Enlarge image

SCHEDULE UT INSTRUCTIONS

You owe use tax on the total purchase price of taxable tangible The following example includes a situation a person may encounter

personal property or taxable services (hereinafter called property) with respect to West Virginia state, and municipal sales and use

that you used, stored, or consumed in West Virginia upon which you taxes, if they purchase items outside West Virginia or from a different

have not previously paid West Virginia sales or use tax The use tax municipality and are required to pay sales or use taxes to the other

applies to the following: internet purchases, magazine subscriptions, state and/or municipality The example provides information on how

mail-order purchases, out-of-state purchases, telephone purchases to use the amount of sales tax paid to the other state as a credit

originating out-of-state, TV shopping networks and other purchases against West Virginia state and municipal use taxes imposed and

of taxable items Schedule UT must be filed with IT-140 if the how to compute and report the West Virginia state and municipal

taxpayer is reporting use tax due taxes due

Examples of reasons you may owe use tax: You bring equipment into West Virginia for use in a municipality

1 You purchased property without paying sales tax from a which imposes municipal sales and use tax You can determine the

seller outside of West Virginia You would have paid sales West Virginia state and municipal use tax as follows:

tax if you purchased the property from a West Virginia seller

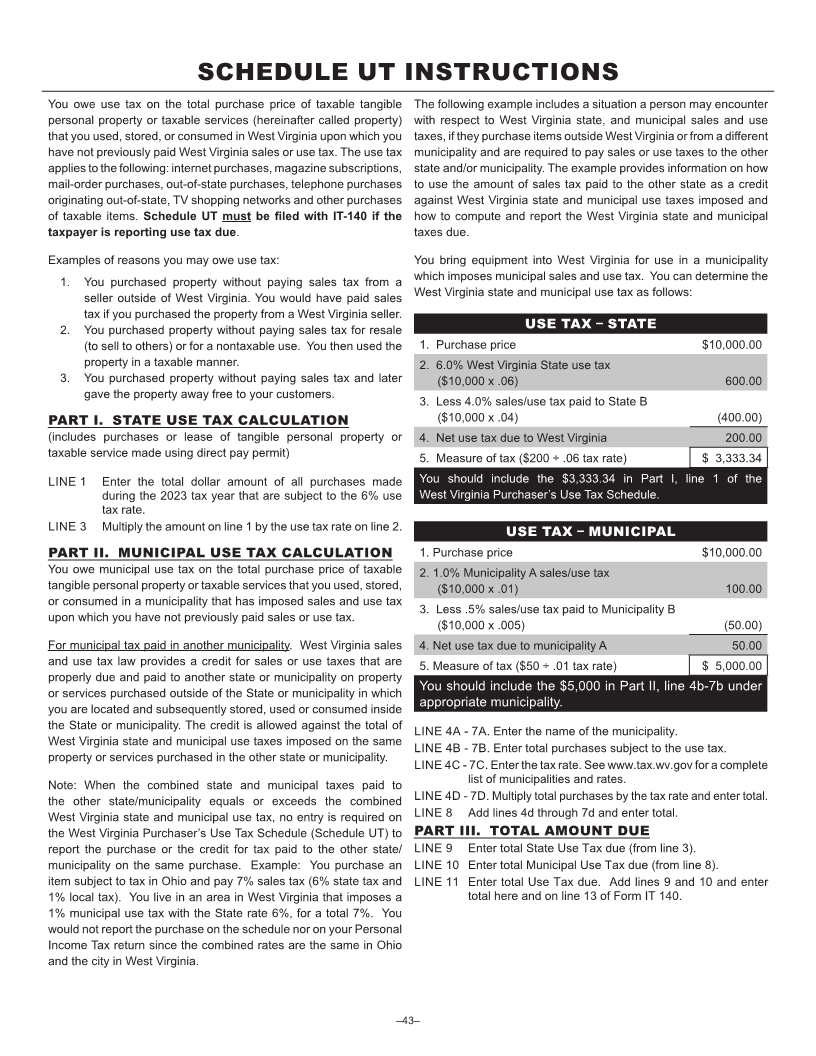

2 You purchased property without paying sales tax for resale USE TAX – STATE

(to sell to others) or for a nontaxable use You then used the 1 Purchase price $10,00000

property in a taxable manner 2 60% West Virginia State use tax

3 You purchased property without paying sales tax and later ($10,000 x 06) 60000

gave the property away free to your customers

3 Less 40% sales/use tax paid to State B

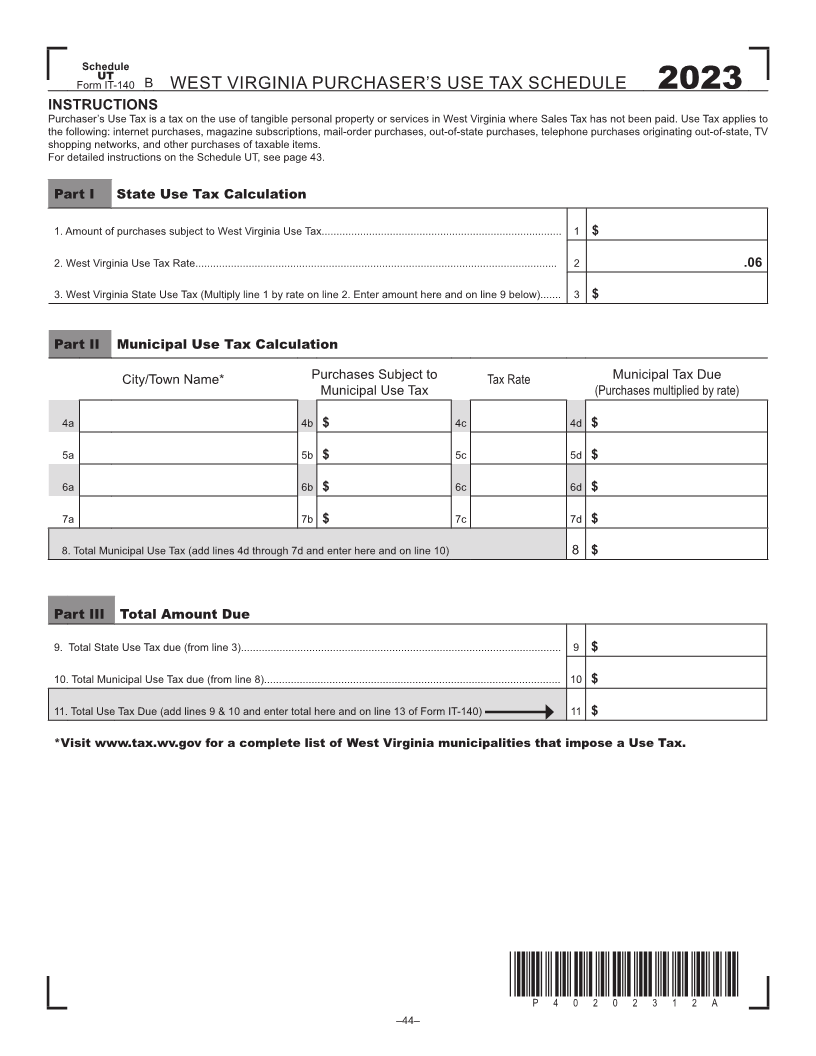

PART I. STATE USE TAX CALCULATION ($10,000 x 04) (40000)

(includes purchases or lease of tangible personal property or 4 Net use tax due to West Virginia 20000

taxable service made using direct pay permit) 5 Measure of tax ($200 ÷ 06 tax rate) $ 3,33334

LINE 1 Enter the total dollar amount of all purchases made You should include the $3,33334 in Part I, line 1 of the

during the 2023 tax year that are subject to the 6% use West Virginia Purchaser’s Use Tax Schedule

tax rate

LINE 3 Multiply the amount on line 1 by the use tax rate on line 2 USE TAX – MUNICIPAL

PART II. MUNICIPAL USE TAX CALCULATION 1 Purchase price $10,00000

You owe municipal use tax on the total purchase price of taxable 2 10% Municipality A sales/use tax

tangible personal property or taxable services that you used, stored, ($10,000 x 01) 10000

or consumed in a municipality that has imposed sales and use tax

3 Less 5% sales/use tax paid to Municipality B

upon which you have not previously paid sales or use tax

($10,000 x 005) (5000)

For municipal tax paid in another municipality West Virginia sales 4 Net use tax due to municipality A 5000

and use tax law provides a credit for sales or use taxes that are 5 Measure of tax ($50 ÷ 01 tax rate) $ 5,00000

properly due and paid to another state or municipality on property

or services purchased outside of the State or municipality in which You should include the $5,000 in Part II, line 4b-7b under

you are located and subsequently stored, used or consumed inside appropriate municipality

the State or municipality The credit is allowed against the total of LINE 4A - 7A Enter the name of the municipality

West Virginia state and municipal use taxes imposed on the same

LINE 4B - 7B Enter total purchases subject to the use tax

property or services purchased in the other state or municipality

LINE 4C - 7C Enter the tax rate See wwwtaxwvgov for a complete

Note: When the combined state and municipal taxes paid to list of municipalities and rates

the other state/municipality equals or exceeds the combined LINE 4D - 7D Multiply total purchases by the tax rate and enter total

West Virginia state and municipal use tax, no entry is required on LINE 8 Add lines 4d through 7d and enter total

the West Virginia Purchaser’s Use Tax Schedule (Schedule UT) to PART III. TOTAL AMOUNT DUE

report the purchase or the credit for tax paid to the other state/ LINE 9 Enter total State Use Tax due (from line 3)

municipality on the same purchase Example: You purchase an LINE 10 Enter total Municipal Use Tax due (from line 8)

item subject to tax in Ohio and pay 7% sales tax (6% state tax and LINE 11 Enter total Use Tax due Add lines 9 and 10 and enter

1% local tax) You live in an area in West Virginia that imposes a total here and on line 13 of Form IT 140

1% municipal use tax with the State rate 6%, for a total 7% You

would not report the purchase on the schedule nor on your Personal

Income Tax return since the combined rates are the same in Ohio

and the city in West Virginia

–43–