity because of a mental or physical condition and that disability has lasted or can be expected to last continuously for at least a year or can be

expected to lead to death

TAXPAYERS WHO ARE DISABLED DURING 2023 REGARDLESS OF AGE

I certify under penalties of perjury that the taxpayer named below was permanently and totally disabled on or before December 31, 2023.

Name of Disabled Taxpayer Social Security Number

Physician’s Name Physician's FEIN Number

Physician’s Street Address

City State Zip Code

Physicians Date

Signature MM DD YYYY

–13–

|

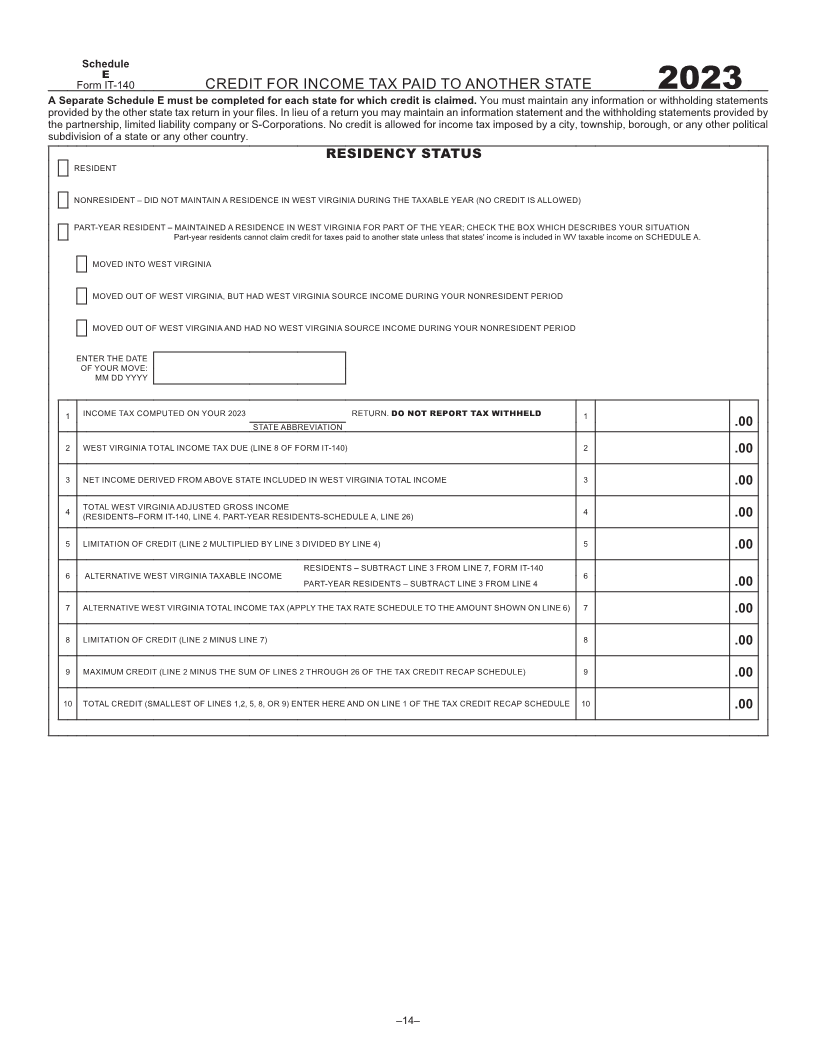

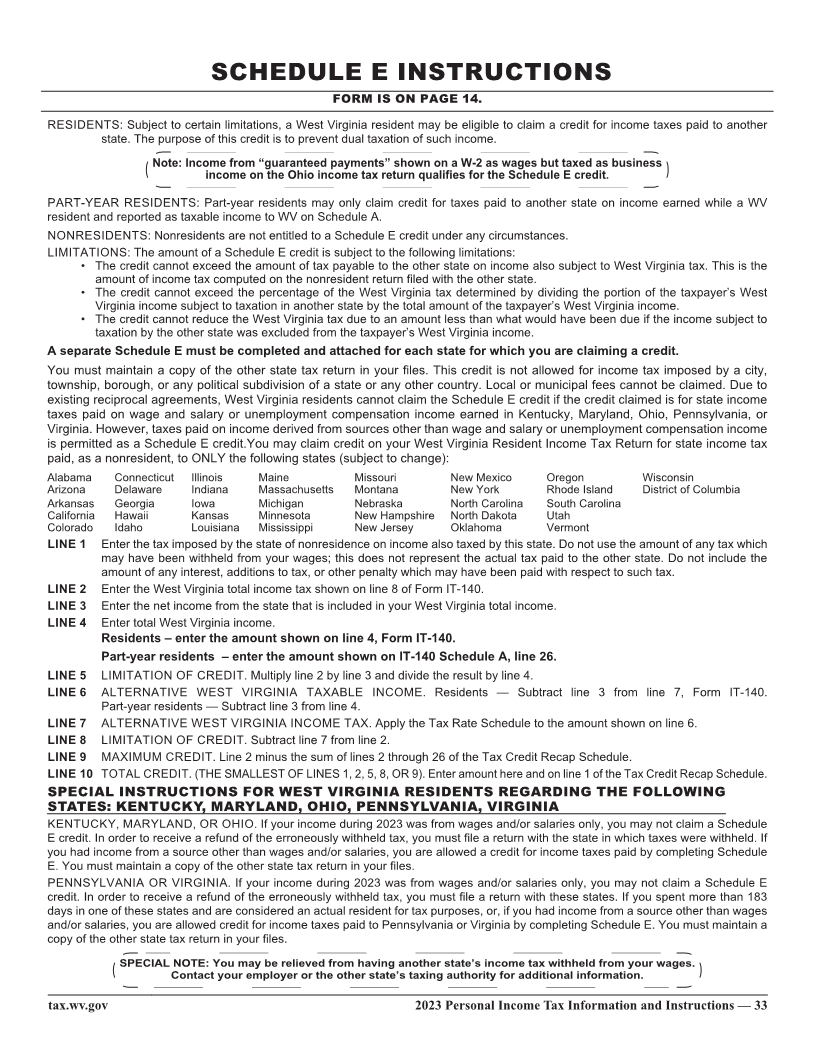

Enlarge image |

Schedule

E

Form IT-140 CREDIT FOR INCOME TAX PAID TO ANOTHER STATE 2023

A Separate Schedule E must be completed for each state for which credit is claimed. You must maintain any information or withholding statements

provided by the other state tax return in your files In lieu of a return you may maintain an information statement and the withholding statements provided by

the partnership, limited liability company or S-Corporations No credit is allowed for income tax imposed by a city, township, borough, or any other political

subdivision of a state or any other country

RESIDENCY STATUS

RESIDENT

NONRESIDENT – DID NOT MAINTAIN A RESIDENCE IN WEST VIRGINIA DURING THE TAXABLE YEAR (NO CREDIT IS ALLOWED)

PART-YEAR RESIDENT – MAINTAINED A RESIDENCE IN WEST VIRGINIA FOR PART OF THE YEAR; CHECK THE BOX WHICH DESCRIBES YOUR SITUATION

Part-year residents cannot claim credit for taxes paid to another state unless that states' income is included in WV taxable income on SCHEDULE A

MOVED INTO WEST VIRGINIA

MOVED OUT OF WEST VIRGINIA, BUT HAD WEST VIRGINIA SOURCE INCOME DURING YOUR NONRESIDENT PERIOD

MOVED OUT OF WEST VIRGINIA AND HAD NO WEST VIRGINIA SOURCE INCOME DURING YOUR NONRESIDENT PERIOD

ENTER THE DATE

OF YOUR MOVE:

MM DD YYYY

1 INCOME TAX COMPUTED ON YOUR 2023 RETURN DO NOT REPORT TAX WITHHELD 1

STATE ABBREVIATION .00

2 WEST VIRGINIA TOTAL INCOME TAX DUE (LINE 8 OF FORM IT-140) 2 .00

3 NET INCOME DERIVED FROM ABOVE STATE INCLUDED IN WEST VIRGINIA TOTAL INCOME 3 .00

4 TOTAL WEST VIRGINIA ADJUSTED GROSS INCOME 4 .00

(RESIDENTS–FORM IT-140, LINE 4 PART-YEAR RESIDENTS-SCHEDULE A, LINE 26)

5 LIMITATION OF CREDIT (LINE 2 MULTIPLIED BY LINE 3 DIVIDED BY LINE 4) 5 .00

RESIDENTS – SUBTRACT LINE 3 FROM LINE 7, FORM IT-140

6 ALTERNATIVE WEST VIRGINIA TAXABLE INCOME 6

PART-YEAR RESIDENTS – SUBTRACT LINE 3 FROM LINE 4 .00

7 ALTERNATIVE WEST VIRGINIA TOTAL INCOME TAX (APPLY THE TAX RATE SCHEDULE TO THE AMOUNT SHOWN ON LINE 6) 7 .00

8 LIMITATION OF CREDIT (LINE 2 MINUS LINE 7) 8 .00

9 MAXIMUM CREDIT (LINE 2 MINUS THE SUM OF LINES 2 THROUGH 26 OF THE TAX CREDIT RECAP SCHEDULE) 9 .00

10 TOTAL CREDIT (SMALLEST OF LINES 1,2, 5, 8, OR 9) ENTER HERE AND ON LINE 1 OF THE TAX CREDIT RECAP SCHEDULE 10 .00

–14–

|

Enlarge image |

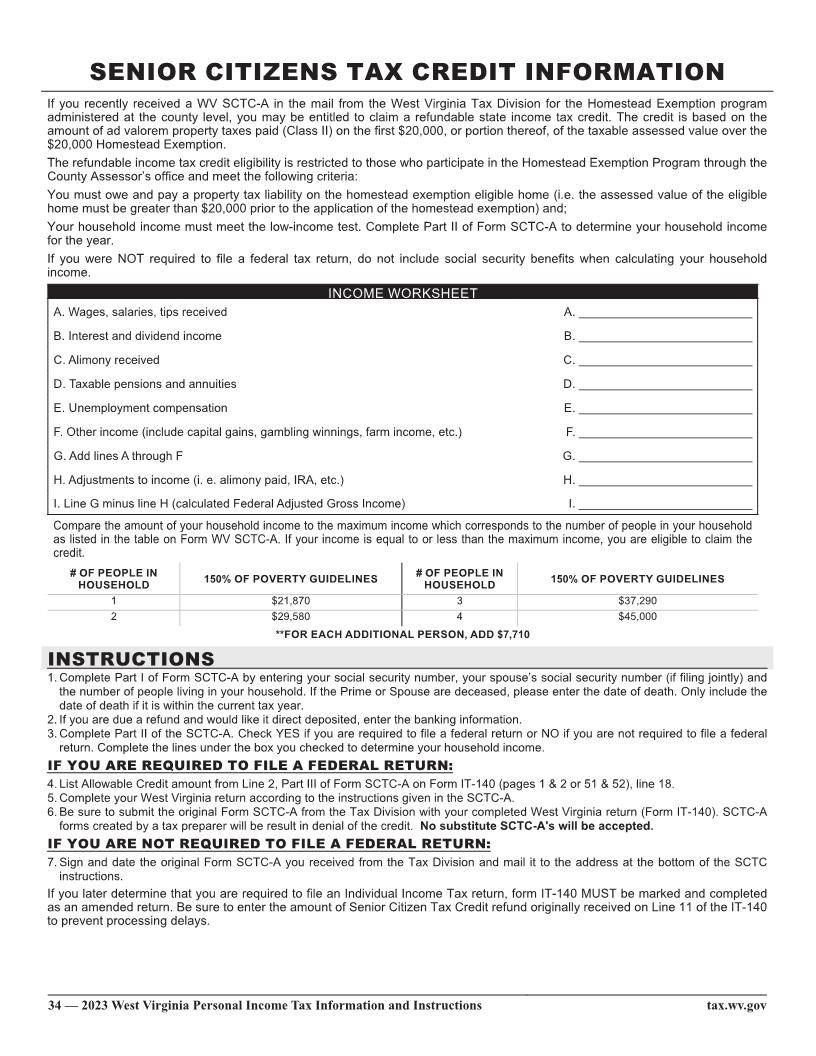

IMPORTANT INFORMATION FOR 2023

• The IT-120 has been removed If you are requesting a waiver or are a qualified farmer, please check the box on the the penalty

due line See page 22 for more information

• On Schedule A, there are two new boxes on top of page You must check one of the boxes if you are a Nonresident or Part-

year resident If you mark part year, you must provide the period of West Virginia residency and complete the appropriate

columns

• If you receive an EK-1 you will claim the "income credit" on the new Recap Line (Elective Income Credit for tax paid by a Pass

Through Entity) and provide the EK-1 to support the claim

• You are required to submit your original withholding documents, such as W-2’s, 1099’s, K-1’s, and NRW-2’s. Failure to

submit this documentation will result in the disallowance of the withholding amount claimed.

• Additional municipalities are now subject to the Municipal Use Tax Visit wwwtaxwvgov for a complete list of West Virginia

municipalities that impose a Use tax

• You can interact with us online at mytaxeswvtaxgov Services offered include bill pay and secure communication about your

return Before you call, please use our MyTaxes portal Online filing options are available on our website

RETURNED PAYMENT CHARGE

The Tax Division will recover a $1500 fee associated with returned electronic bank transactions These bank transactions include

but are not limited to the following:

• Direct Debit (payment) transactions returned for insufficient funds

• Stopped payments

• Bank refusal to authorize payment for any reason

• Direct Deposit of refunds to closed accounts

• Direct Deposit of refunds to accounts containing inaccurate or illegible account information

Paper Checks returned for insufficient funds will incur a $2800 fee

IMPORTANT: THERE ARE STEPS THAT CAN BE TAKEN TO MINIMIZE THE LIKELIHOOD OF A REJECTED

FINANCIAL TRANSACTION OCCURRING:

• Be sure that you are using the most current bank routing and account information

• If you have your tax return professionally prepared, the financial information used from a prior year return often carries over to

the current return It is important to verify your bank routing and account information from a check with your tax preparer This

will ensure the information is accurate and current in the event that a bank account previously used was closed or changed

either by you or the financial institution

• If you prepare your tax return at home using tax preparation software, the financial information used from a prior year return

often carries over to the current return It is important that you verify this information by reviewing the bank routing and account

information from a current check This will ensure the information is accurate and current

• If you prepare your tax return by hand using a paper return form, be sure that all numbers entered when requesting a direct

deposit of refund are clear and legible

• If making a payment using MyTaxes, be sure that the bank routing and account numbers being used are current

• If scheduling a delayed debit payment for an electronic return filed prior to the due date, make sure that the bank routing and

account numbers being used will be active on the scheduled date

• Be sure that funds are available in your bank account to cover the payment when checks or delayed debit payments are

presented for payment

tax.wv.gov 2023 Personal Income Tax Information and Instructions — 15

|

Enlarge image |

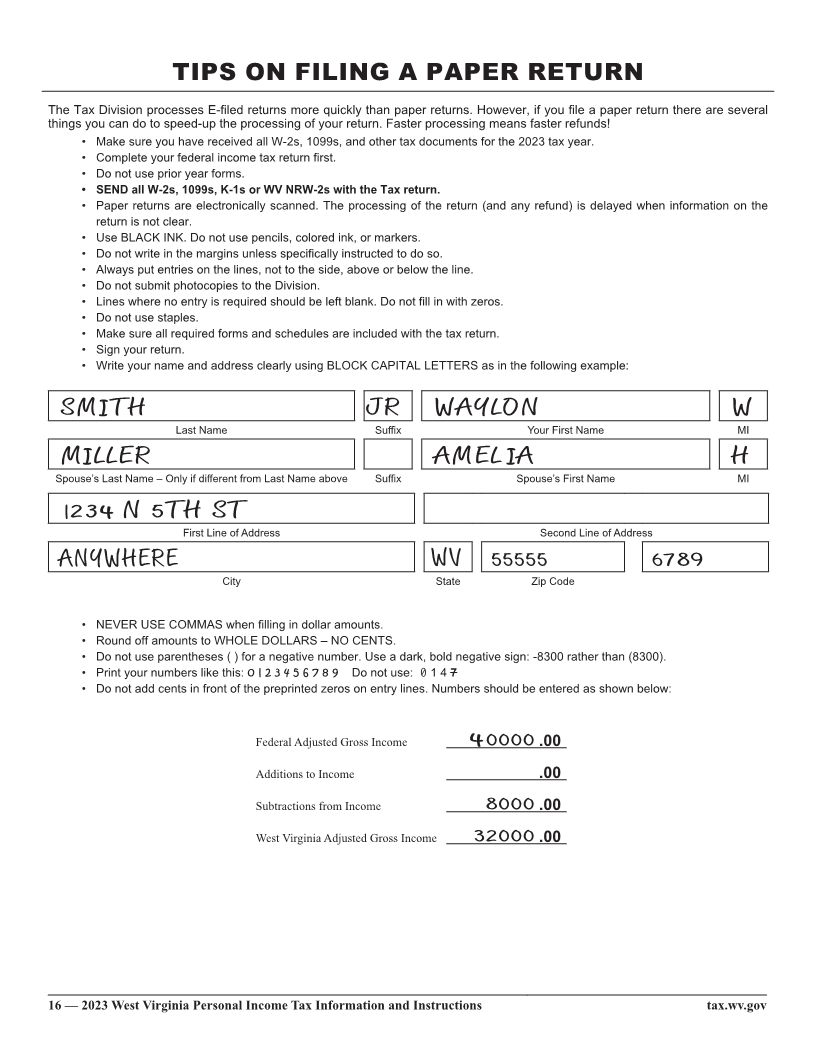

TIPS ON FILING A PAPER RETURN

The Tax Division processes E-filed returns more quickly than paper returns However, if you file a paper return there are several

things you can do to speed-up the processing of your return Faster processing means faster refunds!

• Make sure you have received all W-2s, 1099s, and other tax documents for the 2023 tax year

• Complete your federal income tax return first

• Do not use prior year forms

• SEND all W-2s, 1099s, K-1s or WV NRW-2s with the Tax return.

• Paper returns are electronically scanned The processing of the return (and any refund) is delayed when information on the

return is not clear

• Use BLACK INK Do not use pencils, colored ink, or markers

• Do not write in the margins unless specifically instructed to do so

• Always put entries on the lines, not to the side, above or below the line

• Do not submit photocopies to the Division

• Lines where no entry is required should be left blank Do not fill in with zeros

• Do not use staples

• Make sure all required forms and schedules are included with the tax return

• Sign your return

• Write your name and address clearly using BLOCK CAPITAL LETTERS as in the following example:

SMI TH JR WAYLON W

Last Name Suffix Your First Name MI

MI LLER AMEL AI H

Spouse’s Last Name – Only if different from Last Name above Suffix Spouse’s First Name MI

l 2 3N4 5TH ST

First Line of Address Second Line of Address

ANYWHERE WV 55555 6789

City State Zip Code

• NEVER USE COMMAS when filling in dollar amounts

• Round off amounts to WHOLE DOLLARS – NO CENTS

• Do not use parentheses ( ) for a negative number Use a dark, bold negative sign: -8300 rather than (8300)

• Print your numbers like this: 0 l 2 3 4 5 6 7 8 9 Do not use: 01 4 7

• Do not add cents in front of the preprinted zeros on entry lines Numbers should be entered as shown below:

Federal Adjusted Gross Income 4 0000.00

Additions to Income .00

Subtractions from Income 8000.00

West Virginia Adjusted Gross Income 32000.00

16 — 2023 West Virginia Personal Income Tax Information and Instructions tax.wv.gov

|

Enlarge image |

GENERAL INFORMATION

WHO MUST FILE

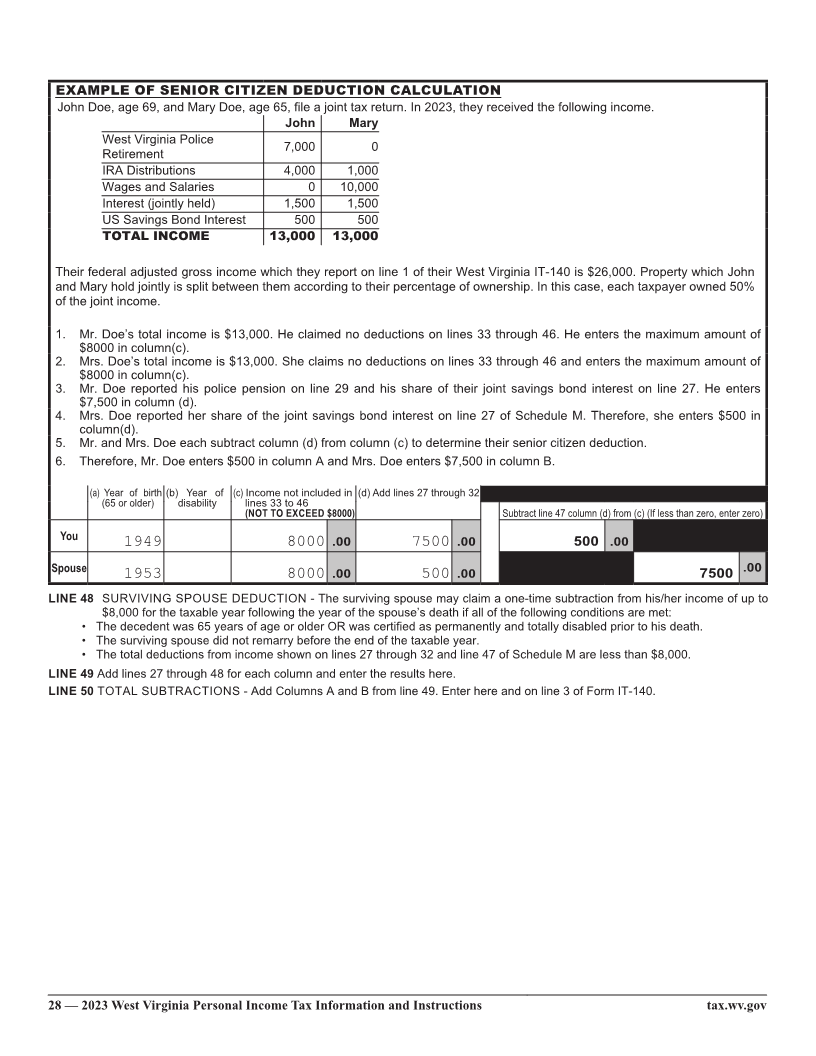

You must file a West Virginia income tax return if:

• You were a resident of West Virginia for the entire taxable year

• You were a resident of West Virginia for a part of the taxable year (Part-Year Resident)

• You were not a resident of West Virginia at any time during 2023, but your federal adjusted gross income includes income from

West Virginia sources (nonresident)

You are required to file a West Virginia return even though you may not be required to file a federal return if:

• Your West Virginia adjusted gross income is greater than your allowable deduction for personal exemptions ($2,000 per

exemption, or $500 if you claim zero exemptions) Your income is to be determined as if you had been required to file a federal

return Your exemptions are to be determined following the rules on page 24

• You are claiming a SCTC or HEPTC credit

• You are due a refund

You are not required to file a West Virginia return if you and your spouse are 65 or older and your total income is less than

your exemption allowance plus the senior citizen modification For example, $2,000 per exemption plus up to $8,000 of income

received by each taxpayer who is 65 or older However, if you are entitled to a refund you must file a return

RESIDENCY STATUS

RESIDENT

A resident is an individual who:

• Spends more than 30 days in West Virginia with the intent of West Virginia becoming his/her permanent residence; or

• Maintains a physical presence in West Virginia for more than 183 days of the taxable year, even though he/she may also be

considered a resident of another state

PART-YEAR RESIDENT

A part-year resident is an individual who changes his/her residence either:

• From West Virginia to another state, or

• From another state to West Virginia during the taxable year

FULL-YEAR NONRESIDENT

A full-year nonresident is an individual who is:

• A resident of West Virginia who spends less than 30 days of the taxable year in West Virginia, and maintains a permanent

place of residence outside West Virginia; or

• A resident of another state who does not maintain a physical presence within West Virginia and does not spend more than 183

days of the taxable year within West Virginia

SPECIAL NONRESIDENTS

A Special Nonresident is an individual who is:

• A resident of Kentucky, Maryland, Ohio, Pennsylvania, or Virginia for the entire taxable year; and

• Your only source of West Virginia income was from wages and salaries

• Mark the nonresident special box on the front of the return and complete Part II of Schedule A

Nonresidents who DO NOT have West Virginia source income or withholdings are not required to file a West Virginia return.

IT-140 NRC-COMPOSITE RETURN

Nonresident individuals who are partners in a partnership, shareholders in a S corporation or beneficiaries of an estate or trust

that derives income from West Virginia sources may elect to be included on a nonresident composite return If this election is

made, the IT-140NRC is filed by the pass-through entity and eliminates the need for the individual to file a separate nonresident/

part-year resident return for income reported on the IT-140NRC A $50 processing fee is required for each composite return filed

If a separate individual return is filed, the nonresident must include the West Virginia income derived from the pass-through entity

filing the composite return Credit may be claimed for the share of West Virginia income tax remitted with the composite returnThe

IT-140NRC is available on our website at taxwvgov

tax.wv.gov 2023 Personal Income Tax Information and Instructions — 17

|

Enlarge image | AMENDED RETURN Use the version of Form IT-140 that corresponds to the tax year to be amended and check the “Amended Return” box These forms and corresponding instructions are available on our website at taxwvgov You must file a West Virginia amended return if any of the following conditions occur: • To correct a previously filed return; or • You filed an amended federal income tax return and that change affected your West Virginia tax liability; or • The Internal Revenue Service made any changes to your federal return (ie, change in federal adjusted gross income, change in exemptions, etc) If either you or the Internal Revenue Service make a change to your federal return which causes either and increase or decrease in your Federal Adjusted Gross Income, an amended West Virginia return must be filed within ninety (90) days after a final determination for such change is made A copy of your amended federal income tax return must be enclosed with the West Virginia amended return WV amended returns cannot be processed until the IRS has processed the amended federal return Do not enclose a copy of your original return. If you are changing your filing status from married filing jointly to married filing separately or from married filing separately to married filing jointly, you must do so in compliance with federal guidelines If your original return was filed jointly and you are amending to file separately, your spouse must also file an amended separate return If the amended return is filed after the due date, interest and penalty for late payment will be charged on any additional tax due An additional penalty will be assessed if you fail to report any change to your federal return within the prescribed time An explanation must be provided as to why you are amending your return. Please complete page 47 and submit with the amended return NONRESIDENT/PART-YEAR RESIDENT A part-year resident is subject to West Virginia tax on the following: • Taxable income received from ALL sources while a resident of West Virginia; • West Virginia source income earned during the period of nonresidence; and • Applicable special accruals WEST VIRGINIA SOURCE INCOME The West Virginia source income of a nonresident is derived from the following sources included in your federal adjusted gross income: • Real or tangible personal property located in West Virginia; • Employee services performed in West Virginia; • A business, trade, profession, or occupation conducted in West Virginia; • An S corporation in which you are a shareholder; • Your distributive share of West Virginia partnership income or gain; • Your share of West Virginia estate or trust income or gain and royalty income; • West Virginia Unemployment Compensation benefits; • Prizes awarded by the West Virginia State Lottery West Virginia source income of a nonresident does not include the following income even if it was included in your federal adjusted gross income: • Annuities and pensions; • Interest, dividends or gains from the sale or exchange of intangible personal property unless they are part of the income you received from conducting a business, trade, profession, or occupation in West Virginia • Gambling winnings, other than prizes awarded by the West Virginia State Lottery as described above, unless you are engaged in the business of gambling (file a Schedule C related to gambling activity for federal income tax purposes) and you engage in that business, trade, profession, or occupation in West Virginia NONRESIDENTS AND PART-YEAR RESIDENTS MUST FIRST COMPLETE LINES 1 THROUGH 7 OF FORM IT-140, THEN COMPLETE SCHEDULE A. Income earned outside of West Virginia may not be claimed on Schedule M as other deductions. Please use Schedule A. To compute tax due, use the calculation worksheet located on page 8. (Instructions for Schedule A can be found on pages 30 through 32.) INCOME. In Column A of Schedule A, you must enter the amounts from your federal return Income received while you were a resident of West Virginia must be reported in Column B Income received from West Virginia sources while a nonresident of West Virginia must be reported in Column C ADJUSTMENTS. The amounts to be shown in each line of Column B and/or Column C of Schedule A are those items that were actually paid or incurred during your period of residency, or paid or incurred as a result of the West Virginia source income during the period of nonresidence For example, if you made payments to an Individual Retirement Account during the entire taxable year, you may not claim any payments made while a nonresident unless the payments were made from West Virginia source income However, you may claim the full amount of any payments made during your period of West Virginia residency SPECIAL ACCRUALS. In the case of a taxpayer changing from a RESIDENT to a NONRESIDENT status, the return must include all items of income, gain, or loss accrued to the taxpayer up to the time of his change of residence This includes any amounts not otherwise includible on the return because of an election to report income on an installment basis The return must be filed on the accrual basis whether or not that is the taxpayer’s established method of reporting For example, a taxpayer who moves from West Virginia and sells his West Virginia home or business on an installment plan must report all income from the sale in the year of the sale, even though federal tax is deferred until the income is actually received 18 — 2023 West Virginia Personal Income Tax Information and Instructions tax.wv.gov |

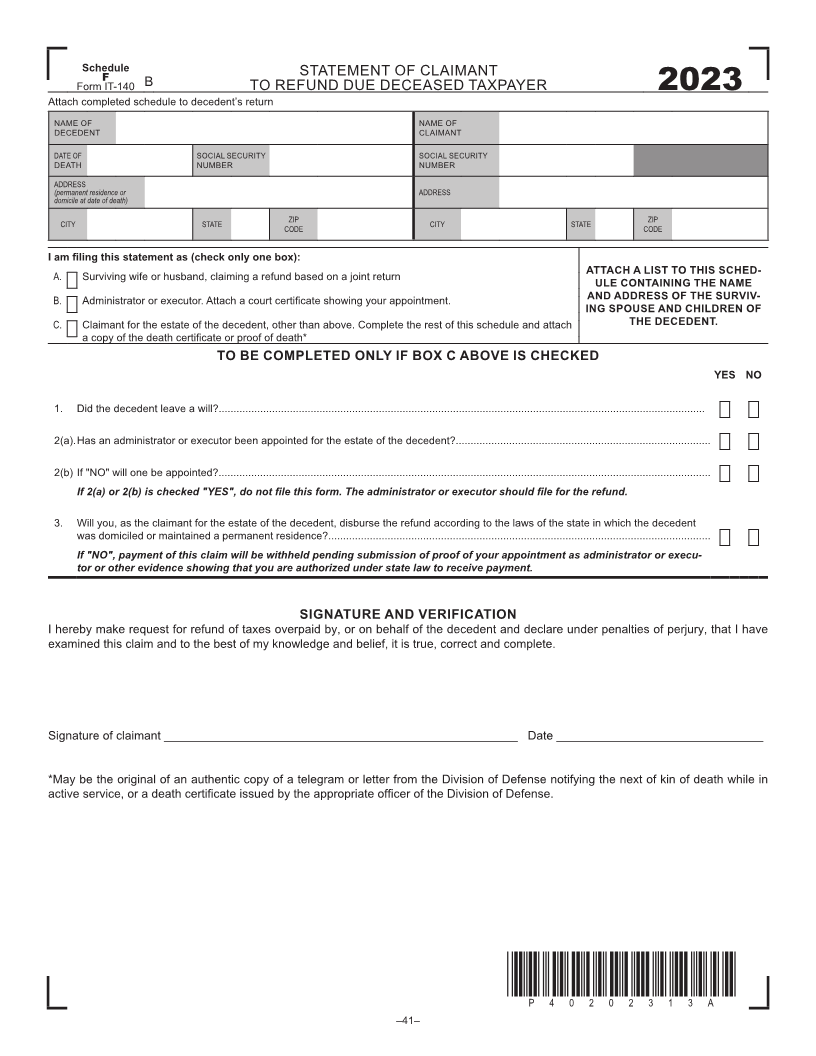

Enlarge image | FILING STATUS There are five (5) filing status categories for state income tax purposes Your filing status will determine the rate used to calculate your tax • Single • Head of Household • Married Filing Jointly You must have filed a joint federal return to be eligible to file a joint state return If you filed a joint federal return, you may elect to file your state return as either “Married Filing Jointly” using the state’s tax Rate Schedule I or as “Married Filing Separately” using Rate Schedule II • Married Filing Separately If you are married but filed separate federal returns, you MUST file separate state returns If you file separate returns you must use the “Married Filing Separately” tax Rate Schedule II to determine your state tax • Widow(er) with a dependent child When joint federal but separate state returns are filed, each spouse must report his/her federal adjusted gross income separately as if the federal adjusted gross income of each had been determined on separately filed federal returns If one spouse was a resident of West Virginia for the entire taxable year and the other spouse a nonresident for the entire taxable year and they filed a joint federal income tax return, they may choose to file jointly as residents of West Virginia The total income earned by each spouse for the entire year, regardless of where earned, must be reported on the joint return as taxable to West Virginia No credit will be allowed for income taxes paid to the other state A joint return may not be filed if one spouse changes residence during the taxable year, while the other spouse-maintained status as a resident or nonresident during the entire taxable year DECEASED TAXPAYER A return must be filed for a taxpayer who died during the taxable year This will serve as notification to close the tax account for the deceased taxpayerCheck the box “DECEASED” and enter the date of death on the line provided If a joint federal return was filed for the deceased and the surviving spouse, the West Virginia return may be filed jointly The surviving spouse should write on the signature line for the deceased “filing as surviving spouse” If a refund is expected, a completed Schedule F must be enclosed with the return so the refund can be issued to the surviving spouse or to the decedent’s estate Schedule F may be found on page 41 EXEMPTIONS You can no longer claim personal exemptions on your federal income tax return West Virginia has retained personal exemptions under the same rules applicable under federal law in prior years The West Virginia personal exemption allowance is $2,000 per allowable exemption, or $500 if someone else can claim an exemption for you on their return See the rules for personal exemptions on page 24 ITEMIZED DEDUCTIONS The State of West Virginia does not recognize most itemized deductions for personal income tax purposes Consequently, the only itemized deductions allowed to be claimed from the federal income tax return is gambling losses PROPERTY TAX CREDITS The Senior Citizen Tax Credit and Homestead Excess Property Tax Credit are available to low-income taxpayers Some taxpayers may qualify for both If you qualify for both credits, a state return must be filed to receive the credits, even if you have no federal requirement SENIOR CITIZENS TAX CREDIT. Credit eligibility is restricted to taxpayers who participate in the Homestead Exemption program (administered by the county assessor’s office), who incur and pay property taxes and whose federal adjusted gross income is less than 150% of federal poverty guidelines The maximum federal adjusted gross income level is $21,870 for a single person household plus an additional $7,710 for each additional person in the household (eg, $29,580 for a two-person household) You will receive form WV SCTC-A by mail if you participate in the Homestead Exemption program If you are only claiming the SCTC-A and are not required to file a tax return, you only need to submit the SCTC-A form If you are claiming both the SCTC-A and the HEPTC-1 you need to file a state tax return to claim the credits Additional information can be found on page 34 of this booklet and in Publication TSD-411 which can be found on our website at taxwvgov HOMESTEAD EXCESS PROPERTY TAX CREDIT. The Homestead Excess Property Tax Credit provides a refundable credit of up to $1,000 for low-income property owners whose real property tax, less senior citizen tax credit, paid on your OWNER-OCCUPIED home exceeds 4% of your income (gross household income including social security benefits) Low-income is defined as federal adjusted gross income that is 300% or less of the federal poverty guideline, based upon the number of individuals in the family Eligibility for the Homestead Exemption program is not necessary to qualify for this credit Schedule HEPTC-1 on page 9 must be completed in its entirety to determine eligibility to claim the credit A completed Schedule HEPTC-1 and Class 2 receipt showing payment must be filed with you return to claim the Homestead Excess Property Tax Credit tax.wv.gov 2023 Personal Income Tax Information and Instructions — 19 |

Enlarge image | SPOUSES OF UNITED STATES MILITARY SERVICE MEMBERS Effective for taxable year 2009, spouses of military service members may be exempt from West Virginia income tax on wages received from services performed in West Virginia if all three of the following conditions are met: • The service member is present in West Virginia in compliance with military orders; • The spouse is in West Virginia solely to be with the service member; and • The spouse maintains domicile in another state It is not a requirement for both spouses to have the same state of domicile, nor in the case of border installations, live in the state where the service member is stationed Eligible spouses wishing to claim this exemption from income tax may file a revised Form IT-104 with the spouse’s employer and must also attach a copy of their “spouse military identification card” when providing this form to their employer Any refunds for taxable year 2023 may be claimed on a properly filed IT-140 indicating “Nonresident Military Spouse” above the title on the first page Military spouses should check the Nonresident Special box on Form IT-140 and complete Part II of Schedule A A copy of their State of Legal Residence Certificate, form DD2058, must be enclosed with their return when it is filed Nonresident military service members and their spouses may be liable for West Virginia income tax on other types of West Virginia income such as business income, interest income, unemployment compensation, etc These types of income are reported on the Schedule A (see pages 7 & 8) MEMBERS OF THE ARMED FORCES If your legal residence was West Virginia at the time you entered military service, assignment to duty outside the state does not change your West Virginia residency status You must file your return and pay the tax due in the same manner as any other resident individual unless you did not maintain a physical presence in West Virginia for more than 30 days during the taxable year If, during 2023, you spent more than 30 days in West Virginia, you are considered to be a West Virginia resident for income tax purposes and must file a resident return and report all of your income to West Virginia If there is no West Virginia income tax withheld from your military income, you may find it necessary to make quarterly estimated tax payments using Form IT-140ES If, during 2023, you did not spend more than 30 days in West Virginia and had income from a West Virginia source, you may be required to file an income tax return with West Virginia as any other nonresident individual, depending upon the type of income received A member of the Armed Forces who is domiciled outside West Virginia is considered to be a nonresident of West Virginia for income tax purposes; therefore, his/her military compensation is not taxable to West Virginia even though he/she is stationed in West Virginia and maintains a permanent place of abode therein Check the Nonresident Special box on Form IT-140 and complete Part II of Schedule A A copy of your military orders and Form DD2058 must be enclosed with the return. Combat pay received during 2023 is not taxable on the federal income tax return Therefore, it is not taxable on the state return ACTIVE DUTY MILITARY PAY. A West Virginia National Guard and Reserve service member is entitled to a decreasing modification while on active duty in support of the contingency operation as defined in Executive Order 13223 and subsequent amendments-- such as those called to active duty as part of Operation Noble Eagle, Operation Enduring Freedom, Operation Iraqi Freedom, Operation New Dawn, and Operation Inherent Resolve, as well as any other current or future military operations deemed to be part of the Overseas Contingent Operations (OCO) The President’s memorandum applies to any West Virginia National Guard and Reserve service members called to active duty in support of the OCO, whether deployed or stateside This income is shown on Schedule M as a decreasing modification to your federal adjusted gross income A copy of your military orders and W-2 must be included with the return when it is filed. Active Military Separation If you are a West Virginia resident on active duty for at least 30 continuous days and have separated from active military service, your active duty military pay from the armed forces of the United States, the National Guard, or Armed Forces Reserve is an authorized modification decreasing your federal adjusted gross income; however, only to the extent the active duty military pay is included on your federal adjusted gross income for the tax year it was received A copy of your military orders, DD 214, and W-2 must be included with your return when filed CERTAIN STATE AND FEDERAL RETIREMENT SYSTEMS The modification for pensions and annuities received from the West Virginia Public Employees’ Retirement System, the West Virginia Teachers’ Retirement System, and Federal Retirement is limited to a maximum of $2,000 and entered on Schedule M The State of West Virginia does not impose tax on the retirement income received from any West Virginia state or local police, deputy sheriffs’ or firemen’s retirement system, federal law enforcement retirement, or military retirement, including survivorship annuities See instructions for Schedule M on page 26 US RAILROAD RETIREMENT. The State of West Virginia does not tax this income All types of United States Railroad Retirement Board benefits, including unemployment compensation, disability and sick pay included on the federal return should be entered on Schedule M See instructions on page 27 20 — 2023 West Virginia Personal Income Tax Information and Instructions tax.wv.gov |

Enlarge image | AUTISM MODIFICATION For tax years beginning on or after January 1, 2011 a modification was created reducing federal adjusted gross income in the amount of any qualifying contribution to a qualified trust maintained for the benefit of a child with autism Any established trust must first be approved by the West Virginia Children with Autism Trust Board The modification is claimed on Schedule M with maximum amounts of $1,000 per individual filer and persons who are married but filing separately and $2,000 per year for persons married and filing a joint income tax return TAXPAYERS OVER AGE 65 OR DISABLED An individual, regardless of age, who was certified by a physician as being permanently and totally disabled during the taxable year, or an individual who was 65 before the end of the taxable year may be eligible for certain modifications that will reduce their federal adjusted gross income for West Virginia income tax purposes up to $8,000 See instructions for Schedule M on page 27 and 28 SURVIVING SPOUSE Regardless of age, a surviving spouse of a decedent may be eligible for a modification reducing his/her income up to $8,000 provided he/she did not remarry before the end of the taxable year The modification is claimed on Schedule M The decedent must have attained the age of 65 prior to his/her death or, regardless of age, must have been certified as permanently and totally disabled See instructions for Schedule M on page 28 to determine if you qualify for this modification The surviving spouse should write on the signature line for the deceased “filing as surviving spouse” A surviving spouse who has not remarried at any time before the end of the taxable year for which the return is being filed may claim an additional exemption for the two (2) taxable years following the year of death of his/her spouse WEST VIRGINIA COLLEGE SAVINGS PLAN AND PREPAID TUITION TRUST FUNDS Taxpayers making payments or contributions to programs of the West Virginia Prepaid Tuition Trust and/or West Virginia Savings Plan Trust, operated under the trade names of SMART529TM or West Virginia Prepaid College Plan, may be eligible for a modification on the state return This deduction can be claimed on Schedule M Unqualified withdraws from the plan/trust must be reported on Schedule M For more information regarding participation in this program, contact SMART529TM Service Center at 1-866-574-3542 GAMBLING LOSS Gambling losses may be deducted up to the amount of winnings and only if you itemized on your federal 1040 Both of these criteria must be met in order to be eligible to deduct the loss You will need to submit a copy of pages 1-2 of the 1040, Schedule A from the 1040, and copies of the W2's For tax years 2020-2022, you may file an amended return to claim gambling losses Report the gambling losses on the Autism Modification Line of Schedule M You must attach the same support listed above to receive the credit FILING REQUIREMENTS FOR CHILDREN UNDER AGE 18 WHO HAVE UNEARNED (INVESTMENT) INCOME Any child under the age of 18 who has investment income and whose parents qualify and elect to report that income on their return, is not required to file a return with the State of West Virginia This election is made in accordance with federal guidelines Any child under the age of 18 whose income is not reported on his/her parent’s return must file their own West Virginia return and report all of their income If the child is claimed as an exemption on their parent’s return, he/she must claim zero exemptions on the state return and claim a $500 personal exemption allowance REFUND OF OVERPAYMENT A return must be filed to obtain a refund of any overpayment In order to receive a refund of an overpayment of $2 or less, you must enclose a signed statement with your return requesting that the refund be sent to you Any unclaimed payments or adjustments that increase overpayment will be applied to the following period unless written request is received for overpayment to be refunded DIRECT DEPOSIT You may have your refund directly deposited into your bank account To avoid delay of your direct deposit, verify your routing and account numbers from a check before filing your return Refunds are issued in the form of United States currency If you choose to have your refund direct deposited, your depositor must be capable of accepting US currency PENALTIES AND INTEREST Interest must be added to any tax due that is not paid by the due date of the return even if an extension of time for filing has been granted The rate of interest will be fixed every year to equal the adjusted prime rate charged by banks (as of the first business day of the preceding December) plus three percentage points Visit wwwtaxwvgov in order to obtain the current interest rate Penalties (ie Additions to Tax) for late filing can be avoided by sending in your return by the due date The law provides that a tax.wv.gov 2023 Personal Income Tax Information and Instructions — 21 |

Enlarge image | penalty of five percent (5%) of the tax due for each month, or part of a month, may be imposed for the late filing of the return up to a maximum of twenty-five percent (25%) unless reasonable cause can be shown for the delay The law provides that an additional penalty may be imposed for not paying your tax when due This penalty is one-half of one percent (½ of 1%) of the unpaid balance of tax for each month, or part of a month, the tax remains unpaid, up to a maximum of twenty-five percent (25%) You may access an Interest and Additions to Tax Calculator on our website at taxwvgov or you may call (304) 558-3333 or 1-800-982-8297 for assistance The West Virginia Tax Crimes and Penalties Act imposes severe penalties for failing to file a return or pay any tax when due, or for making a false return or certification The mere fact that the figures reported on your state return are taken from your federal return will not relieve you from the imposition of penalties because of negligence or for filing a false or fraudulent return The statute of limitations for prosecuting these offenses is three years after the offense was committed PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX WHO MUST PAY THE UNDERPAYMENT PENALTY? You may be charged a penalty if you did not have enough West Virginia state income tax withheld from your income or pay enough estimated tax by any of the due dates This may be true even if you are due a refund when you file your return The penalty is computed separately for each due date (quarter) You may owe a penalty for an earlier due date (quarter) even if you make large enough payments later to make up the underpayment You may owe the penalty if you did not pay at least the smaller of 90% of your current year tax liability; or 100% of your prior tax liability (if you filed a prior year return that covered a full 12 months) EXCEPTIONS TO THE PENALTY You will not have to pay any penalty if either of these exceptions apply: 1 You had $0 tax after credit for the prior year and meet ALL of the following conditions: • your prior year tax return was (or would have been had you been required to file) for a taxable year of twelve months; • you were a citizen or resident of the United States throughout the preceding taxable year; • your tax liability for the current year is less than $5,000 2 The total tax shown on your current return minus the tax you paid through West Virginia withholding is less than $600 If you file your tax return and pay any tax due on or before February 1, no fourth quarter penalty is due SPECIAL RULES FOR FARMERS If at least two-thirds of your gross income for this year was from farming sources, the following special rules apply: 1 You are only required to make one payment for the taxable year (due January 18) 2 The amount of estimated tax required to be paid is sixty-six and two-thirds percent (66 ⅔%) instead of ninety percent (90%). 3 If you fail to pay your estimated tax by January 18, but you file your return and pay the tax due on or before the first day of March, no penalty is due The West Virginia Tax Division will calculate the penalty for you. You will receive a notice for the amount of penalty due. To avoid future penalties, you should increase your withholding or begin making quarterly estimated payments for tax year 2024 WAIVER OF PENALTY If you are subject to underpayment penalty, all or part of the penalty will be waived if the West Virginia Tax Division determines that: 1 The penalty was caused by reason of casualty or disaster; 2 The penalty was caused by unusual circumstances which makes imposing the penalty unfair or inequitable To request a waiver of the penalty, check the box for and enclose a signed statement explaining the reasons you believe the penalty should be waived (see page 47) If you have documentation substantiating your statement, enclose a copy The Division will notify you if your request for waiver is not approved RETURNED PAYMENT CHARGE The Tax Division will recover a $1500 fee associated with returned electronic bank transactions These bank transactions include but are not limited to the following: • Direct Debit (payment) transactions returned for insufficient funds • Stopped payments • Bank refusal to authorize payment for any reason • Direct Deposit of refunds to closed accounts • Direct Deposit of refunds to accounts containing inaccurate or illegible account information Paper Checks returned for insufficient funds will incur a $2800 fee CREDIT FOR ESTIMATED TAX You must make quarterly estimated tax payments if your estimated tax liability (your estimated tax reduced by any state tax withheld from your income) is at least $600, unless that liability is less than ten percent (10%) of your estimated tax The total estimated tax credit to be claimed on your return is the sum of the payments made with the quarterly installments for taxable year 2023, any overpayments applied from your 2022 personal income tax return and any payments made with your West Virginia Application for Extension of Time to File (WV 4868) 22 — 2023 West Virginia Personal Income Tax Information and Instructions tax.wv.gov |

Enlarge image | EXTENSION OF TIME If you obtain an extension of time to file your federal income tax return, you are automatically allowed the same extension of time to file your West Virginia income tax return Enter the date of the federal extension was granted in the appropriate box on page 1 of IT-140 If a federal extension was granted electronically, write “Federal Extension Granted” and the confirmation number at the top of the West Virginia return Also, enter the extended due date in the appropriate box A copy of Federal Schedule 4868 must be enclosed with your return If you only need an extension of time to file the West Virginia return, you must submit a completed West Virginia Application for Extension of Time to File (WV4868) This is not an extension to pay SIGNATURE Your return MUST be signed A joint return must be signed by both spouses If you and your spouse (if filing a joint return) do not sign the return, it will not be processed If the return is prepared by an authorized agent of the taxpayer, the agent must provide their FEIN, sign the return, date and enter their phone number If a joint federal return was filed for a deceased taxpayer, the surviving spouse should write on the signature line for the deceased “filing as surviving spouse” WEST VIRGINIA INCOME TAX WITHHELD Electronic Filing – It is not necessary to submit withholding documents since this information will transmit electronically once entered within the software No need to submit a paper return if confirmation was received Paper Filed Returns – Enter the total amount of West Virginia tax withheld as shown on your withholding documents If you are filing a joint return, be sure to include any withholding for your spouse Original withholding documents (W-2’s, 1099’s, K-1’s, and NRW-2’s) must be enclosed with your paper return. Failure to submit this documentation will result in the disallowance of the credit claimed. Note: Local or municipal fees cannot be claimed as West Virginia income tax withheld If the withholding source is for a nonresident sale of real estate transaction, a form WV NRSR must be completed and on file with the Tax Division prior to submitting a tax return On your tax return, mark the box, submit Schedule D, and form 8949 or 4797 from your federal return FAILURE TO RECEIVE A WITHHOLDING TAX STATEMENT (W-2) If you fail to receive a withholding tax statement (Form W-2, W-2G, or 1099) from an employer by February 15th, you may file your income tax return using a substitute form All efforts to obtain a W-2 statement from the payer must be exhausted before a substitute form will be accepted West Virginia Substitute W-2 (Form WV IT-102-1) must be completed and retained for your records in the same manner as Form W-2 for a period of not less than three years This information may be obtained from your pay stub(s) DO NOT use federal Form 4852 (Substitute for W-2) It does not provide all the necessary information and WILL NOT be accepted PRIOR YEAR TAX LIABILITIES Taxpayers who have delinquent state or federal tax liabilities may not receive the full amount of their tax refund If you have an outstanding state or federal tax lien, your refund will be reduced and applied to your past due liability If a portion of your refund is captured, you will receive a notice and the balance of the refund Any final unpaid West Virginia personal income tax liabilities may be referred to the United States Treasury Division in order to recover the balance due from your federal income tax refund IRS INFORMATION EXCHANGE The West Virginia Tax Division and the Internal Revenue Service share tax information including results of any audits Differences, other than those allowed under state law, will be identified and may result in the assessment of a negligence penalty Taxpayers may be subject to further investigation and future audits INJURED SPOUSE You may be considered an injured spouse if you file a joint return and all or part of your refund was, or is expected to be, applied against your spouse’s past due child support payments or a prior year tax liability You must file an injured spouse allocation form (Form WV-8379) to claim your part of the refund if all three of the following apply: • You are not required to pay the past due amount; • You received and reported income (such as wages, taxable interest, etc) on a joint return; and • You made and reported payments such as West Virginia tax withheld from your wages or estimated tax payments If all of the above apply and you want your share of the joint return refund, you must: 3. Check the injured spouse box on the front of the return; 4. Complete the West Virginia Injured Spouse Allocation Form, WV-8379; and 5. Enclose the completed form with your West Virginia personal income tax return DO NOT check the injured spouse box unless you qualify as an injured spouse and have enclosed the completed form with your return This will cause a delay in the processing of your refund TAX DIVISION PROCESSING AND PROCEDURES The Tax Division has a modern tax system that allows us to better serve you This system decreases processing time and allows us to contact taxpayers in a timely manner If a change has been made to your return, you will first receive a letter from us explaining the changeIf there is additional tax due, you will receive a Statement of Account If you disagree with the balance due, return a copy of the statement with your comments and provide any additional schedules to substantiate your claim You will receive a statement of account on a monthly basis until your outstanding liability is either paid or your account is settled If you sent us information and receive a second statement of account, it may be a timing issue Please allow sufficient time for mailing and processing of the additional information before you contact us again tax.wv.gov 2023 Personal Income Tax Information and Instructions — 23 |

Enlarge image |

FORM IT-140 INSTRUCTIONS

FORM IS ON PAGES 1-2 & 51-52

The due date for filing your 2023 West Virginia Personal Income Tax return is April 15, 2024, unless you have a valid extension of time

to file The starting point for the West Virginia income tax return is your federal adjusted gross income Therefore, you must complete

your federal return before you can begin your state return It is not necessary to enclose a copy of your federal return with your West

Virginia return

SOCIAL SECURITY NUMBER - Print your social security number as it appears on your social security card

NAME & ADDRESS - Enter your name and current address in the spaces provided If you are married and filing a joint return or

married filing separate returns, fill in your spouse’s name and your spouse’s social security number If the taxpayer or spouse died