Enlarge image

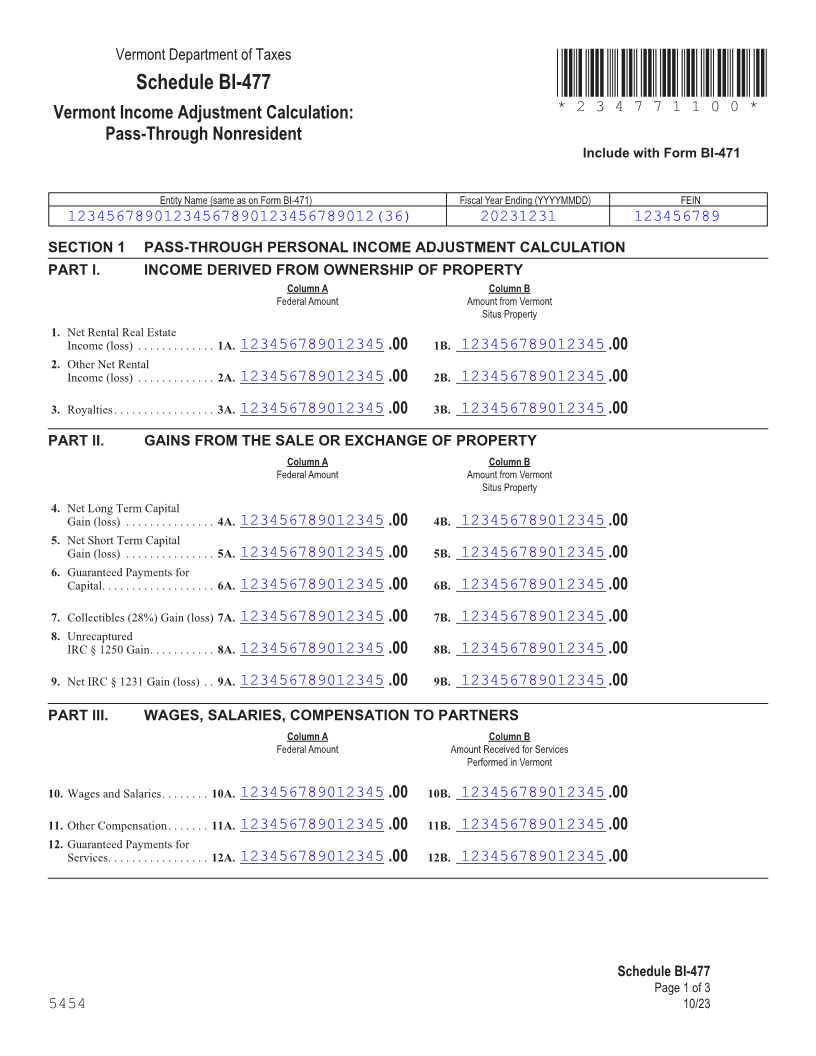

Vermont Department of Taxes

Schedule BI-477 *234771100*

Vermont Income Adjustment Calculation: *234771100*

Page 9

Pass-Through Nonresident

Include with Form BI-471

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

12345678901234567890123456789012(36) 20231231 123456789

SECTION 1 PASS-THROUGH PERSONAL INCOME ADJUSTMENT CALCULATION

PART I. INCOME DERIVED FROM OWNERSHIP OF PROPERTY

Column A Column B

Federal Amount Amount from Vermont

Situs Property

1. Net Rental Real Estate

Income (loss) . . . . . . . . . . . . .1A. 123456789012345 ________________________ .00 1B. _________________________123456789012345 .00

2. Other Net Rental

Income (loss) . . . . . . . . . . . . .2A. 123456789012345 ________________________ .00 2B. _________________________123456789012345 .00

FORM (Place at FIRST page)

3. Royalties . . . . . . . . . . . . . . . . .3A. 123456789012345 ________________________ .00 3B. _________________________123456789012345 .00 Form pages

PART II. GAINS FROM THE SALE OR EXCHANGE OF PROPERTY

Column A Column B

Federal Amount Amount from Vermont

Situs Property

9 - 11

4. Net Long Term Capital

Gain (loss) . . . . . . . . . . . . . . .4A. 123456789012345 ________________________ .00 4B. _________________________123456789012345 .00

5. Net Short Term Capital

Gain (loss) . . . . . . . . . . . . . . .5A. 123456789012345 ________________________ .00 5B. _________________________123456789012345 .00

6. Guaranteed Payments for

Capital . . . . . . . . . . . . . . . . . . .6A. 123456789012345 ________________________ .00 6B. _________________________123456789012345 .00

7. Collectibles (28%) Gain (loss) 7A. 123456789012345 ________________________ .00 7B. _________________________123456789012345 .00

8. Unrecaptured

IRC § 1250 Gain . . . . . . . . . . .8A. 123456789012345 ________________________ .00 8B. _________________________123456789012345 .00

9. Net IRC § 1231 Gain (loss) . . 9A. 123456789012345 ________________________ .00 9B. _________________________123456789012345 .00

PART III. WAGES, SALARIES, COMPENSATION TO PARTNERS

Column A Column B

Federal Amount Amount Received for Services

Performed in Vermont

10. Wages and Salaries . . . . . . . .10A. 123456789012345 ________________________ .00 10B. _________________________123456789012345 .00

11. Other Compensation . . . . . . .11A. 123456789012345 ________________________ .00 11B. _________________________123456789012345 .00

12. Guaranteed Payments for

Services . . . . . . . . . . . . . . . . .12A. 123456789012345 ________________________ .00 12B. _________________________123456789012345 .00

Schedule BI-477

Page 1 of 3

5454 10/23